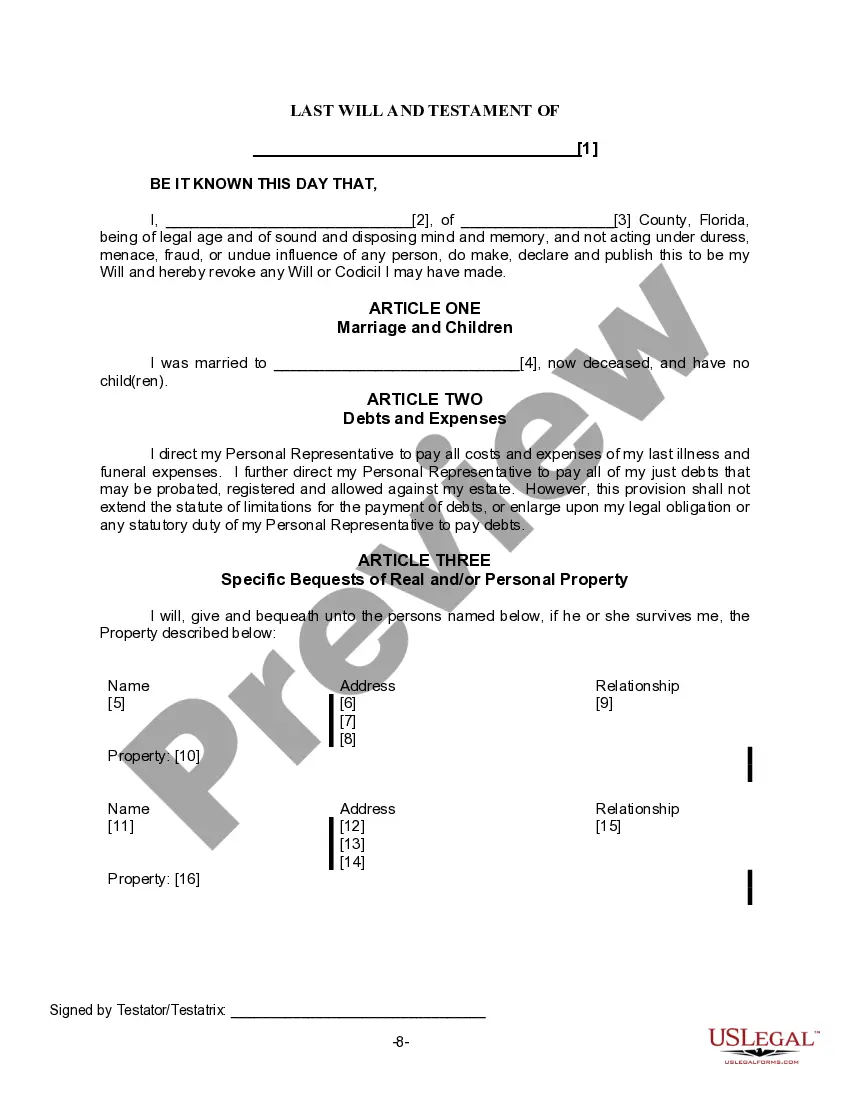

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Miami-Dade Florida Last Will for a Widow or Widower with no Children

Description

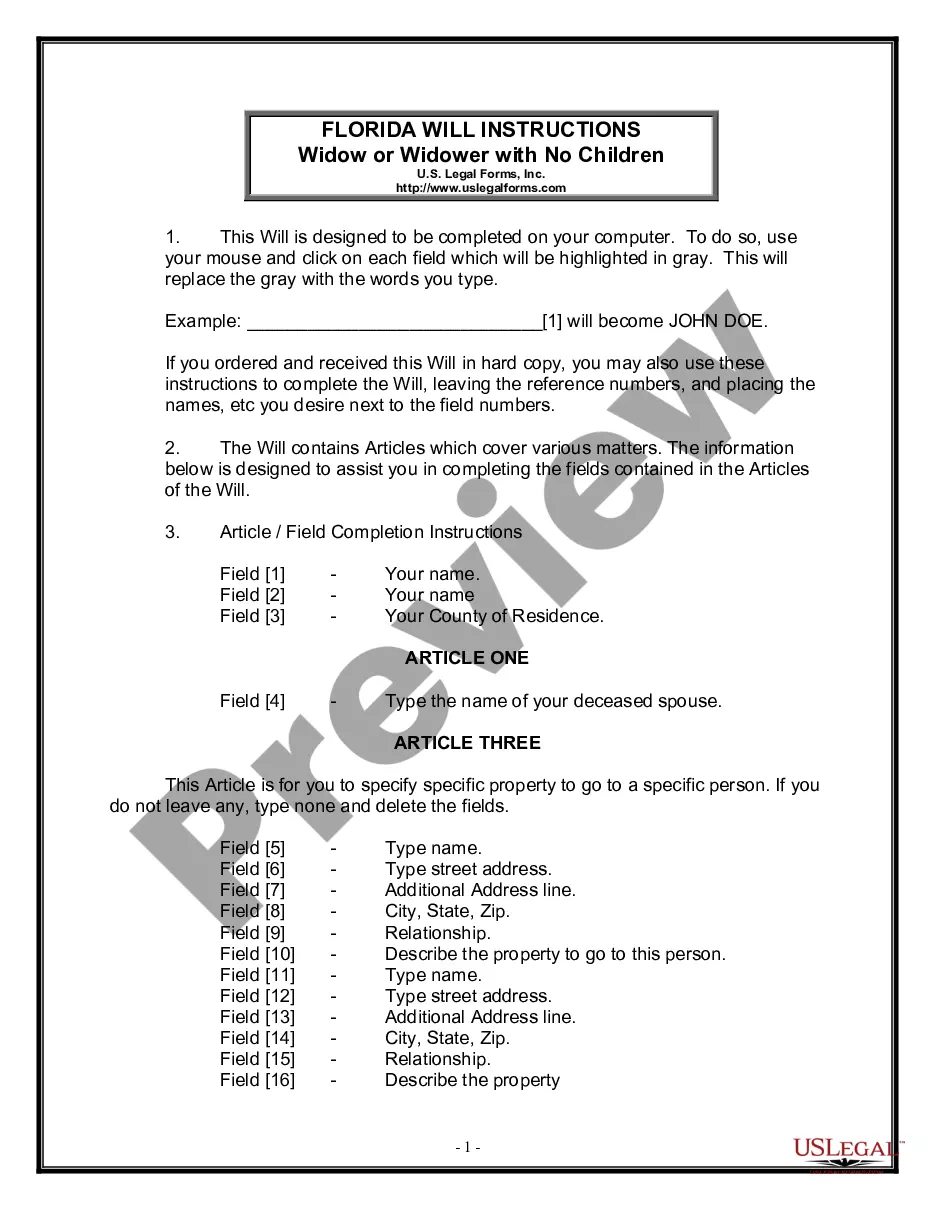

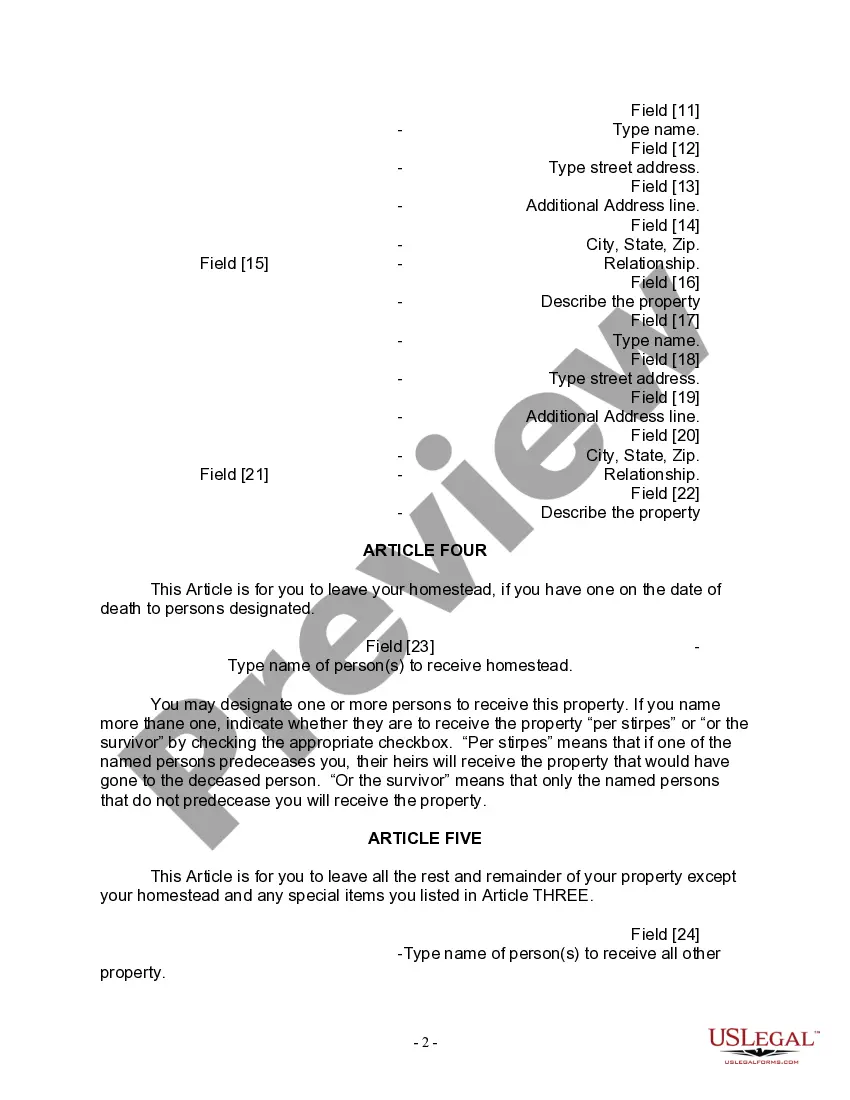

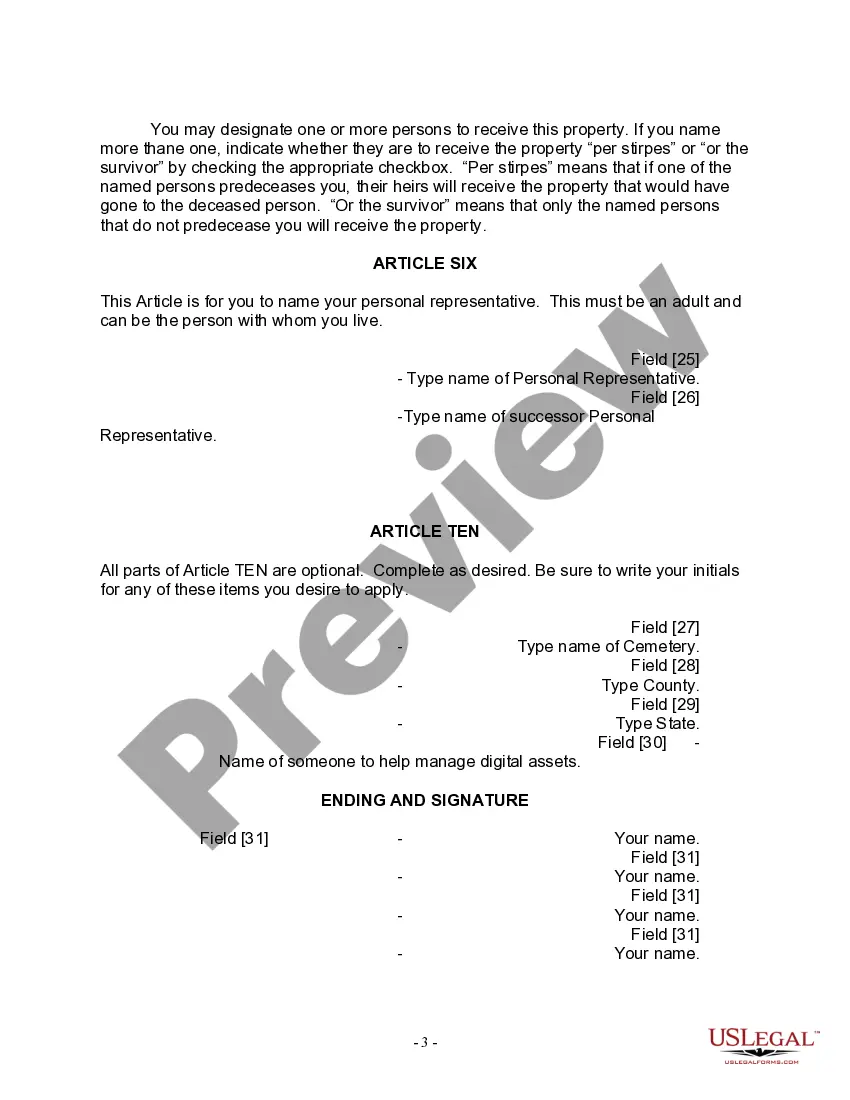

How to fill out Florida Last Will For A Widow Or Widower With No Children?

Do you require a reliable and cost-effective supplier of legal forms to obtain the Miami-Dade Florida Legal Last Will Form for a Widow or Widower without Children? US Legal Forms is your ideal option.

Whether you need a basic contract to establish rules for living together with your partner or a collection of documents to finalize your divorce through the legal system, we are here to assist you. Our service provides over 85,000 current legal document templates for both personal and business purposes. All templates we offer are not one-size-fits-all but are tailored to meet the needs of specific states and counties.

To acquire the form, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please remember that you can download your previously obtained document templates at any time from the My documents section.

Is this your first visit to our platform? No problem. You can set up an account in just a few minutes, but first, ensure you do the following: Check if the Miami-Dade Florida Legal Last Will Form for a Widow or Widower with no Children adheres to the laws of your state and local area.

Then select the subscription plan and proceed to payment. Once the payment is completed, you can download the Miami-Dade Florida Legal Last Will Form for a Widow or Widower with no Children in any available format. You are welcome to revisit the website at any time and download the form at no cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time studying legal papers online once and for all.

- Examine the form’s specifics (if provided) to understand who and what the form is meant for.

- Re-initiate the search if the template does not fit your particular situation.

- Now you can establish your account.

Form popularity

FAQ

Yes, you can write your own will in Florida. However, it's crucial to ensure that your document meets the legal requirements to be valid. When creating your Miami-Dade Florida Last Will for a Widow or Widower with no Children, consider the formalities of execution, such as having witnesses. For added peace of mind, using a reliable platform like uslegalforms can help ensure that your will aligns with legal standards, providing you with confidence in your estate planning.

Yes, you can legally write your own will in Florida, as long as it meets the state's legal requirements. A Miami-Dade Florida Last Will for a Widow or Widower with no Children must be in writing, signed by you, and witnessed by at least two individuals. To ensure your will is valid and up to standard, consider using the templates provided by USLegalForms, which guide you through creating a satisfactory document.

While hiring a lawyer can help navigate the complexities of filing a will in Florida, it is not always necessary. You can represent yourself when filing the Miami-Dade Florida Last Will for a Widow or Widower with no Children, provided you understand the requirements. Utilizing resources like USLegalForms can simplify the process and help ensure compliance with state laws.

In Miami-Dade County, you should file a will at the Miami-Dade County Clerk of the Courts, specifically in the Probate Division. This office handles the probate process and will ensure your Miami-Dade Florida Last Will for a Widow or Widower with no Children is properly recorded. Check their website for a list of required documents and office hours to make your visit efficient.

To submit a will in Florida, you typically need to file it with the local probate court in the county where the deceased resided. In Miami-Dade County, visit the clerk of the court's office to ensure proper filing. Filing the Miami-Dade Florida Last Will for a Widow or Widower with no Children promptly is crucial for the probate process. Always double-check requirements or consider using USLegalForms for assistance.

Creating a Miami-Dade Florida Last Will for a Widow or Widower with no Children without a lawyer is a straightforward process. Begin by organizing your assets and deciding how you wish to distribute them. Then, use a reliable online platform, such as USLegalForms, to access easy templates that guide you through the necessary steps. It's important to ensure your will meets Florida's legal requirements to ensure its validity.

When a spouse dies, there are several essential documents to manage, including the death certificate and any existing wills. If the deceased had assets, you may need to file probate forms. Utilizing resources like USLegalForms can simplify these processes, particularly when creating a Miami-Dade Florida Last Will for a Widow or Widower with no Children.

In Florida, a wife has specific rights after her husband's death, including the right to inherit a share of his estate. This can vary depending on whether there are children involved. To protect these rights effectively, a Miami-Dade Florida Last Will for a Widow or Widower with no Children can serve as a vital legal tool.

If there is no will in Florida, the state’s intestacy laws determine who inherits the estate. Typically, the surviving spouse will inherit a portion, along with any children. In situations without children, the surviving spouse may inherit everything, emphasizing the importance of a Miami-Dade Florida Last Will for a Widow or Widower with no Children to avoid uncertainty.

A surviving spouse in Florida is entitled to a significant portion of the deceased spouse's estate. This includes rights to a share of the estate and possibly the marital home. Understanding these rights is crucial, and having a Miami-Dade Florida Last Will for a Widow or Widower with no Children can ensure your entitlements are clearly outlined.