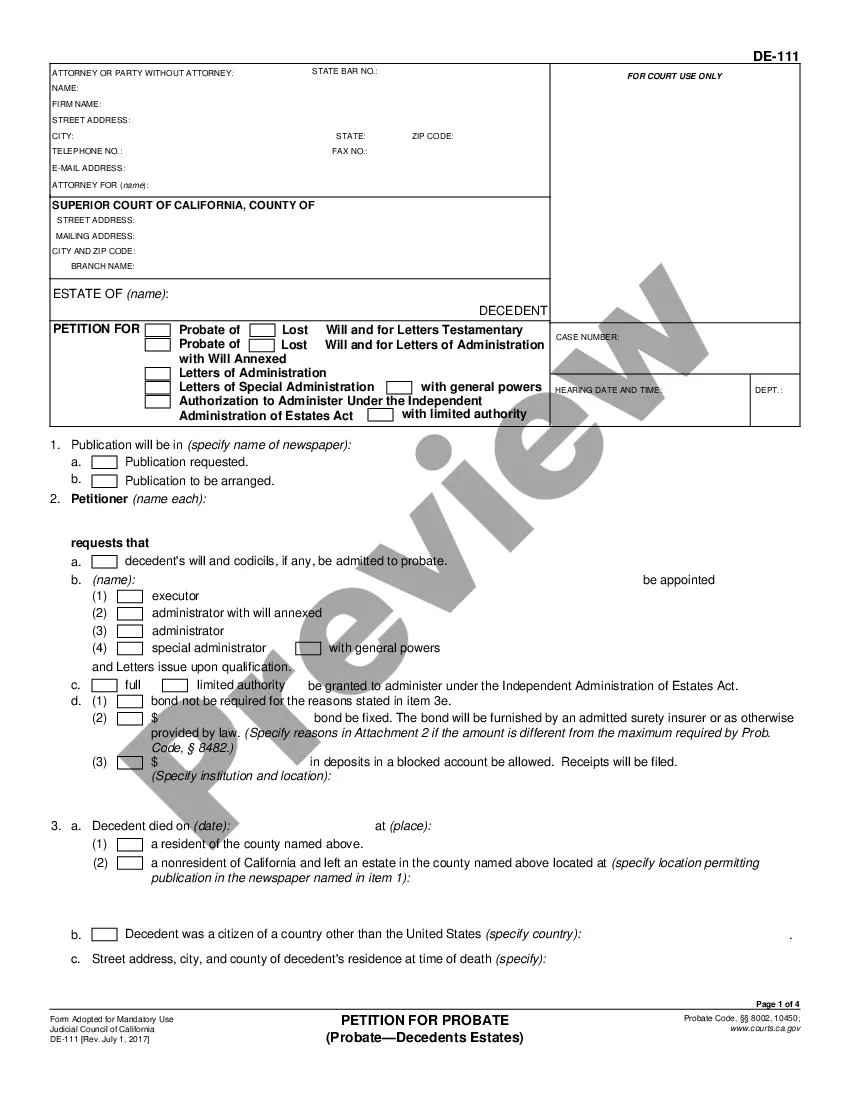

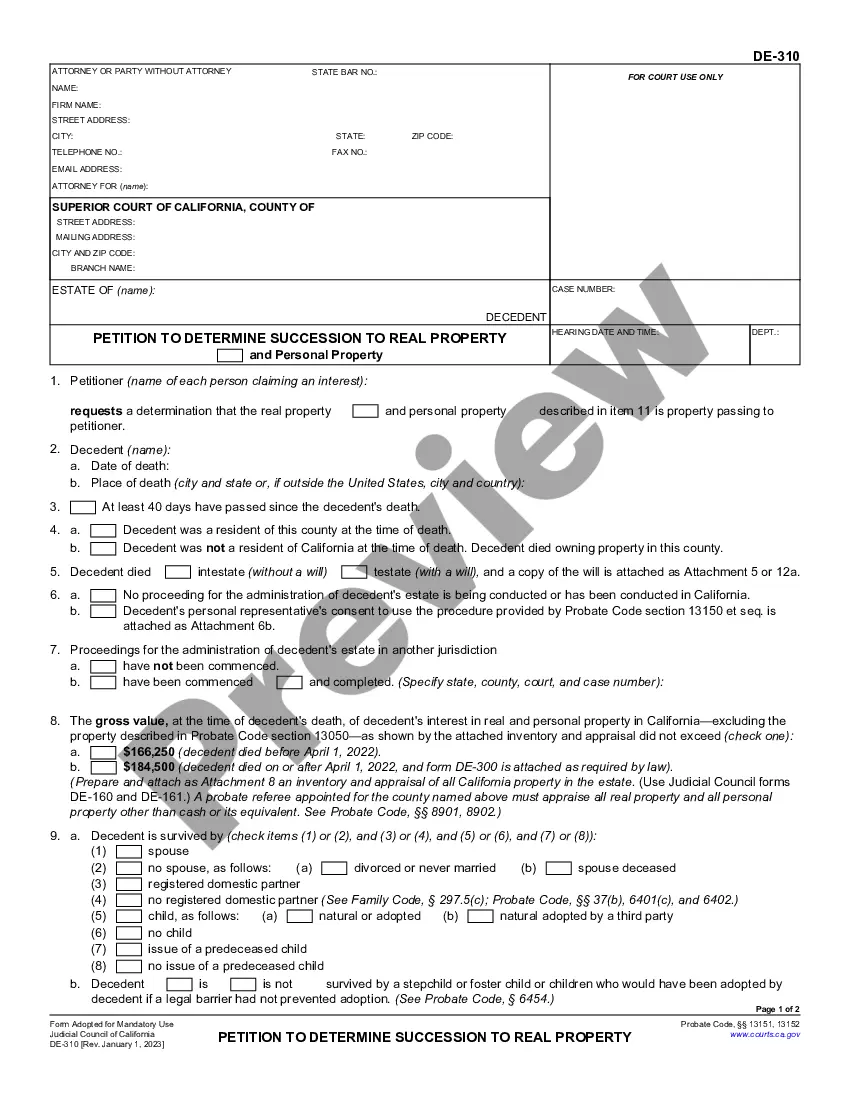

This form, Spousal Property Petition, is an official form from the California Judicial Counsel, which complies with all applicable laws and statutes. USLF amends and updates the Judicial Counsel forms as is required by California statutes and law. This form is a request for either determination of property passing to a surviving spouse or a surviving registered domestic partner without administration, confirmation of property belonging to a surviving spouse or surviving registered domestic partner or immediate appointment of a probate.

San Jose California Spousal Property Petition

Description

How to fill out California Spousal Property Petition?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our user-friendly website with a vast array of documents simplifies the process of locating and acquiring nearly any document sample you need.

You can store, fill out, and sign the San Jose California Spousal Property Petition in just minutes instead of sifting through the internet for hours in search of the appropriate template.

Using our catalog is a fantastic method to enhance the security of your document submissions.

If you haven’t created a profile yet, follow the instructions outlined below.

Feel free to take full advantage of our form catalog and enhance your document experience to be as effortless as possible!

- Our experienced attorneys consistently review all the files to guarantee that the templates are suitable for a specific state and comply with new laws and regulations.

- How do you acquire the San Jose California Spousal Property Petition.

- If you possess a profile, just Log In to your account.

- The Download option will be activated on all the samples you view.

- Furthermore, you can locate all the previously stored documents in the My documents section.

Form popularity

FAQ

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

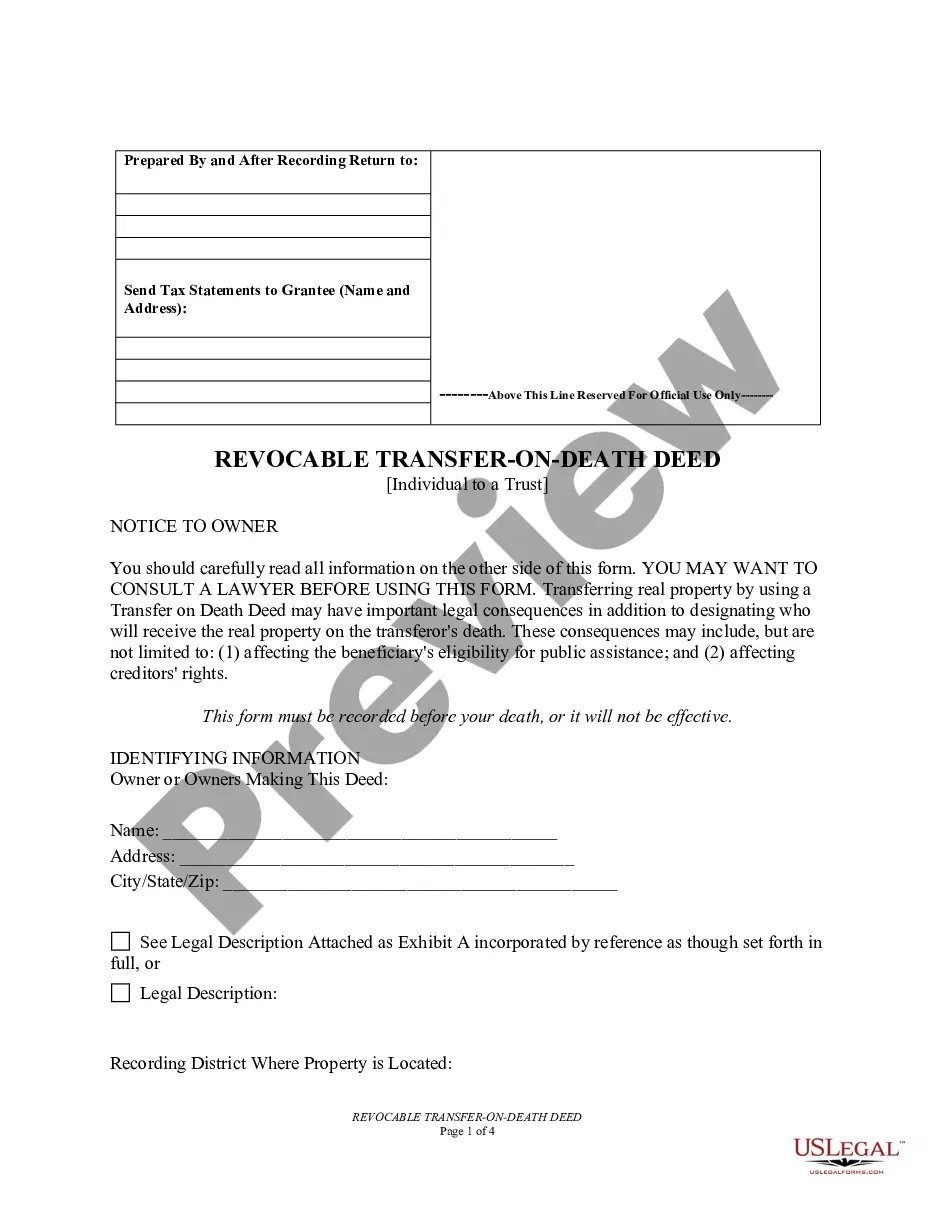

Upon death of the transferor, the beneficiary must file a Change in Ownership Statement with the county assessor within 150 days of date of death in accord with Revenue and Taxation Code section 480(b).

How Do I Prepare the Transfer on Death Deed? Fill out all general required information about your identity and address.Name your beneficiary or beneficiaries.Sign and date the transfer on death deed before a notary public.Have the notarized deed recorded with your county clerk's office.

California Probate Code section 850 makes it possible for litigants to seek the transfer of property into or out of an estate, trust, conservatorship or guardianship estate as part of an expedited court proceeding. In some cases, Probate Code 850 Petitions can help litigants avoid formal probate.

Sunset Date. California's legislation that originally authorized TOD deeds in 2016 contained a sunset provision automatically repealing the TOD statute on January 1, 2022?unless extended before that date.

If a spouse with separate property does intestate (without a will), the separate property passes according to California law of intestacy. The deceased's spouse's entire share of separate property goes to the surviving spouse if there are no surviving immediate family members, children, or grandchildren.

California Spousal Property Petition Form DE-221 - YouTube YouTube Start of suggested clip End of suggested clip So we always start by going to the California Judicial Council site I just put it into Google. And.MoreSo we always start by going to the California Judicial Council site I just put it into Google. And. I find the link for California Judicial Council.

When someone dies intestate, the California probate estate must be administered, distributing his or her property. Their assets will go to the deceased's closest relatives under California's intestate success laws.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

A Spousal Property petition is a way to transfer or confirm property to a surviving spouse without a full probate proceeding. It can usually be done with only one hearing in the court. If the decedent's estate is not complicated, the petition can settle questions about title or ownership of property.