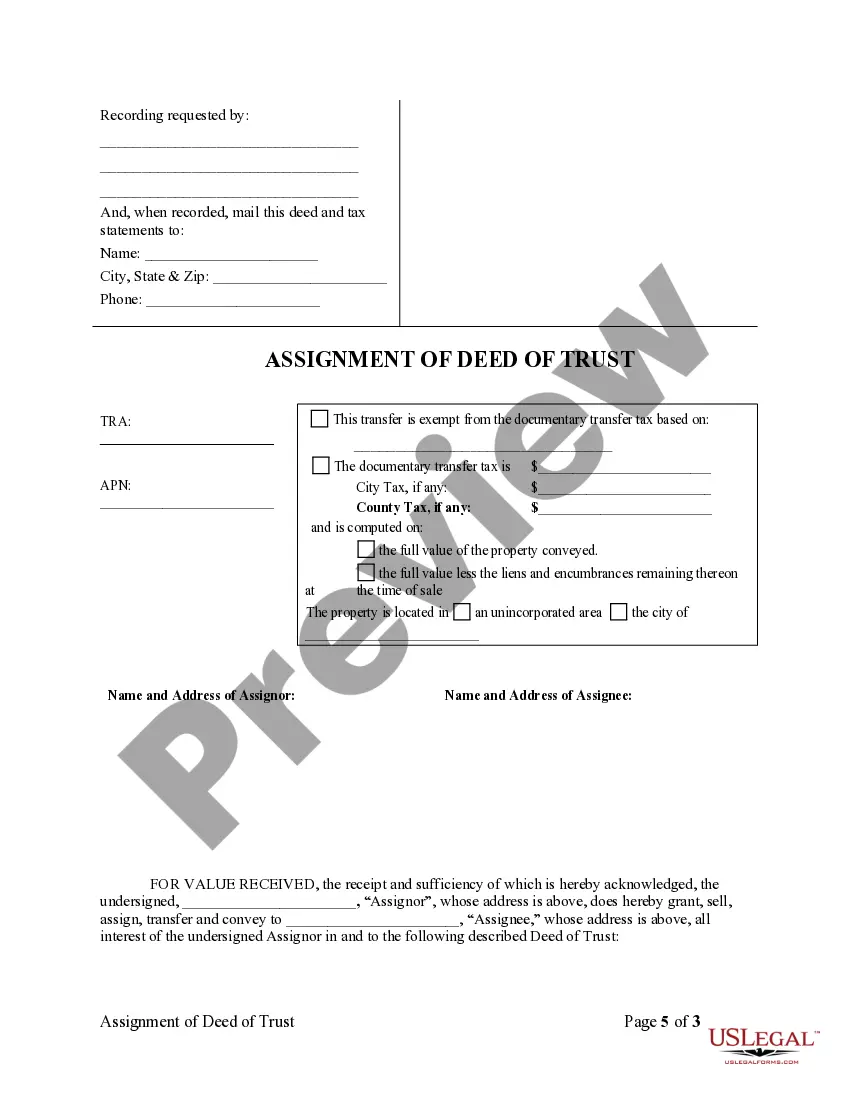

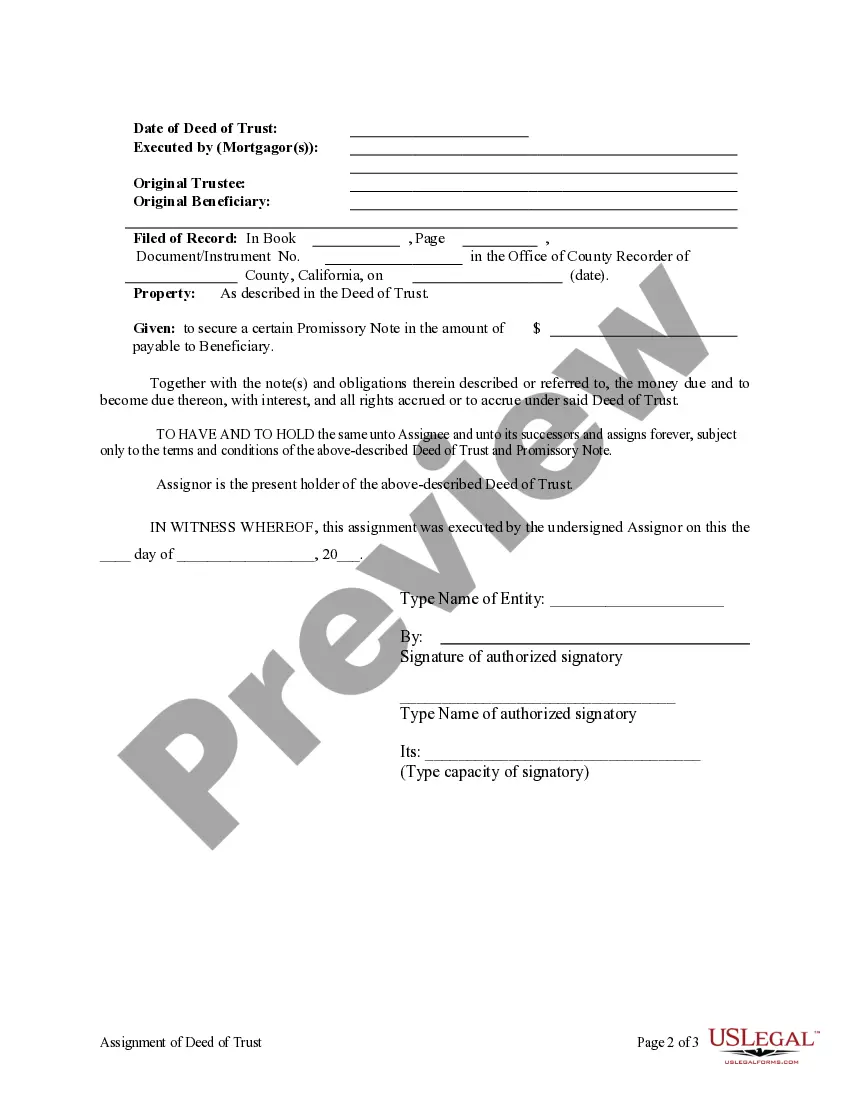

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

San Diego California Assignment of Deed of Trust by Corporate Mortgage Holder

Description

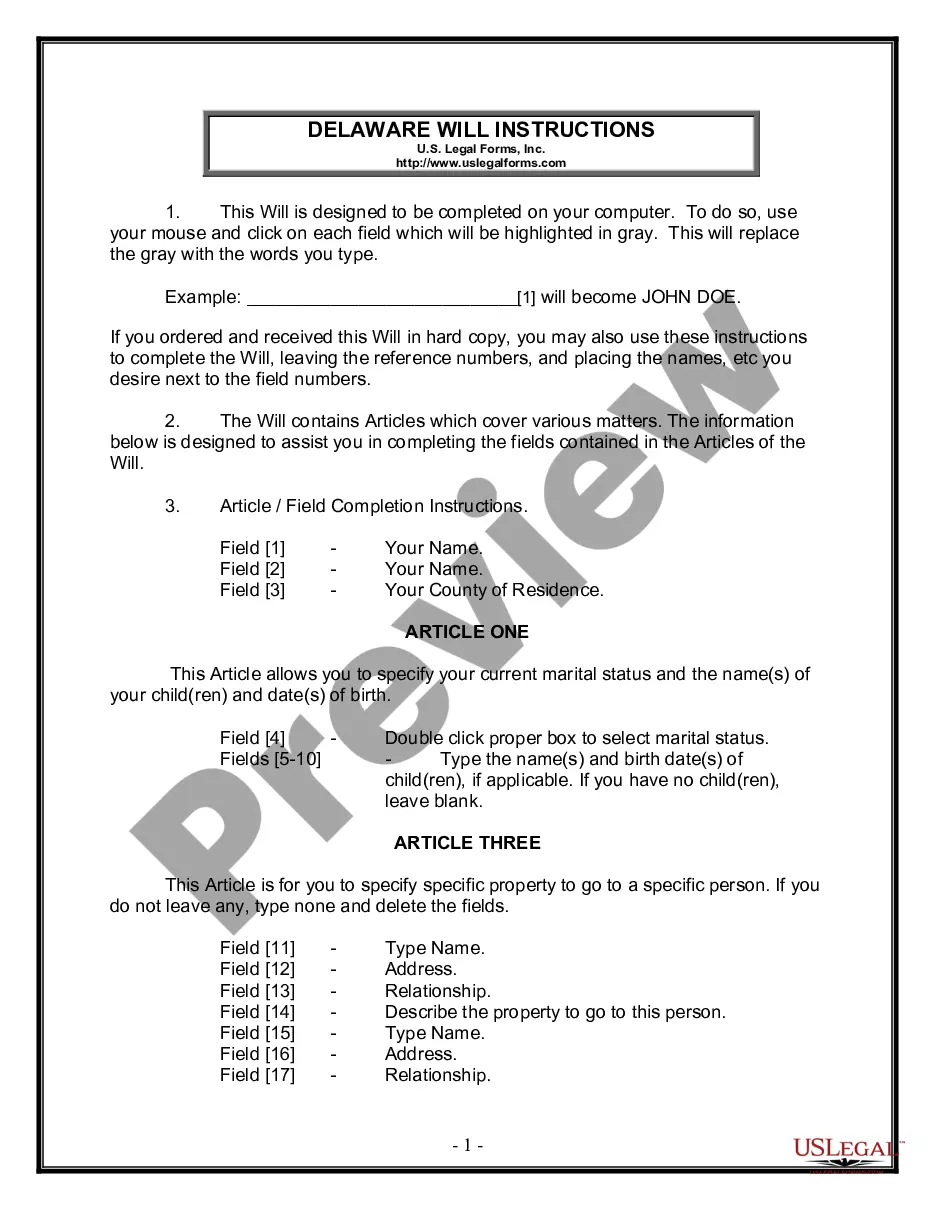

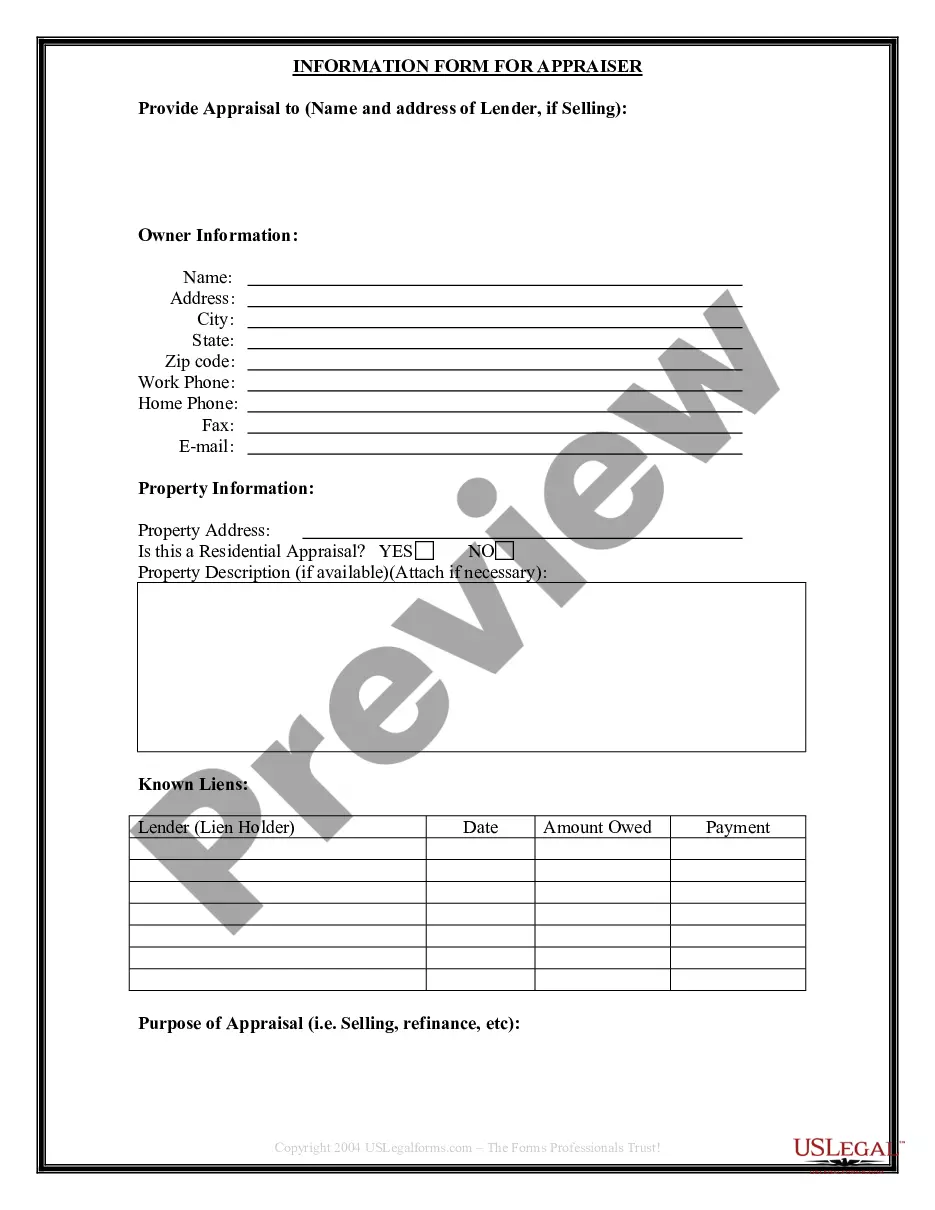

How to fill out California Assignment Of Deed Of Trust By Corporate Mortgage Holder?

If you’ve previously utilized our service, sign in to your account and acquire the San Diego California Assignment of Deed of Trust by Corporate Mortgage Holder on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment agreement.

If this is your inaugural experience with our service, follow these straightforward steps to secure your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Ensure you’ve found the appropriate document. Review the description and use the Preview option, if available, to verify if it fulfills your needs. If it doesn’t fit, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Download your San Diego California Assignment of Deed of Trust by Corporate Mortgage Holder. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

California primarily uses deeds of trust rather than traditional mortgages in real estate transactions. A deed of trust provides a more straightforward mechanism for borrowers and lenders, allowing for quicker resolution in case of default. By being familiar with these terms, you can navigate the complexities of real estate markets in San Diego more effectively. Leveraging platforms like USLegalForms can aid in understanding and implementing these transactions.

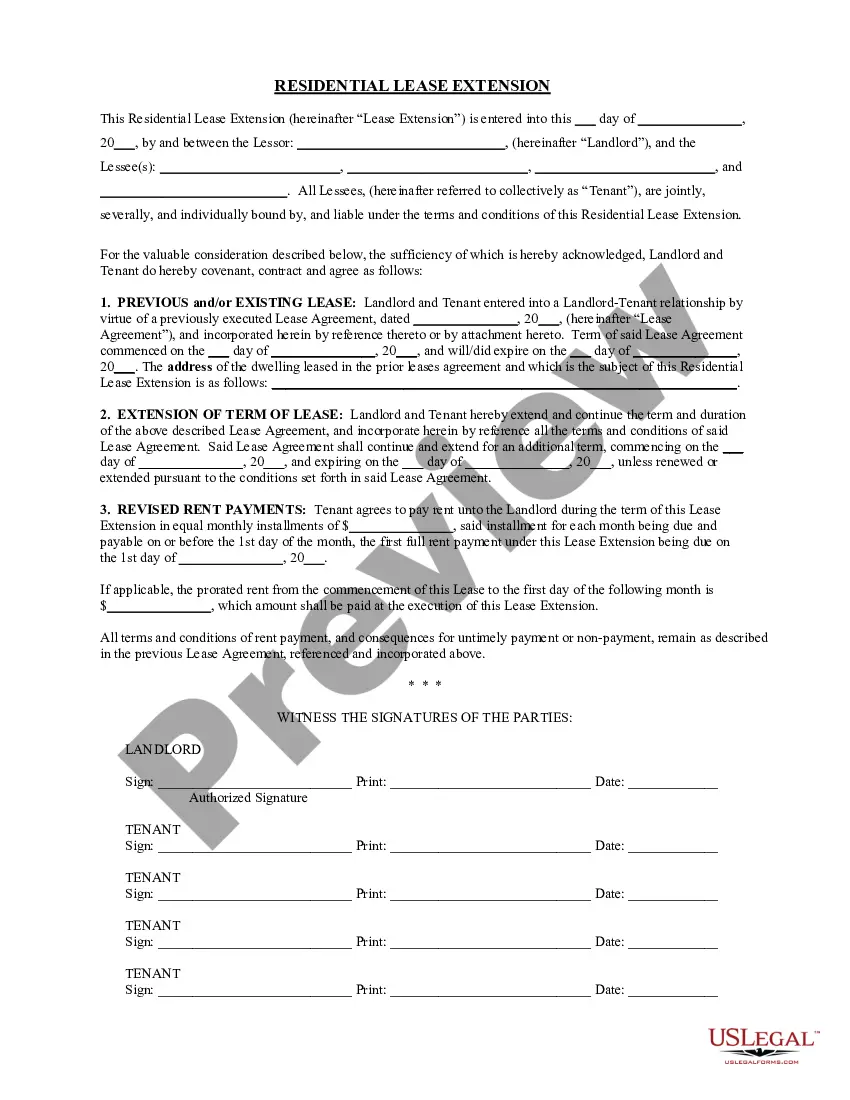

The assignment of mortgage or deed of trust signifies the process of transferring ownership rights from one lender to another. This ensures that the new lender has the authority to manage the agreement, including the collection of payments and any necessary legal actions. Knowing how this assignment operates within the framework of your transactions can prevent complications and safeguard your interests, especially in the context of the San Diego California Assignment of Deed of Trust by Corporate Mortgage Holder.

A corporate assignment of deed of trust involves a corporation transferring its rights under a deed of trust to another entity. This practice often occurs in the context of financial restructuring or asset sales, where corporate entities seek greater efficiency in managing their real estate assets. By facilitating this transfer, corporate assignments help maintain clarity in ownership and ensure compliance with state laws, specifically in San Diego, California.

The assignment of a deed of trust refers to the formal transfer of the beneficial interest from one lender to another. This change allows the new lender to enforce the terms of the deed, including the right to collect payments and foreclose if necessary. Understanding this process is crucial, especially in the San Diego market, to ensure that transactions are executed legally and efficiently.

The primary purpose of an assignment of a mortgage is to transfer the lender's rights and responsibilities to another party. This process allows the new lender to take over the original mortgage terms and ensures that all parties are aware of the change. In the context of the San Diego California Assignment of Deed of Trust by Corporate Mortgage Holder, this means an organization can manage the deed more effectively, streamlining operations and enhancing service delivery.

Using a deed of trust instead of a mortgage in San Diego, California offers several benefits. A deed of trust involves three parties: the borrower, the lender, and a trustee, which can streamline the process. This arrangement often leads to quicker foreclosure proceedings compared to mortgages, providing a more efficient way for lenders to recover their investment. By understanding the implications of a deed of trust, you can make informed decisions for your real estate transactions.

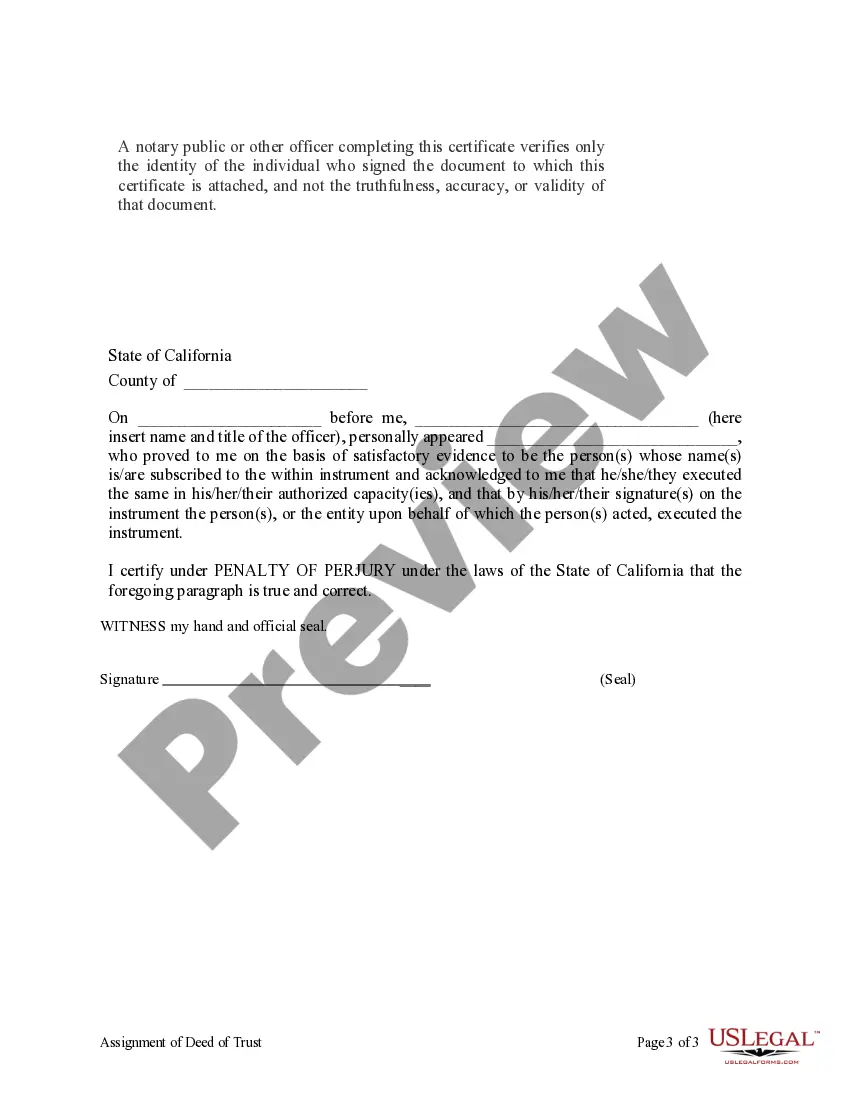

Yes, recording a trust deed in California is crucial as it establishes the lender's legal claim to the property. By submitting the deed of trust to the county recorder's office, you protect your interests and ensure public notice of the lender's rights. Failing to record a trust deed can result in difficulties in enforcing the agreement in the future. For more guidance on this process, especially regarding the San Diego California Assignment of Deed of Trust by Corporate Mortgage Holder, visit US Legal Forms for helpful templates and resources.

Corporate assignment of deed of trust refers to the transfer of rights and obligations associated with a deed of trust by a corporation to another party. This process allows corporations to manage their financial interests more effectively, especially in transactions involving real estate. In San Diego, California, this assignment can affect multiple stakeholders, including borrowers and investors. Understanding these dynamics is crucial for anyone involved in property transactions, as it directly influences the ownership and financial responsibilities associated with the property.

To obtain a copy of your deed of trust in California, you can visit your county's recorder or assessor's office, where public records are available. Alternatively, online platforms such as US Legal Forms offer easy access to records, making the retrieval process simple and efficient. You will need to provide details about your property, such as the address and any relevant names. This document is essential for understanding your interests in relation to the San Diego California Assignment of Deed of Trust by Corporate Mortgage Holder.

A corporation Assignment of deed of trust mortgage is a legal procedure where a corporate mortgage holder transfers the rights and obligations of the deed of trust to another entity. This process is common in real estate transactions, especially in San Diego, California, where corporate ownership of properties is widespread. The new holder assumes the responsibilities tied to the mortgage, ensuring that lenders retain security interests in the property. Understanding this assignment can help homeowners navigate their financial obligations.