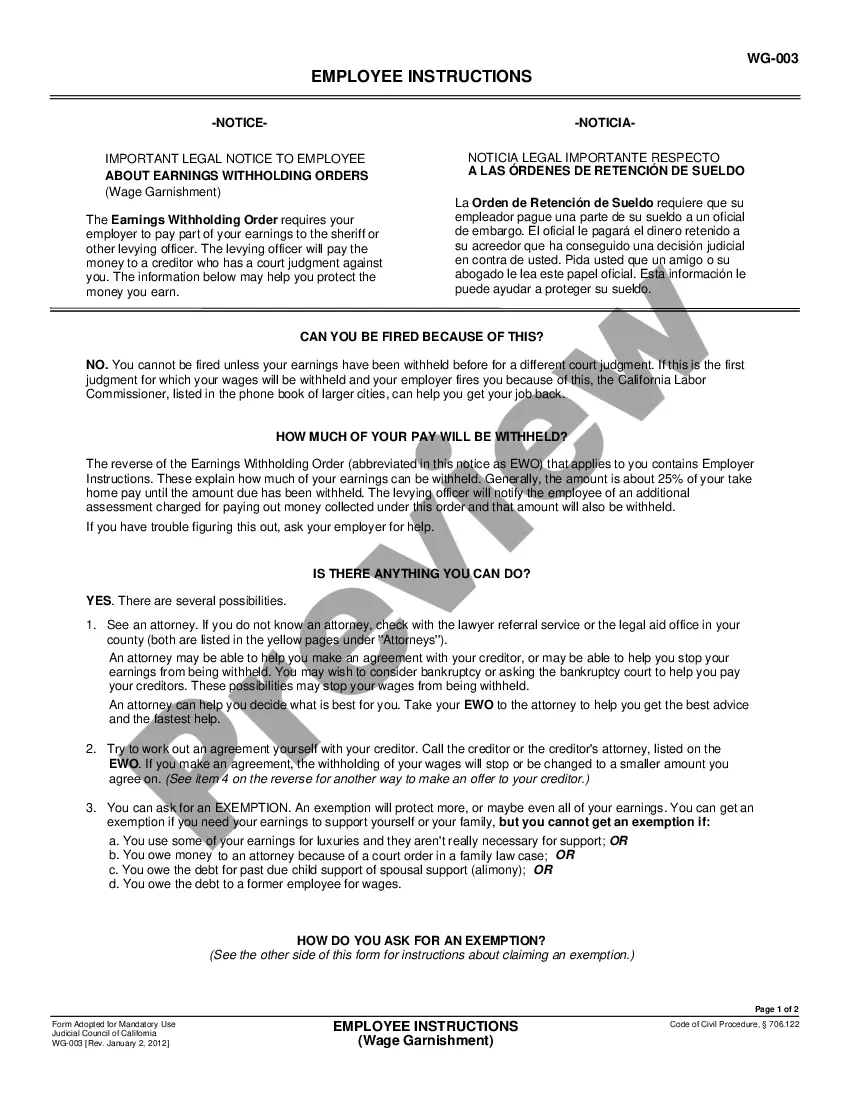

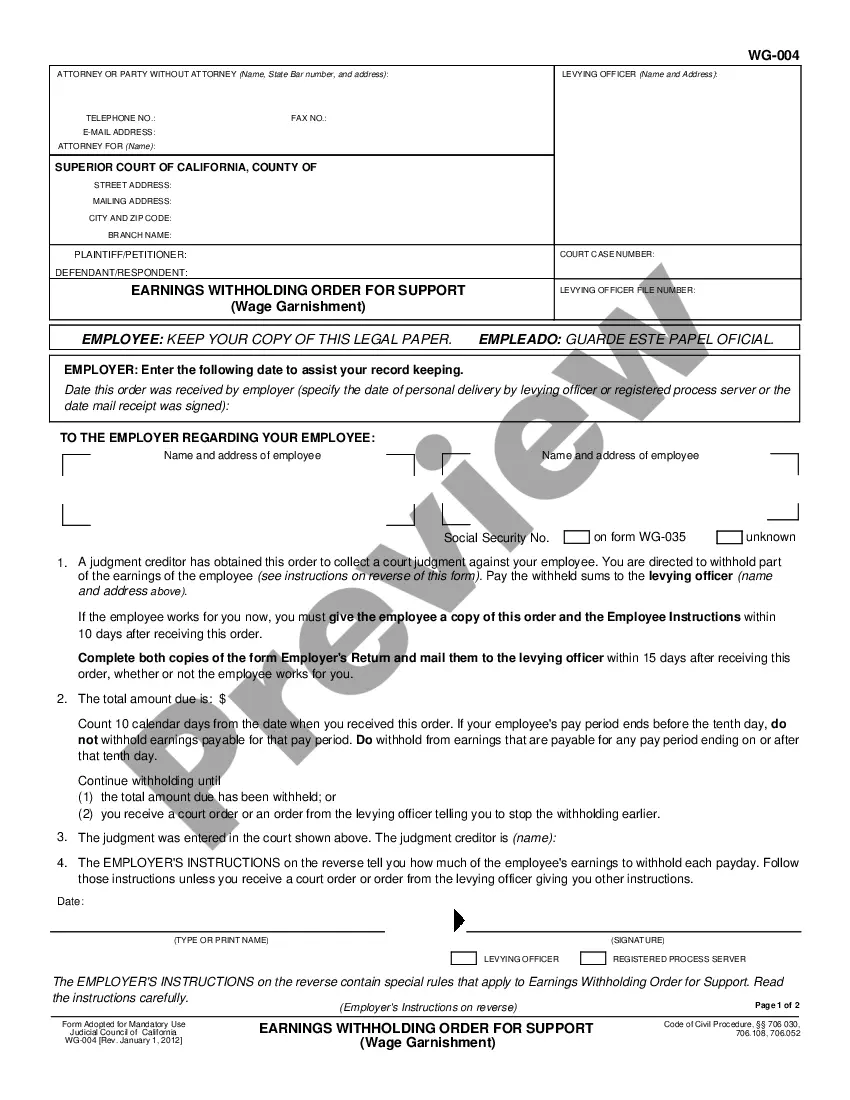

Employer's Return: An Employer's Return involves the wage garnishment of an Employee. This form is to be filled out and signed by the Employer, or risk fines from the court for non-compliance. It lists the Employee's name, address and wages, among other things.

Simi Valley California Employer's Return - Wage Garnishment

Description

How to fill out California Employer's Return - Wage Garnishment?

Regardless of one's social or occupational position, completing legal documents is a regrettable requirement in today's society.

Frequently, it's nearly impossible for individuals lacking a legal background to generate such documentation from scratch, primarily because of the complicated terminology and legal subtleties involved.

Here is where US Legal Forms comes to the aid. Our platform provides an extensive library with over 85,000 ready-to-use forms specific to each state, accommodating nearly every legal circumstance.

Click 'Buy now' and select the subscription package that fits you best.

Enter your account Log In credentials or create a new one from the beginning. Then select the payment method and proceed to download the Simi Valley California Employer's Return - Wage Garnishment once the payment is processed. You're all set! Now you can either print the form or fill it out online. If you encounter any difficulties in accessing your purchased forms, you can easily find them in the My documents section. Whatever issue you're attempting to resolve, US Legal Forms has you covered. Give it a try now and witness the benefits for yourself.

- Whether you need the Simi Valley California Employer's Return - Wage Garnishment or any other document that will be recognized in your locality, US Legal Forms has everything readily available.

- To obtain the Simi Valley California Employer's Return - Wage Garnishment swiftly using our reliable service, if you are already a subscriber, you may proceed to Log In to your account to access the desired form.

- However, if you are not acquainted with our platform, make sure to follow these steps before downloading the Simi Valley California Employer's Return - Wage Garnishment.

- Confirm that the form you have located is appropriate for your jurisdiction since the laws of one state or region may not apply to another.

- Examine the form and peruse a brief summary (if present) concerning the scenarios for which the paper can be utilized.

- If the form you selected does not fulfill your requirements, you can restart and search for the needed document.

Form popularity

FAQ

Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

Unfortunately a garnishee order can only be stopped by bringing an application to court to have the order stopped, or, if the judgment creditor informs the employer or garnishee that he no longer needs to deduct money from your salary.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

The earnings withholding order is valid until 180 consecutive days have passed with no money withheld under that order from that employee's earnings.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

Stop Wage Garnishment in California Call the Creditor ? There is nothing lost in trying to talk to the creditor and work out a different arrangement to repay the debt back.File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption.