The Norwalk California Affidavit for Collection of Personal Property is an essential legal document used in probate cases involving small estates under $166,250. This affidavit, as authorized by Probate Code Section 13100, streamlines the process of transferring the decedent's personal property to the rightful heirs or beneficiaries without the need for a formal probate administration. The Affidavit for Collection of Personal Property in Norwalk California is designed to simplify the legal procedures for those left dealing with a small estate. Small estates usually consist of assets, including bank accounts, vehicles, personal belongings, and other tangible properties, valued below the specified threshold. There are different types of Norwalk California Affidavits that fall under the Probate Code Section 13100. Some key variants are as follows: 1. Norwalk California Affidavit for Collection of Personal Property — Probate Code Section 13100 (Real Property): This specific affidavit is used when the small estate solely includes real property, such as land, houses, or buildings. It allows for the efficient transfer of ownership without resorting to a formal probate process. This affidavit must include a legal description of the real property and be recorded with the county recorder's office. 2. Norwalk California Affidavit for Collection of Personal Property — Probate Code Section 13100 (Bank Accounts): This type of affidavit is utilized when the small estate comprises only bank accounts or financial assets held by financial institutions. It enables the heir or beneficiary to collect the funds without going through the probate court. A certified copy of the decedent's death certificate should be submitted with this affidavit. 3. Norwalk California Affidavit for Collection of Personal Property — Probate Code Section 13100 (General): This is the most common type of Norwalk California affidavit that covers all personal property assets not falling under the real property or bank accounts categories. It includes items like household possessions, vehicles, jewelry, and other tangible belongings giving heirs the authority to gather and distribute these assets quickly. By filing the appropriate Norwalk California Affidavit for Collection of Personal Property — Probate Code Section 13100, residents can expedite the process of transferring ownership and avoid the complexities and expenses associated with formal probate administration. Note: It is essential to consult with an attorney or legal professional well-versed in California probate laws to appropriately complete and file the required affidavit specific to your circumstances.

Norwalk California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500

Description

How to fill out Norwalk California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $184,500?

If you have previously utilized our service, Log In to your account and retrieve the Norwalk California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250 onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your billing plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your document.

You have perpetual access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to access it again. Leverage the US Legal Forms service to effortlessly locate and save any template for your personal or business needs!

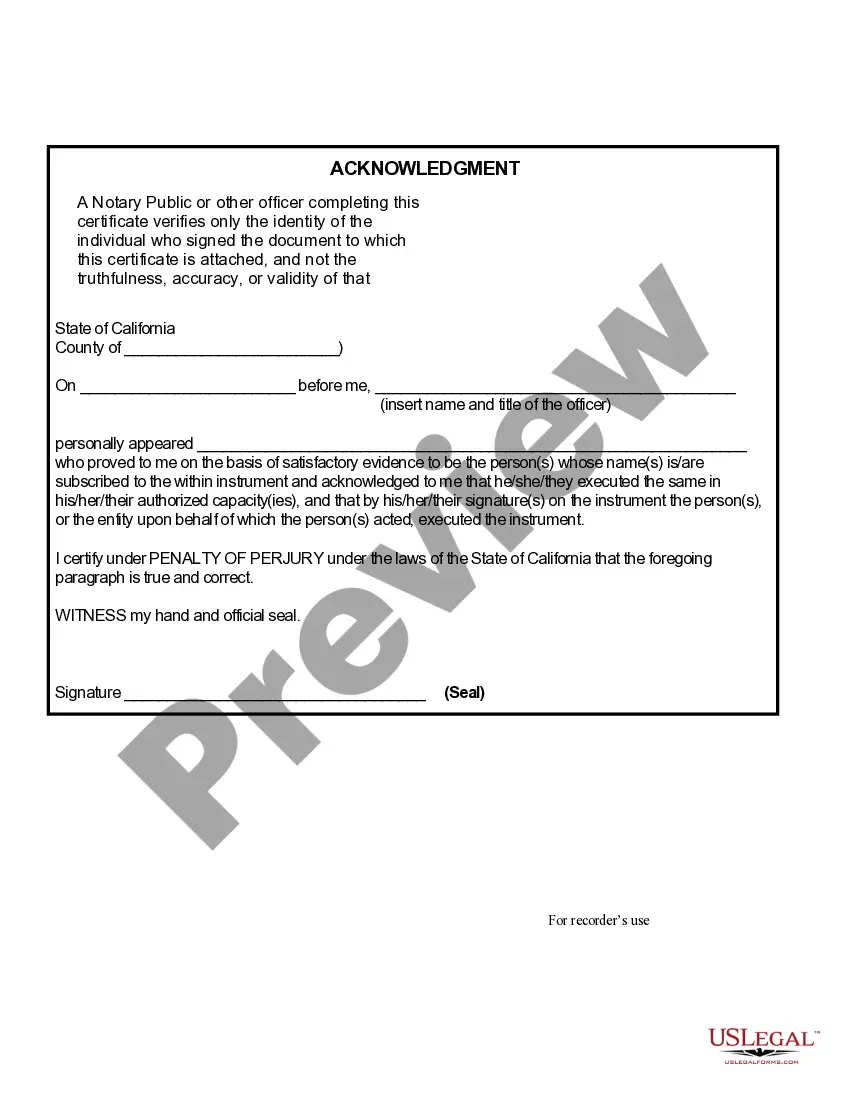

- Verify you’ve found an appropriate document. Read the description and utilize the Preview option, if available, to confirm it aligns with your needs. If it doesn't fit your criteria, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Acquire your Norwalk California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under 166,250. Select the file format for your document and save it onto your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To write a small estate affidavit, you need to gather essential information about the deceased, including their name, date of death, and details of the property you wish to collect. You must also confirm the total market value of the estate does not exceed $184,500. Completing the affidavit accurately is crucial, and you might find it helpful to use templates offered by platforms like USLegalForms, which can guide you through the requirements for the Norwalk California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500.

Once a small estate affidavit is filed in California, the designated individual can start collecting the deceased's property without further probate proceedings. The affidavit acts as a legal claim for the assets detailed in the document. It's important for the claimant to present the affidavit to financial institutions or other holders of the deceased’s assets in order to transfer ownership. Following the guidelines of the Norwalk California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 ensures a smoother process.

A small estate affidavit for collection of personal property in California is a legal document used to claim the personal belongings of a deceased person when the estate falls below the value threshold of $184,500. This affidavit provides a way for heirs to bypass probate court, expediting the transfer process. In Norwalk, using this affidavit can significantly reduce hassle and time involved in settling small estates. It ensures that rightful beneficiaries receive their share of the estate more promptly.

An affidavit for collection of personal property in California allows a person to collect assets from a deceased individual's estate without going through the lengthy probate process. This method is particularly useful in Norwalk for estates valued under $184,500. The process streamlines the transfer of personal property, making it accessible for heirs or beneficiaries quicker and more efficiently. Utilizing the Norwalk California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 can simplify estate management.

You do not need a lawyer to file a small estate affidavit in California. The California Probate Code Section 13100 is structured to allow individuals to handle estates under $184,500 easily and efficiently. While legal assistance can help navigate complexities, many find success without it. Using a platform like US Legal Forms can provide the support you need to complete the affidavit on your own.

Yes, you can file an affidavit without a lawyer in California, particularly for estates under $184,500. The process is designed to be accessible for individuals without legal representation. However, having guidance can be beneficial, especially in understanding the specific forms and requirements. US Legal Forms offers resources that can help you confidently proceed without legal counsel.

In California, you file the small estate affidavit with the county clerk where the deceased resided before their passing. This process includes presenting the completed affidavit along with any required documentation. Filing accurately ensures that you comply with local regulations and can collect the personal property as intended. For convenience, consider using US Legal Forms to guide you through all necessary steps.

In Indiana, the limit for a small estate affidavit is set at $50,000. This allows individuals to collect their loved ones' property without undergoing the full probate process, similar to California's provisions under Probate Code Section 13100. Knowing these limits is essential for efficient estate management and ensuring you are within the legal framework. For detailed assistance and forms, look into US Legal Forms.

In New York, small estate provisions enable the transfer of assets for estates valued at $50,000 or less without formal probate. The process requires filing a request with the court to collect the estate's property. While the laws differ from California, understanding these regulations is crucial for successful navigation. If you're also dealing with California's regulations, US Legal Forms can guide you through both states effectively.

The affidavit for collection of personal property under California Probate Code Section 13100 allows a successor to collect personal property of a deceased person without going through full probate. This process streamlines the transfer of assets valued at $184,500 or less, ensuring that heirs access their inheritance more quickly. Utilizing this affidavit can help simplify the transition during a difficult time. You can learn more and access your affidavit through US Legal Forms.