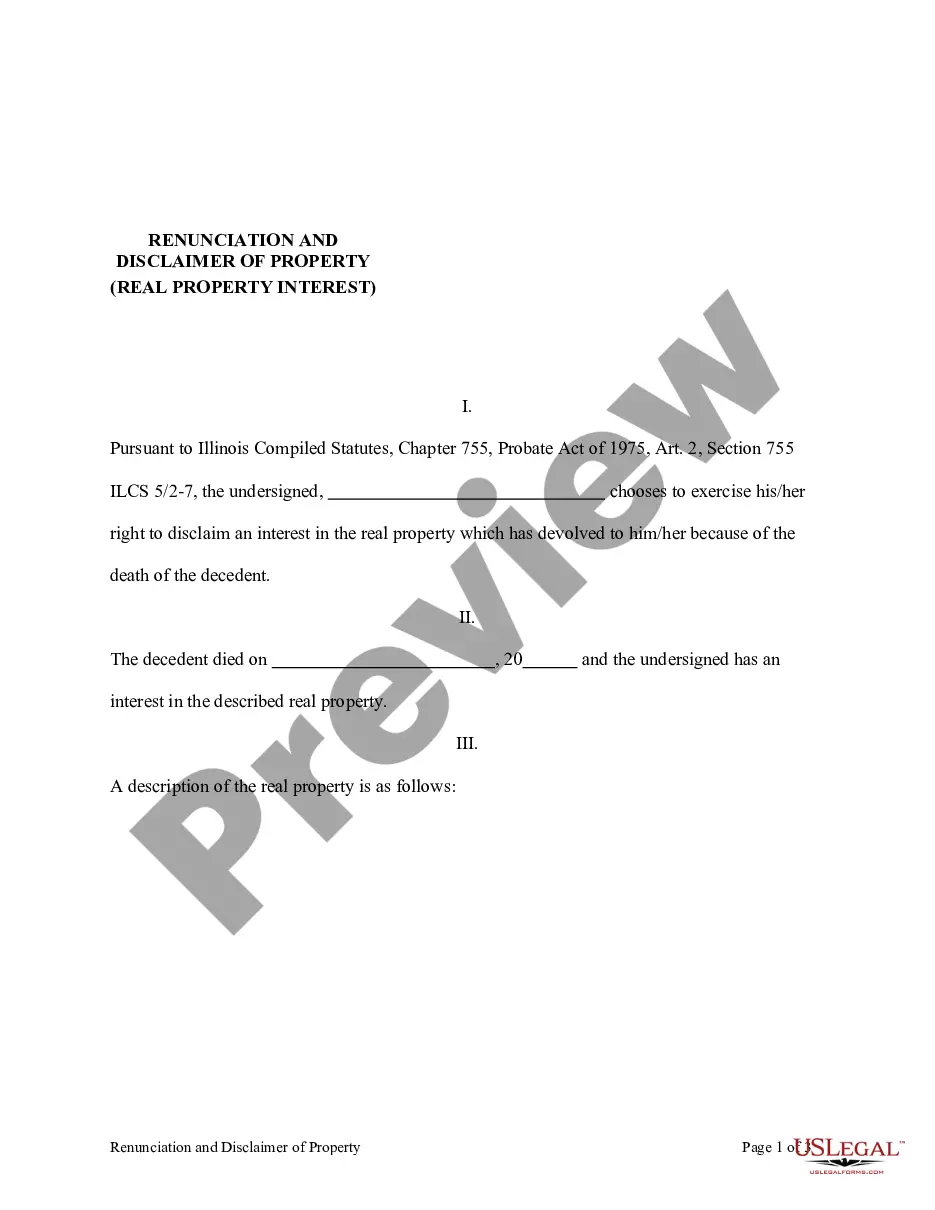

Cook Illinois Renunciation and Disclaimer of Real Property Interest

Description

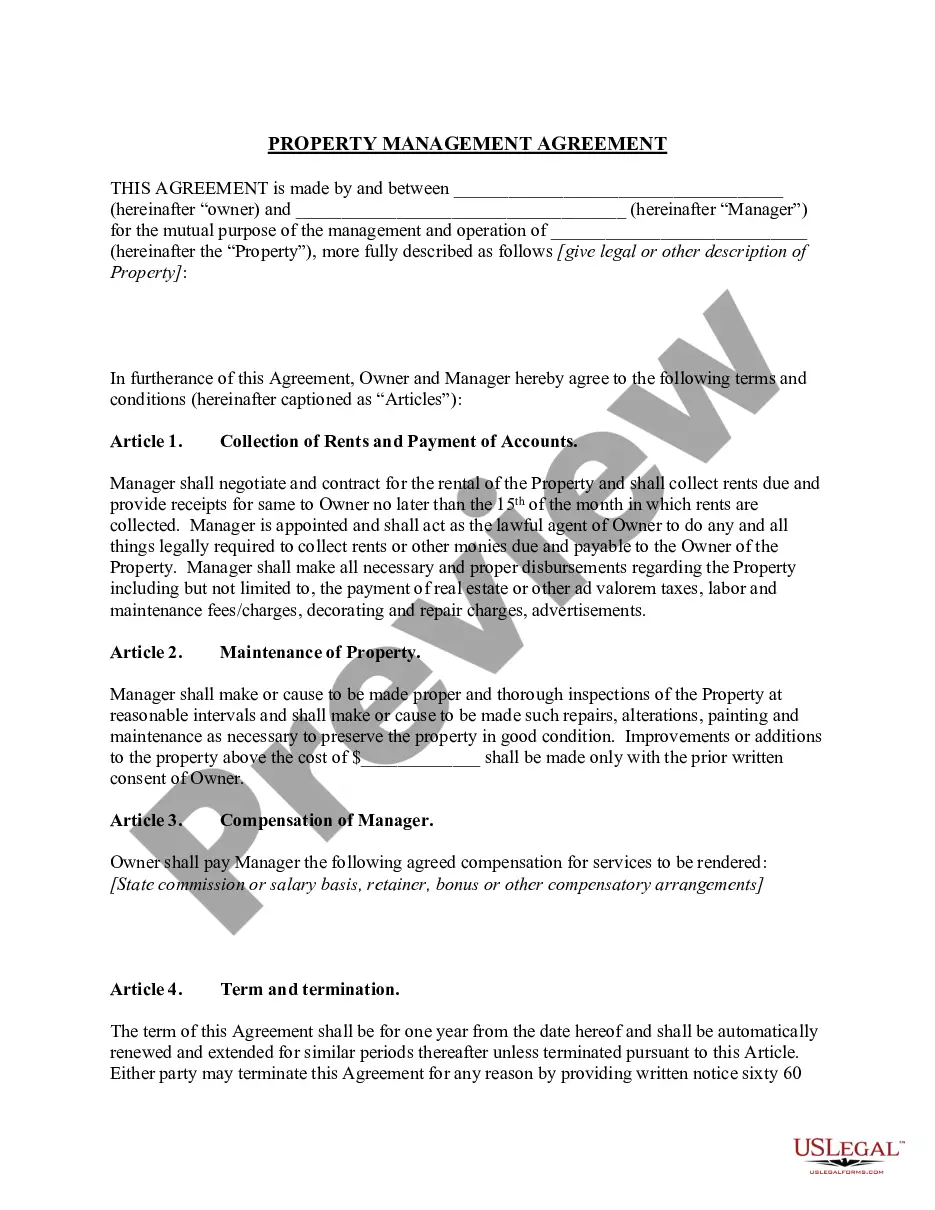

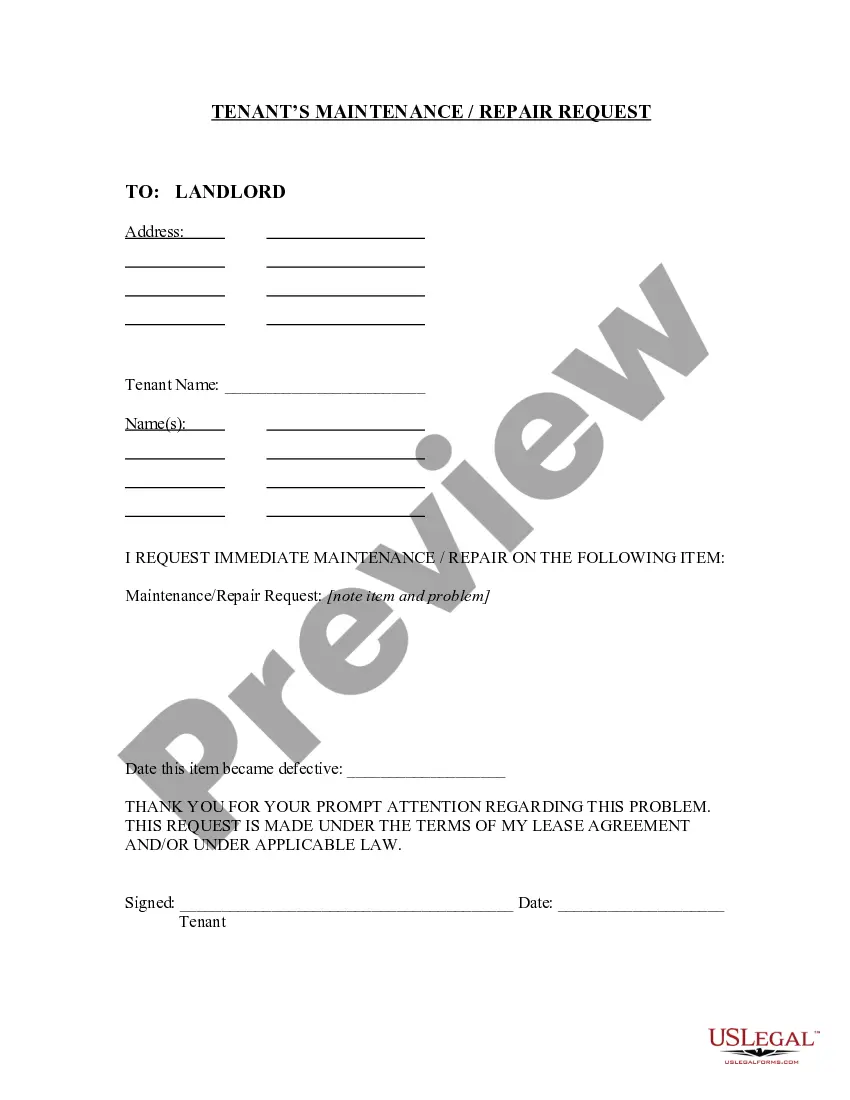

How to fill out Illinois Renunciation And Disclaimer Of Real Property Interest?

If you are in search of a legitimate form template, it’s incredibly challenging to find a more suitable platform than the US Legal Forms website – likely the most extensive collections available online.

With this collection, you can discover a vast array of document examples for business and personal purposes categorized by types and states, or keywords.

With the high-caliber search feature, locating the most recent Cook Illinois Renunciation and Disclaimer of Real Property Interest is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the file format and download it to your device. Edit. Complete, modify, print, and sign the acquired Cook Illinois Renunciation and Disclaimer of Real Property Interest.

- Additionally, the accuracy of each document is confirmed by a group of experienced attorneys who frequently review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Cook Illinois Renunciation and Disclaimer of Real Property Interest is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have selected the template you require. Review its details and utilize the Preview feature to inspect its content. If it doesn’t satisfy your needs, use the Search option at the top of the screen to locate the suitable document.

- Confirm your choice. Click the Buy now button. Then, choose your preferred subscription plan and provide the necessary credentials to establish an account.

Form popularity

FAQ

Yes, you can give away some of your inheritance, but this often involves specific legal processes to ensure it's done correctly. If you disclaim part of your inheritance, the remainder could still pass to you or be redirected according to your wishes. The Cook Illinois Renunciation and Disclaimer of Real Property Interest provides a structured approach for managing such decisions.

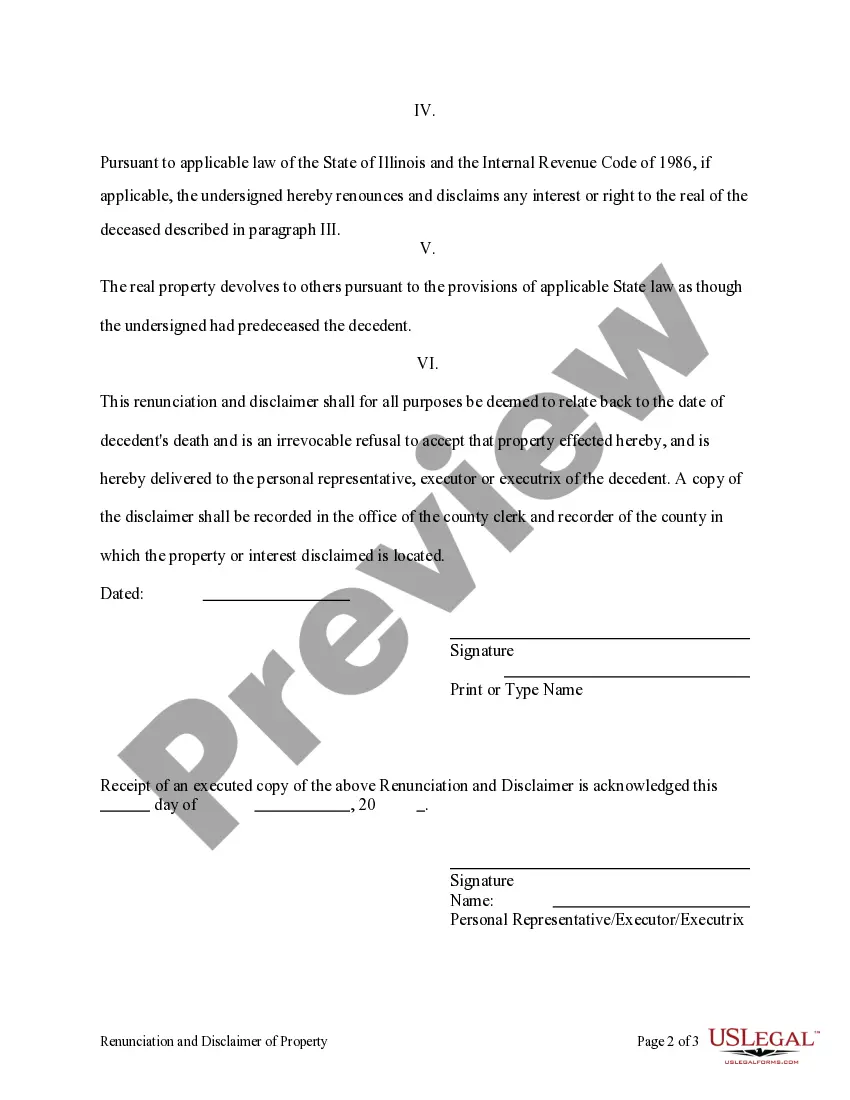

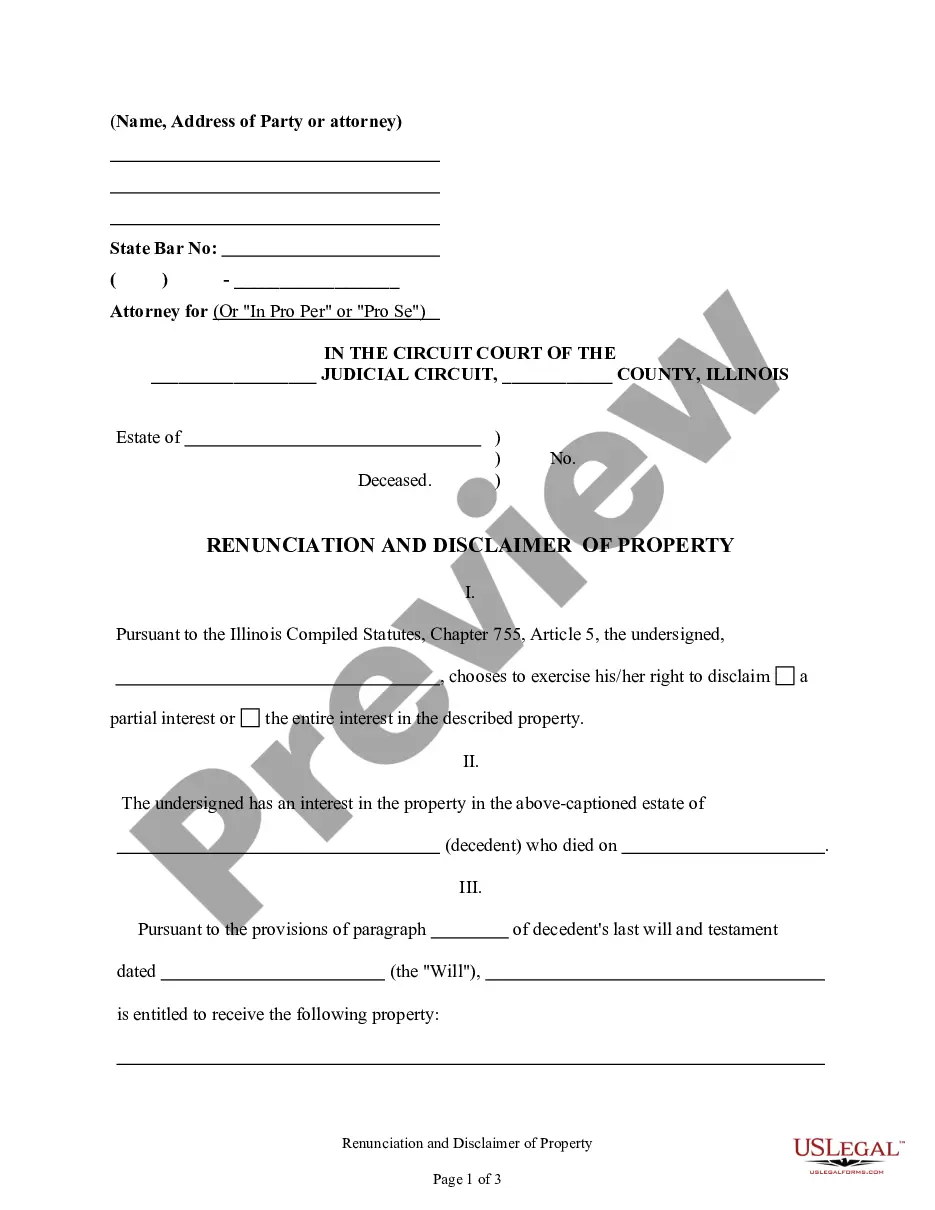

Renunciation and disclaimer of interests in an estate refer to the legal actions that allow a person to refuse an interest in property or assets. This process can prevent unwanted tax liabilities and simplify estate management. By utilizing the Cook Illinois Renunciation and Disclaimer of Real Property Interest, individuals can navigate these decisions with clarity.

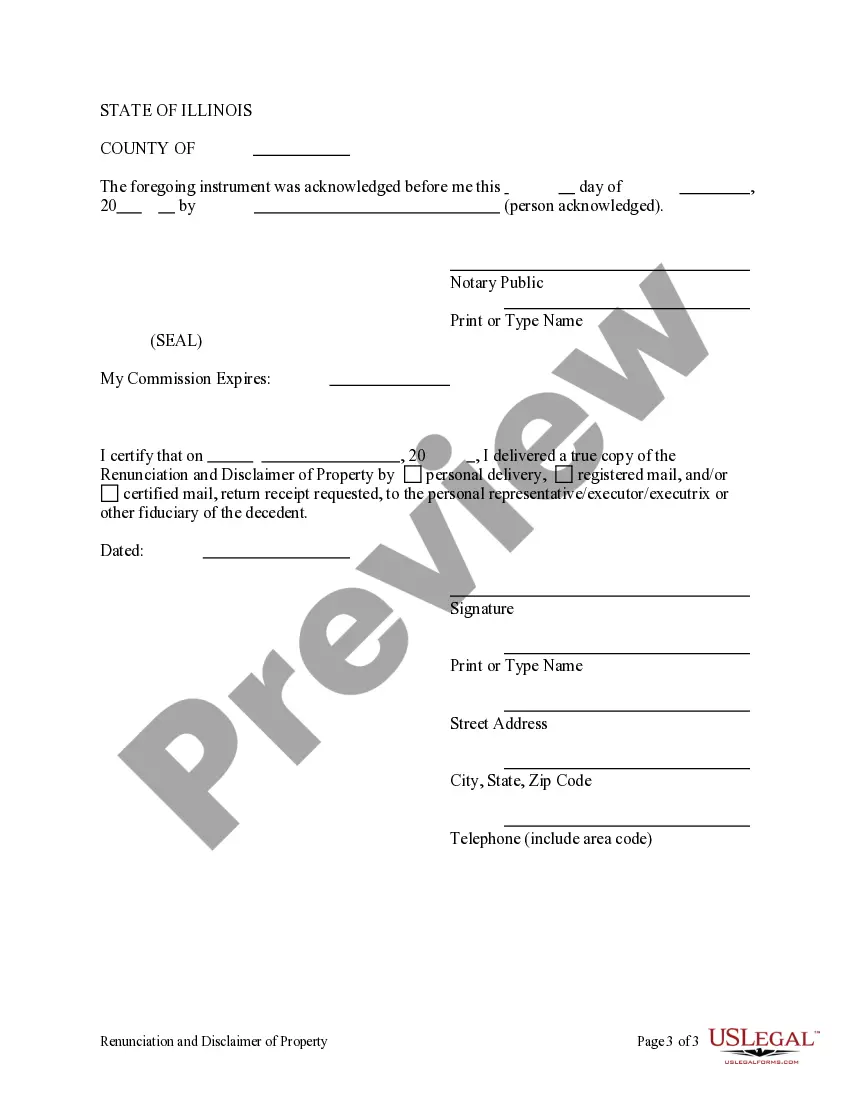

To disclaim an inheritance in Illinois, start by drafting a written disclaimer that clearly states your decision. Ensure the document aligns with Illinois laws and includes necessary details such as the inheritance's description and your signature. For a smooth process, consider using USLegalForms for a compliant Cook Illinois Renunciation and Disclaimer of Real Property Interest.

The process to disclaim an inheritance involves creating a formal disclaimer document and filing it with the appropriate authorities. In Illinois, this must be done within a specific time frame after the inheritance is accepted. Following the guidelines of the Cook Illinois Renunciation and Disclaimer of Real Property Interest ensures your disclaimer is valid.

A disclaimer of inheritance sample should clearly outline the property or interest being disclaimed. You should state your personal information, the specific details of the inheritance, and declare your intention to disclaim. Use a format compliant with the Cook Illinois Renunciation and Disclaimer of Real Property Interest to craft this document effectively.

To disclaim an inheritance in Illinois, you must file a written disclaimer that states your refusal to accept the property. This document should detail the property and your intent to disclaim it, following the state's requirements. Engaging with the Cook Illinois Renunciation and Disclaimer of Real Property Interest ensures you complete this process correctly.

To write a disclaimer of interest, you should identify the specific property interest you wish to disclaim and state your refusal clearly. In Illinois, it's important to adhere to legal requirements, including a signature and possibly notarization. Utilizing resources like USLegalForms can help ensure you create a compliant Cook Illinois Renunciation and Disclaimer of Real Property Interest.

A disclaimer of property interest in Illinois is a legal declaration stating that an individual refuses to accept a specific property interest. This process allows individuals to reject their rights to inherited property without facing potential tax consequences. By completing a Cook Illinois Renunciation and Disclaimer of Real Property Interest, you formalize your decision and protect your interests.

An example of a disclaimer of interest could involve a person inheriting a property that they do not wish to manage or own. For instance, if a relative leaves them a house requiring extensive repairs, the individual might opt to file a Cook Illinois Renunciation and Disclaimer of Real Property Interest. This action would officially state their decision to decline the property, preventing financial obligations and maintaining clarity in estate matters.

Renunciation and disclaimer of interests in an estate refer to the processes by which individuals can formally reject their rights to inherit property or assets. This legal action is crucial in avoiding unwanted responsibilities associated with an estate. The Cook Illinois Renunciation and Disclaimer of Real Property Interest acts as a guiding framework for individuals who wish to navigate these decisions smoothly, ensuring that their decisions are legally sound and communicated effectively.