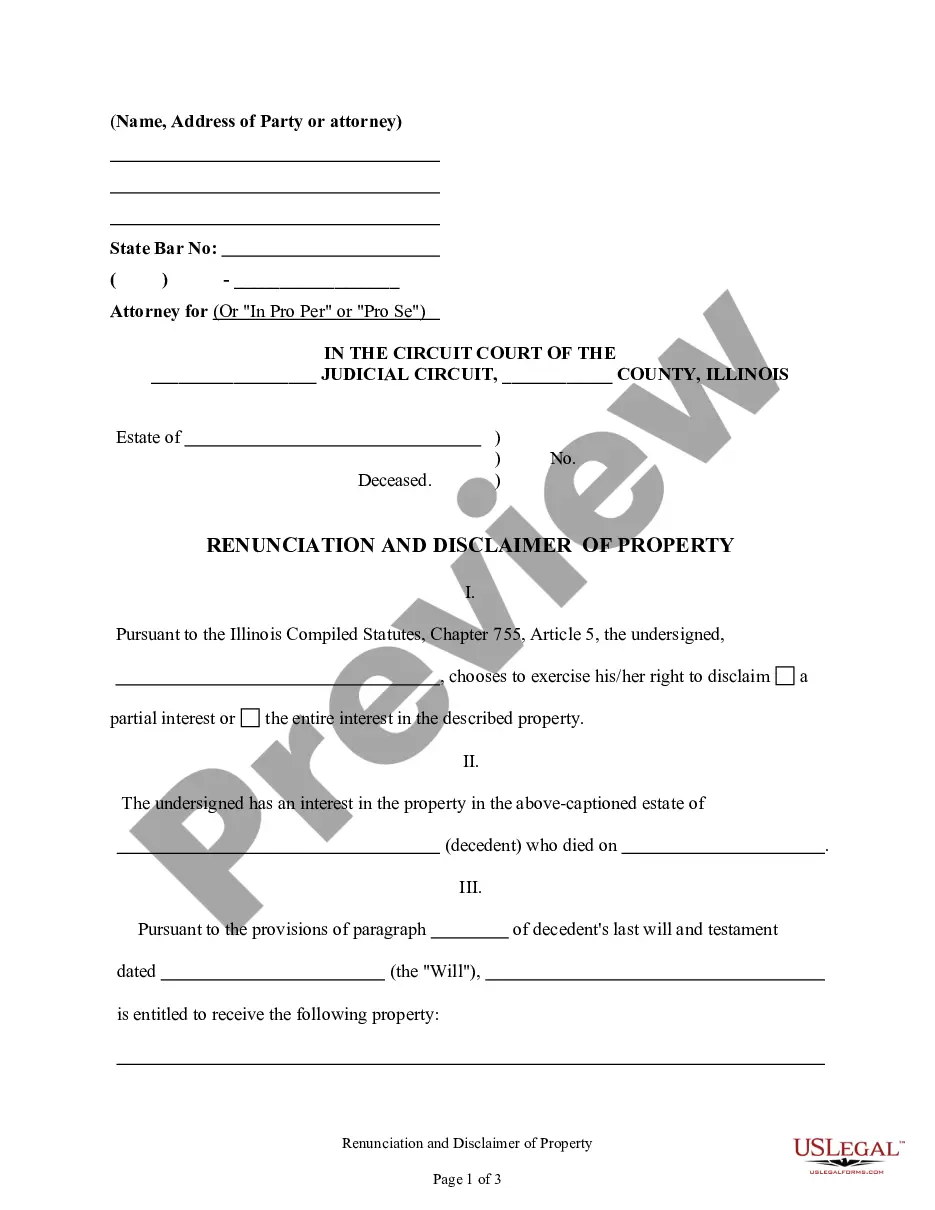

Illinois Renunciation and Disclaimer of Property received by Intestate Succession

Illinois Compiled Statutes

CHAPTER 755 ESTATES

Probate Act of 1975

ARTICLE II DESCENT AND DISTRIBUTION

Disclaimer.

(a) Right to Disclaim Interest in Property. A person

to whom any property or interest therein passes, by whatever means, may

disclaim the property or interest in whole or in part by delivering or

filing a written disclaimer as hereinafter provided. A disclaimer may be

of a fractional share or undivided interest, a specifically identifiable

asset, portion or amount, any limited interest or estate or any property

or interest derived through right of survivorship. A power (as defined

in "An Act Concerning Termination of Powers", approved May 25, 1943, as

amended)with respect to property shall be deemed to be an interest

in such property. The representative of a decedent or ward may disclaim

on behalf of the decedent or ward with leave of court. The court may approve

the disclaimer by a representative of a decedent if it finds that

the disclaimer benefits the estate as a whole and those interested in the

estate generally even if the disclaimer alters the distribution of the

property, part or interest disclaimed. The court may approve the

disclaimer by a representative of a ward if it finds that it benefits those

interested in the estate generally and is not materially detrimental

to the interests of the ward. A disclaimer by a representative of a decedent

or ward may be made without leave of court if a will or other instrument

signed by the decedent or ward designating the representative specifically

authorizes the representative to disclaim without court approval.

The right to disclaim granted by this Section exists irrespective of any

limitation on the interest of the disclaimant in the nature of a spendthrift

provision or similar restriction.

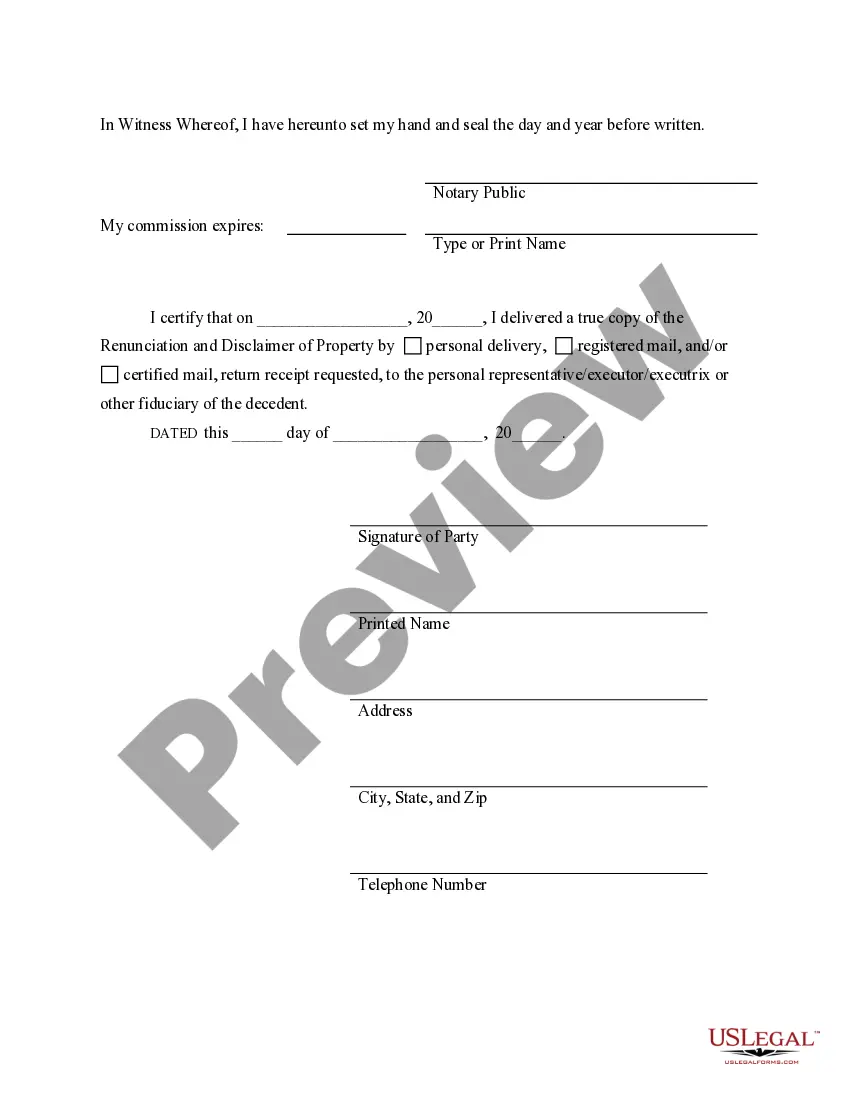

(b) Form of Disclaimer. The disclaimer shall (1) describe

the property or part or interest disclaimed, (2) be signed

by the disclaimant or his representative and (3) declare the disclaimer

and the extent thereof.

(c) Delivery of Disclaimer. The disclaimer shall be delivered

to the transferor or donor or his representative, or to the trustee or

other person who has legal title to the property, part or interest

disclaimed, or, if none of the foregoing is readily determinable, shall

be either delivered to a person having possession of the property, part

or interest or who is entitled thereto by reason of the disclaimer, or

filed or recorded as hereinafter provided. In the case of an interest

passing by reason of the death of any person, an executed counterpart of

the disclaimer may be filed with the clerk of the circuit court in the

county in which the estate of the decedent is administered, or, if

administration has not been commenced, in which it could be commenced.

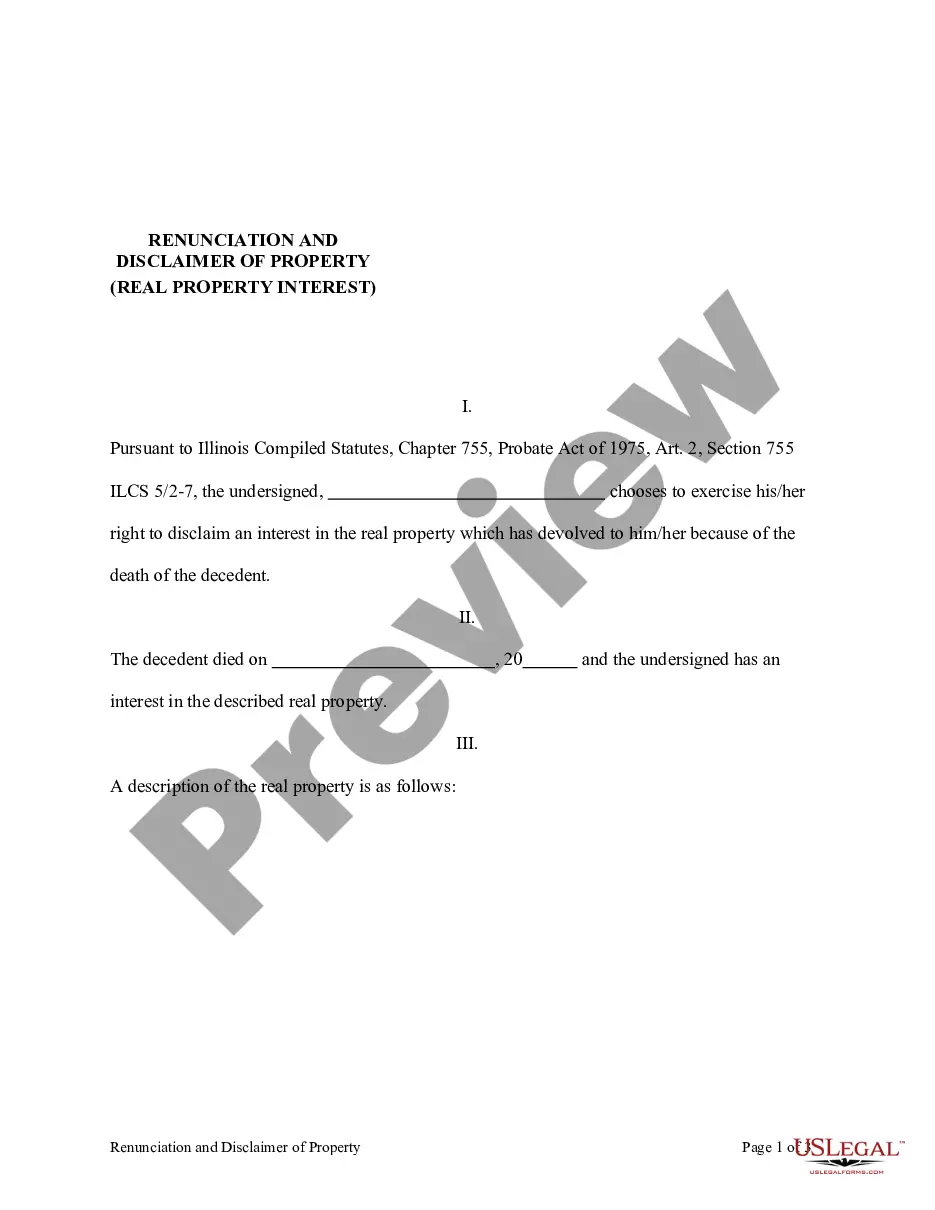

If an interest in real property is disclaimed, an executed counterpart

of the disclaimer may be recorded in the office of the recorder in the

county in which the real estate lies, or, if the title to the real

estate is registered under "An Act concerning land titles", approved May

1, 1897, as amended, may be filed in the office of the registrar of titles

of such county.

(d) Effect of Disclaimer. Unless expressly provided otherwise

in an instrument transferring the property or creating the interest

disclaimed, the property, part or interest disclaimed shall descend or

be distributed (1) if a present interest (a) in the case of a transfer

by reason of the death of any person, as if the disclaimant had predeceased

the decedent; (b) in the case of a transfer by revocable instrument

or contract, as if the disclaimant had predeceased the date the maker no

longer has the power to transfer to himself or another the entire legal

and equitable ownership of the property or interest; or (c)in the case

of any other inter vivos transfer, as if the disclaimant had predeceased

the date of the transfer; and (2) if a future interest, as if the disclaimant

had predeceased the event which determines that the taker of the property

or interest has become finally ascertained and his interest has become

indefeasibly fixed both in quality and quantity; and in each case the disclaimer

shall relate back to such date for all purposes. A disclaimer of

property or an interest in property shall not preclude any disclaimant

from receiving the same property in another capacity or from receiving

other interests in the property to which the disclaimer relates. Unless

expressly provided otherwise in an instrument transferring the property

or creating the interest disclaimed, a future interest limited to take

effect at or after the termination of the estate or interest disclaimed

shall accelerate and take effect in possession and enjoyment to the same

extent as if the disclaimant had died before the date to which the disclaimer

relates back. A disclaimer made pursuant to this Section shall be irrevocable

and shall be binding upon the disclaimant and all persons claiming by,

through or under the disclaimant.

(e) Waiver and Bar.The right to disclaim property or a part thereof

or an interest therein shall be barred by (1) a judicial sale of the property,

part or interest before the disclaimer is effected; (2) an assignment,

conveyance, encumbrance, pledge, sale or other transfer of the property,

part or interest, or a contract therefor, by the disclaimant or his representative;

(3) a written waiver of the right to disclaim; or (4) an acceptance of

the property, part or interest by the disclaimant or his representative.

Any person may presume, in the absence of actual knowledge to the contrary,

that a disclaimer delivered or filed as provided in this Section is a valid

disclaimer which is not barred by the preceding provisions of this paragraph.

A written waiver of the right to disclaim may be made by any person or

his representative and an executed counterpart of a waiver of the right

to disclaim may be recorded or filed, all in the same manner as provided

in this Section with respect to a disclaimer. In every case, acceptance

must be affirmatively proved in order to constitute a bar to a disclaimer.

An acceptance of property or an interest in property shall include the

taking of possession, the acceptance of delivery or the receipt of

benefits of the property or interest; except that (1) in the case of an

interest in joint tenancy with right of survivorship such acceptance

shall extend only to the fractional share of such property or interest

determined by dividing the number one by the number of joint tenants, and

(2) in the case of a ward, such acceptance shall extend only to property

actually received by or on behalf of the ward or his representative during

his minority or incapacity. The mere lapse of time or creation of an interest,

in joint tenancy with right of survivorship or otherwise, with or

without knowledge of the interest on the part of the disclaimant,

shall not constitute acceptance for purposes of this Section.

This Section does not abridge the right of any person to assign,convey,

release, renounce or disclaim any property or interest therein arising

under any other statute or which arose under prior law. Any interest in

real or personal property which exists on or after the effective date of

this Section may be disclaimed after that date in the manner provided herein,

but no interest which has arisen prior to that date in any person other

than the disclaimant shall be destroyed or diminished by any action of

the disclaimant taken pursuant to this Section.

Chap. 755, Art. II, Sec. 2-7.

(Source: P.A. 83-1362.)

Renunciation of will by spouse.

(a) If a will is renounced by the testator's surviving

spouse, whether or not the will contains any provision for

the benefit of the surviving spouse, the surviving spouse is entitled to

the following share of the testator's estate after payment of all just

claims: 1/3 of the entire estate if the testator leaves a descendant or

1/2 of the entire estate if the testator leaves no descendant.

(b) In order to renounce a will, the testator's surviving spouse

must file in the court in which the will was admitted to probate a written

instrument signed by the surviving spouse and declaring the renunciation.

The time of filing the instrument is: (1) within 7 months after the admission

of the will to probate or (2) within such further time as may be

allowed by the court if, within 7 months after the admission of the will

to probate or before the expiration of any extended period, the surviving

spouse files a petition therefor setting forth that litigation is pending

that affects the share of the surviving spouse in the estate. The filing

of the instrument is a complete bar to any claim of the surviving spouse

under the will.

(c) If a will is renounced in the manner provided by this Section,

any future interest which is to take effect in possession or enjoyment

at or after the termination of an estate or other interest given by the

will to the surviving spouse takes effect as though the surviving spouse

had predeceased the testator, unless the will expressly provides that in

case of renunciation the future interest shall not be accelerated.

(d) If a surviving spouse of the testator renounces the will and

the legacies to other persons are thereby diminished or increased in value,

the court, upon settlement of the estate, shall abate from or add to the

legacies in such a manner as to apportion the loss or advantage among the

legatees in proportion to the amount and value of their legacies.

Chap. 755, Art. II, Sec. 2-8.

(Source: P.A. 79-328.)