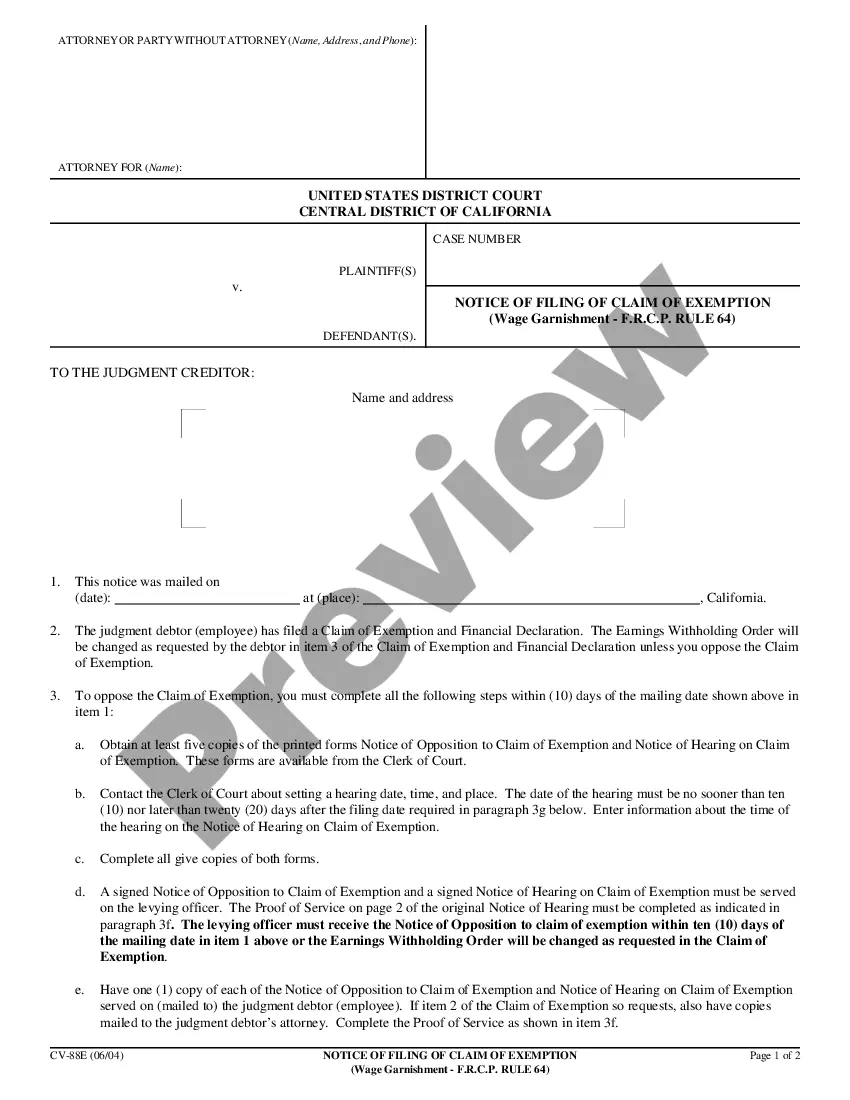

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Downey California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

Are you searching for a trustworthy and economical legal forms provider to obtain the Downey California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64? US Legal Forms is your primary answer.

Whether you require a straightforward agreement to establish guidelines for livingTogether with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform provides over 85,000 current legal document templates for personal and business use. All templates we offer are not generic and tailored according to the regulations of specific states and regions.

To retrieve the document, you need to Log In to your account, locate the required template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired document templates at any time in the My documents section.

Are you a newcomer to our platform? No problem. You can establish an account in a few minutes, but first, ensure to do the following.

Now you are ready to create your account. Then choose the subscription plan and proceed with payment. Once the payment is finalized, download the Downey California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 in any available format. You can return to the website when needed and redownload the document at no additional cost.

Finding current legal documents has never been more straightforward. Give US Legal Forms a try today, and say goodbye to wasting hours researching legal documents online forever.

- Check if the Downey California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 aligns with the regulations of your state and local region.

- Review the form’s description (if available) to understand who and what the document is designed for.

- Restart your search if the template does not meet your legal requirements.

Form popularity

FAQ

Who Can Garnish My Wages in California? If you work in California, creditors, debt collectors, and debt buyers can garnish your wages for past-due consumer debt, such as credit card debt, back rent, car loans, medical bills, or payday loans. Generally, creditors must get a court order judgment to collect consumer debt.

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. We issue 3 types of wage garnishments: Earnings withholding orders (EWO): Earnings Withholding Order for Vehicle Registration (FTB 2204)

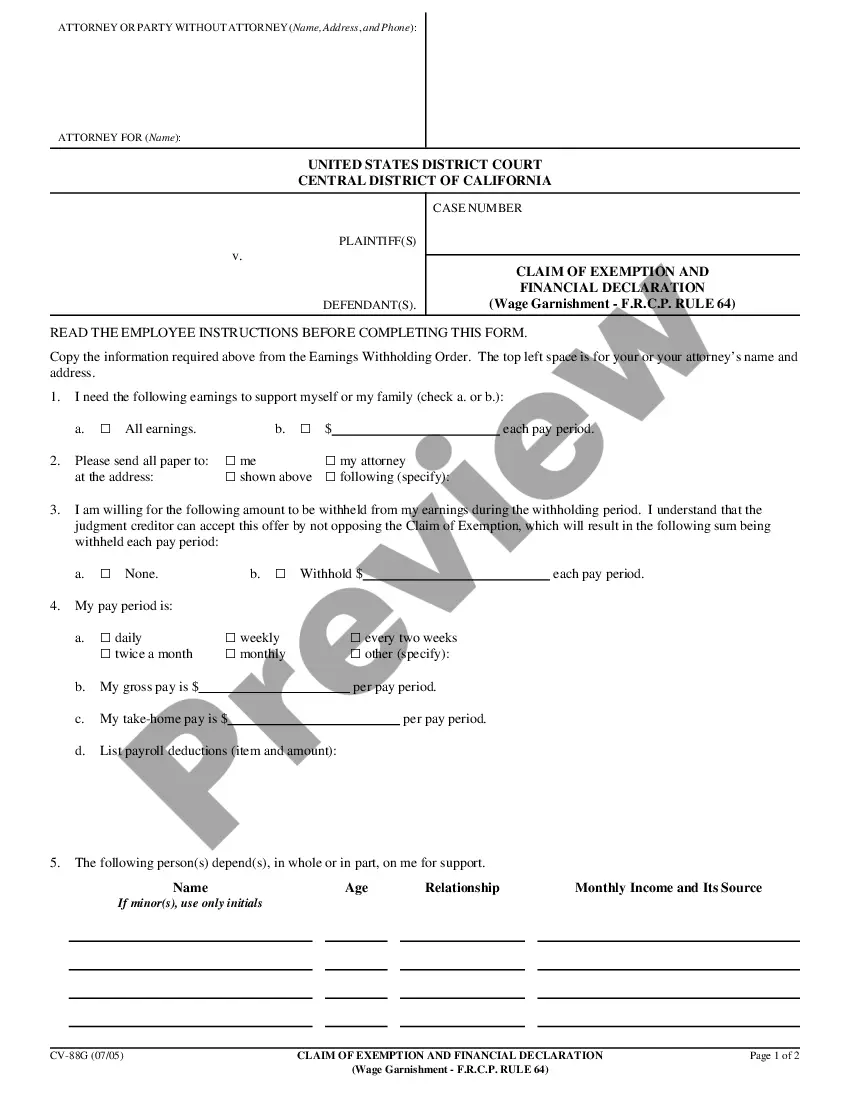

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Disposable wages (wages paid out after deducted. taxes) is 75% Exempt (only 50% exempt if enforcement is of a child support order). If wages are deposited, the exemption is preserved as to any funds in the account that can be traced back to wages paid within the previous 30 days before a levy.

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

With the notice of garnishment, you should have been served with a form to claim the exemption for money necessary for support. To claim the exemption in wages, you need to also complete the form financial statement. Note that the financial statement asks for your monthly income.