This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you are looking for an authentic document, it’s incredibly difficult to find a superior platform than the US Legal Forms site – one of the largest repositories on the internet.

Here you can discover thousands of templates for business and personal needs categorized by types and states, or keywords.

With the excellent search feature, locating the latest Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finish the registration process.

Obtain the document. Choose the format and save it to your device.

- Additionally, the correctness of each document is confirmed by a team of qualified attorneys who consistently review the templates on our platform and update them according to the latest state and county laws.

- If you are already familiar with our platform and have an account, all you need to obtain the Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is to Log In to your user account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the form you require. Review its details and use the Preview option (if available) to view its contents. If it doesn’t meet your requirements, use the Search option at the top of the page to find the correct document.

- Verify your choice. Click the Buy now button. Afterward, select your desired subscription plan and provide your information to register for an account.

Form popularity

FAQ

For an Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate to be valid, it must include specific elements. First, it should clearly state the amount to be repaid, along with the interest rate and payment schedule. Second, both parties must agree to the terms and sign the document. Lastly, the note must be for a lawful purpose and contain the necessary signatures to be enforceable.

When reporting an Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate on your taxes, you should keep detailed records of interest payments received. You will typically report this income on your tax return as interest income. Make sure to include any associated expenses as well. For personalized assistance, consider exploring resources on USLegalForms, which can help you navigate tax obligations regarding promissory notes.

Yes, a promissory note can indeed be secured by real property, which is often ideal for both lenders and borrowers. When you have an Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the property acts as collateral. This arrangement enhances security for the lender while providing access to necessary funds for the borrower. It’s a common practice to ensure trust and responsibility in borrowing.

You typically file a promissory note with the county recorder's office where the property is located. For an Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this secure filing establishes a public record. Filing helps protect your rights and interests in the promissory note. It also provides important documentation in case of any disputes or legal matters.

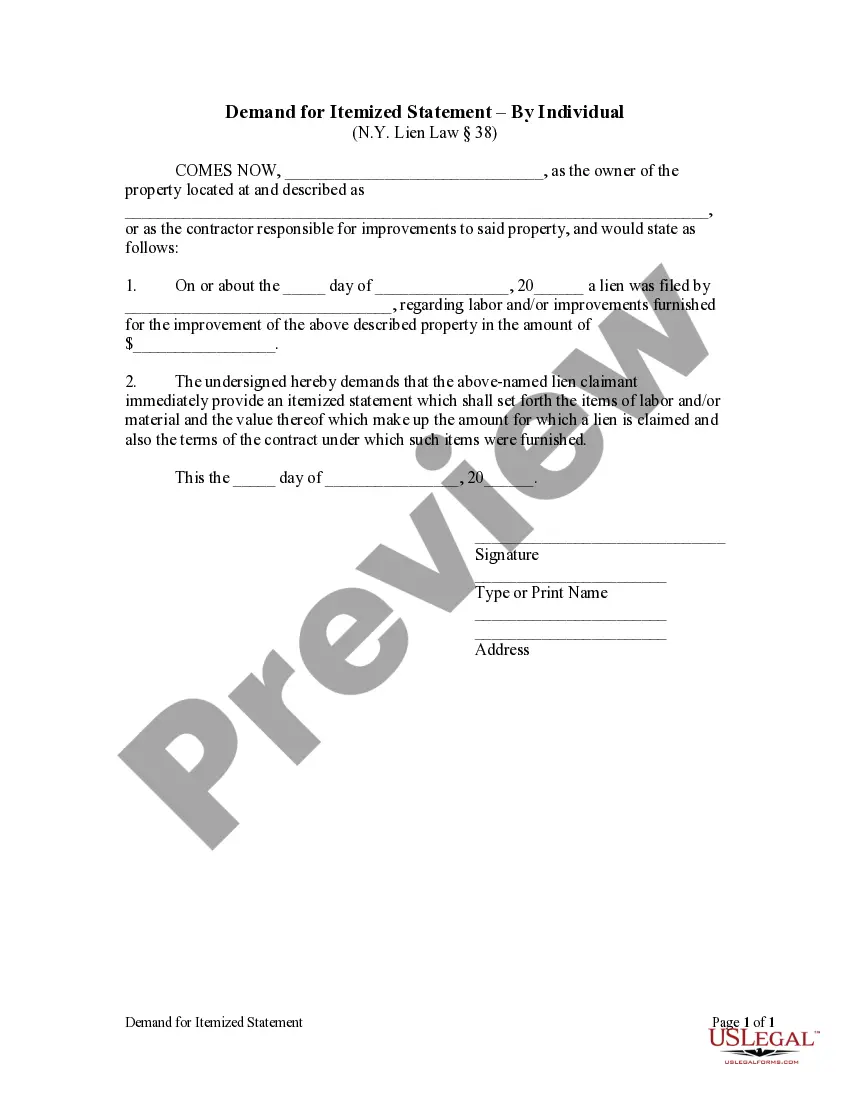

The format of a promissory note usually includes the title, date, parties involved, the amount borrowed, interest rate, repayment terms, and signatures. For an Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is crucial to include specific details about the collateral to protect both parties. Following this structure helps maintain clarity in the agreement.

Filling out a promissory note sample requires accuracy and attention to detail. Write the date and include the names of the borrower and lender, then specify the amount financed. In the context of an Orange California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensure you include any collateral information related to the commercial property.

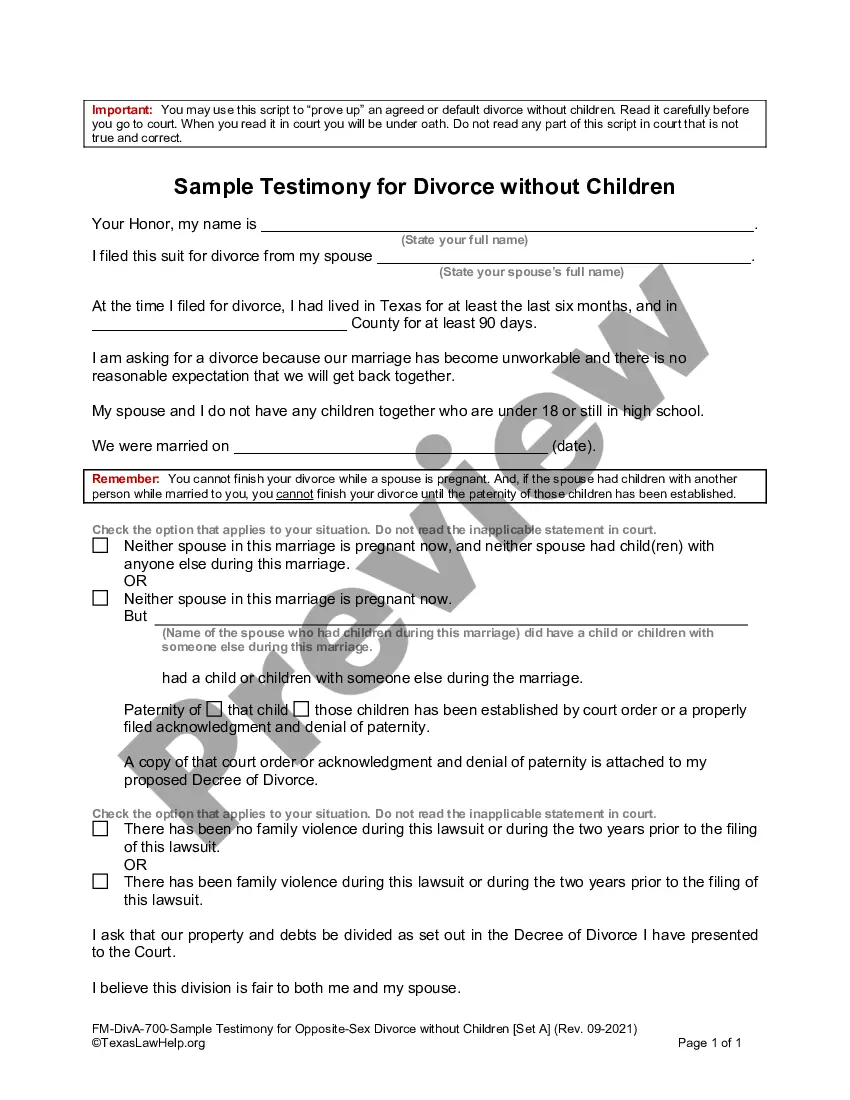

California Promissory Note Requirements A promissory note, although the name suggests is a promise, has the same legal consequences as a legally binding contract. In other words, a ?promissory note? is a type of contract.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

California Promissory Note Requirements A promissory note, although the name suggests is a promise, has the same legal consequences as a legally binding contract. In other words, a ?promissory note? is a type of contract.