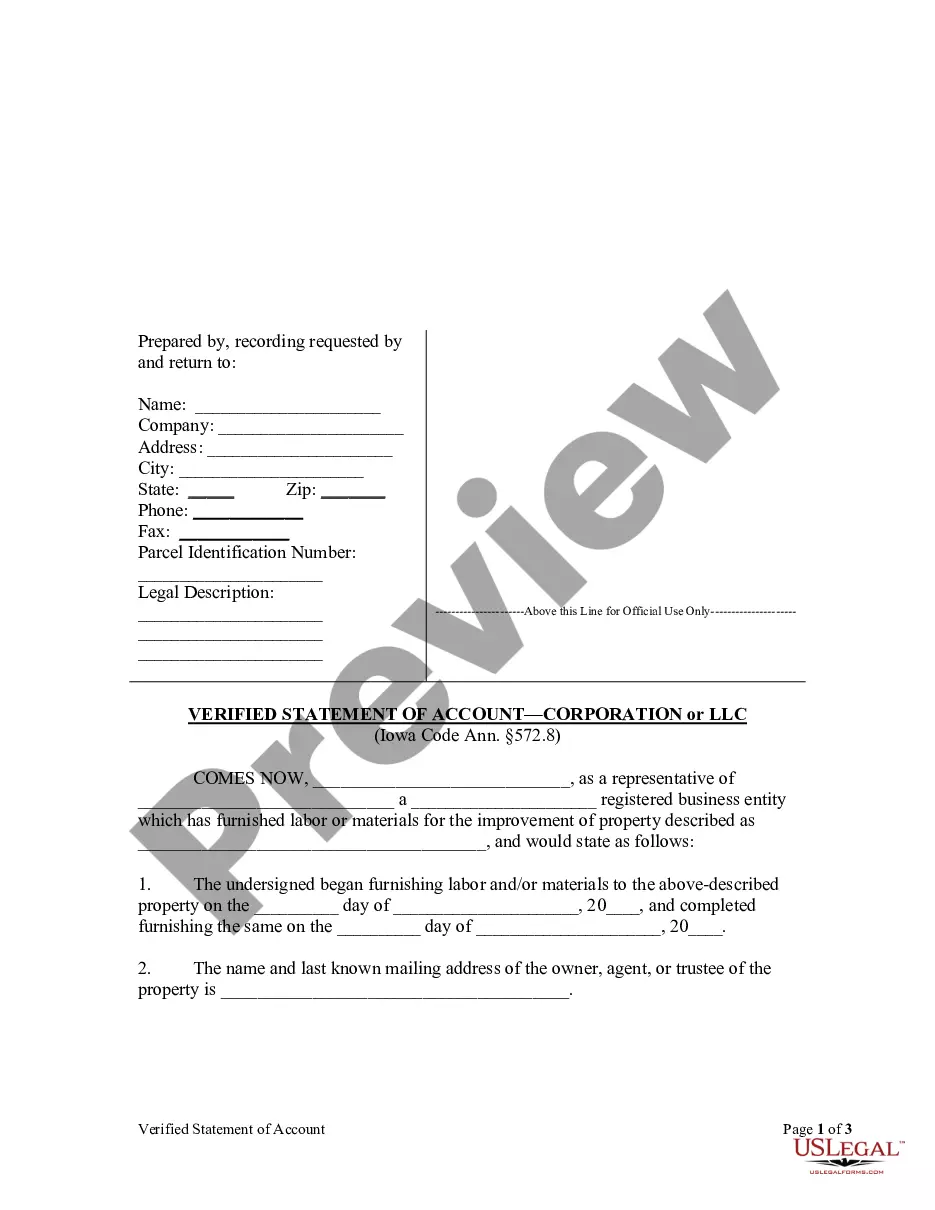

Iowa law requires a party seeking to perfect a mechanic's lien to file a verified statement with the clerk of the district court of the county in which the building, land, or improvement is situated. The verified statement contains a description of the property and the name and address of the property owner. It is the responsibility of the district court clerk to forward a copy of the lien to the property owner after filing. The verified statement must be filed within ninety (90) days from the date on which the last material was furnished or labor performed.

Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC

Description

How to fill out Iowa Verified Statement Of Account By Corporation Or LLC?

We consistently seek to minimize or avert legal repercussions when handling intricate legal or financial issues.

To achieve this, we enlist attorney services that are typically very costly.

However, not every legal issue is equally complicated; many can be managed independently.

US Legal Forms is an online repository of current DIY legal templates ranging from wills and powers of attorney to incorporation documents and dissolution petitions.

Just Log In to your account and hit the Get button adjacent to it. If you happen to misplace the form, you can easily re-download it from the My documents section. The procedure is as straightforward if you're a newcomer to the platform! You can establish your account in just a few minutes. Please ensure that the Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC complies with the statutes and regulations of your state and area. Additionally, it’s essential to review the form’s outline (if available), and if you notice any inconsistencies with your initial requirements, search for a different form. Once you confirm that the Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC is suitable for your situation, you can choose the subscription option and proceed with the payment. Then, you can download the form in any available file format. Over the course of more than 24 years, we’ve assisted millions of individuals by offering ready-to-customize and current legal forms. Utilize US Legal Forms today to conserve time and resources!

- Our library empowers you to manage your affairs without needing legal representation.

- We offer access to legal document templates that are not always publicly available.

- Our templates are tailored to specific states and regions, which significantly streamlines the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC or any other document swiftly and securely.

Form popularity

FAQ

If you fail to file a biennial report in Iowa, your LLC may face penalties, including fines or administrative dissolution. Your business status could also become inactive, complicating future operations. To avoid these issues, it’s crucial to file on time and maintain your Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC in good standing. Consider using US Legal Forms for a streamlined filing experience.

A statement of termination for an LLC in Iowa signifies the formal dissolution of your business entity. To file this document, you must follow the state's procedures, detailing the reasons for your termination. Once filed, you will receive confirmation, which includes a Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC confirming your LLC’s closure.

Iowa does not require annual reports for LLCs; instead, it mandates a biennial report. This means you should file this report every two years, ensuring your LLC remains compliant. Staying on top of this requirement secures your Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC and helps avoid any penalties.

You can file an Iowa biennial report online through the Iowa Secretary of State's official website. This platform allows you to complete your report efficiently and securely. Just log in, enter your business information, and follow the prompts. By ensuring timely filing, you help maintain your Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC in good standing.

To file a Certificate of Organization in Iowa, visit the Secretary of State's website and access the online filing system. You need to provide details about your LLC, including its name, business purpose, and registered agent. After completing the form, you can submit payment electronically. Once your filing is approved, you will receive a Cedar Rapids Iowa Verified Statement of Account by Corporation or LLC.

A certificate of organization form, sometimes referred to as the articles of organization, is the document that one must complete and submit to the state to establish the creation of an LLC within Iowa. It sets forth the name of the proposed company and contact information for its registered agent, among other details.

To lookup any type of business entity in Iowa, you must first go to the Secretary of State's Website. Here you will be able to preform a lookup by Name or Number.

A certificate of organization form, sometimes referred to as the articles of organization, is the document that one must complete and submit to the state to establish the creation of an LLC within Iowa. It sets forth the name of the proposed company and contact information for its registered agent, among other details.

If you fail to do so, the ICO can issue a monetary penalty of up to £4,000 on top of the fee you are required to pay. It is the law to pay the fee, which funds the ICO's work, but it also makes good business sense because whether or not you have paid could have an impact on your reputation.

You are allowed to operate a sole proprietorship without registering, but you are required to register with your local government to collect and file state taxes. There is nothing wrong with running an unregistered business as long as your business is legal and meets all licensing and tax requirements.