Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less

Description

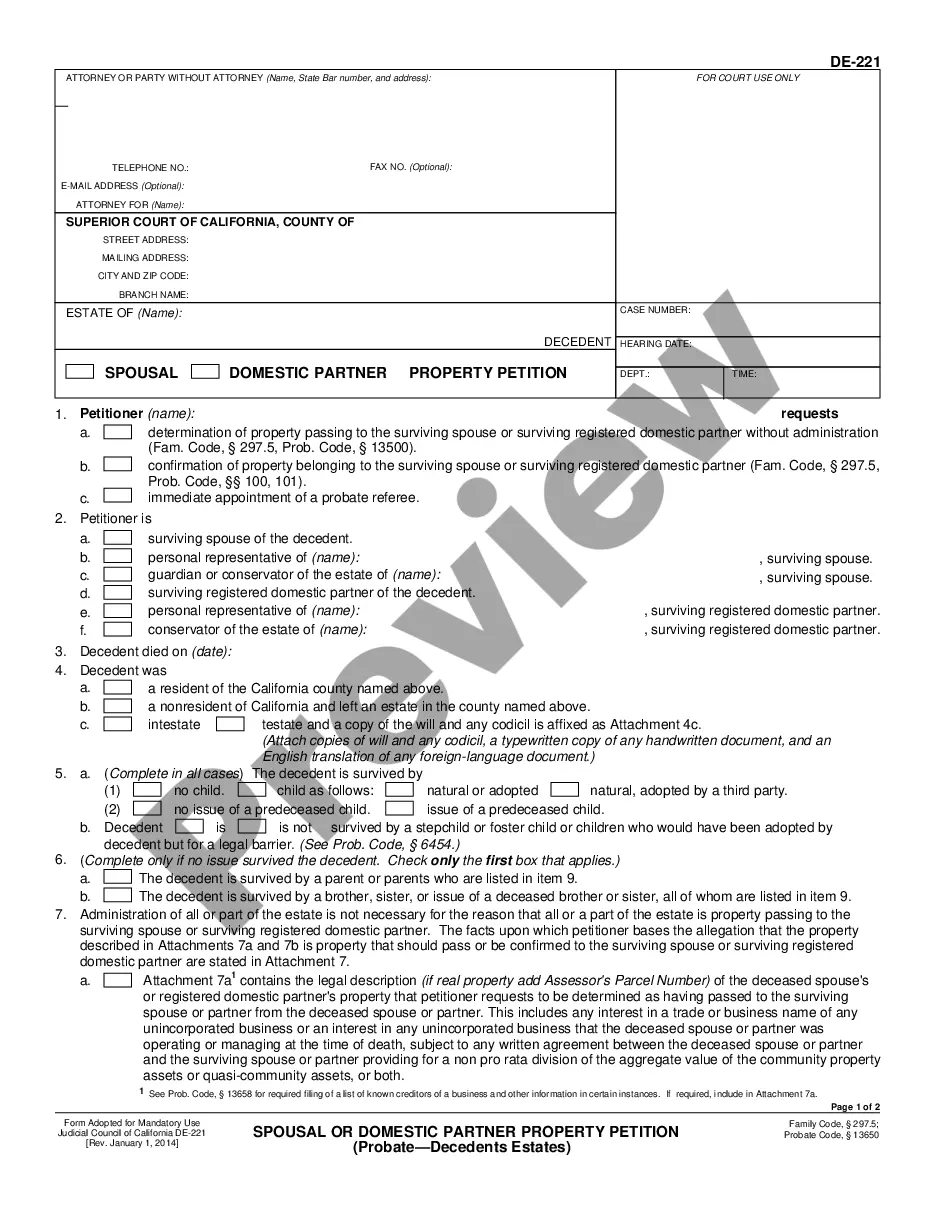

How to fill out California Petition To Determine Succession To Real And Personal Property - Small Estates - Estates $184,500 Or Less?

Regardless of social or occupational position, completing law-related documents is an unfortunate requirement in our current society.

Frequently, it’s nearly impossible for individuals without legal training to create such documents from scratch, largely due to the complex terminology and legal nuances involved.

This is where US Legal Forms can come to the rescue. Our service offers an extensive catalog with over 85,000 ready-to-use state-specific documents that cater to nearly any legal circumstance.

If the one you chose does not fit your requirements, you can reset and search for the needed document.

Click Buy now and select the subscription plan that best suits your needs. Use your Log In details or create one from the beginning. Choose the payment method and proceed to download the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less as soon as the payment has been completed.

- No matter if you need the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less or any other form that will be recognized in your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how to obtain the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less in just a few minutes using our reliable service.

- If you are currently a subscriber, please Log In to your account to retrieve the appropriate document.

- However, if you are new to our collection, make sure to follow these steps before downloading the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $166,250 or Less.

- Confirm that the template you have located is relevant to your location as the laws of one state or county do not apply to another.

- Review the form and look for a brief summary (if available) of situations the document can address.

Form popularity

FAQ

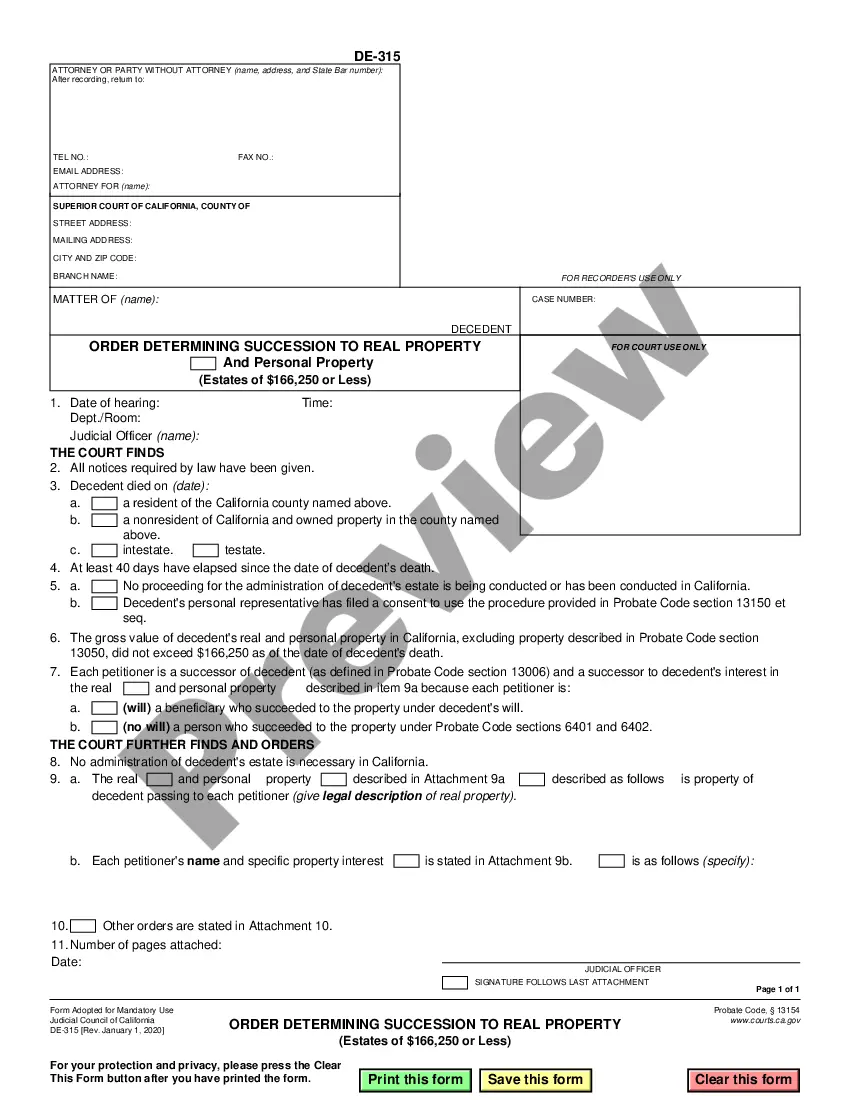

In California, a small estate affidavit does not need to be filed with the court for estates valued at $184,500 or less. Instead, you can use the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less to transfer the property without formal probate proceedings. This process simplifies the transfer of assets, allowing heirs to access the estate faster. By utilizing tools like USLegalForms, you can fill out the affidavit correctly and ensure you meet all local requirements, streamlining the process.

In California, the limit for a small estate affidavit pertains to estates valued at $184,500 or less. This limit is significant when you are considering a Thousand Oaks California Petition to Determine Succession to Real and Personal Property – Small Estates – Estates $184,500 or Less. Utilizing a small estate affidavit simplifies the legal process, allowing heirs to claim the deceased's assets without lengthy probate. This method not only saves time but also reduces costs, making it an efficient option for many families.

The threshold for a small estate affidavit in California is currently set at $184,500, making this an important factor for those considering the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less. This figure represents the maximum value of the estate that can be administered without going through probate. Utilizing a small estate affidavit can facilitate a smoother transfer of property to heirs or beneficiaries, ensuring that the deceased’s wishes are honored efficiently and effectively. For assistance in this process, consider trusted platforms like USLegalForms.

As we look ahead to 2025, it is important to note that the small estate threshold in California is expected to remain at $184,500. This threshold includes real and personal property, making it essential for those interested in the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less. This means individuals with estates at or below this amount can still benefit from the streamlined process that a small estate petition provides. Staying updated on this threshold can help you better plan your estate management.

In California, the limit for a small estate affidavit stands at $184,500 as of now. This means that if the total value of the deceased's estate is $184,500 or less, you can use the Thousand Oaks California Petition to Determine Succession to Real and Personal Property - Small Estates - Estates $184,500 or Less to simplify the process. A small estate affidavit allows you to bypass the lengthy probate process, directly transferring assets without the need for court supervision. For those navigating estate management in Thousand Oaks, knowing this limit can save significant time and resources.

In California, heirs are determined based on the laws of intestate succession, which dictate how assets are distributed when someone dies without a will. Typically, the closest relatives have the first claim, including spouses, children, parents, and siblings. For small estates, the Thousand Oaks California Petition to Determine Succession to Real and Personal Property can clarify this process and ensure proper distribution.

Real property in probate refers to land and any permanent structures on it that are part of a deceased person's estate. Understanding which assets fall under this category is crucial during estate administration. By filing a petition for succession to determine the distribution of real property in Thousand Oaks, California, you can streamline the process for estates valued at $184,500 or less.

To petition for a determination of heirship in California, you must file the appropriate forms with the local probate court. It is essential to provide relevant information about the deceased and potential heirs. Utilizing the Thousand Oaks California Petition to Determine Succession to Real and Personal Property simplifies this process, ensuring all details are correctly submitted.

The determination of heirship generally takes several weeks to a few months, depending on court schedules and the complexity of the case. For small estates, the process in Thousand Oaks can be faster, especially if the petition is straightforward. Using a structured approach to file a petition can further reduce delays.

To prove heirship in California, you typically need to provide documentation such as a birth certificate or marriage license that establishes your relationship to the deceased. Witnesses may also affirm your status as an heir. If you are navigating the process for a small estate, a Thousand Oaks California Petition to Determine Succession to Real and Personal Property can help solidify your claim.