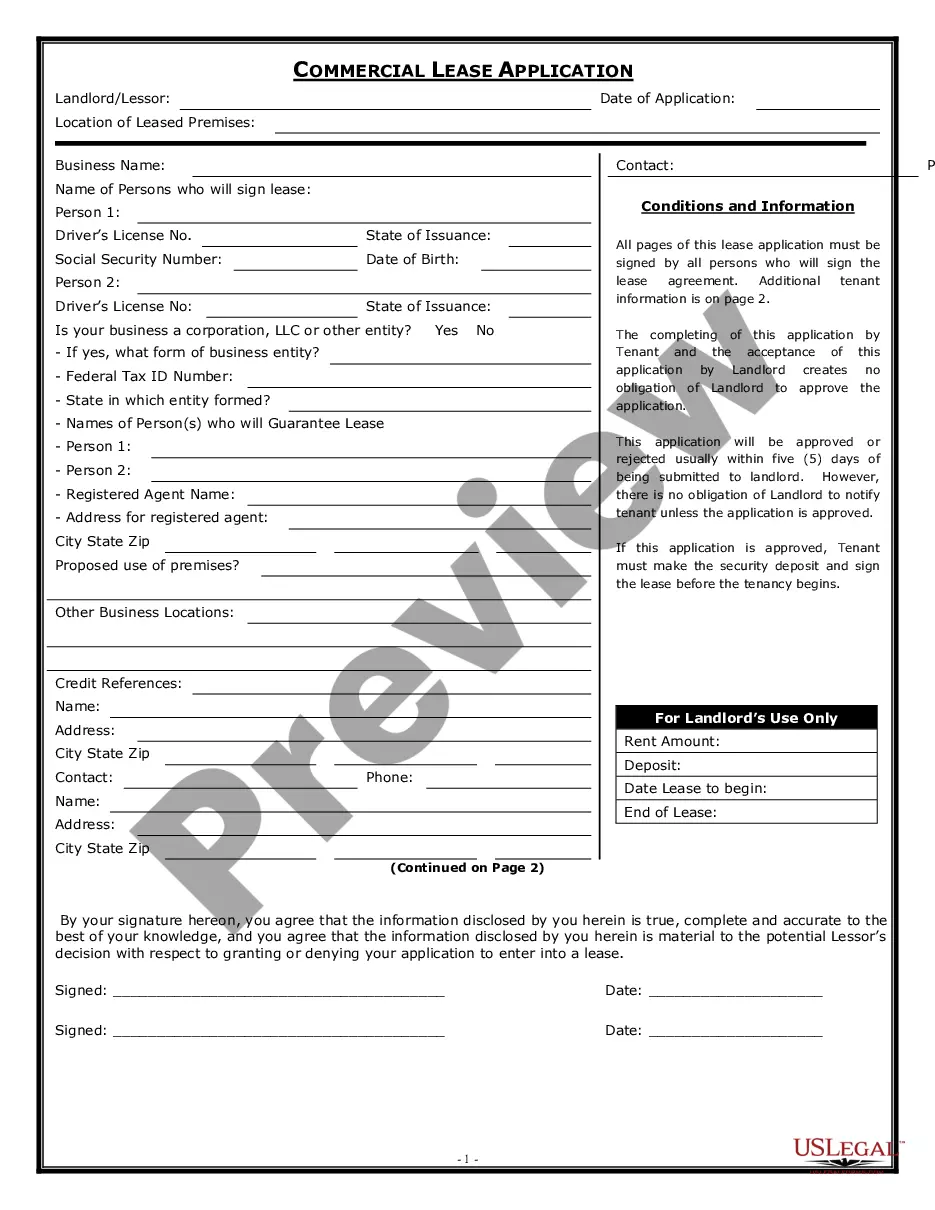

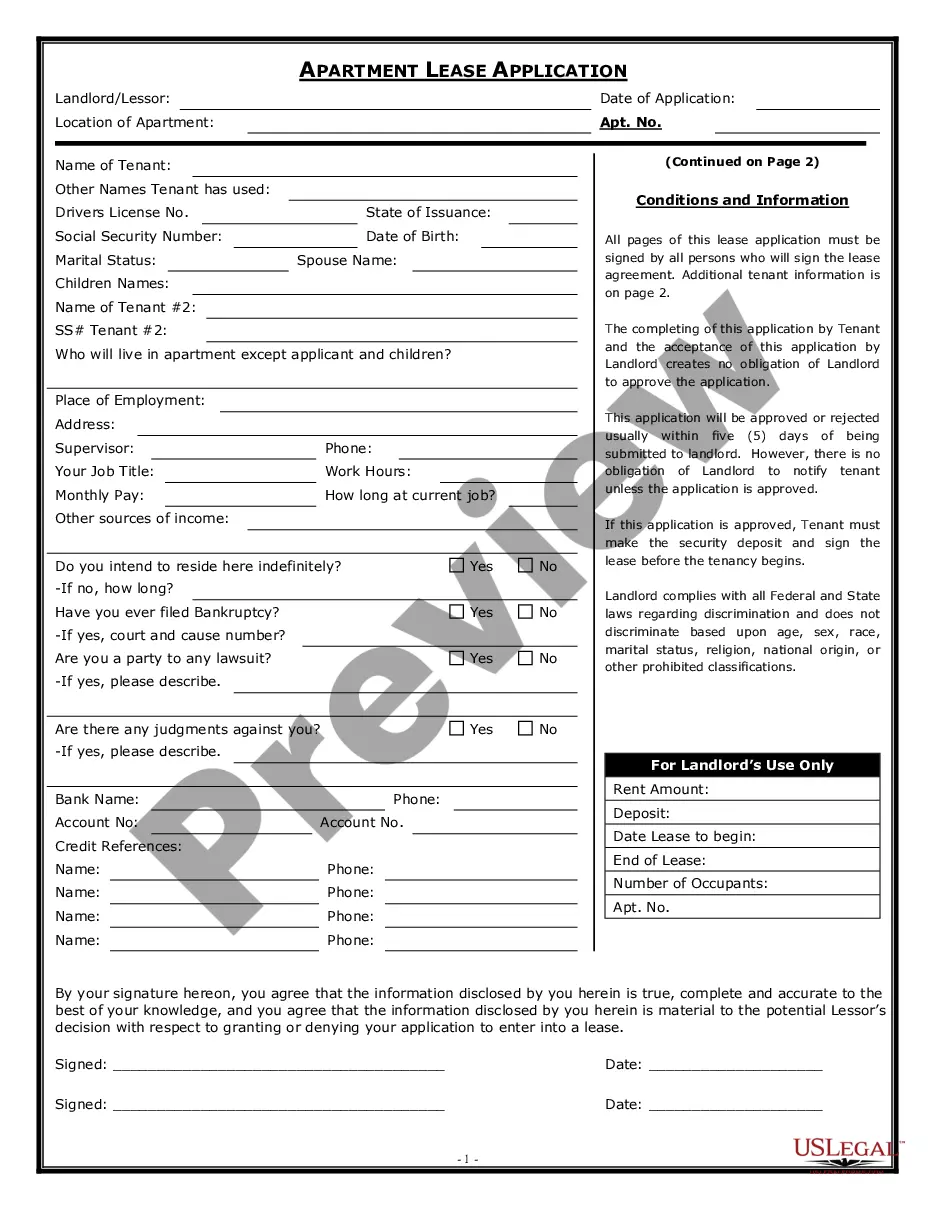

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you are looking for a legitimate form template, it’s incredibly difficult to locate a superior service compared to the US Legal Forms website – one of the most comprehensive collections online.

With this database, you can discover thousands of form examples for business and personal use categorized by types and states, or keywords.

With the enhanced search feature, locating the latest Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as simple as 1-2-3.

Validate your choice. Click the Buy now button. Then, select your desired pricing option and provide your information to create an account.

Finalize the purchase. Use your credit card or PayPal account to complete the registration process.

- Moreover, the accuracy of every document is validated by a group of expert lawyers who routinely assess the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is to sign in to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have located the sample you need. Review its description and utilize the Preview function (if available) to view its contents.

- If it does not satisfy your needs, use the Search feature at the top of the screen to find the correct document.

Form popularity

FAQ

You can obtain a promissory note for your mortgage through various online resources, including U.S. Legal Forms. This platform offers customizable templates specifically for an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Additionally, you may consult with a local attorney to ensure the document meets California's legal requirements.

Yes, a promissory note can be secured by real property, providing added security to the lender. An Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a common example of this type of arrangement. By securing the note with real estate, lenders can mitigate risk. To draft proper agreements, consider using a platform like uslegalforms for reliable templates.

Yes, interest on a promissory note is generally considered taxable income. When involved with an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you should include this interest in your taxable income for the year. Since tax laws can change, it's advisable to seek guidance from a tax professional to understand your specific obligations.

Promissory note interest is reported on your IRS Form 1040, typically under the section for interest income. If you hold an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, all interest amounts received should be accounted for. Make sure to keep any supporting documents for your records. Using uslegalforms can help in preparing your documents to simplify this process.

You report promissory note interest by including it as part of your income on your tax return. When using an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, gather all interest payments received throughout the year. Document any deductions applicable for expenses related to the note. Consider consulting a tax advisor to ensure accurate reporting.

To record interest on a promissory note, maintain a clear schedule marking payment dates, amounts, and interest calculations. For an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you can use amortization formulas to track the amount of interest owed over time. Stay organized to avoid errors. Uslegalforms can provide templates that simplify these calculations.

You would typically file a promissory note at your local county recorder's office, particularly for an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate. This establishes a public record of the agreement and can protect your interests. The process may vary by county, so it's best to confirm requirements with local authorities. Using a platform like uslegalforms can streamline this process.

No, you are not required to report interest earnings under $10 when dealing with an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate. However, you should maintain accurate records in case your total interest exceeds this threshold over the year. Reporting small amounts can be good practice for transparency. It's wise to check with a tax professional for your specific situation.

Promissory notes are enforceable in California, provided they comply with legal standards. A well-constructed note provides the lender with the right to seek repayment through the courts if the borrower defaults. Therefore, utilizing an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate can offer peace of mind and protection for your financial interests.

Yes, a promissory note is legally binding in California when it meets the necessary legal requirements. It must include the terms of repayment, the amount borrowed, and the signatures of the involved parties. Thus, an Orange California Installments Fixed Rate Promissory Note Secured by Residential Real Estate can effectively secure your investment when crafted correctly.