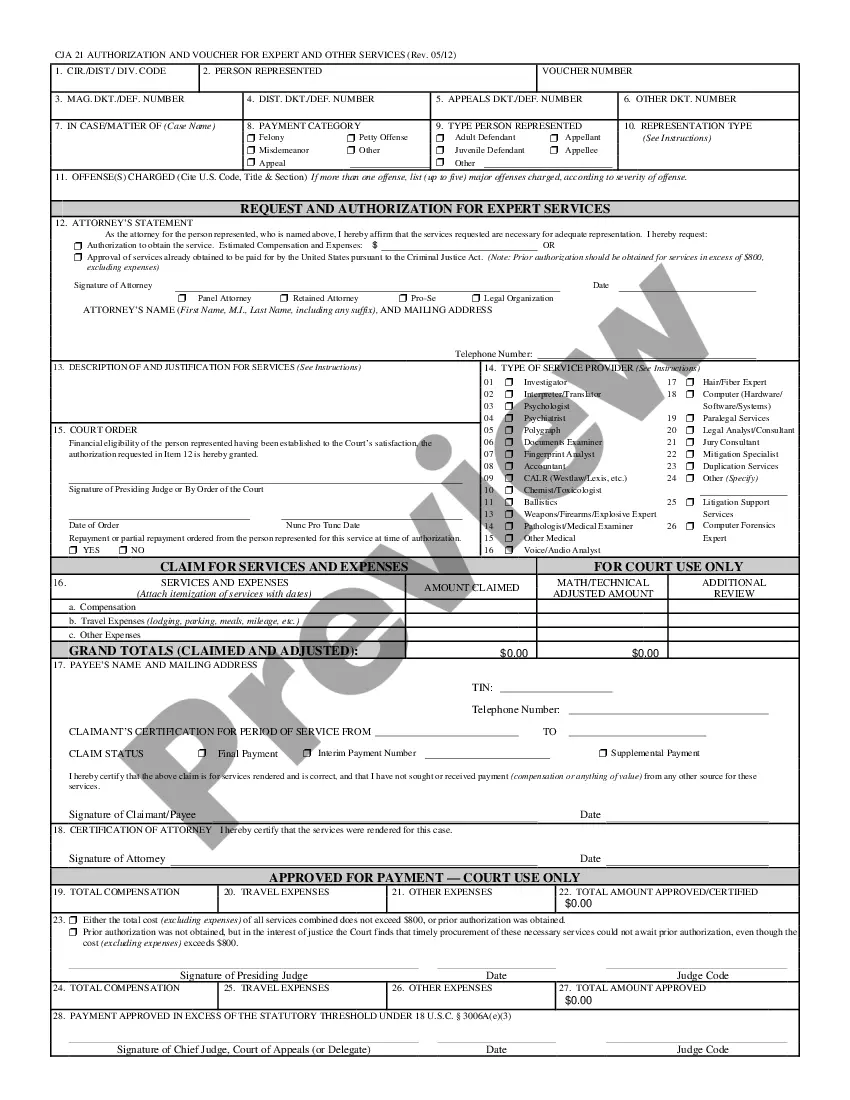

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Clara California Transportation Expense Request and Authorization - Bar Association

Description

How to fill out California Transportation Expense Request And Authorization - Bar Association?

Are you searching for a trustworthy and budget-friendly provider of legal documents to purchase the Santa Clara California Transportation Expense Request and Authorization - Bar Association? US Legal Forms is your best option.

Whether you need a simple agreement to establish rules for living with your partner or a collection of documents to move your divorce process through the court, we have you covered. Our site offers over 85,000 current legal document templates for individual and business usage. All templates we provide are not generic and are tailored according to the requirements of specific states and regions.

To obtain the form, you must Log In to your account, locate the required template, and click the Download button next to it. Please note that you can download your previously acquired document templates anytime from the My documents section.

Is this your first time visiting our platform? No problem. You can create an account with ease, but first, ensure to do the following.

Now you can register your account. Then choose the subscription plan and continue to payment. Once the payment is processed, download the Santa Clara California Transportation Expense Request and Authorization - Bar Association in any offered file format. You can revisit the website at any moment and redownload the form at no additional cost.

Finding current legal forms has never been simpler. Give US Legal Forms a try today, and forget about spending endless hours researching legal documents online once and for all.

- Check if the Santa Clara California Transportation Expense Request and Authorization - Bar Association complies with the laws of your state and locality.

- Review the form’s specifics (if available) to understand who and what the form is suitable for.

- Initiate the search again if the template does not fit your legal needs.

Form popularity

FAQ

The IRS requires that expense reimbursements meet specific criteria to qualify as non-taxable income. Employees must provide receipts and ensure that their expenses are necessary and ordinary for the business. Maintaining compliance with IRS regulations is crucial for anyone involved in the Santa Clara California Transportation Expense Request and Authorization - Bar Association, as it helps avoid tax complications.

Expense reimbursement rules in California emphasize the need for clear documentation and reasonable limits on expenses. Employers are responsible for informing their employees about legitimate expenses that can be reimbursed, along with proper procedures for submitting claims. Understanding these rules is essential when preparing a Santa Clara California Transportation Expense Request and Authorization - Bar Association.

California law mandates that employers must reimburse employees for all necessary expenses incurred while traveling for work. This includes transportation, meals, and accommodations. Employees should keep detailed records of their expenses to ensure compliance when completing the Santa Clara California Transportation Expense Request and Authorization - Bar Association.

California conforms to employee business expense reimbursement through strict guidelines that protect employees' rights. Employers must document all reimbursable expenses and ensure timely payment. By adhering to these rules, organizations demonstrate accountability and transparency in their expense policies, aligning with processes like the Santa Clara California Transportation Expense Request and Authorization - Bar Association.

Under California law, business-related expense reimbursement requires employers to reimburse employees for necessary expenses incurred while performing their job. This includes travel, lodging, and meals, provided the expenses are reasonable and documented. Familiarity with these requirements is crucial for those utilizing the Santa Clara California Transportation Expense Request and Authorization - Bar Association.

The 50 mile rule for California Human Resources (CalHR) stipulates that employees can only receive reimbursement for travel expenses if their trip exceeds 50 miles from their regular workplace. This measure helps manage costs associated with employee travel. Understanding this rule is vital for anyone engaging in the Santa Clara California Transportation Expense Request and Authorization - Bar Association, as it influences expense eligibility.

To fill out a travel expense form associated with the Santa Clara California Transportation Expense Request and Authorization - Bar Association, start by entering your personal information, including your name and contact details. Then, list all travel expenses chronologically, attaching relevant receipts for verification. Lastly, submit the completed form along with any required documentation to your supervisor for approval.

Reimbursement rules for Santa Clara California Transportation Expense Request and Authorization - Bar Association typically require clear documentation of travel-related expenses. Employees must provide receipts and a detailed description of the purpose for each expense. Additionally, all expenses must align with the organization's established guidelines. Following these criteria ensures a smoother approval process.

Obtaining a California bar card involves successfully completing the bar admission process after passing the exam. You will need to submit the necessary documentation and applications to the State Bar. Beyond the basics, understanding the Santa Clara California Transportation Expense Request and Authorization - Bar Association can provide clarity on the specific steps and requirements.

In California, meal allowances vary depending on the organization and the purpose of the travel. Professionals often set daily limits, influenced by current economic conditions. It’s advisable to check guidelines from your employer or organizations like the Santa Clara California Transportation Expense Request and Authorization - Bar Association for specific information about meal allowances related to travel.