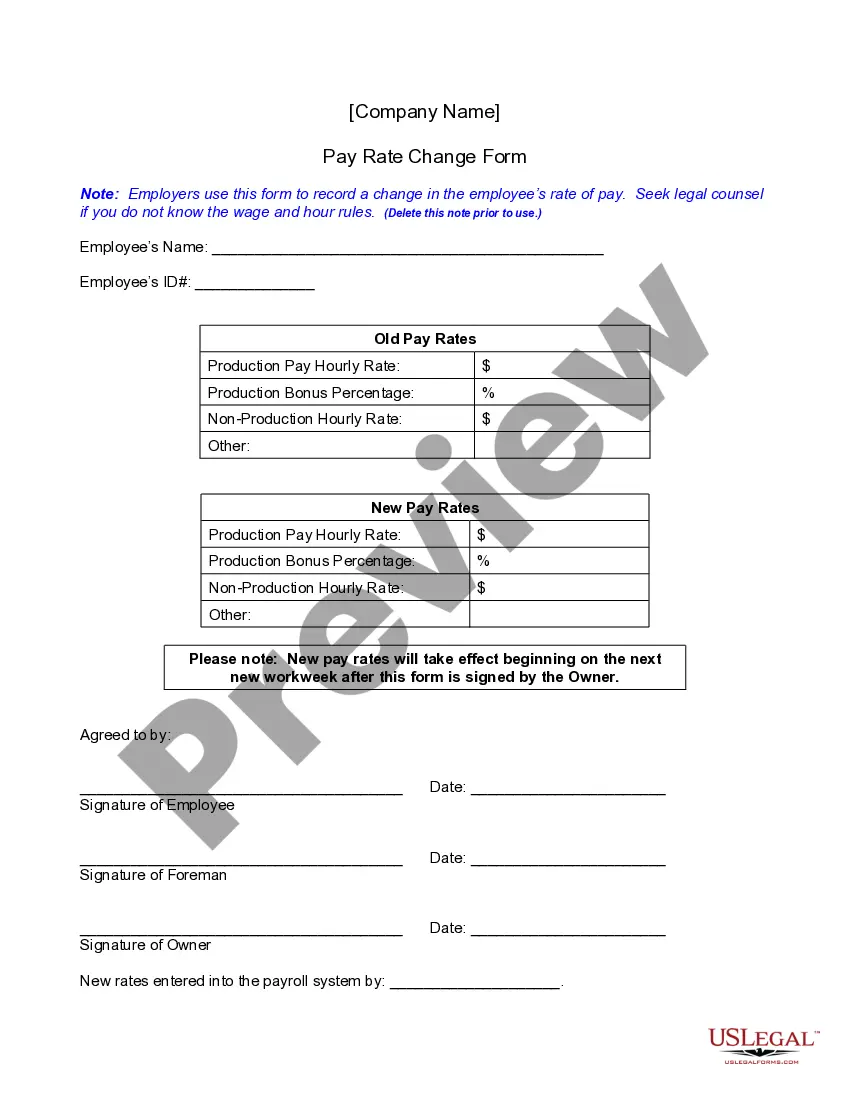

Employers use this form to record a change in the employee’s rate of pay.

Orange California Pay Rate Change Form

Description

How to fill out California Pay Rate Change Form?

If you are looking for an applicable form template, it’s hard to find a more user-friendly platform than the US Legal Forms website – probably the most comprehensive collections on the internet.

With this collection, you can discover a vast number of templates for business and personal use categorized by type and state, or keywords.

Thanks to the efficient search feature, locating the most current Orange California Pay Rate Change Form is as simple as 1-2-3.

Validate your choice. Click the Buy now button. Then, select the desired subscription plan and provide details to register an account.

Complete the transaction. Use your credit card or PayPal to finish the registration process. Acquire the template. Choose the file format and download it to your device.

- Moreover, the relevance of each document is confirmed by a team of professional attorneys who frequently review the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our system and have an established account, all you need to do to obtain the Orange California Pay Rate Change Form is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Ensure you have located the sample you need. Review its details and utilize the Preview feature (if available) to examine its content.

- If it doesn't meet your requirements, use the Search option at the top of the page to find the needed document.

Form popularity

FAQ

Filing an amended DE9 involves redoing the DE9 form with any corrected information. Clearly mark your submission as amended to avoid confusion. You then need to submit the amended form to the appropriate address provided by the EDD. To make the process smoother, consider utilizing resources available on the US Legal Forms platform.

To file a wage claim in California, begin by completing the necessary wage claim form provided by the Division of Labor Standards Enforcement. Make sure to include all relevant information about your employment and the unpaid wages. After filling out the form, submit it to the nearest DLSE office for review. If you need templates or further advice, the US Legal Forms platform can be very helpful.

To correct mistakes on an EDD claim form online, log into your EDD account. Locate the specific claim you wish to amend, then follow the prompts to make your corrections. It's important to submit your adjustments as soon as possible to prevent delays or issues with your benefits. For assistance, consider accessing resources from US Legal Forms to help navigate this process.

You should mail your DE 9 adjustment to the address specified in the instructions provided by the Employment Development Department (EDD). Typically, this will be directed to their processing center. Double-check the mailing information on the EDD website to ensure your DE 9 adj reaches the right location. For more detailed instructions, the US Legal Forms platform offers valuable resources.

To file an amended form, you should first gather all necessary information that reflects the changes accurately. Then, complete the form, clearly indicating any corrections made. Finally, submit the form to the relevant government agency either online or by mail. For added assistance and templates, check out the US Legal Forms website.

To amend a DE9, you need to complete a new DE9 form with the corrected information. Make sure to clearly mark the form as amended to avoid confusion. Once completed, you can submit it through the appropriate channel for processing. If you have questions about the process, consider using the US Legal Forms platform for guidance.

For the remainder of 2022, the current minimum wage in the state will stay at $14 per hour for California employers with 25 employees or less. If your business employs 26 or more people, you've already been subject to a $15 per hour minimum wage rate as of January 1, 2022.

California Enacts Pay Transparency and Disclosure Requirements Effective January 1, 2023. On September 27, 2022, Governor Newsom signed California's new pay transparency and pay scale disclosure law.

As a general rule, employers may reduce your salary or wages for any lawful reason. There is no California labor law specifically prohibiting employers from reducing an employee's compensation. However, the reduced salary or wages must still comply with California's wage and hour laws.

The California Wage Theft Protection Act does require notice within seven days of making a change to a pay date or period, but it has no notice requirements prior to the change.