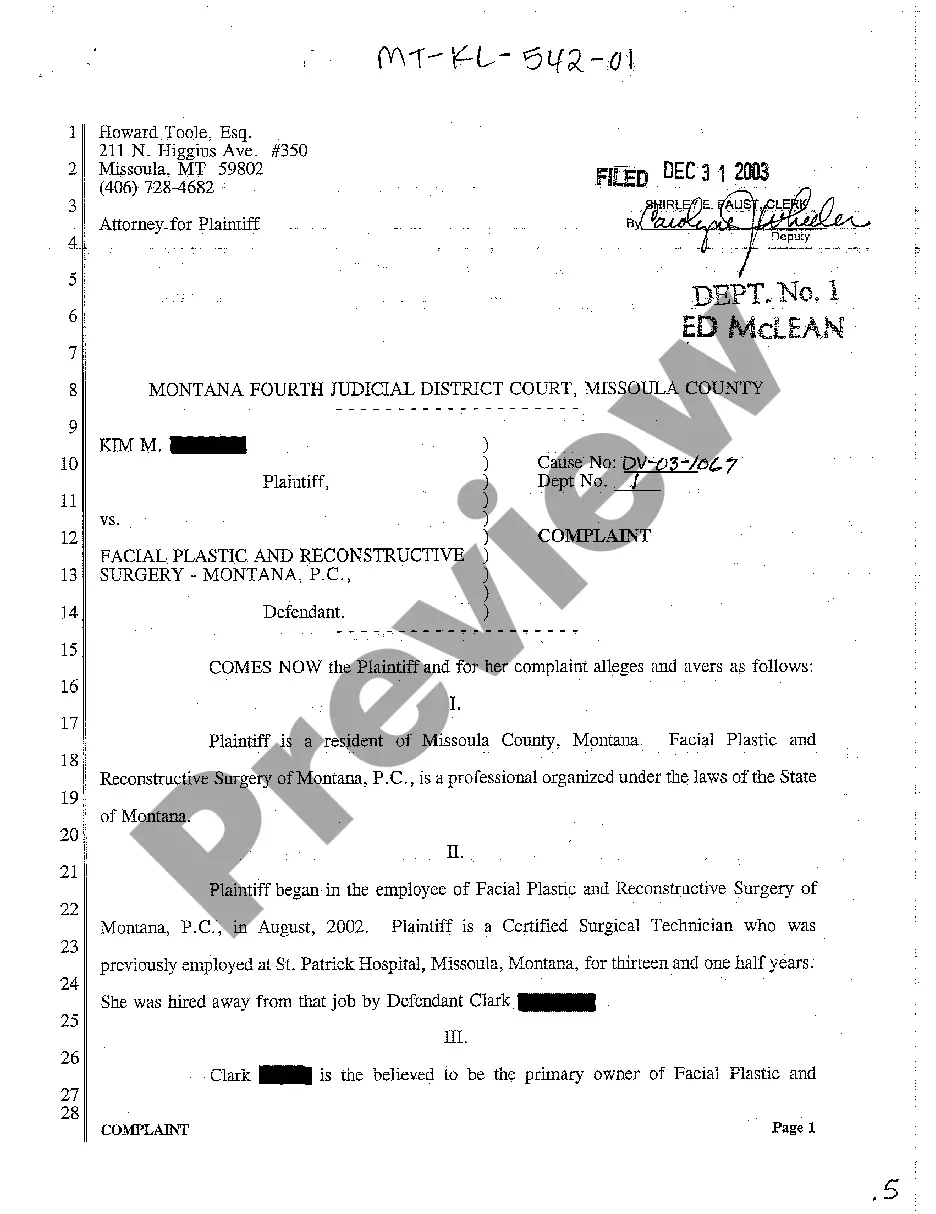

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Personal Property?

If you have previously utilized our service, Log In to your account and download the Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property to your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to reuse it. Take advantage of the US Legal Forms service to conveniently locate and save any template for your personal or business requirements!

- Ensure you’ve found a suitable document. Review the description and use the Preview option, if available, to verify if it aligns with your needs. If it does not fit, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and proceed with payment. Enter your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property. Choose the file format for your document and save it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To fill out a promissory demand note, you’ll start similarly to a standard promissory note by including the names of the parties involved, the amount owed, and any applicable interest rates. However, it is essential to indicate that the full amount is due upon the lender’s request, thus specifying the demand feature. For a better understanding of an Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property, uslegalforms can offer helpful templates and resources.

A valid promissory note contains essential elements such as the principal amount, interest rate, and terms of repayment. For instance, a valid Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property might state that a borrower agrees to repay $10,000 with a fixed 5% interest over 5 years, secured by their vehicle. This clarity fosters trust in the transaction and ensures legal enforceability. You can find examples through uslegalforms.

Yes, a promissory note can be secured, and this is often the case with loans backed by collateral. In the context of an Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property, the collateral provides a safeguard for the lender against potential defaults. This means that if the borrower fails to repay, the lender can claim the secured property. Using a secured note enhances confidence for both parties in the transaction.

Yes, promissory notes are legally binding in California when they meet specific legal requirements. An Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property is enforceable if it contains clear terms and is executed properly. This means both parties must agree to the terms, and the document must be signed. Understanding these elements will ensure your promissory note protects your interests.

You can find Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property documents on various online platforms. Websites like USLegalForms offer a range of customizable templates to suit your needs. These platforms provide easy access to legal forms, ensuring you have the right documents for your financial agreements. Exploring these resources can help you locate the exact promissory note you require.

To turn a promissory note into a security, you must follow specific legal steps that involve registration and compliance with securities laws. This process typically requires filing documentation with appropriate authorities. If you are using an Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property, seeking guidance from professionals or platforms like uslegalforms can help you navigate this complex process effectively.

In California, a promissory note does not require notarization to be valid. However, having the note notarized can provide additional legal protection and a clearer record of the agreement. If you utilize an Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property, considering notarization might enhance the document's credibility.

A reasonable interest rate for a promissory note varies based on several factors, including the borrower's creditworthiness and current market conditions. In the context of an Oxnard California Installments Fixed Rate Promissory Note Secured by Personal Property, rates can be competitive yet should reflect fair lending practices. Generally, consulting a knowledgeable financial advisor can help you determine an appropriate interest rate tailored to your circumstances.