Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less

Description

How to fill out California Petition To Determine Succession To Real And Personal Property - Small Estates - Estates $184,500 Or Less?

Utilize the US Legal Forms and gain instant access to any document template you need.

Our user-friendly platform with numerous document templates makes it easy to locate and acquire almost any sample document you require.

You can download, complete, and sign the Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less in just a few minutes instead of spending hours online searching for the appropriate template.

Using our resource is an excellent method to enhance the security of your document submissions.

If you haven’t created an account yet, follow the steps listed below.

Locate the form you need. Ensure it is the form you were searching for: confirm its title and description, and use the Preview option when available. If not, employ the Search box to find the required document.

- Our experienced attorneys regularly review all records to ensure that the forms are appropriate for a specific state and compliant with current laws and regulations.

- How can you obtain the Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less? If you already have a subscription, simply Log In to your account. The Download option will appear for all templates you view.

- Moreover, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

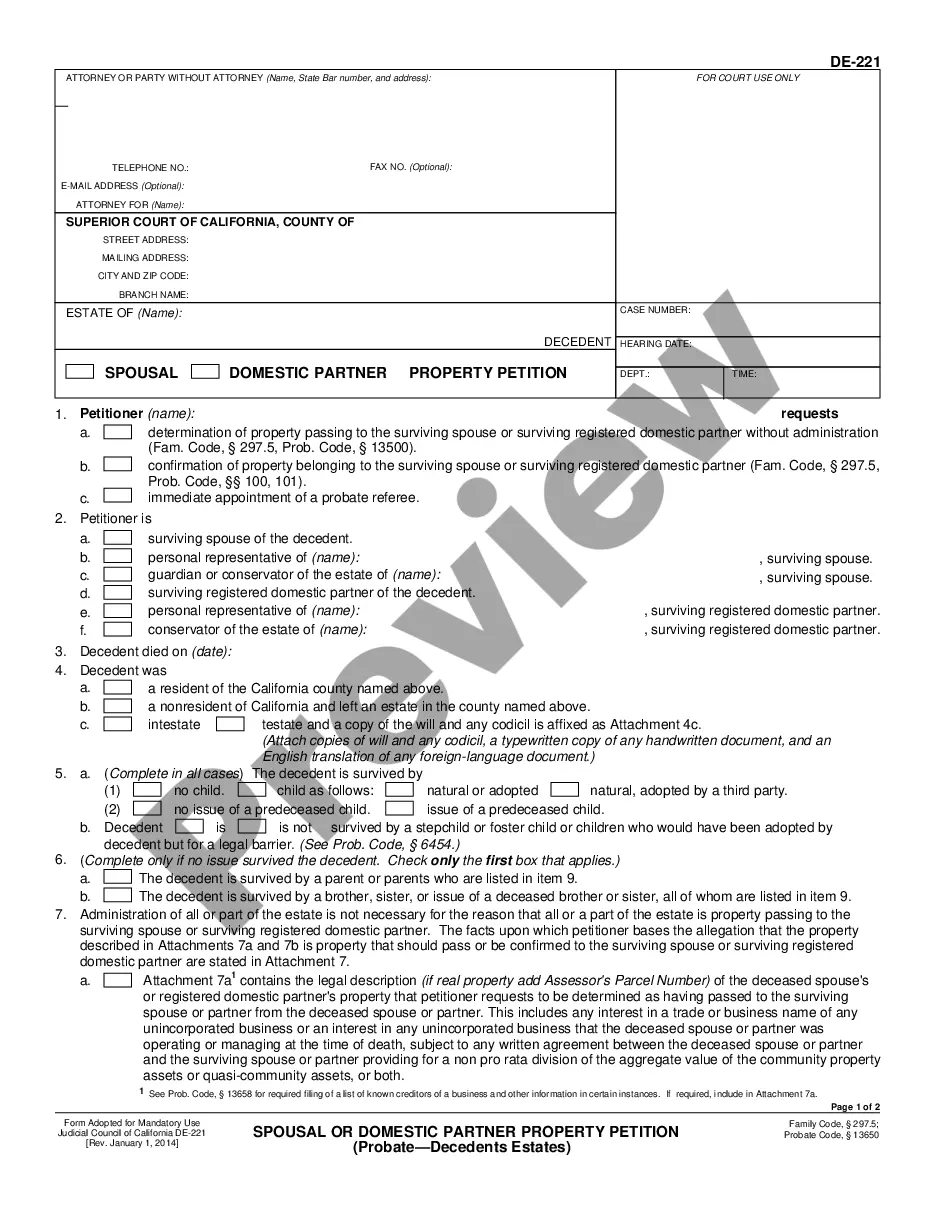

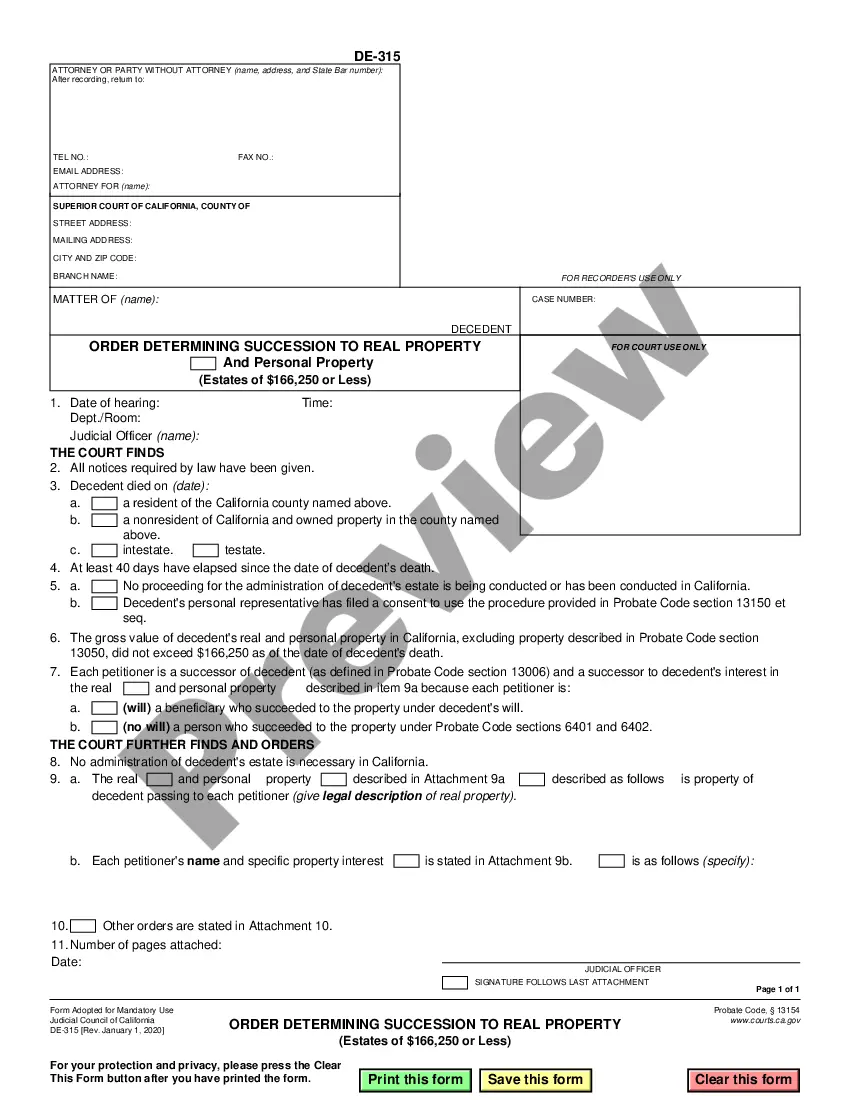

To petition someone to determine heirship in California, you must first gather necessary documents, such as the decedent's death certificate and any relevant estate planning documents. Next, you will complete the appropriate form for a Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less, ensuring all required information is accurate. Once you file this petition in the appropriate court, you may need to attend a hearing where a judge will evaluate your request to confirm the rightful heirs to the estate. Additionally, consider utilizing the US Legal Forms platform for comprehensive templates and guidance to streamline the process.

A petition to determine succession to real property is a legal request filed in court to facilitate the transfer of assets from a deceased person's estate. Specifically, for estates valued at $184,500 or less, this petition simplifies the process, making it easier for heirs to secure their inheritance. In Santa Ana, California, utilizing the Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less can expedite the transfer without the need for a full probate proceeding. This approach allows families to focus on their needs during a difficult time, rather than navigating complex legal hurdles.

To fill out a small estate affidavit, begin by gathering all necessary information about the deceased's assets and debts. You'll need to complete the form with details regarding the total value of the estate, which must be $184,500 or less, as specified in the Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates. Once you've completed the affidavit, ensure that it is signed in front of a notary public, and then file it with the appropriate court. Utilizing platforms like US Legal Forms can streamline this process, ensuring you have the correct documents and guidance for your specific situation.

In California, a small estate affidavit does not typically need to be filed with the court, as these affidavits often serve as a simpler alternative to full probate. However, if you intend to use the Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less to transfer assets, it's crucial to follow the required procedures carefully. You may need to show the affidavit to secure the transfer of property to the rightful heirs. Ensure you understand the regulations to avoid any missteps.

Filing a small estate affidavit in California involves several straightforward steps. First, you must complete the necessary forms, including the Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less. Then, you need to gather any required documentation, such as the death certificate and property value estimates. Finally, submit the affidavit to the appropriate entity, usually the county clerk or recorder's office, to begin the inheritance process.

The maximum amount for a small estate affidavit in California is currently $184,500. If the total value of the estate is below this threshold, you may receive certain benefits by using the Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less. This process enables faster distribution of the deceased's assets without court intervention. Make sure to keep this limit in mind when planning your estate resolution.

In California, the limit for a small estate affidavit is set at $184,500 or less in value. This means that if the total value of the real and personal property owned by the deceased falls within this threshold, you can file a Santa Ana California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less. Utilizing this process simplifies the transfer of assets without the need for a formal probate. It helps heirs access their inheritance more efficiently.