Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less

Description

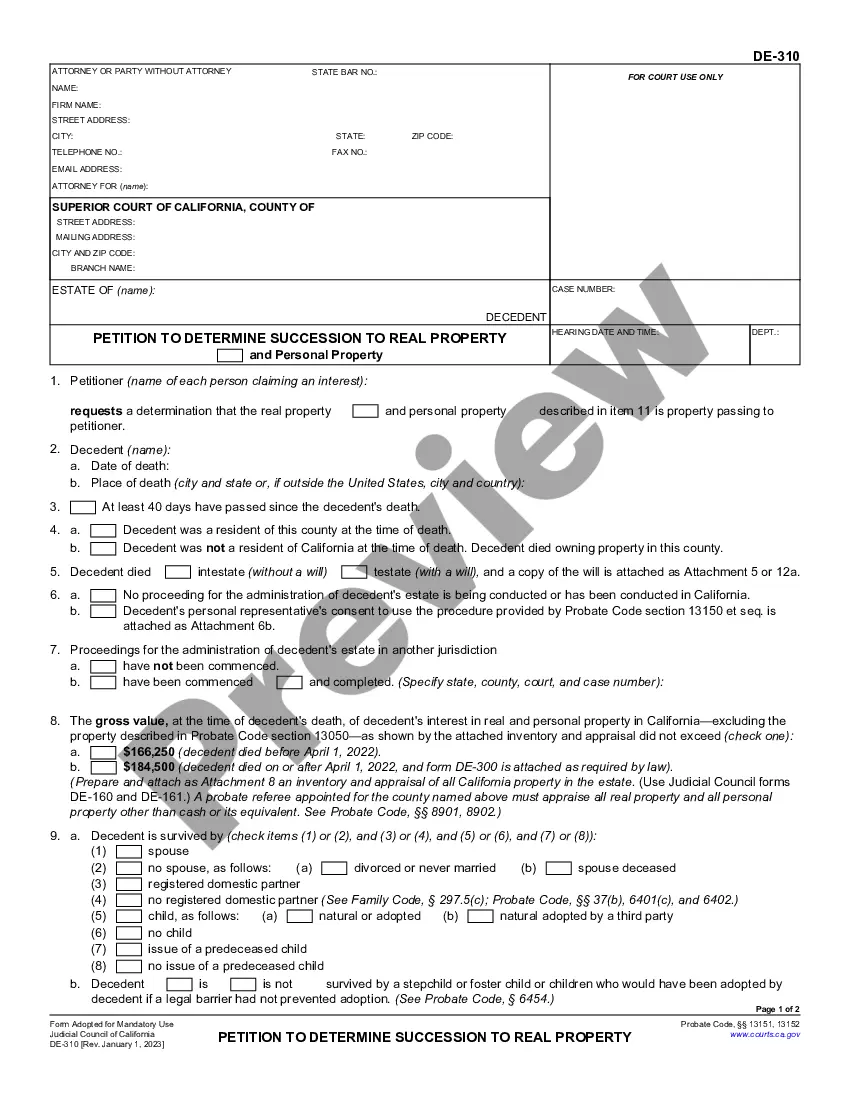

How to fill out California Order Determining Succession To Real Property And Personal Property - Small Estates $184,500 Or Less?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our practical platform with countless templates enables you to locate and acquire nearly any document example you need.

You can download, fill out, and authenticate the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less in mere minutes instead of spending several hours online searching for the appropriate template.

Leveraging our repository is a fantastic method to enhance the security of your record submission.

Access the page with the form you require. Verify that it is the document you were looking for: confirm its title and description, and use the Preview feature if it exists. Alternatively, use the Search bar to locate the correct one.

Initiate the download process. Select Buy Now and decide on your preferred pricing option. Then, create an account and complete your order payment via credit card or PayPal.

- Our skilled attorneys routinely review all the documents to ensure that the templates are applicable for a specific area and compliant with the latest laws and regulations.

- How can you get the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less.

- If you have an account, simply sign in to your profile. The Download option will be available on all the samples you browse.

- You can also access all saved documents in the My documents section.

- If you still don’t have an account, follow these steps.

Form popularity

FAQ

A small estate in California qualifies if the total value of the assets is $184,500 or lower. This encompasses both real property, like houses and land, and personal property, such as bank accounts and personal belongings. For residents seeking an Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, qualifying assets can make the inheritance process much more straightforward. Utilizing services like US Legal Forms can provide you with the necessary guidance and documents to navigate this process effectively.

In California, the small estate limit is $184,500 or less. This amount pertains to the total value of real property and personal property when determining the succession process. Understanding this limit is essential for those considering an Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less. This process can simplify estate management and facilitate the transfer of assets without the lengthy procedures required for larger estates.

As of 2025, the small estate limit in California is projected to remain at $184,500. This figure allows for simplified transfer options for estates of this value, minimizing the need for complicated probate procedures. If you're dealing with such an estate, considering the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less can streamline the process and protect the interests of all heirs involved.

In California, the threshold for a small estate affidavit is set at $184,500. This means that if an estate falls below this amount, heirs can use the small estate affidavit process to claim their inheritance without formal probate. If you find yourself navigating this process, the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less could be an ideal solution.

An estate in California must be valued at over $166,250 to require a probate process. However, for estates below this value, options such as the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less can provide simpler resolutions. Understanding these thresholds can help you decide the most efficient way to handle estate matters.

In California, if an estate's value is under $166,250, it can often avoid probate altogether. This is particularly relevant for those considering options like the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less. Utilizing this alternative can save time, resources, and unwanted complexity, allowing for smoother transitions of property.

To initiate a petition determining heirship in California, you should complete the necessary court forms and file them with the appropriate court. This process typically involves detailing the decedent's assets and potential heirs. You may also need to provide notice to interested parties, ensuring they are aware of the petition, particularly if you're considering the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less as an option.

In California, the probate code threshold for an estate is typically set at $166,250 for real property. However, if you're looking at small estates, such as the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, you may be eligible for simplified processes. Being under this limit often allows heirs to transfer property without the need for a lengthy probate process, making it a more efficient option.

In California, a small estate affidavit does not need to be filed with the court when preventing the probate process for estates valued at $184,500 or less. Utilizing the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less allows for a simpler transfer without official court filings. However, it's still important to prepare and complete the necessary documents correctly. UsLegalForms can assist you in navigating these requirements effortlessly, ensuring you stay compliant.

To avoid probate in California, an estate should generally be valued at $184,500 or less. This allows families to utilize the Alameda California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, which streamlines the transfer of assets. By understanding these guidelines, you can proactively organize your estate to ease your loved ones' burdens later. Speak to a qualified legal advisor to align your estate planning with these requirements.