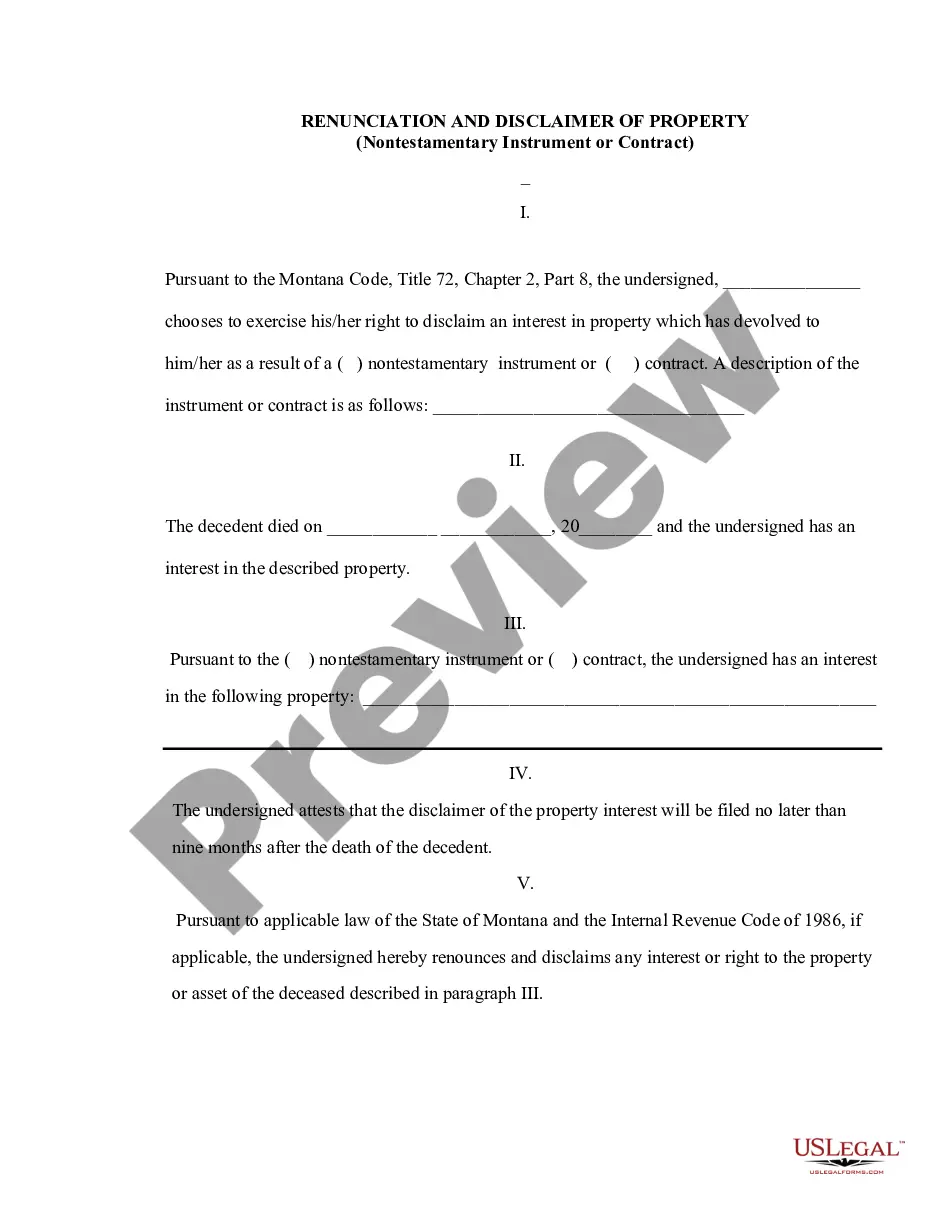

Montana Renunciation and Disclaimer of Property received by Intestate Succession

Disclaimer of Property

Interest-Montana

Title 72 ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2 UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8 General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer of property interests.

(1) (a) A person or the representative of a person to whom

an interest in or with respect to property or an interest in the property

devolves by whatever means may disclaim it in whole or in part by delivering

or filing a written disclaimer under this section.

(c) For purposes of this subsection (1), the "representative of a person"

includes a personal representative of a decedent; a conservator of a disabled

person; a guardian of a minor or incapacitated person; a guardian ad litem

of a minor, an incapacitated person, an unborn person, an unascertained

person, or a person whose identity or address is unknown; and an agent

acting on behalf of the person within the authority of a power of attorney.

The representative of a person may rely on a general family benefit accruing

to the living members of the represented person's family as a basis for

making a disclaimer.

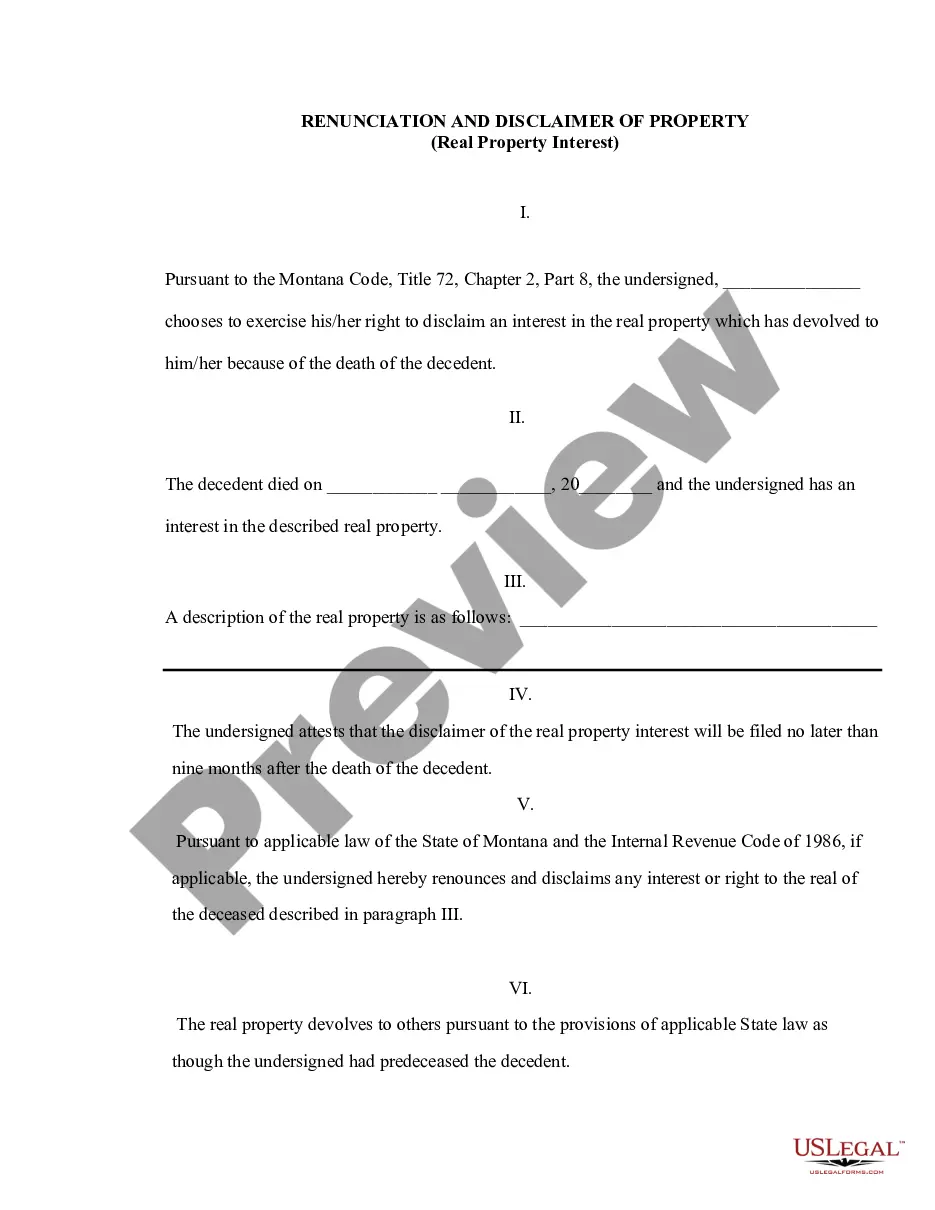

(a) If the property or interest has devolved to the disclaimant

under a testamentary instrument or by the laws of intestacy, the disclaimer

must be filed, if of a present interest, not later than 9 months after

the death of the deceased owner or deceased donee of a power of appointment

and, if of a future interest, not later than 9 months after the event determining

that the taker of the property or interest is finally ascertained and the

taker's interest is indefeasibly vested. The disclaimer must be filed in

the court of the county in which proceedings for the administration of

the estate of the deceased owner or deceased donee of the power have been

commenced. A copy of the disclaimer must be delivered in person or mailed

by certified mail, return receipt requested, to any personal representative

or other fiduciary of the decedent or donee of the power.

(b) If a property or interest has devolved to the disclaimant under

a nontestamentary instrument or contract, the disclaimer must be delivered

or filed, if of a present interest, not later than 9 months after the effective

date of the nontestamentary instrument or contract and, if of a future

interest, not later than 9 months after the event determining that the

taker of the property or interest is finally ascertained and the taker's

interest is indefeasibly vested. If the person entitled to disclaim does

not know of the existence of the interest, the disclaimer must be delivered

or filed not later than 9 months after the person learns of the existence

of the interest. The effective date of a revocable instrument or contract

is the date on which the maker no longer has power to revoke it or to transfer

to the maker or another the entire legal and equitable ownership of the

interest. The disclaimer or a copy of the disclaimer must be delivered

in person or mailed by certified mail, return receipt requested, to the

person who has legal title to or possession of the interest disclaimed.

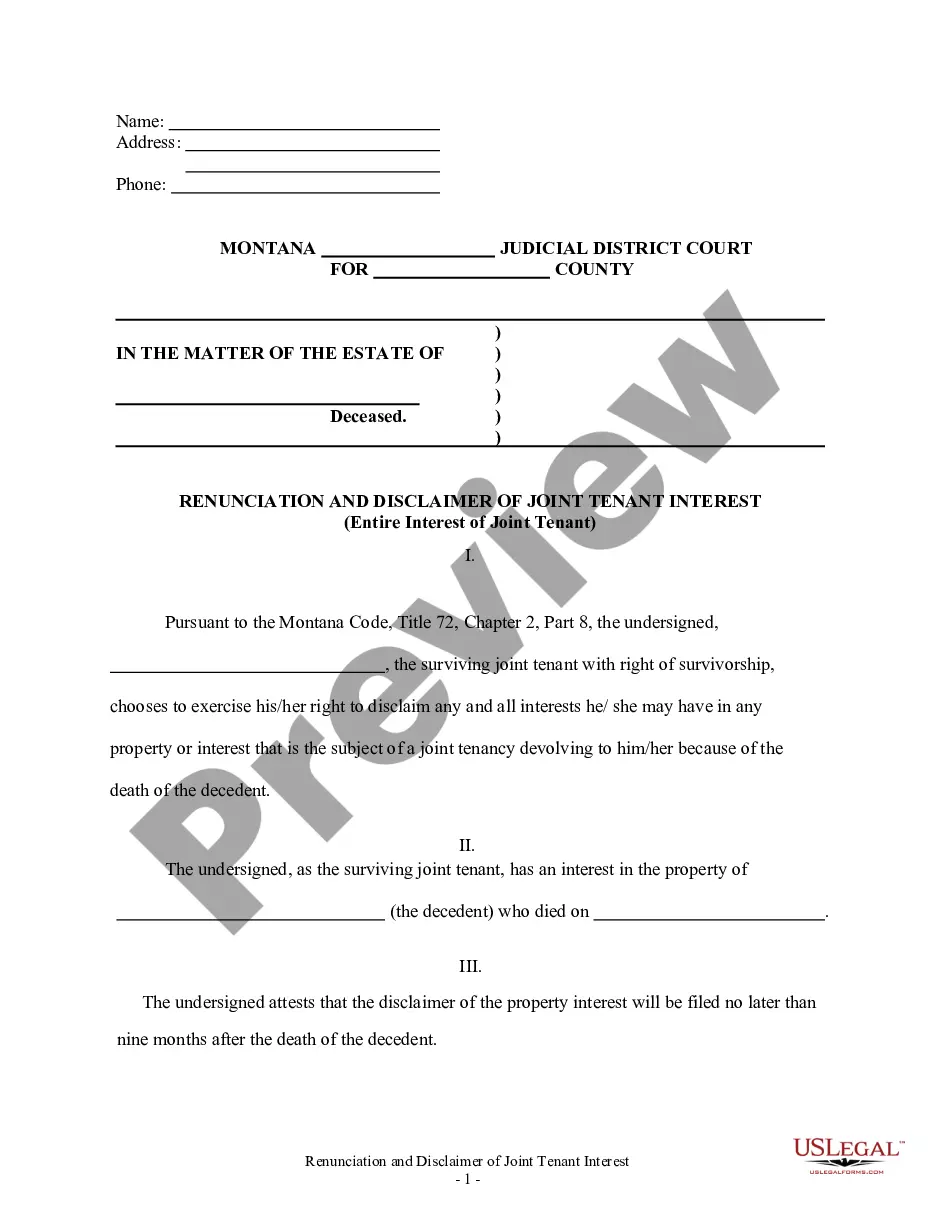

(c) A surviving joint tenant may disclaim as a separate interest

any property or interest in property devolving to the surviving joint tenant

by right of survivorship within 9 months after the death of the deceased

joint owner, regardless of whether the surviving joint tenant contributed

to the purchase of jointly held property or benefited from the jointly

held property prior to the other joint tenant's death.

(a) If property or an interest in property devolves to

a disclaimant under a testamentary instrument, under a power of appointment

exercised by a testamentary instrument, or under the laws of intestacy

and the decedent has not provided for another disposition of that interest,

should it be disclaimed, or of disclaimed or failed interests in general,

the disclaimed interest devolves as if the disclaimant had predeceased

the decedent, but if by law or under the testamentary instrument the descendants

of the disclaimant would share in the disclaimed interest by representation

or otherwise were the disclaimant to predecease the decedent, then the

disclaimed interest passes by representation, or passes as directed by

the governing instrument, to the descendants of the disclaimant who survive

the decedent. A future interest that takes effect in possession or enjoyment

after the termination of the estate or interest disclaimed takes effect

as if the disclaimant had predeceased the decedent. A disclaimer relates

back for all purposes to the date of the death of the decedent.

(b) If property or an interest in property devolves to a disclaimant

under a nontestamentary instrument or contract and the instrument or contract

does not provide for another disposition of that interest, should it be

disclaimed, or of disclaimed or failed interests in general, the disclaimed

interest devolves as if the disclaimant had predeceased the effective date

of the instrument or contract, but if by law or under the nontestamentary

instrument or contract the descendants of the disclaimant would share in

the disclaimed interest by representation or otherwise were the disclaimant

to predecease the effective date of the instrument, then the disclaimed

interest passes by representation, or passes as directed by the governing

instrument, to the descendants of the disclaimant who survive the effective

date of the instrument. A disclaimer relates back for all purposes to that

date. A future interest that takes effect in possession or enjoyment at

or after the termination of the disclaimed interest takes effect as if

the disclaimant had died before the effective date of the instrument or

contract that transferred the disclaimed interest.

(a) an assignment, conveyance, encumbrance, pledge, or

transfer of the property or interest or a contract therefor;

(6) This section does not abridge the right of a person to waive, release,

disclaim, or renounce property or an interest in property under any other

statute.

(7) An interest in property that exists on October 1, 1993, as to

which, if a present interest, the time for filing a disclaimer under this

section has not expired or, if a future interest, the interest has not

become indefeasibly vested or the taker finally ascertained may be disclaimed

within 9 months after October 1, 1993.

History: En. 91A-2-801 by Sec. 1, Ch. 365, L. 1974; R.C.M. 1947, 91A-2-801;

amd. Sec. 1, Ch. 52, L. 1981; amd. Sec. 1, Ch. 511, L. 1983; amd. Sec.

5, Ch. 494, L. 1993; Sec. 72-2-101, MCA 1991; redes. 72-2-811 by Code Commissioner,

1993; amd. Sec. 20, Ch. 592, L. 1995; amd. Sec. 4, Ch. 290, L. 1999.

Official Comments: Purpose and Scope of Revisions.

This section brings into the Code the Uniform Disclaimer of Property Interests Act,

replacing the prior incorporation of the Uniform Disclaimer of Transfers

by Will, Intestacy or Appointment Act. The reason for incorporating the

broader Act is that the scope of Article II [Title 72, chapter 2] has now

been expanded to cover dispositive provisions not contained in wills.

Explanation of Revisions.

Only three revisions of the Uniform Disclaimer of Property Interests Act are adopted at this time, though the

Joint Editorial Board believes that this and the other Uniform Disclaimer

Acts are in need of revision in other respects.

Subsection (a) [72-2-811(1)]. Subsection (a) [72-2-811(1)] is revised

in two respects. First, the right to disclaim is extended to a decedent

through his or her personal representative. The Uniform Disclaimer of Property

Interests Act does not authorize disclaimers on behalf of a deceased person.

Second, the sentence authorizing a disclaimer despite a limitation or restriction

in the governing instrument is clarified to leave no doubt that an explicit

restriction or limitation on the right to disclaim in the governing instrument

is ineffective.

Subsection (d) [72-2-811(4)]. The third revision clarifies the effect

of a disclaimer. The Uniform Disclaimer of Property Interests Act states

that "it" shall devolve "as if the disclaimant had predeceased the decedent."

Literally interpreted, the word "it" refers to "the disclaimed interest,"

not to the estate as a whole. (One of the changes above is to make this

point unmistakable by replacing "it" with "the disclaimed interest.")

Unfortunately, even though the word "it" refers to the disclaimed

interest, not to the estate as a whole, there is still a plausible interpretation

of the phrase "the disclaimed interest devolves as if the disclaimant had

predeceased the decedent" that does not produce the desired result. The

desired result is to prevent an heir, for example, from using a disclaimer to effect a change in the division

of an intestate's estate. To illustrate this point, consider the following

example:

Under these facts, G's intestate estate is divided into

two equal parts: A takes half and B's child, Z, takes the other half. Suppose,

however, that A files a disclaimer. The desired effect of that disclaimer

is to prevent A from affecting the basic division of G's intestate estate

by this maneuver. If, however, the disclaimer statute merely provides that

the "disclaimed interest" devolves as though the disclaimant (A) had predeceased

the decedent, then A's one half interest would not pass only to X and Y,

but to X, Y, and Z. To prevent this possible interpretation of that language,

the "but if" phrase is added to (d)(1) [72-2-811(4)(a)] and (d)(2) [72-2-811(4)(b)].

This added phrase explicitly provides that A's disclaimed interest passes

to A's descendants, if A left any descendants.

Time Allowed for Filing Disclaimer.

It should be noted that there may be a discrepancy between the time allowed for filing a disclaimer

under this section (and under the freestanding Uniform Acts) and the time

allowed for filing a qualified disclaimer under the Internal Revenue Code

§ 2518. Lawyers are cautioned to check both the state and federal

disclaimer statutes before advising clients, especially with respect to

disclaimers of future interests.

Compiler's Comments:

1999 Amendment: Chapter 290 in (2)(c) near beginning after "devolving

to the" inserted "surviving" and inserted "within 9 months after the death

of the deceased joint owner, regardless of whether the surviving joint

tenant contributed to the purchase of jointly held property or benefited

from the jointly held property prior to the other joint tenant's death"

and at end deleted sentence that read: "A surviving joint tenant may disclaim

the entire interest in any property or interest in the property that is

the subject of a joint tenancy devolving to the joint tenant if the joint

tenancy was created by act of a deceased joint tenant, the survivor did

not join in creating the joint tenancy, and the survivor has not accepted

a benefit under it." Amendment effective April 9, 1999.

1995 Amendment: Chapter 592 in first sentence of (4)(a) and

(4)(b) substituted "share in the disclaimed interest by representation

or otherwise" for "take the disclaimant's share by representation" and

near end of both sentences, after "representation", inserted "or passes

as directed by the governing instrument"; and made minor changes in style.

1993 Amendment: Chapter 494 substituted current text concerning

disclaimer of property interests for former text that read:

"(1) A person or his personal representative or the representative

of an incapacitated or protected person who is an heir, devisee, person

succeeding to a renounced interest, donee, appointee, grantee, recipient,

or beneficiary under a trust or other nontestamentary instrument or under

a power of appointment exercised by a testamentary or nontestamentary instrument,

surviving joint owner or surviving joint tenant, or beneficiary or owner

of an insurance contract or any incident of ownership therein may renounce,

in whole or in part, the right of succession to any property or interest

therein, including a future interest, by filing a written renunciation

under this section. The instrument shall:

(2) The court may direct or permit a trustee under a testamentary or

nontestamentary instrument to renounce, modify, amend, or otherwise deviate

from any restriction on or power of administration, management, or allocation

of benefit upon finding that such restriction on the exercise of the power

may defeat or impair the accomplishment of the purposes of the trust, whether

by the imposition of tax, the allocation of beneficial interest inconsistent

with such purposes, or by other reason. Such authority shall be exercised,

after hearing and upon notice to all known persons beneficially interested

in such trust, in the manner directed by the court.

(3) The instrument of renunciation must be received by the transferor

of the interest, his legal representative, the personal representative

of a deceased transferor, the trustee of any trust in which the interest

being renounced exists, or the holder of the legal title to the property

to which the interest relates. To be effective for purposes of determining

inheritance and estate taxes, the instrument must be received not later

than the date which is 9 months after the later of the date on which the

transfer creating the interest in a person is made or the date on which

the person attains 18 years of age. If the circumstances that establish

the right of a person to renounce an interest arise as a result of the

death of an individual, the instrument must also be filed in the court

of the county where proceedings concerning the decedent's estate are pending

or where they would be pending if commenced. If real property or an interest

therein is renounced, a copy of the renunciation may be recorded in the

office of the county clerk and recorder of the county in which the real

estate is situated. No person entitled to a copy of the instrument is liable

for any proper distribution or disposition made without actual notice of

the renunciation, and no person making a proper distribution or disposition

in reliance upon the renunciation is liable for any such distribution or

disposition in the absence of actual notice that an action has been instituted

contesting the validity of the renunciation.

(4) Unless the transferor of the interest has otherwise provided,

the property or interest renounced devolves as though the person renouncing

had predeceased the decedent or, if the appointment was exercised by a

testamentary instrument, as though the person renouncing had predeceased

the donee of the power. A future interest that takes effect in possession

or enjoyment after the termination of the estate or interest renounced

takes effect as though the person renouncing had predeceased the decedent

or the donee of the power. A renunciation relates back for all purposes

to the date of the death of the decedent or the donee of the power.

(i) an assignment, conveyance, encumbrance, pledge, or

transfer of property or interest, or a contract therefor;

(6) This section does not abridge the right of a person to waive, release,

disclaim, or renounce property or an interest therein under any other statute.

(7) Within 30 days of receipt of a written instrument of renunciation

by the transferor of the interest, the renouncer, his legal representative,

the personal representative of the decedent, the trustee of any trust in

which the interest being renounced exists, or the holder of the legal title

to the property to which the interest relates, as the case may be, shall

attempt to notify in writing those persons who are known or ascertainable

with reasonable diligence who are recipients or potential recipients of

the renounced interest of the renunciation and the interest or potential

interest such recipient will receive as a result of the renunciation.

(8) Any interest in property which exists on July 1, 1983, may be

renounced after October 1, 1983, as provided in this section. An interest

that has arisen prior to July 1, 1983, in any person other than the person

renouncing is not destroyed or diminished by any action of the person renouncing

taken under this section."

Saving Clause: Section 136, Ch. 494, L. 1993, was

a saving clause.

1983 Amendment: In (1), after "renounced interest" substituted

"donee, appointee, grantee, recipient, or beneficiary under a . . . ownership

therein" (see 1983 Session Law for complete text) for "beneficiary under

a testamentary instrument, or appointee under a power of appointment exercised

by a testamentary instrument"; deleted former (2), which read:

"(a) An instrument renouncing a present interest shall

be filed within 9 months after the death of the decedent or the donee of

the power.

(b) An instrument renouncing a future interest may be filed not

later than 9 months after the event determining that the taker of the property

or interest is finally ascertained and his interest is indefeasibly vested.

(c) The renunciation must be filed in the court of the county in

which proceedings have been commenced for the administration of the estate

of the deceased owner or deceased donee of the power or, if they have not

been commenced, in which they could be commenced. A copy of the renunciation

shall be delivered in person or mailed by registered or certified mail

to any personal representative or other fiduciary of the decedent or donee

of the power. If real property or an interest therein is renounced, a copy

of the renunciation may be recorded in the office of the county clerk of

the county in which the real estate is situated."; inserted (2) allowing

trustee renunciation; inserted (3) relating to receipt of instrument of

renunciation and date of renunciation; in (4) near beginning of first sentence

substituted "transferor of the interest" for "decedent or donee of the

power"; deleted former (6), which read: "An interest in property which

exists on July 1, 1975, as to which, if a present interest, the time for

filing a renunciation under the Uniform Probate Code has not expired, or

if a future interest, the interest has not become indefeasibly vested or

the taker finally ascertained, may be renounced within 9 months after July

1, 1975."; inserted (7) concerning notice of renunciation; and inserted

(8) concerning renunciation of interest in property arising prior to and

existing on July 1, 1983.

Title 72, Chap. 2, Par 8, §72-2-811.