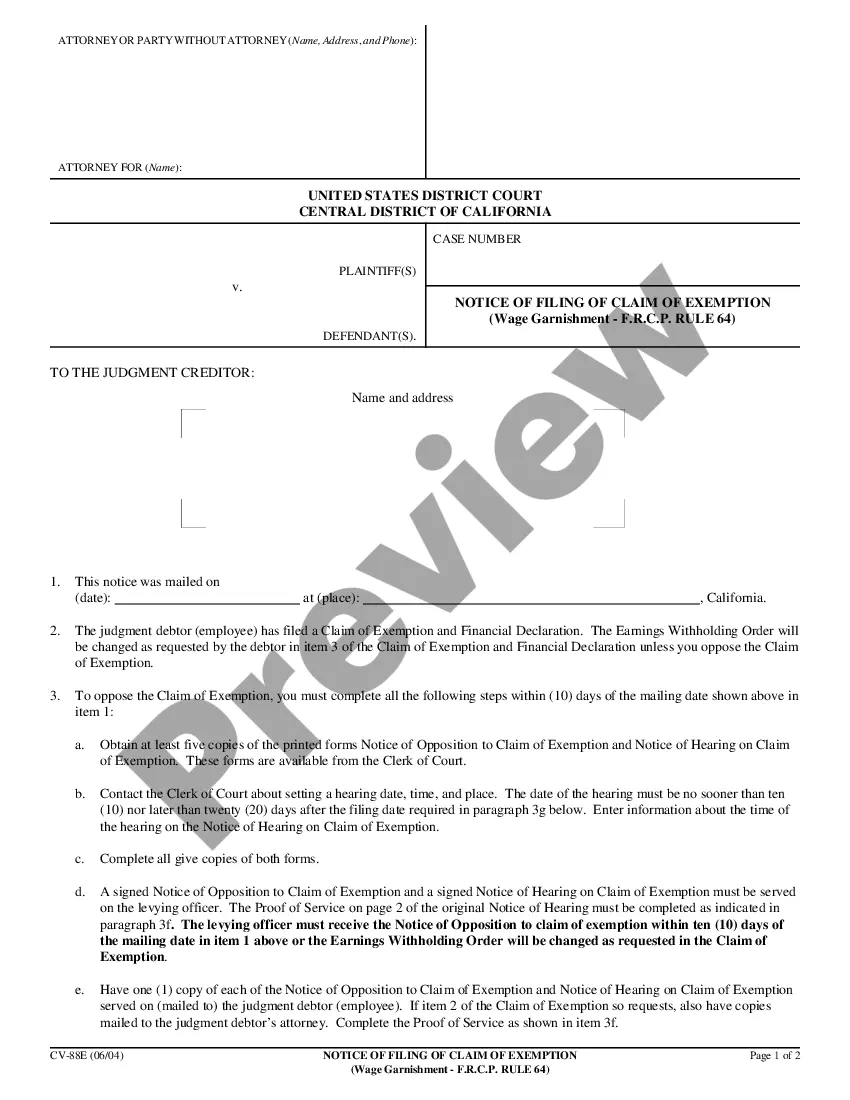

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Carlsbad California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

We consistently seek to minimize or avert legal complications when managing intricate legal or financial matters.

To achieve this, we seek legal assistance that is often quite expensive.

Nevertheless, not every legal issue is so complicated.

Many can be handled independently.

Utilize US Legal Forms whenever you need to locate and download the Carlsbad California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 or any other form swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and requests for dissolution.

- Our library empowers you to manage your affairs autonomously without needing to hire an attorney.

- We grant access to legal form templates that aren’t always accessible to the public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

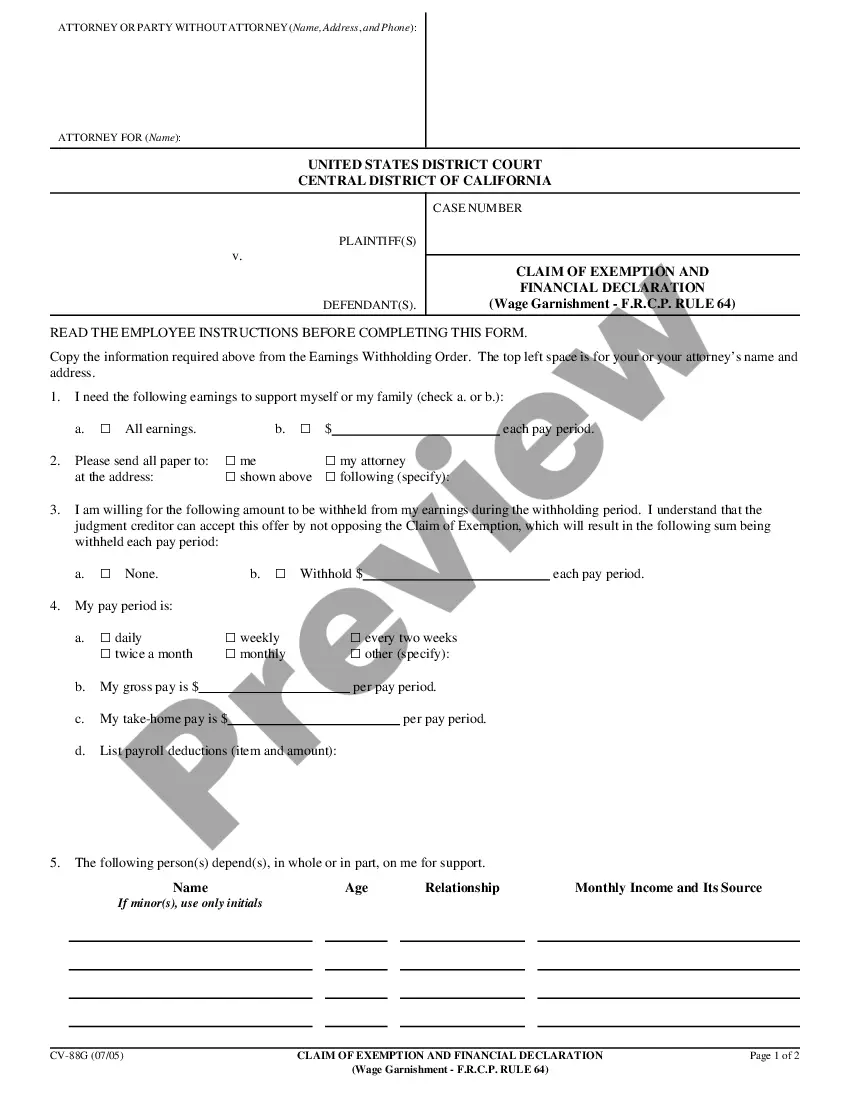

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

Debt collectors can only take money from your paycheck, bank account, or benefits?which is called garnishment?if they have already sued you and a court entered a judgment against you for the amount of money you owe. The law sets certain limits on how much debt collectors can garnish your wages and bank accounts.

If someone falls behind in paying support and does not already have their wages withheld to pay support, you can ask the court order to issue a wage assignment for you to serve on the other person's employer to withhold support from wages. Click if the local child support agency (LCSA) is involved in your case.

Limits on Wage Garnishment in California Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

California Wage Garnishment for Unpaid Taxes If your tax debts are owed to the state of California, they can garnish up to 25% of your disposable earnings. The IRS doesn't have a limit; instead they use a complicated formula involving your dependents and deductions to determine how much of your check you get to keep.

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

Who Can Garnish My Wages in California? If you work in California, creditors, debt collectors, and debt buyers can garnish your wages for past-due consumer debt, such as credit card debt, back rent, car loans, medical bills, or payday loans. Generally, creditors must get a court order judgment to collect consumer debt.

When support is late by 120 days or more, California can revoke a driver's license altogether. Delinquent child support may also be reported to the credit bureaus and hurt a parent's credit rating.

To open a case in California, fill out the online application or visit your local child support agency ? agency locations can be found here. After an application is submitted, the applicant will be contacted by their local office to assist with the process of obtaining a child support order with the court.

Get form EJ-100 and fill it out. File it with the court and send a copy to the debtor. Keep a copy for your records. Notify the levying officer (i.e., the sheriff's department) that the judgment has been paid and ask them to release the garnishment.