Use this form to file a declared homestead at the County Recorder's Office in the county where the property is located.

Santa Maria California Homestead Declaration for Single Person

Description

How to fill out California Homestead Declaration For Single Person?

Irrespective of social or professional rank, fulfilling law-related paperwork is a regrettable obligation in today’s work landscape.

Often, it is nearly impossible for an individual without legal education to draft such documents from the ground up, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms steps in to assist.

Ensure the form you have identified is appropriate for your area since the regulations of one state or jurisdiction do not apply to another.

Preview the document and check a short summary (if available) of situations the form is applicable to.

- Our service offers an extensive collection with over 85,000 ready-to-use state-specific forms tailored for nearly any legal situation.

- US Legal Forms is also an excellent asset for associates or legal advisors seeking to conserve time utilizing our DIY templates.

- Whether you require the Santa Maria California Homestead Declaration for a Single Person or any other documentation appropriate for your jurisdiction, with US Legal Forms, everything is readily accessible.

- Here’s how to obtain the Santa Maria California Homestead Declaration for a Single Person in moments using our reliable service.

- If you are already a customer, simply Log In to your account to retrieve the required form.

- However, if you are not familiar with our platform, please follow these steps prior to acquiring the Santa Maria California Homestead Declaration for a Single Person.

Form popularity

FAQ

In Kansas, the homestead exemption amount can vary based on property value and the applicant's specific circumstances. Typically, it shields a portion of your home’s value from property taxes. For individuals like you interested in California guidelines, understanding the Santa Maria California Homestead Declaration for Single Person can provide useful parallels and support.

To qualify for the homestead credit, you typically need to own and occupy your residence as your primary home. There are often income limits and other specific criteria. If you're in Santa Maria, California, using the Santa Maria California Homestead Declaration for Single Person can simplify this process, ensuring you meet all necessary qualifications.

In Wisconsin, you must be a resident and own a home to qualify for the homestead credit. Typically, it applies to individuals who earn a certain income level. The Santa Maria California Homestead Declaration for Single Person may offer insights on similar processes, providing an easy-to-understand guide.

In Minnesota, to qualify for a homestead, the property must be your primary residence. Additionally, you must own the property and occupy it as your home. If you’re looking for a specific process, consider the Santa Maria California Homestead Declaration for Single Person, as it provides clarity on claiming homestead status.

To determine if your property has a homestead exemption, you can check with your local county assessor's office. They maintain records of homestead declarations and exemptions that may apply to your property. Using platforms like uslegalforms can assist you in understanding your rights and ensuring your Santa Maria California Homestead Declaration for Single Person is properly executed.

To qualify for the homestead credit in California, you must reside in your home and use it as your primary dwelling. Additionally, the property must meet financial criteria regarding ownership and equity stakes. Filing a Santa Maria California Homestead Declaration for Single Person will help you claim this credit and secure financial benefits.

Individuals who reside in their homes and make them their primary residence typically qualify for the homestead exemption in California. This includes single persons who own and occupy the property. To maximize your protection, consider filing a Santa Maria California Homestead Declaration for Single Person as soon as you meet the requirements.

As of 2023, the homestead exemption in California varies based on individual circumstances but generally offers protection up to $600,000 in equity for single persons. This exemption can significantly impact your financial security, allowing you to claim your home as a protected asset. Discovering and filing your Santa Maria California Homestead Declaration for Single Person ensures that you benefit from this exemption.

The new homestead law in California increases the homestead exemption limits, providing greater protection for homeowners. Under this law, single individuals can claim a higher value in their homestead declaration. This adjustment aims to safeguard more homeowners in Santa Maria, California, from debt collections and should encourage more people to file a Santa Maria California Homestead Declaration for Single Person.

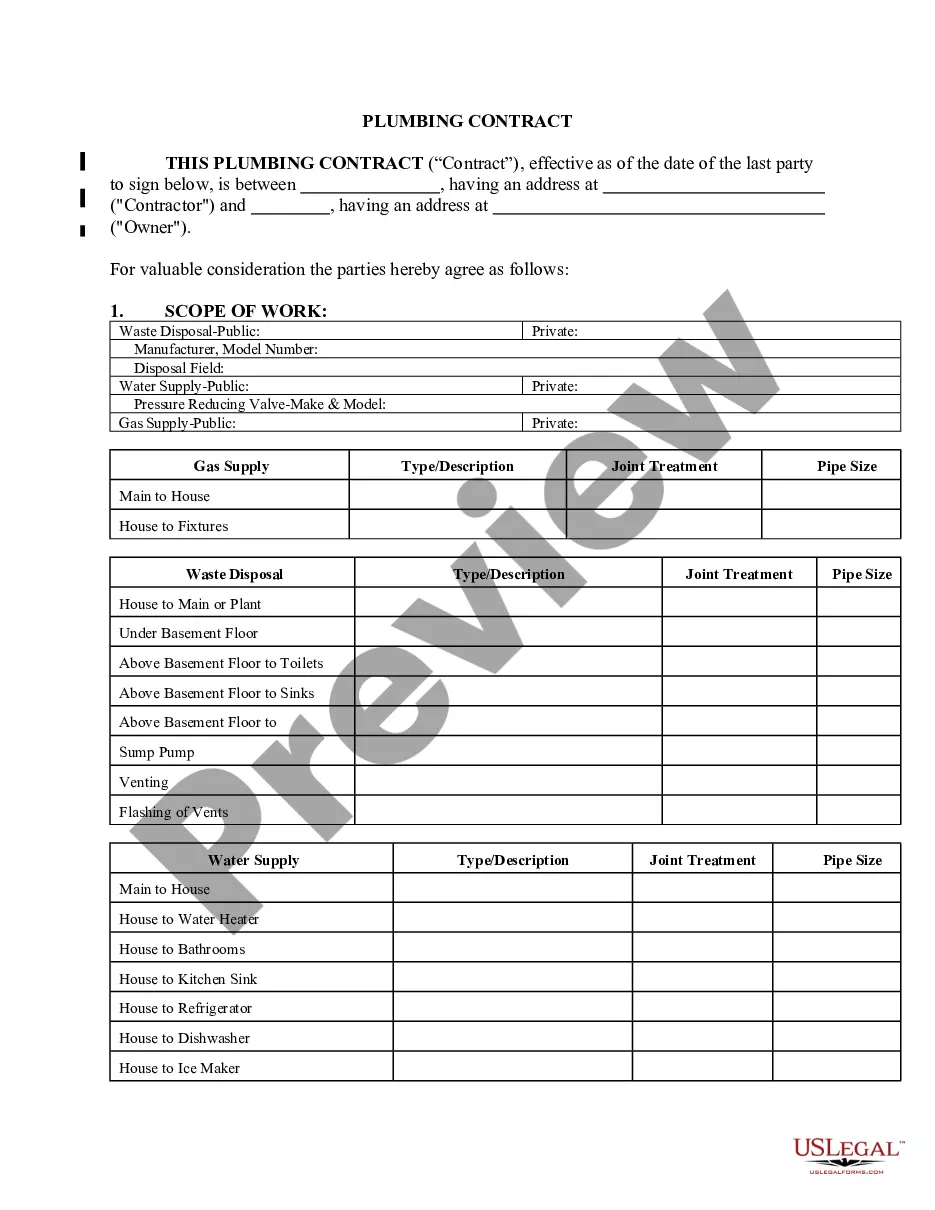

To file a homestead declaration in California, start by completing the required form. You can obtain this form from your local county recorder's office or online through platforms like uslegalforms. Submit the completed declaration to your county recorder, where it will be recorded, establishing your homestead rights in Santa Maria, California.