Right of First Refusal Agreement

Description

Key Concepts & Definitions

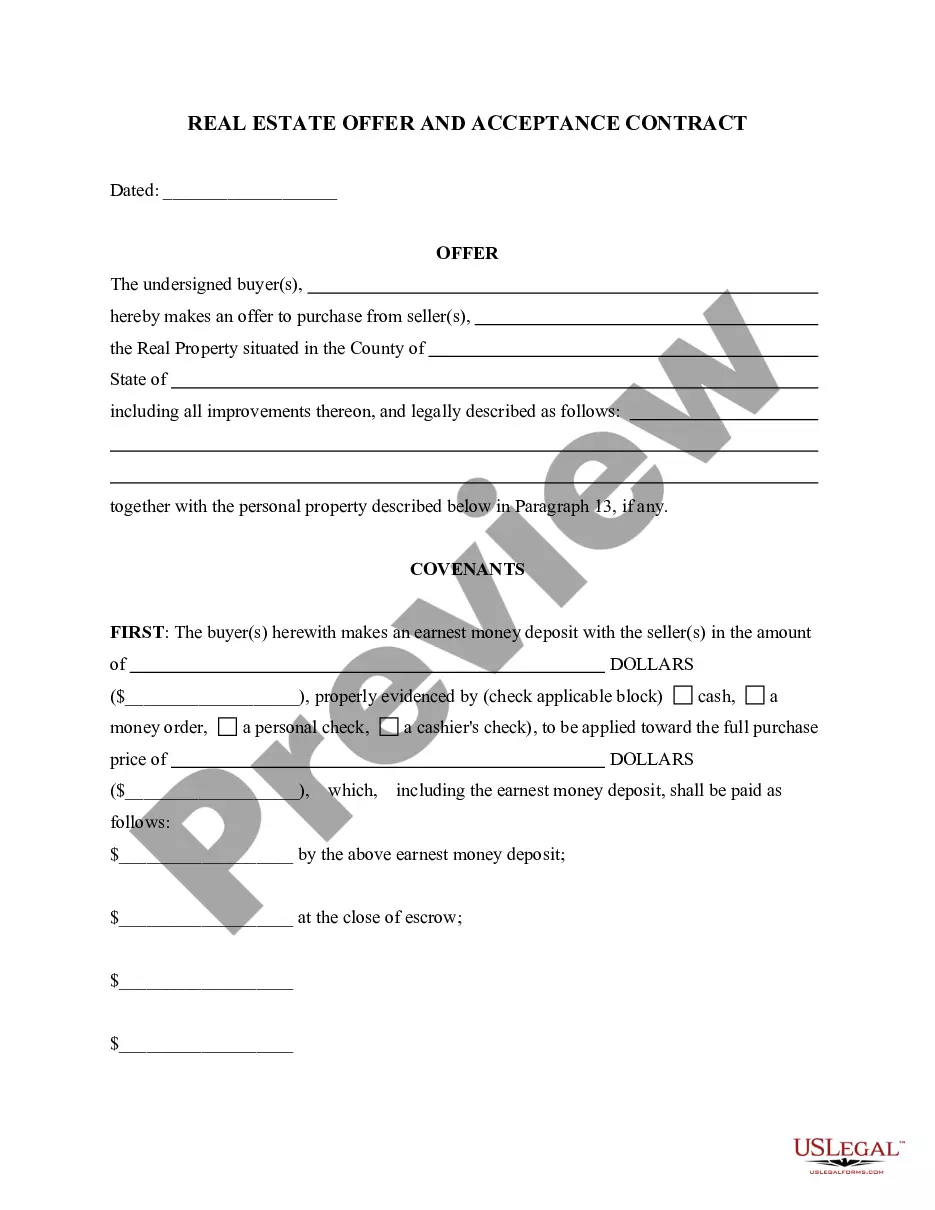

Right of First Refusal Agreement: A legal provision allowing a party the opportunity to enter into a business transaction with a person or company before anyone else can. If the holder of the right of first refusal declines the offer, the proposer is free to pursue other buyers.

Step-by-Step Guide

- Determine the Need: Assess whether a right of first refusal agreement is suitable for your transaction, considering factors such as confidentiality and competitive positioning.

- Identify the Parties Involved: Clearly specify the grantor (owner) and the holder (potential buyer) in the agreement.

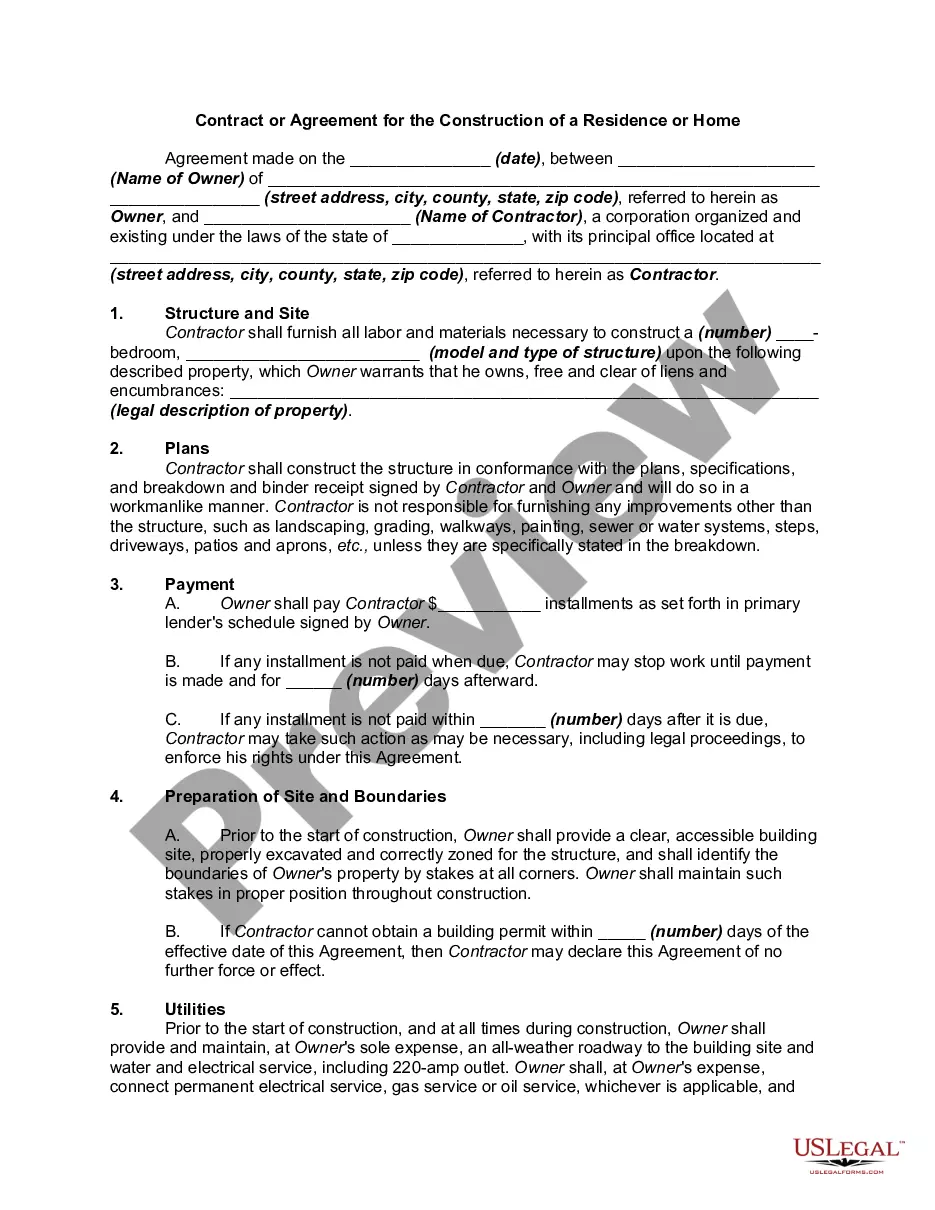

- Define the Terms: Outline the specifics of the deal, including price, timeframe, and conditions of the sale.

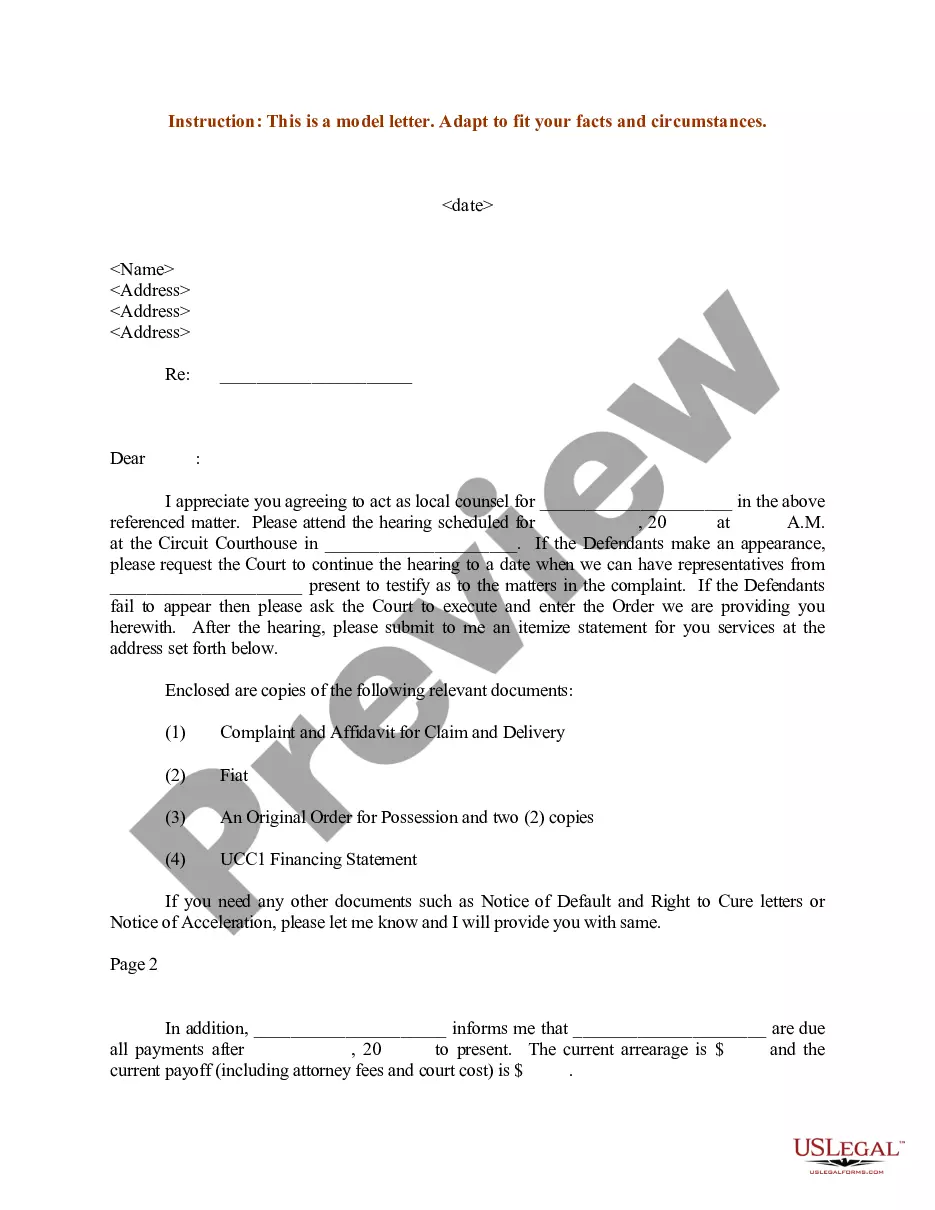

- Legal Consultation: Seek advice from a legal professional to ensure the agreement is compliant with local state laws in the United States.

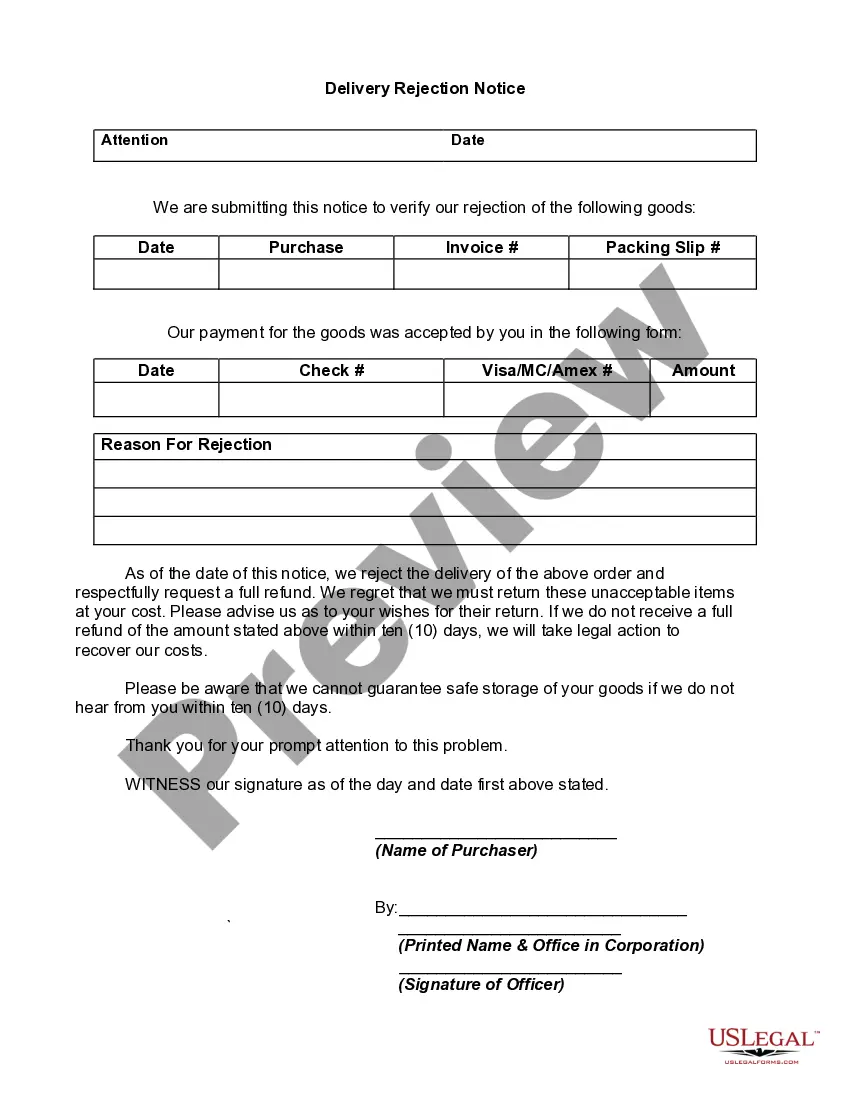

- Draft the Agreement: Create a formal document detailing all agreed-upon terms and get it signed by all parties involved.

- Enforce the Agreement: Implement monitoring mechanisms to ensure all parties adhere to terms stipulated in the agreement.

Risk Analysis

- Legal Risks: Possibility of disputes over unclear terms or breaches of agreement.

- Investment Risks: Economic factors that might change the attractiveness of the proposal after the right has been granted.

- Operational Risks: Challenges in enforcing the agreement across different jurisdictions especially if multi-state business operations are involved.

Best Practices

- Clear Wording: Use clear and unambiguous language in the agreement to avoid potential legal conflicts.

- Time Limits: Set explicit time frames for the right of first refusal to be exercised to prevent prolonged uncertainty.

- Record Keeping: Maintain thorough records of all communications and agreements made under the right of first refusal clause.

FAQ

- What happens if the right of first refusal is not exercised? The seller is free to sell the asset to any other party under the same conditions offered to the holder of the right.

- Is a right of first refusal legally binding? Yes, it is a legally enforceable agreement when properly drafted and executed.

- Can the terms of a right of first refusal be negotiated? Yes, terms can usually be negotiated before the agreement is finalized.

How to fill out Right Of First Refusal Agreement?

When it comes to drafting a legal document, it is easier to leave it to the professionals. However, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself cannot find a sample to utilize, however. Download Right of First Refusal Agreement straight from the US Legal Forms website. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. When you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we’ve included an 8-step how-to guide for finding and downloading Right of First Refusal Agreement fast:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Select the suitable subscription for your requirements.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the file.

When the Right of First Refusal Agreement is downloaded it is possible to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

A right of first refusal agreement allows a buyer and seller to enter into an arrangement by which the potential buyer is given the first crack at a property when it goes up for sale.

A right of first refusal agreement allows a buyer and seller to enter into an arrangement by which the potential buyer is given the first crack at a property when it goes up for sale.

When a casting director issues a first refusal it means that a final casting decision has not been made; the casting director is requesting that the performer contact him/her before accepting a booking for another job on the same day(s), i.e., giving the original producer the first opportunity to book the person.

Every RFR should be drafted as either an agreement or a contract (in which the holder gives some consideration, or pays for, the right). It may bind the current owner alone or run with the land. In either case, I would advise having it recorded.

Right of first refusal (ROFR), also known as first right of refusal, is a contractual right to enter into a business transaction with a person or company before anyone else can. If the party with this right declines to enter into a transaction, the obligor is free to entertain other offers.

The right of first refusal is usually triggered when a third party offers to buy or lease the property owner's asset. Before the property owner accepts this offer, the property holder (the person with the right of first refusal) must be allowed to buy or lease the asset under the same terms offered by the third party.

The United States District Court for the District of Columbia restated the fundamental principle that in order for a right of first refusal to be enforceable, it must be in writing under the Statute of Frauds.

One or two years is the typical range. Some RFRs allow either seller or buyer to invoke the RFR at any point during its term. Others give the buyer the right to make an offer only at the end of the specified term.