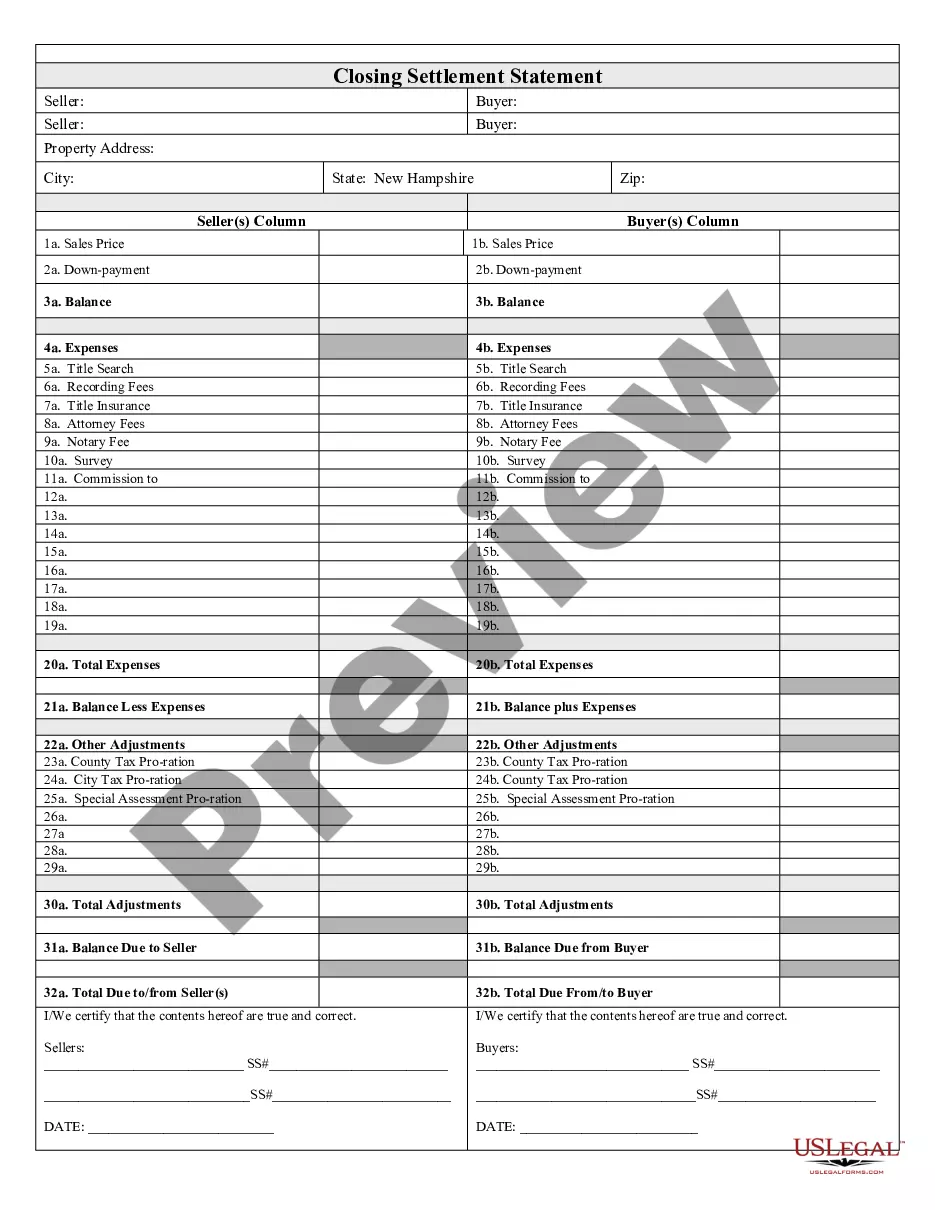

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

California Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you're attempting to locate accurate California Installments Fixed Rate Promissory Note Secured by Residential Real Estate replicas, US Legal Forms is precisely what you require; obtain documents crafted and evaluated by state-certified attorneys.

Using US Legal Forms not only spares you from complications related to legal documents; additionally, you save time, effort, and money! Downloading, printing, and filling out a professional template is truly more economical than hiring a lawyer to draft it for you.

And that’s it. With a few simple clicks, you have an editable California Installments Fixed Rate Promissory Note Secured by Residential Real Estate. When you create an account, all future requests will be processed even more smoothly. If you have a US Legal Forms subscription, just Log In and click the Download button visible on the form’s page. Then, when you need to use this template again, you can always find it in the My documents section. Don’t waste your time and effort sifting through numerous forms across various platforms. Purchase accurate templates from a single trusted source!

- To start, complete your registration process by entering your email and setting a password.

- Follow the steps below to create your account and obtain the California Installments Fixed Rate Promissory Note Secured by Residential Real Estate template to solve your issues.

- Utilize the Preview feature or review the document description (if available) to ensure that the template is the one you need.

- Verify its validity in your residing state.

- Click on Buy Now to place your order.

- Choose a suitable rate plan.

- Set up your account and make payment with your credit card or PayPal.

Form popularity

FAQ

Yes, a secured promissory note should be recorded to protect the lender's interest in the property. By recording the California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you ensure that your claim is publicly documented. This process can prevent any future disputes regarding ownership or priority of claims. Additionally, using a reliable platform like US Legal Forms can simplify the recording process and ensure all necessary legal requirements are met.

You can obtain a promissory note for your mortgage through various trusted sources such as legal document preparation services or online platforms. One effective option is US Legal Forms, where you can find a California Installments Fixed Rate Promissory Note Secured by Residential Real Estate tailored to your needs. These resources often offer templates and guidance to help you create a compliant and effective document. Explore these tools to simplify the process of securing your mortgage.

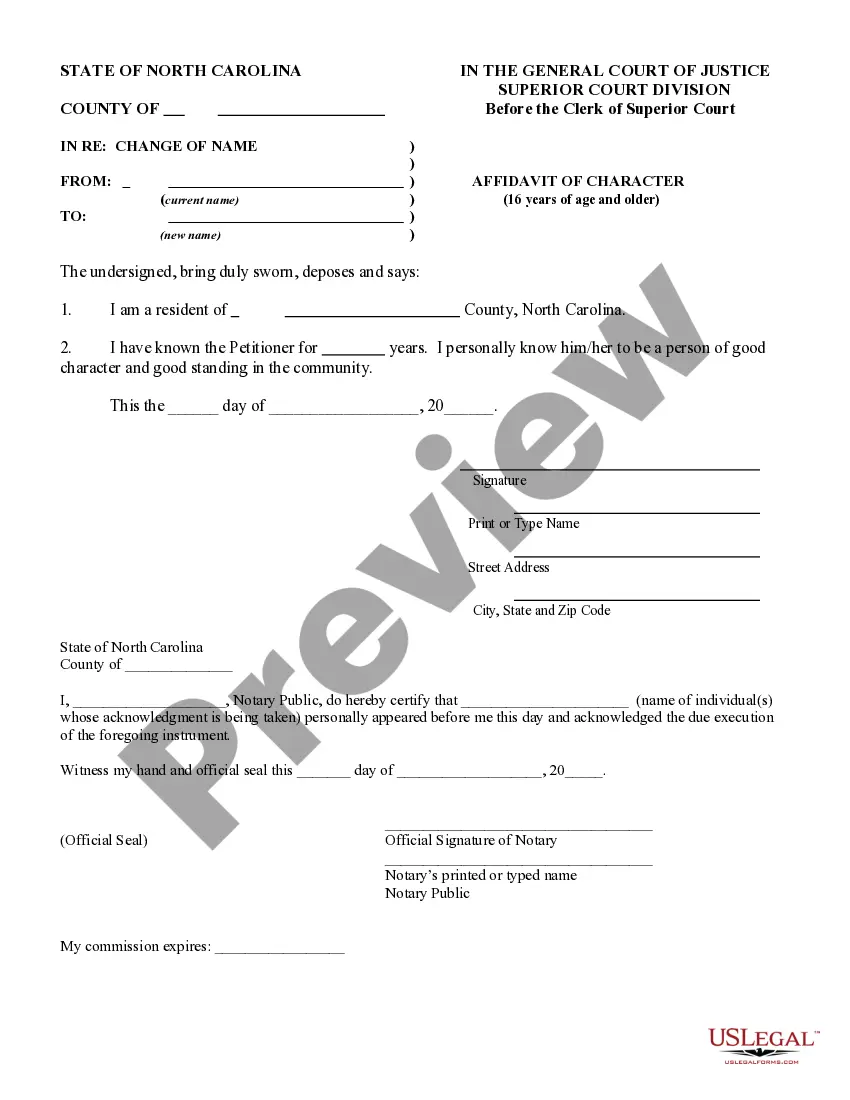

A promissory note remains legally binding even if it is not notarized, as long as it meets the basic requirements of an agreement. In a California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, a written agreement ensures both parties have a clear understanding of their obligations. However, notarization adds a layer of authenticity, which can help in legal matters if disputes arise. For peace of mind, consider having your document notarized.

Yes, a promissory note can be secured, and this usually involves backing the note with an asset, such as real estate. A California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a perfect example of this security. By linking the note to a tangible asset, lenders reduce their risk, making it a more attractive option for both parties involved.

A valid promissory note typically includes essential information such as the borrower's and lender's names, the amount borrowed, interest rate, and payment terms. For instance, a California Installments Fixed Rate Promissory Note Secured by Residential Real Estate would outline these elements and specify the real estate being used as collateral. Additionally, it must be signed by the borrower and include a date, creating a legally binding document.

A properly executed promissory note can hold up in court in California, assuming it complies with legal standards. Courts typically enforce notes that consist of clear terms, conditions, and valid signatures. For optimal protection and legitimacy, consider using platforms like US Legal Forms to create your California Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Yes, a promissory note can indeed be secured by real property in California. This typically involves the borrower pledging a residential property as collateral to assure the lender of repayment. This arrangement enhances the security of a California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, giving both parties added confidence in the transaction.