This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

If you are in search of a pertinent form, it’s challenging to select a more suitable location than the US Legal Forms site – one of the largest databases on the web. With this library, you can access a vast array of templates for business and personal needs categorized by types and regions, or keywords.

Utilizing our premium search feature, finding the latest Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445 is as straightforward as 1-2-3. In addition, the relevance of each document is verified by a team of experienced attorneys who regularly review the templates on our site and update them according to the most recent state and county laws.

If you are already familiar with our platform and possess an account, all you need to acquire the Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445 is to sign in to your user profile and click the Download button.

Every template you preserve in your user profile has no expiration date and belongs to you indefinitely. You can access them through the My documents menu, so if you need an additional copy for enhancement or printing, feel free to return and download it again at any point.

Utilize the US Legal Forms professional catalog to gain access to the Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445 you were seeking and a vast number of other specialized and state-specific templates all on one platform!

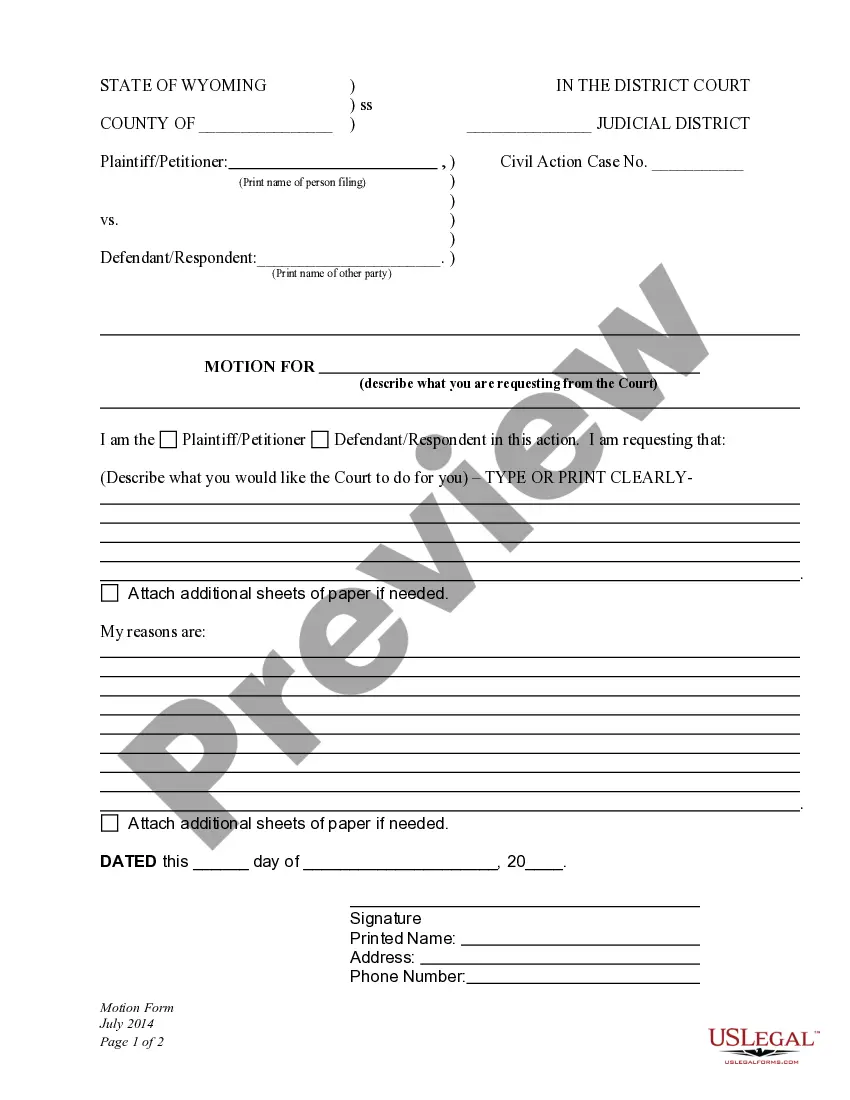

- Ensure you have located the sample you require. Review its details and use the Preview option (if available) to view its content. If it doesn’t fulfill your needs, utilize the Search feature at the top of the page to find the necessary document.

- Validate your choice. Click the Buy now button. Then, pick your desired pricing plan and offer information to create an account.

- Complete the purchase. Use your credit card or PayPal account to finish the registration process.

- Obtain the template. Select the file format and download it onto your device.

- Make alterations. Fill in, edit, print, and sign the acquired Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445.

Form popularity

FAQ

If a seller is classified as a foreign person, they should prepare for FIRPTA withholding on their property sale. This means that a portion of their sale proceeds will be withheld by the buyer to cover potential tax liabilities. However, by using a Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445, the seller may legally certify their status and potentially bypass this withholding.

When a foreign person sells U.S. property, the IRS typically withholds 15% of the gross amount realized on the sale. This withholding serves as a prepayment of any potential tax liability. Utilizing a Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445 could help mitigate this withholding, provided the seller meets the criteria.

A foreign person is defined as a non-U.S. citizen or non-resident alien according to the IRS. This classification also extends to foreign corporations, partnerships, or estates. For sellers who find themselves classified as foreign persons, securing a Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445 may be beneficial.

Foreigners selling U.S. property must comply with FIRPTA, which requires tax withholding unless an exemption applies. They should complete the necessary documentation, possibly including a Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445, to certify their status. Understanding these regulations is critical for a smooth transaction and minimized tax liability.

A transferor may realize zero on the transfer of a U.S. real property interest if the property is transferred without receiving any payment, such as in a gift or in a foreclosure. In these situations, understanding FIRPTA implications is vital. You may consider obtaining a Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445 to clarify your tax obligations.

A seller is classified as a foreign person if they are not a U.S. citizen or resident alien. This classification pertains to both individuals and entities that do not meet the residency requirements outlined by the Internal Revenue Service. To alleviate potential FIRPTA withholding, sellers can utilize a Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445.

To navigate the requirements of FIRPTA, you can utilize a Rancho Cucamonga California Non-Foreign Affidavit Under IRC 1445. This affidavit allows foreign sellers to exempt themselves from withholding taxes by certifying that they are not considered foreign persons under U.S. tax laws. Completing this affidavit correctly ensures smoother transactions and protects both buyers and sellers from unnecessary tax complications. Consider using USLegalForms for expert guidance in preparing your legal documents to ensure compliance and peace of mind.

The Internal Revenue Service Code 2042 relates to additional tax rules for certain types of property transactions, specifically involving foreign persons. It may impose different requirements or tax implications depending on the nature of the asset sold. If you are dealing with property transactions in Rancho Cucamonga, California, understanding both Code 2042 and the Non-Foreign Affidavit Under IRC 1445 is important to ensure compliance. Platforms like USLegalForms help simplify the required documentation in such cases.

An internal revenue service code refers to a specific section of the Internal Revenue Code (IRC) that outlines regulations and requirements for tax collection, reporting, and compliance. These codes provide guidance to taxpayers and tax professionals on various issues, ranging from property sales to income taxes. For residents in Rancho Cucamonga, California, understanding these codes, especially regarding the Non-Foreign Affidavit Under IRC 1445, is crucial for tax regulations. Resources like USLegalForms can aid in navigating these codes effectively.

The Internal Revenue Service Code 1445 addresses withholding tax obligations on the sale of U.S. real property by foreign sellers. It ensures that the U.S. government collects tax on gains from real estate transactions involving non-U.S. residents. For those involved in these transactions in Rancho Cucamonga, California, filing a Non-Foreign Affidavit Under IRC 1445 can provide assurance to buyers that no withholding tax applies. Utilizing the right forms can streamline this process.