This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you have previously utilized our service, Log In to your account and download the Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate onto your device by hitting the Download button. Make sure your subscription is active. If not, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these easy steps to acquire your document.

You will have ongoing access to all documents you have acquired: you can find them in your profile under the My documents section whenever you wish to access them again. Utilize the US Legal Forms service to effortlessly find and download any template for your personal or professional use!

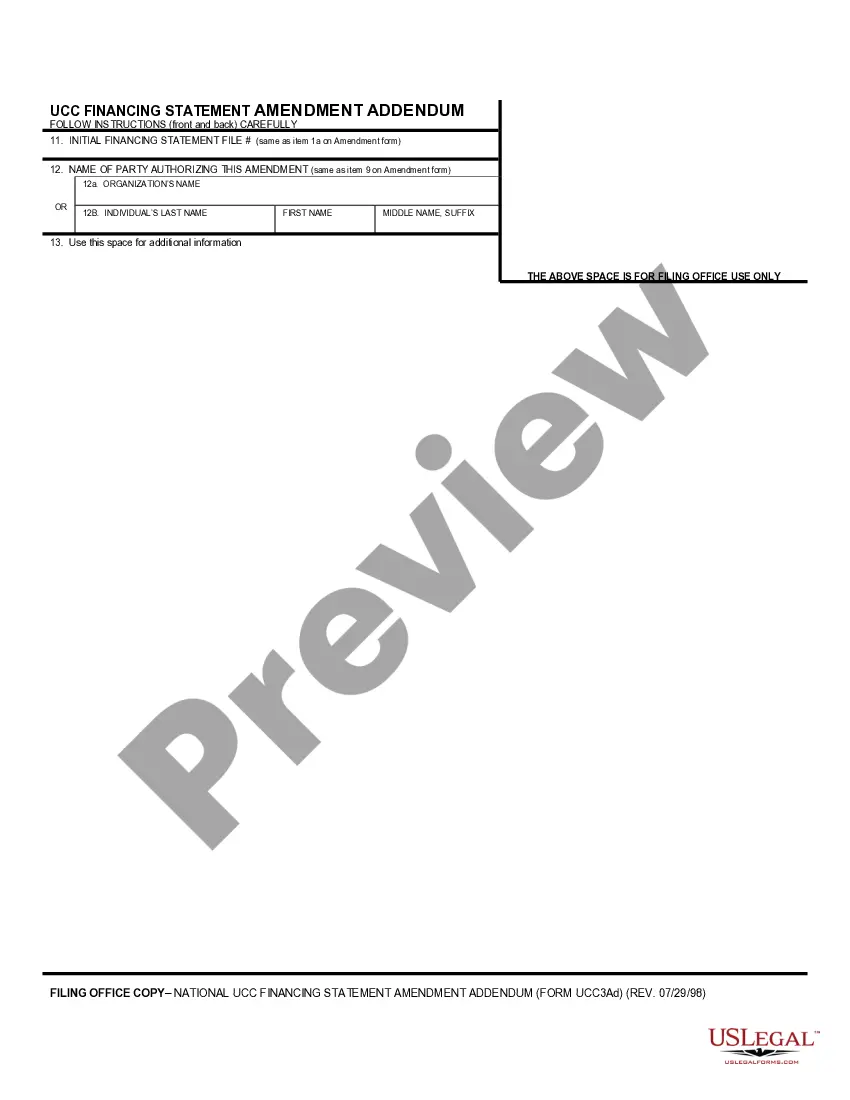

- Confirm you have the correct document. Review the description and utilize the Preview feature, if offered, to verify if it aligns with your needs. If it does not suit you, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Obtain your Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Select the file format for your document and save it to your device.

- Complete your document. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

An invalid promissory note is one that fails to meet legal requirements for enforceability, typically due to missing information or violation of applicable laws. For example, if an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate does not have a clear repayment structure or lacks signatures, it may be declared invalid. Understanding these aspects can help you avoid pitfalls when drafting or signing notes.

To disprove a promissory note, one must provide evidence that challenges its authenticity or legality. This could involve demonstrating the lack of required signatures, proving the absence of consideration, or highlighting any discrepancies in the terms stated in the note. Utilizing services like US Legal Forms can assist in ensuring your Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate meets all legal criteria, reducing the chances of disputes.

A promissory note may be deemed invalid in California if it lacks essential elements, such as the borrower's signature or a clear repayment schedule. Additionally, notes that involve illegal activities or are made under duress fail to meet legal standards. Remember, an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate must adhere to California's specific regulations to maintain its validity.

Absolutely, a promissory note can be secured using collateral, such as commercial real estate. In fact, an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate often provides lenders with a greater sense of security. This arrangement ensures that the borrower has a vested interest in honoring their repayment obligations.

Yes, promissory notes are enforceable in California as long as they meet specific legal requirements. The state's legal framework supports the enforcement of notes that are clear, valid, and signed by the borrower. When dealing with an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensuring compliance with California law strengthens its enforceability.

The format of a promissory note typically includes a title, the date, the names of the parties involved, the principal amount, the interest rate, and the repayment terms. It should also specify any collateral like real estate if applicable. To simplify this process, you can find a customizable template for an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate on UsLegalForms, making it easier to draft a legally sound document.

Filling out a promissory note requires you to include essential details such as the names of the borrower and lender, the amount borrowed, interest rates, repayment schedule, and any collateral involved. It's important to clearly state the terms to prevent misunderstandings. You can easily access templates for an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate through the UsLegalForms platform to ensure you cover all necessary components.

The primary difference lies in the collateral involved. A secured promissory note is backed by collateral, like commercial real estate, which provides additional protection to the lender. In contrast, an unsecured promissory note does not have this backing. If you're considering an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the secured nature provides greater security for your investment.

In California, the statute of limitations on a promissory note is generally four years from the date of default. This means that if a payment is missed, the lender has four years to take legal action to recover the debt. For those considering an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it's crucial to understand this timeframe in relation to your investment and payment structure.

Yes, promissory notes are legal and enforceable in the USA, provided they meet applicable laws and requirements. When dealing with an Oxnard California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is crucial to follow federal and state regulations to ensure validity. Both lenders and borrowers benefit from the security and clarity a promissory note provides in financial transactions. Always keep a copy of the note for your records.