Illinois Renunciation and Disclaimer of Real Property Interest

Overview of this form

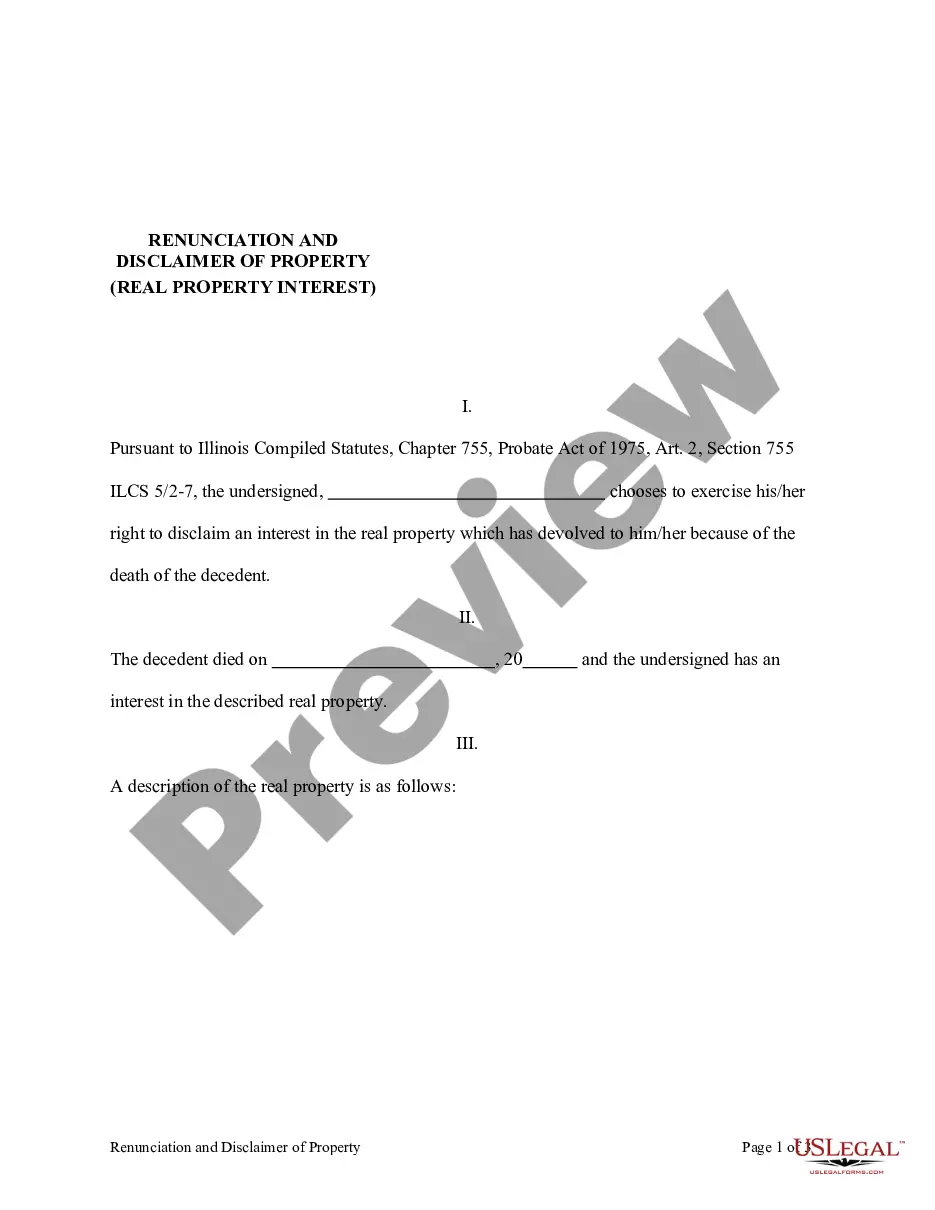

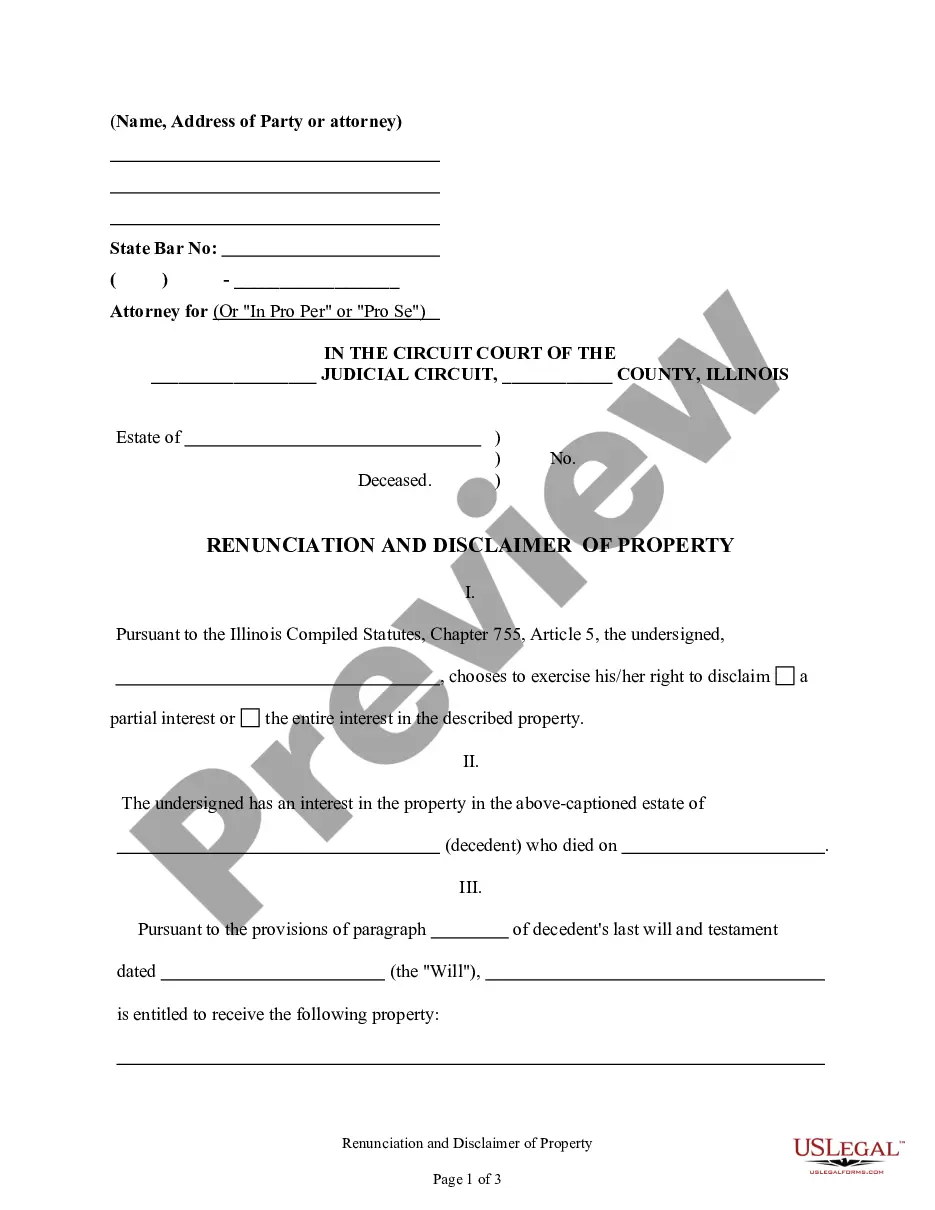

The Illinois Renunciation and Disclaimer of Real Property Interest is a legal document that allows a beneficiary to formally renounce their interest in real property acquired through the death of a decedent. By completing this form, the beneficiary ensures that the property will be transferred to the next beneficiaries as if they had predeceased the decedent. This form is distinct from other forms of property transfer as it specifically addresses the rejection of an inherited interest, following the guidelines set forth by Illinois law.

Key parts of this document

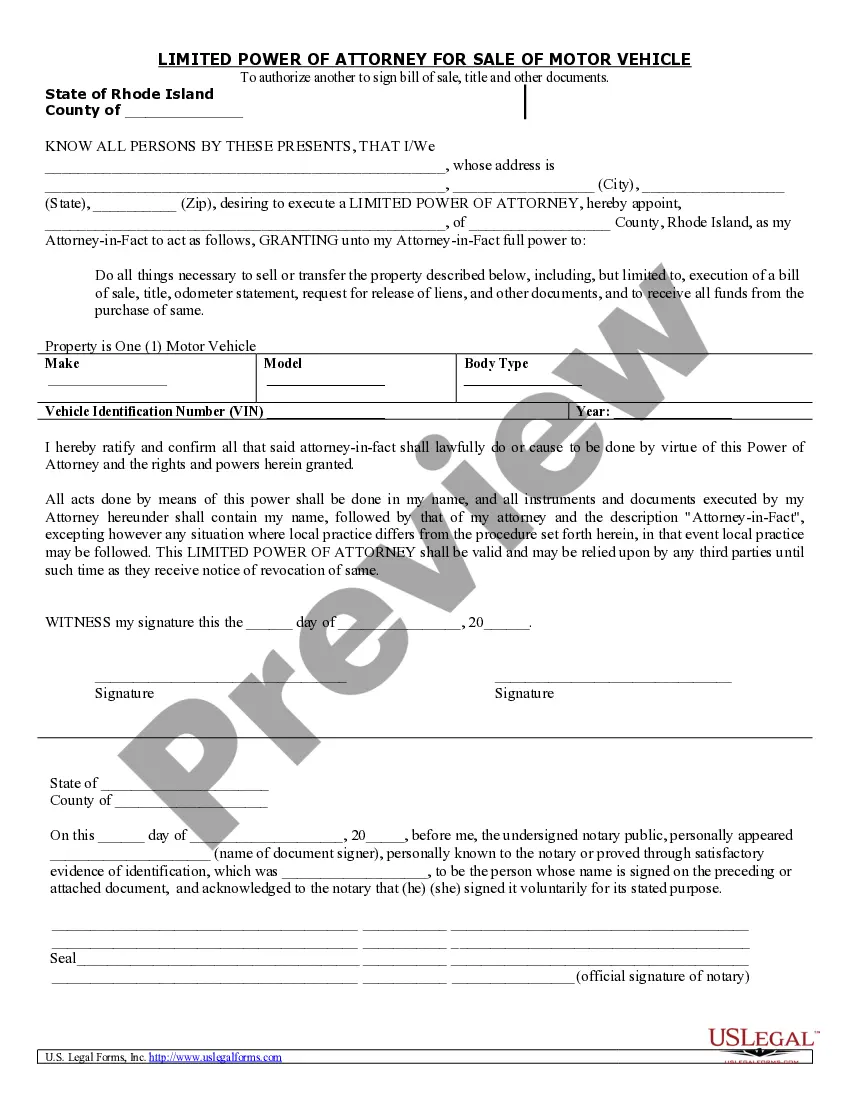

- Identification of the beneficiary and decedent.

- Description of the real property being disclaimed.

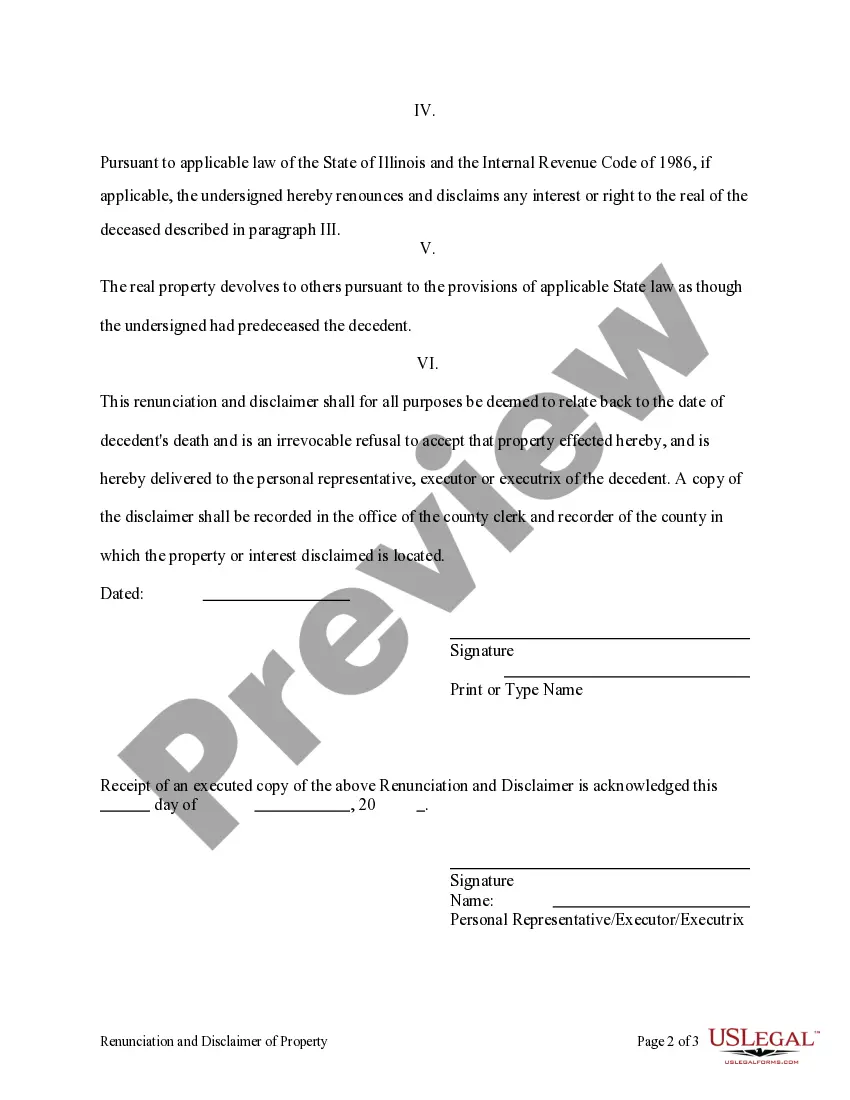

- Statement of renunciation and disclaimer of interest.

- Legal language specifying the consequences of the disclaimer.

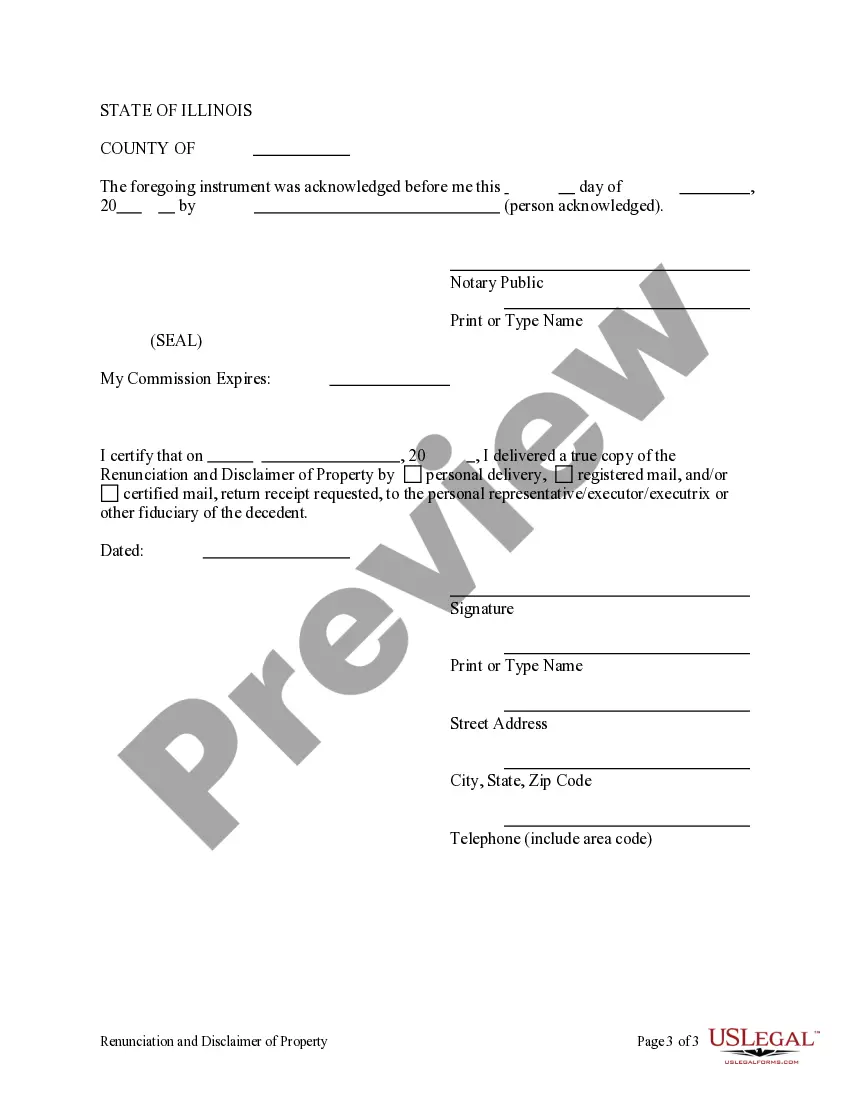

- State-specific acknowledgment and certificate of delivery.

When to use this form

This form is used when a beneficiary inherits real property but chooses to decline their interest. Situations that may prompt the use of this form include:

- The beneficiary wishes to avoid potential liabilities associated with the property.

- The beneficiary wants to ensure the property passes to other specified heirs.

- The beneficiary does not wish to hold the property for personal or financial reasons.

Intended users of this form

This form is intended for:

- Beneficiaries who have inherited real property in Illinois.

- Individuals seeking to formally refuse their interest in inherited property.

- Probate professionals assisting clients in managing estate interests.

How to prepare this document

- Identify the beneficiary and provide their contact information.

- Detail the decedent's name and the specific real property being disclaimed.

- Clearly state the renunciation of interest in the property.

- Sign the form in the presence of a notary public, if required.

- Ensure delivery of the completed form to relevant parties as required by law.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not providing all required identifying information for the property.

- Failing to sign the form in the presence of a notary, if needed.

- Neglecting to deliver the completed form to the appropriate parties.

Benefits of using this form online

- Convenience of downloading and completing the form from anywhere.

- Editable templates that ensure accuracy and ease of use.

- Access to legal forms prepared by licensed attorneys, providing reliability.

What to keep in mind

- The form allows a beneficiary to renounce their real property interest after a decedent's death.

- Completing the form correctly ensures that property passes to other beneficiaries efficiently.

- Always verify state-specific requirements when using this form in Illinois.

Looking for another form?

Form popularity

FAQ

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

In law, a disclaimer is a statement denying responsibility intended to prevent civil liability arising for particular acts or omissions. Disclaimers are frequently made to escape the effects of the torts of negligence and of occupiers' liability towards visitors.

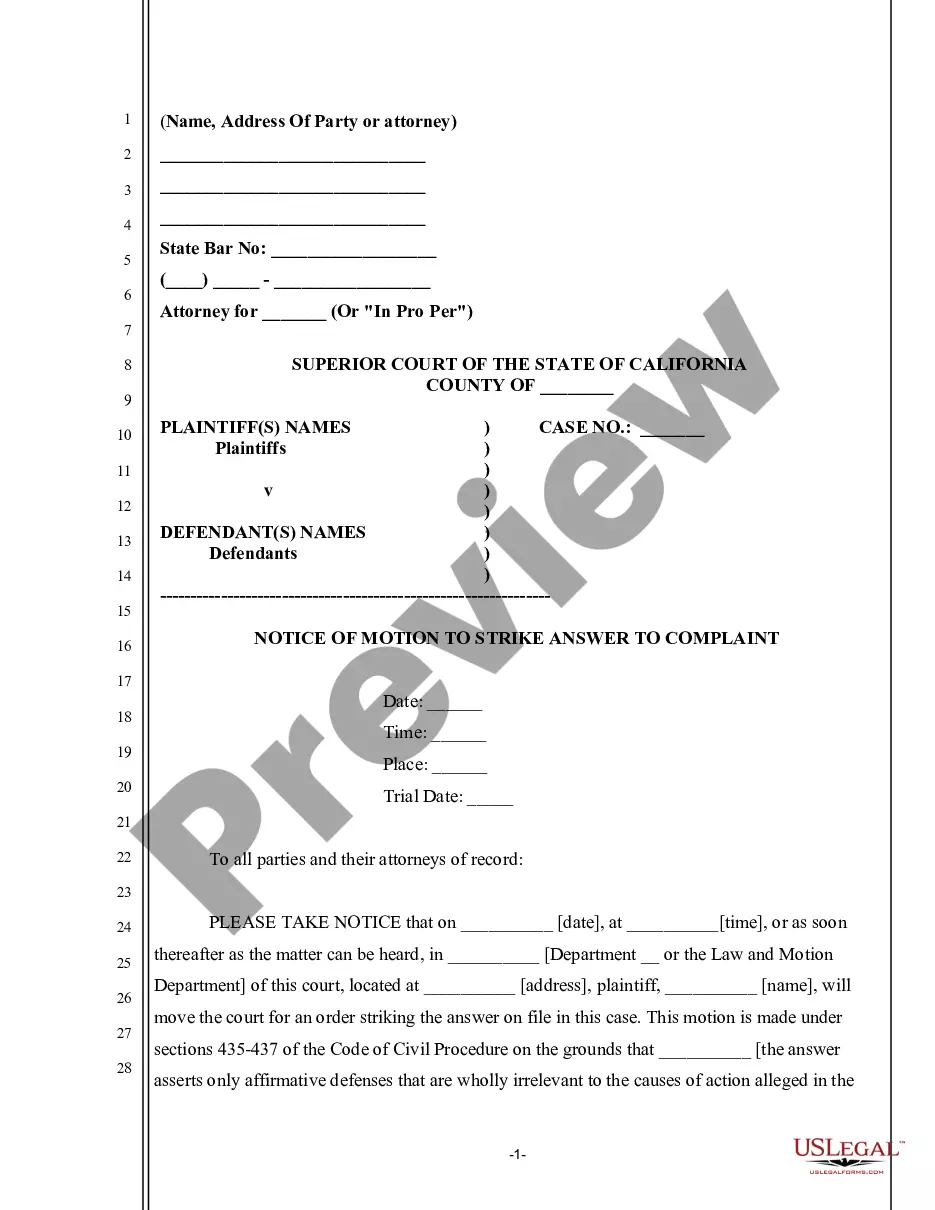

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.