California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $208,850

Overview of this form

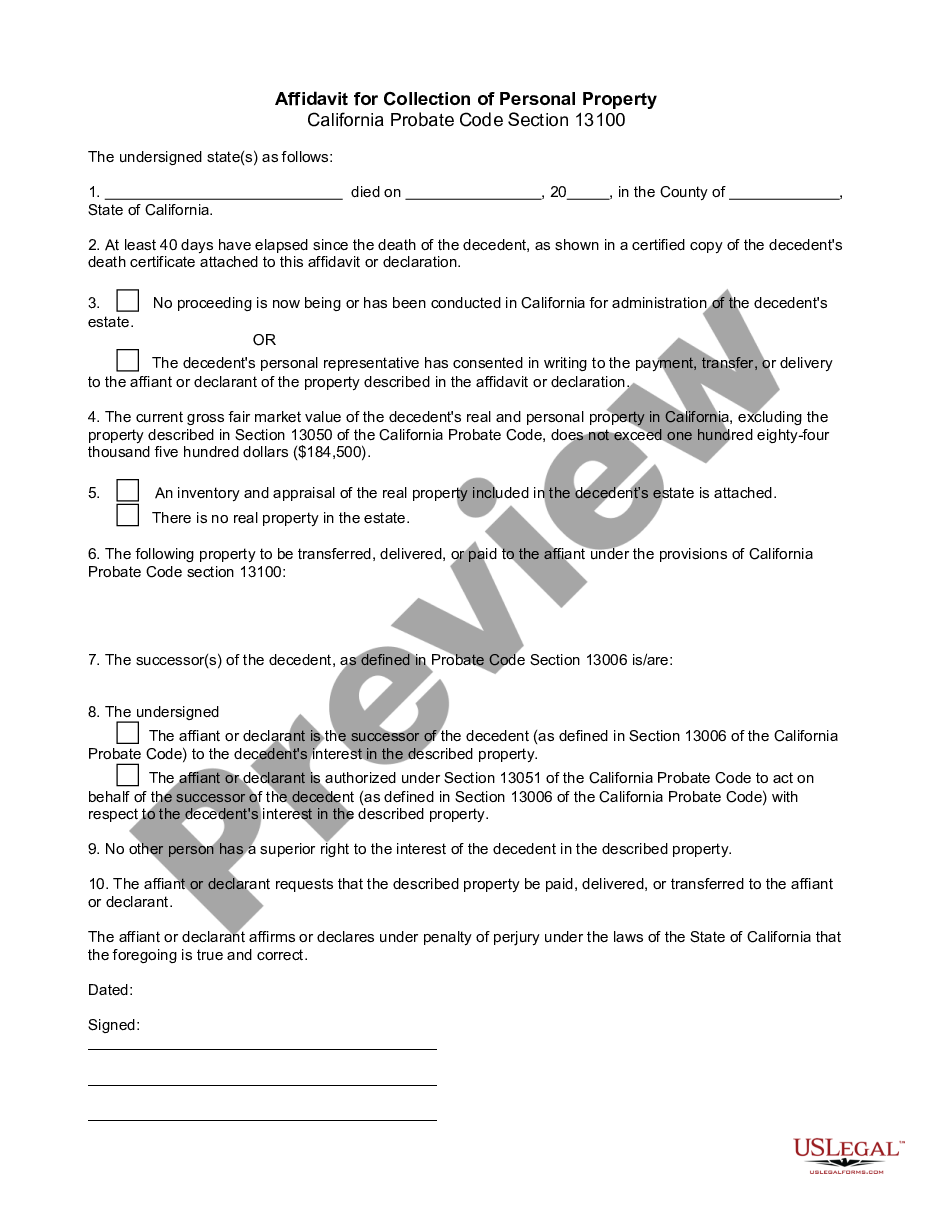

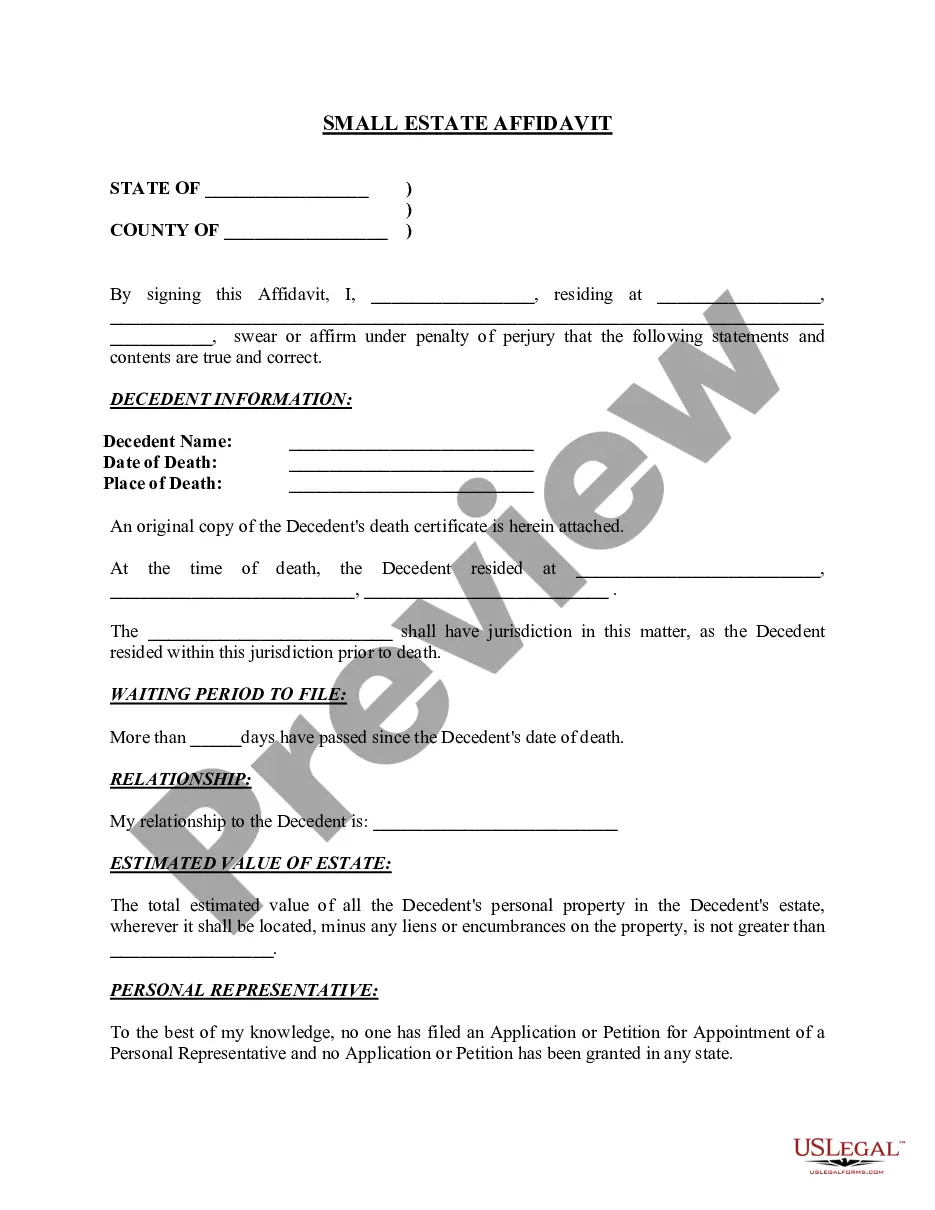

The Affidavit for Collection of Personal Property is a legal document used in California to facilitate the transfer of personal property belonging to a deceased individual when the estate's value does not exceed $184,500. This affidavit allows an interested party to claim the decedent's assets without the need for formal probate proceedings, provided that certain conditions are met. It simplifies the process for small estates, enabling heirs to access assets efficiently compared to traditional probate methods.

Main sections of this form

- This affidavit confirms that no probate proceedings are currently underway for the decedent's estate.

- The affiant must declare that they are authorized to act on behalf of the decedent's successors.

- It specifies the gross fair market value of the estate, which must not exceed $184,500.

- An inventory and appraisal of the decedent's property must be attached or indicated.

- It affirms that no other party has a superior claim to the decedent's property.

- The affiant requests the transfer of specific property to themselves.

When this form is needed

This form is appropriate when an individual passes away, and the estate consists of personal property valued at no more than $184,500. If at least forty days have passed since the decedent's death, an interested party, such as a family member or heir, can use this affidavit to collect debts owed to the decedent or to claim their personal assets directly without going through probate court.

Who can use this document

- Family members or heirs of the decedent.

- Individuals who are designated as successors or have a legal right to claim the decedent's personal property.

- Anyone involved in the estate settlement of a decedent whose estate qualifies as a small estate under California law.

Steps to complete this form

- Identify the affiant and provide their contact information.

- Confirm that no probate proceedings are ongoing concerning the decedent's estate.

- State the gross fair market value of the decedent's personal property and document inventory details.

- Name the specific property to be collected and transferred to the affiant.

- Sign the affidavit under penalty of perjury, affirming that all information provided is accurate.

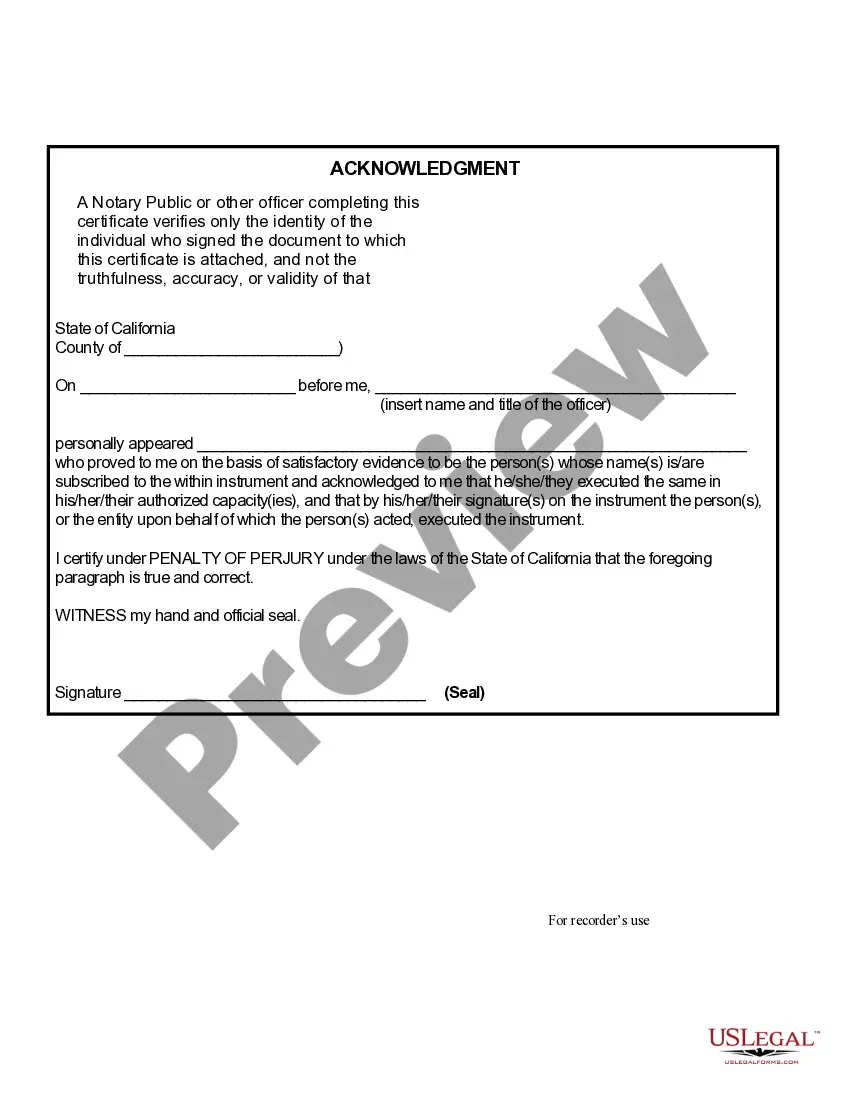

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include an inventory and appraisal of the estate's property.

- Not ensuring the form is signed under penalty of perjury, which could invalidate the affidavit.

- Overestimating the estate value, which may disqualify the use of this form.

- Not waiting the required forty days after the death before submitting the affidavit.

Benefits of using this form online

- Convenience: Easily accessible for download and can be filled out at your own pace.

- Editability: Allows you to customize the form based on your specific needs without requiring an appointment.

- Reliability: Created by licensed attorneys, ensuring the document's legality and adherence to state laws.

Main things to remember

- The Affidavit for Collection of Personal Property is intended for small estates in California.

- Essential for claiming assets when the estate value is under $184,500.

- Must be completed accurately to avoid legal issues and delays.

Looking for another form?

Form popularity

FAQ

Excluded property as described in section 13050 of the California Probate Code refers to certain assets that do not count toward the small estate threshold of $184,500. This typically includes specific types of property such as joint tenancy accounts or assets held in trust. Knowing what constitutes excluded property ensures that individuals can properly navigate the California Affidavit for Collection of Personal Property for a smoother estate transfer.

According to California Probate Code section 13006, successors of the decedent include those individuals entitled to inherit the decedent’s property under the terms of a will or through the laws of intestacy. This typically involves heirs, beneficiaries, or those named in legal documents pertaining to the estate. Understanding who qualifies as a successor helps in properly utilizing the California Affidavit for Collection of Personal Property effectively.

California Probate Code 13100 provides specific guidelines for the transfer of small estates to streamline the process for heirs or beneficiaries. This code allows claimants to collect personal property directly, avoiding formal probate court proceedings if the estate value is under $184,500. This process saves time and resources, making the California Affidavit for Collection of Personal Property essential for efficient estate management.

Under the California Probate Code 13100 and 13115, a declaration allows successors to claim personal property by affirming their right to do so after following the prescribed process. This declaration verifies the value of the estate is within the $184,500 limit and that the decedent had no real property. By using the California Affidavit for Collection of Personal Property, individuals can simplify the transfer process while ensuring compliance with the relevant regulations.

Section 13100 of the California Probate Code outlines the process for transferring small estates valued under $184,500 without the need for a full probate proceeding. This section provides a streamlined method through the California Affidavit for Collection of Personal Property, enabling heirs or designated individuals to collect personal property of the decedent more efficiently. Utilizing this section helps beneficiaries avoid the lengthy and often costly probate process.

To fill out a small estate affidavit, start by obtaining the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 form. Carefully provide information about the estate and sign the document in front of a notary. For your convenience, UsLegalForms offers comprehensive resources and templates that walk you through each step of filling out the affidavit correctly.

A California affidavit is a legal document used to affirm facts under penalty of perjury. Specifically, the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 serves as a means for heirs to access a decedent's personal property without probate. This affidavit streamlines the distribution process, making it efficient for small estate management.

To fill out a lack of probate affidavit, you should obtain the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 form. Gather the required information about the decedent and the estate’s value. Completing the affidavit accurately is crucial, and UsLegalForms provides user-friendly templates and instructions to simplify the task.

In California, affidavits must comply with Probate Code Section 13100, particularly for small estates under $184,500. The affidavit allows heirs to collect personal property without going through formal probate. It is important to ensure that the affidavit is signed, notarized, and includes the necessary supporting documents to avoid complications.

To obtain a copy of a small estate affidavit, visit your local probate court or access their online services. You will need to complete the California Affidavit for Collection of Personal Property - Probate Code Section 13100 - Small Estates under $184,500 form. If you need assistance, resources from UsLegalForms can guide you through the process, ensuring you have the correct documentation.