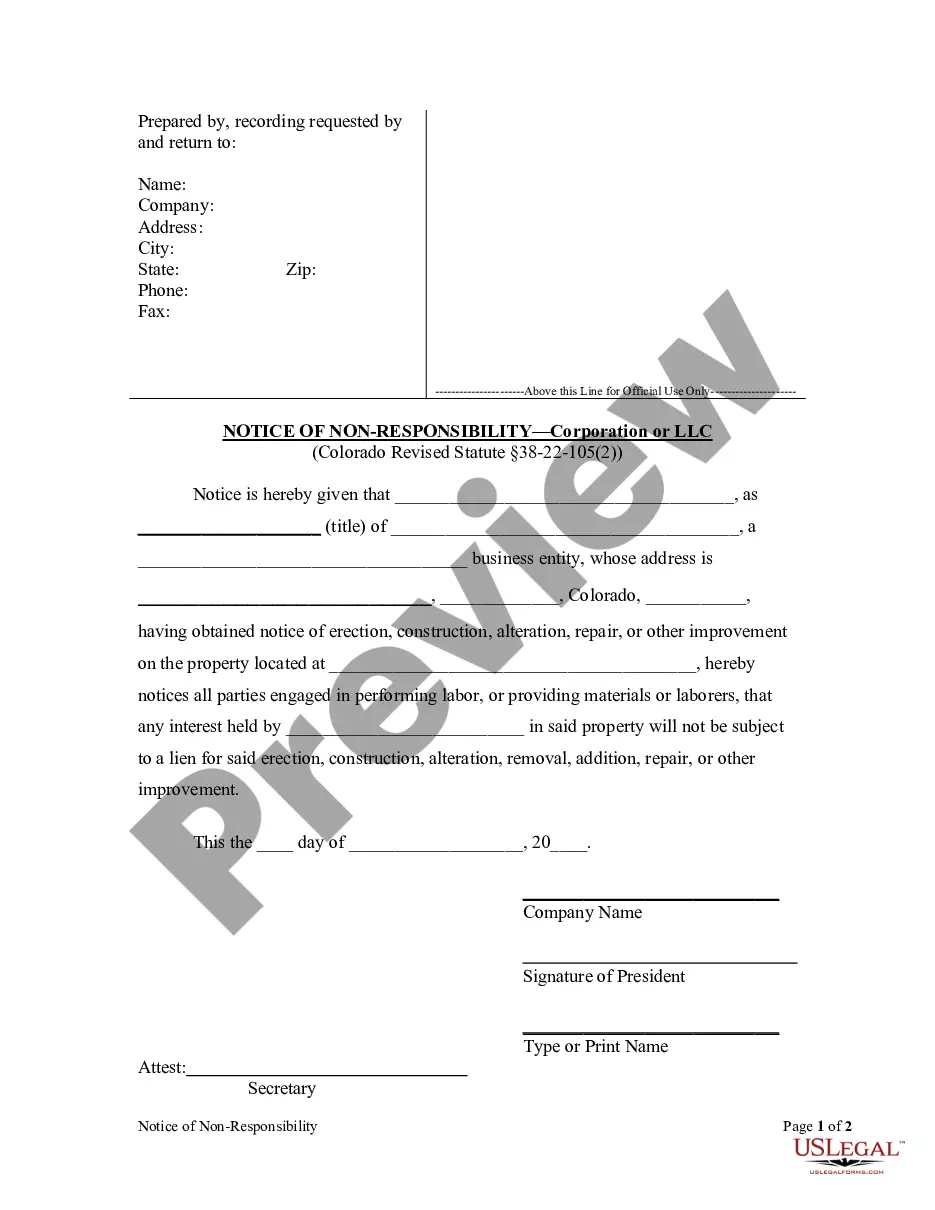

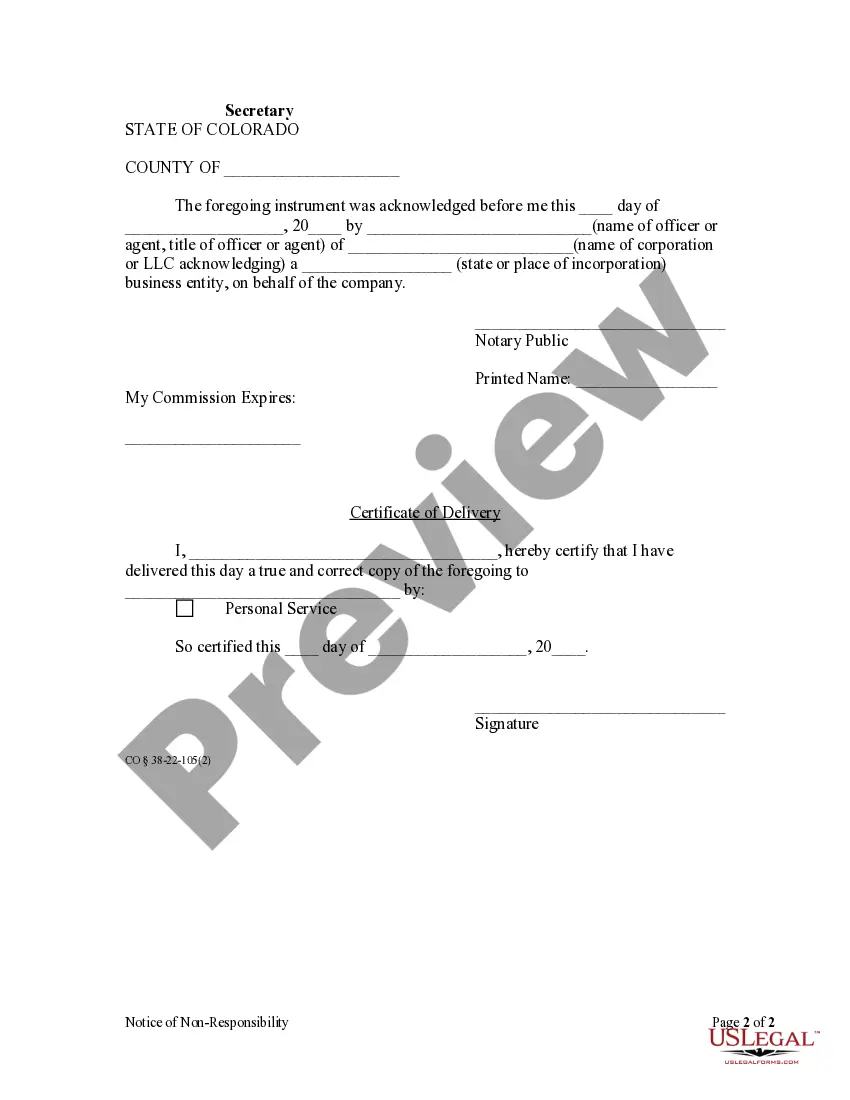

This notice allows a corporate property owner to provide notice to any party performing improvements on the owner's property that the owner's interest in the property will not be subject to a lien. This notice must be personally served upon all parties performing labor or supplying materials or posted continuously in some conspicuous place upon the land or building being improved within five days of the owner receiving notice of improvements.

Westminster Colorado Notice of Nonresponsibility by Corporation

Description

How to fill out Colorado Notice Of Nonresponsibility By Corporation?

We consistently aim to minimize or prevent legal harm when navigating intricate legal or financial issues.

To achieve this, we seek legal assistance solutions that, generally speaking, are quite costly.

However, not all legal challenges are similarly complicated.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the Westminster Colorado Notice of Nonresponsibility by Corporation or LLC or any other document in a straightforward and secure manner. Simply Log In to your account and click the Get button adjacent to it. If you misplace the form, you can always retrieve it again from within the My documents tab. The procedure is just as simple for new users! You can establish your account in a few minutes. Ensure to verify if the Westminster Colorado Notice of Nonresponsibility by Corporation or LLC conforms to the laws and regulations of your state and region. Furthermore, it’s crucial to review the form’s outline (if available), and if you perceive any inconsistencies with your initial expectations, look for an alternative form. Once you’ve confirmed that the Westminster Colorado Notice of Nonresponsibility by Corporation or LLC is appropriate for your situation, you can choose the subscription option and process the payment. You can then download the form in any suitable format. With over 24 years in operation, we’ve assisted millions of individuals by providing customizable and current legal documents. Capitalize on US Legal Forms now to conserve time and resources!

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository enables you to manage your affairs without enlisting the services of an attorney.

- We provide access to legal document templates that are not always readily available.

- Our templates are specific to state and locality, which greatly simplifies the search process.

Form popularity

FAQ

Police Administration Division The Police Department has a total of 199 sworn personnel and 80.3 professional staff.

Quiet hours are from 10 p.m. to 6 a.m. All generators, music, radios or other loud noises that may disturb the peace are not permitted during these hours. Generator noise can not exceed 60dB. Fires are allowed only in provided fire pits and in designated areas.

To apply for this certificate with Colorado, use the Application for Sales Tax Exemption for Colorado Organization (DR 0715). No fee is required for this exemption certificate and it does not expire.

An S corporation must file Form 106 for any year it is doing business in Colorado. Doing business in a state is defined as having income arising from the activity of one or more employees located in the state; or arising from the fact that real or personal property is located in the state for business purposes.

How to Apply Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt.Attach a copy of your latest financial statement to reflect sources of Colorado income and expenditures.Attach a copy of Colorado Articles of Incorporation or of Organization.

How to fill out the Colorado Sales Tax Exemption Certificate Step 1 ? Begin by downloading the Colorado Sales Tax Exemption Certificate Form DR 0563. Step 2 ? Identify the business name and business address of the seller. Step 3 ? Identify the name and business address of the buyer.

What is the sales tax rate in Westminster, California? The minimum combined 2022 sales tax rate for Westminster, California is 8.6%. This is the total of state, county and city sales tax rates.

Livestock is not allowed. In the City of Westminster, there is not any breed specific laws in place.

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter ?Exempt? on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

(a) A seller must verify that the purchaser's sales tax license or exemption certificate is current and valid at the time of the sale. a license or certificate is current and valid, a seller can go online to and follow the link to ?Verify a License or Certificate.?