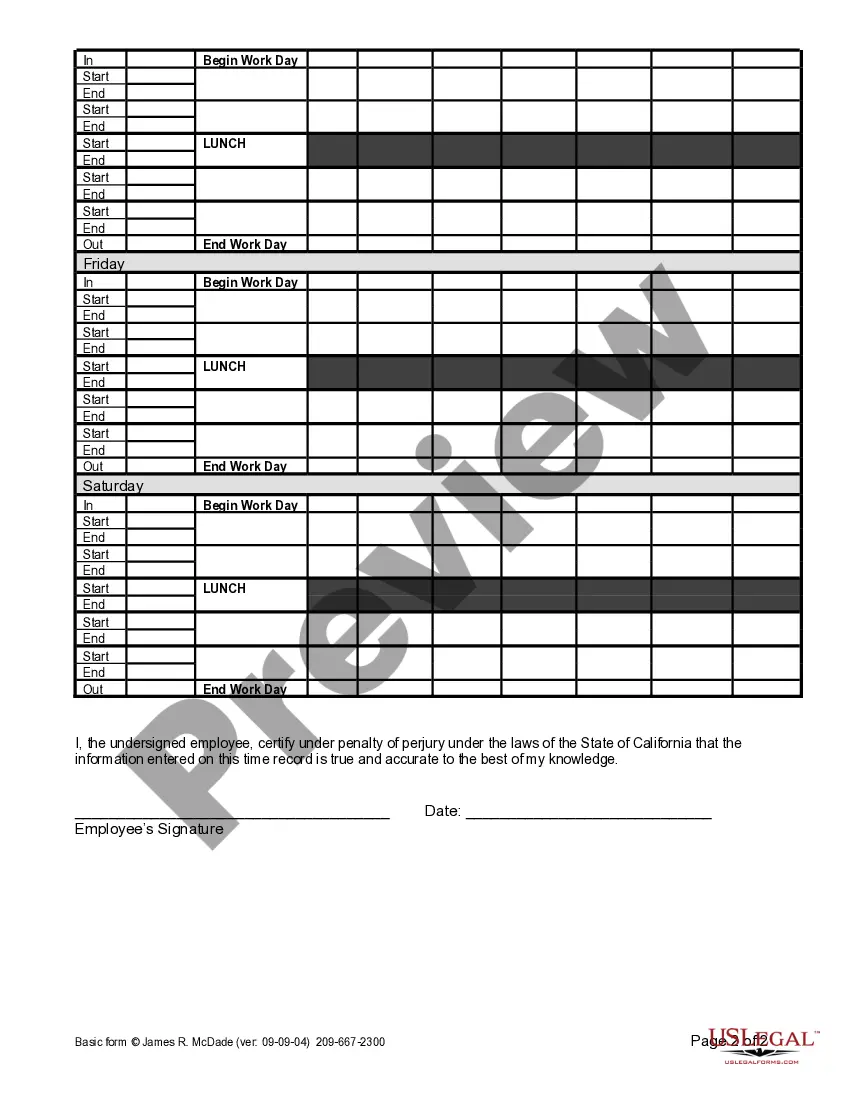

Employers use this form to keep track of an employee’s work time when the employee is paid different wage rates for different work.

San Jose California Weekly Time Sheet for Multiple Pay Rate

Description

How to fill out California Weekly Time Sheet For Multiple Pay Rate?

We consistently endeavor to minimize or sidestep legal repercussions when handling intricate legal or financial matters.

To achieve this, we enlist attorney services that are generally very expensive.

Nevertheless, not all legal issues are as convoluted.

Most can be resolved by ourselves.

Utilize US Legal Forms whenever you need to locate and download the San Jose California Weekly Time Sheet for Multiple Pay Rate or any other document easily and securely. Just Log In to your account and click the Get button next to it. If you lose the form, you can always download it again from the My documents tab.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection empowers you to manage your affairs independently without the necessity of a lawyer's services.

- We offer access to legal document templates that are not always available to the public.

- Our templates are specific to states and regions, which greatly eases the search process.

Form popularity

FAQ

There is nothing in state law that mandates an employer pay an employee a special premium for work performed on holidays, Saturdays, or Sundays, other than the overtime premium required for work in excess of eight hours in a workday or 40 hours in a workweek.

California law requires employees to be paid overtime for any hours they work over 40 in any workweek. If the employee works 40 hours or less in a workweek then they will receive no weekly overtime. They will still receive daily overtime for any workdays over 8 hours.

Double time is a rate of pay double the usual amount a person receives for normal hours worked. So, if your normal rate of pay was $11.00 an hour, double-time pay would be $22.00 per hour. Double time is sometimes paid for working on federal holidays or when hours work exceeding the normal workday.

If you want to calculate a double-time rate for an employee who is a nonexempt hourly employee and makes $25 per hour ($950 per 38-hour week), you can simply double their hourly rate.

Employees who qualify for California overtime are paid at 1.5 times their standard rate when they work more than eight hours in a workday and more than 40 hours in a workweek. Employees also earn 1.5 times their standard rate for the first eight hours of their seventh consecutive day of work.

Double-time pay example Step 1: Determine how many hours are subject to double-time wages. For Jake, eight hours count toward double-time wages. Step 2: Double the employee's regular hourly rate. If Jake normally earns $11 per hour, his double-time rate would be $22 ($11 x 2).

In general, California overtime provisions require that all nonexempt employees (including domestic workers) receive overtime pay at a rate of 1.5 times their regular rate of pay for all hours worked in excess of 8 per day and 40 per week. These overtime rules apply to all nonexempt employees.

In most cases, the regular rate is calculated by adding all ?remuneration? for employment (i.e., all compensation and earnings), except statutory exclusions, in any workweek divided by the total hours worked by that employee in the workweek.

What is time and a half for $18 an hour? If you are paid $18 per hour, you will make $27 per hour when being paid time and a half ($18 × 1.5) and $36 when being paid double time.

For each overtime hour worked you are entitled to an additional one-half the regular rate for hours requiring time and one-half, and to the full rate for hours requiring double time.