California Assignment of Deed of Trust by Corporate Mortgage Holder

What is this form?

The Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document used by a corporation to assign its interest in a deed of trust to another party. This form differentiates itself from other mortgage documents by explicitly addressing assignments made by corporate entities, ensuring legal clarity in transferring mortgage rights.

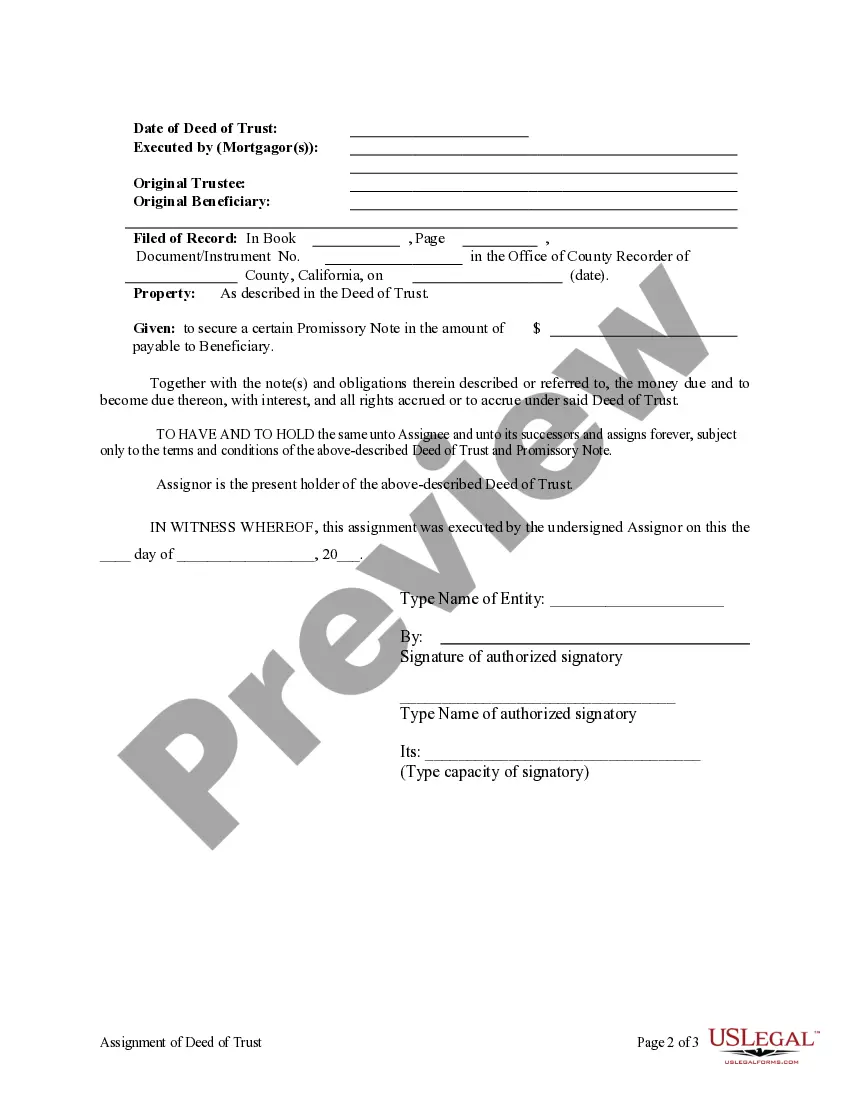

Main sections of this form

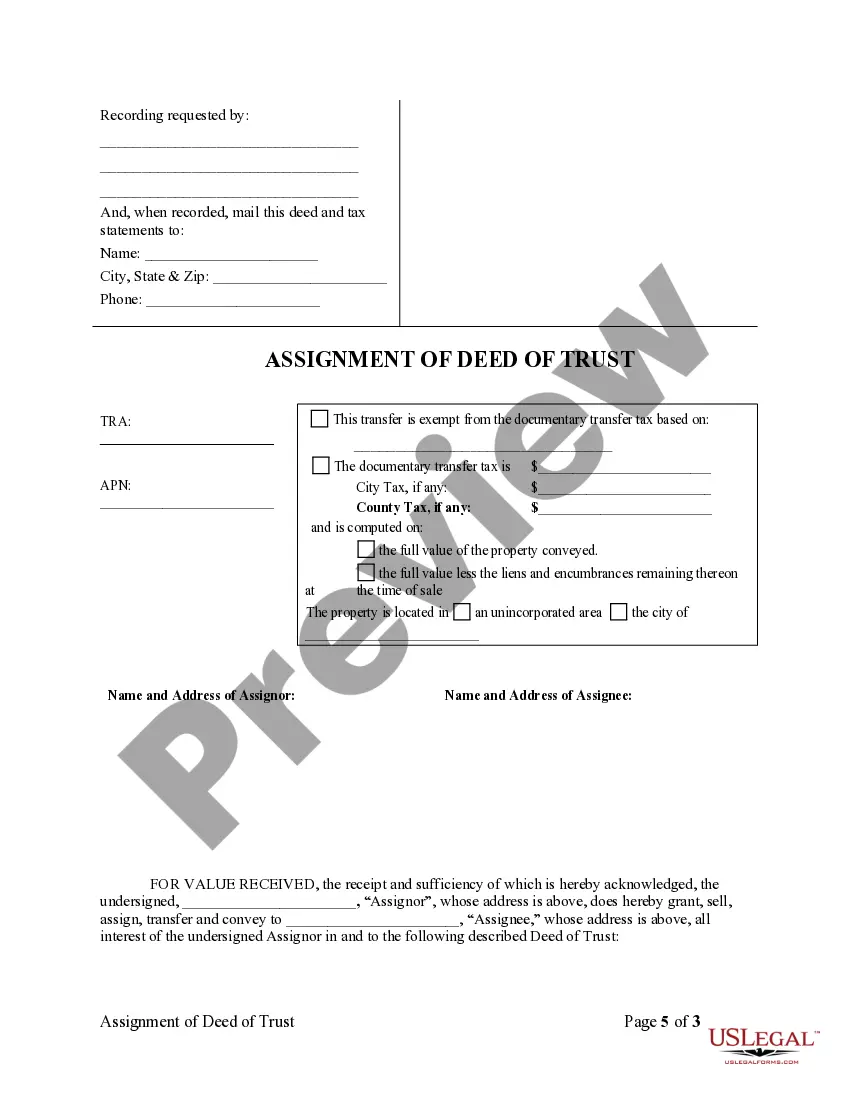

- Identification of the assignor (current mortgage holder) and the assignee (new mortgage holder).

- Description of the property involved in the deed of trust.

- Clear language establishing the transfer of rights associated with the deed of trust.

- Space for signatures and notarization, if required.

- Notes on exemptions from transfer tax relevant to the transaction.

Situations where this form applies

This form should be used when a corporation wishes to transfer its interest in a deed of trust to another party, typically as part of a financial transaction, restructuring of debt, or corporate acquisition. It is essential for formalizing the assignment of mortgage responsibilities and rights.

Who can use this document

This form is intended for:

- Corporate mortgage holders looking to assign their deeds of trust.

- Financial institutions involved in mortgage management.

- Legal professionals assisting corporations in real estate transactions.

How to complete this form

- Identify and enter the names of the assignor and assignee in the appropriate fields.

- Provide a detailed description of the property associated with the deed of trust.

- Reference the original deed of trust and include any relevant document numbers.

- Specify any exemptions from transfer tax if applicable.

- Have both parties sign and date the form, and arrange for notarization if required.

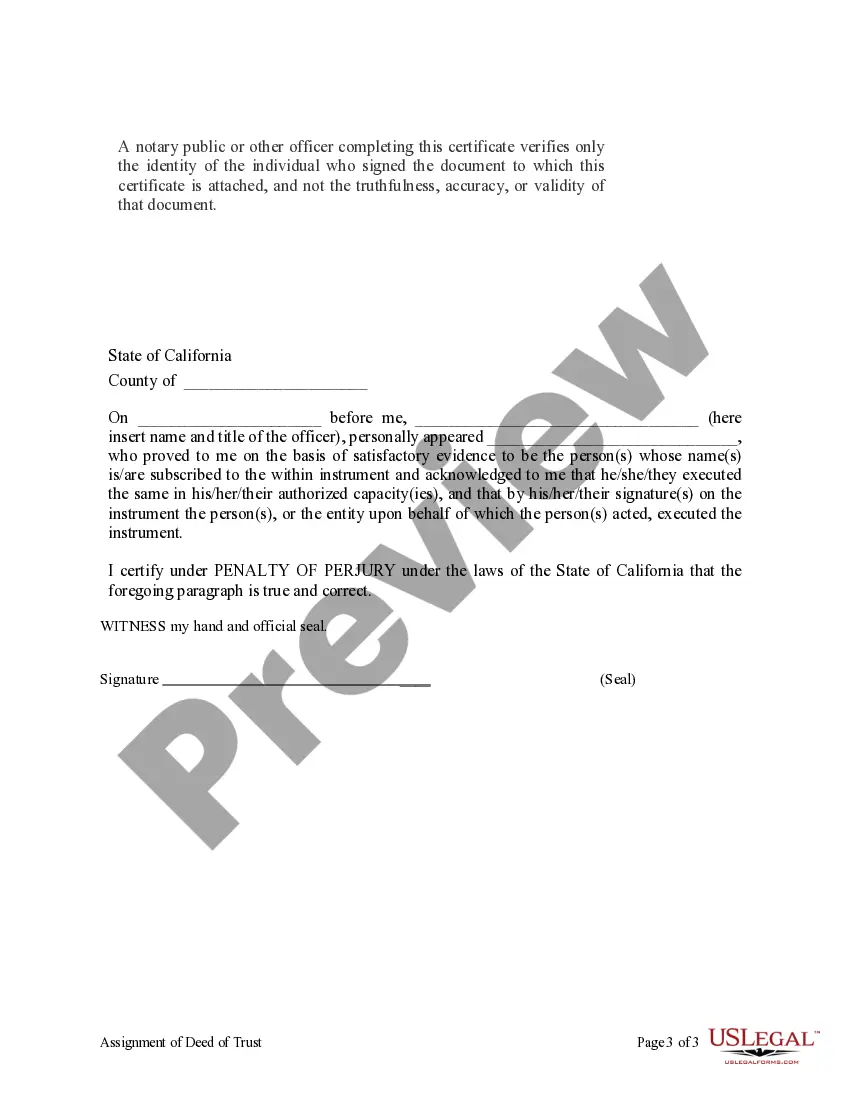

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

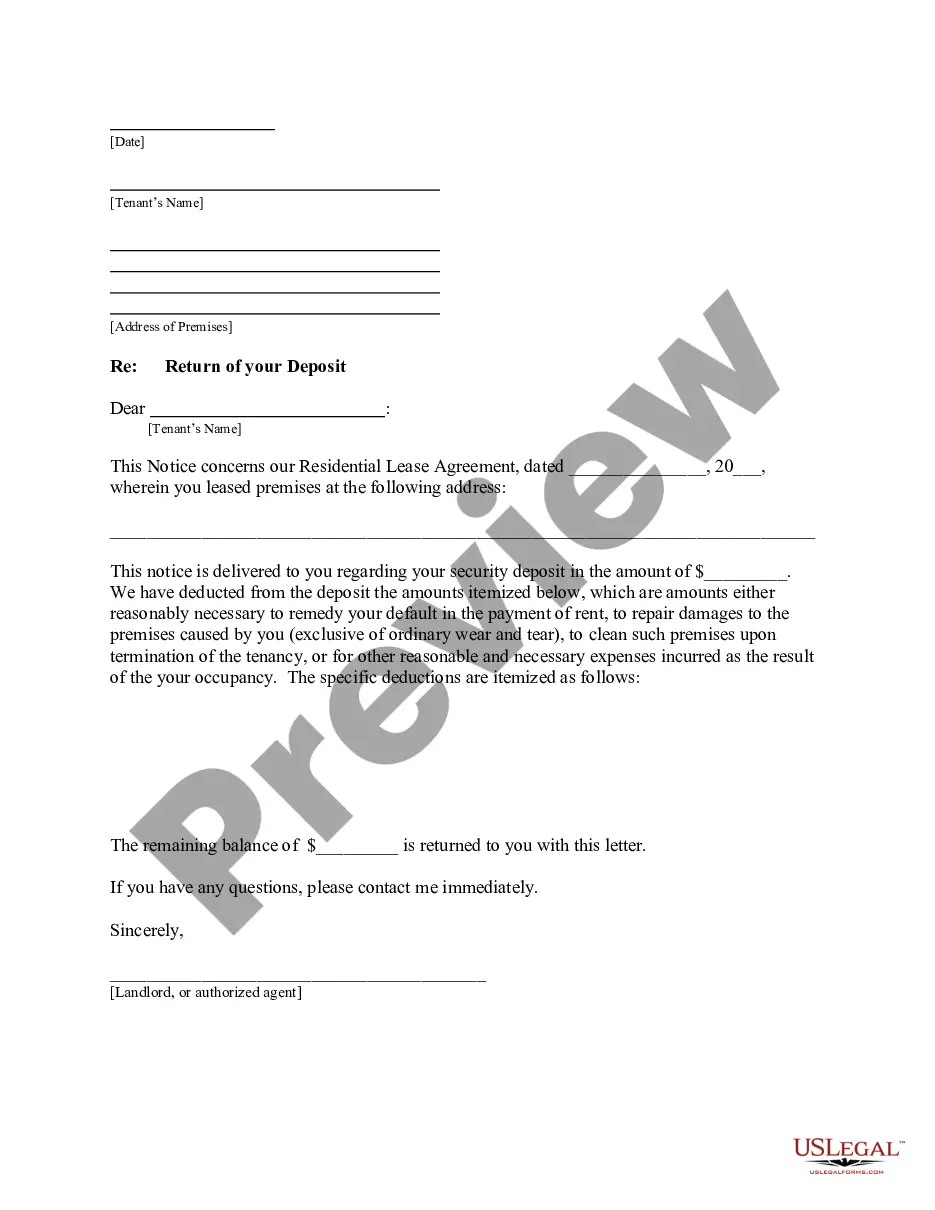

Common mistakes

- Failing to accurately identify the original deed of trust, which can lead to complications.

- Not specifying the applicable exemptions from transfer tax.

- Omitting signatures and dates from both the assignor and assignee.

- Neglecting to check state-specific requirements before submission.

Why use this form online

- Convenience of downloading the form from any location at any time.

- Editability allows for customization to suit specific circumstances.

- Reliability of using attorney-drafted templates ensures legal compliance.

Looking for another form?

Form popularity

FAQ

To obtain a copy of your deed of trust in California, you can visit the county recorder’s office where your property is located. Alternatively, you can request a copy online through various public records platforms. It's important to have your property details handy to expedite the search process. If you need assistance with the procedures or navigating legal documents, consider using resources like US Legal Forms, which can help clarify issues related to the California Assignment of Deed of Trust by Corporate Mortgage Holder.

California predominantly uses deeds of trust rather than traditional mortgages. This approach benefits lenders by facilitating a more efficient foreclosure process, which includes non-judicial foreclosures. As a borrower or a corporate mortgage holder, understanding this key distinction is vital when navigating lending agreements in California. Many find that familiarizing themselves with the California Assignment of Deed of Trust by Corporate Mortgage Holder greatly enhances their real estate experience.

In the United States, some states primarily use deeds of trust, while others use mortgages for property financing. States like California, Arizona, and Nevada favor deeds of trust, which allow for faster foreclosure processes. Conversely, states such as New York and Florida typically utilize mortgages. Understanding these distinctions can help borrowers navigate the complexities of property financing, especially concerning the California Assignment of Deed of Trust by Corporate Mortgage Holder.

Yes, in California, a trust deed must be recorded to protect the lender’s interests and establish priority. Recording the trust deed creates a public record, ensuring it is enforceable against third parties. Therefore, always file the trust deed with the appropriate county recorder's office promptly after execution. US Legal Forms can assist you with this process by providing the necessary forms and clear instructions for the California Assignment of Deed of Trust by Corporate Mortgage Holder.

To file a deed of trust in California, first, obtain the correct form and fill it out with accurate property details and borrower information. It is essential that all parties involved sign the document in front of a notary public. Afterward, file the completed deed of trust with the county recorder’s office to make it official. For additional help, explore the US Legal Forms platform, which simplifies the process and includes resources for the California Assignment of Deed of Trust by Corporate Mortgage Holder.

To file a deed in California, start by completing the deed form, ensuring it complies with state requirements. After filling out the deed, you must sign it in front of a notary public to validate your signature. Once notarized, you can file the deed with the county recorder’s office where the property is located. For convenience, consider using the US Legal Forms platform, which offers the necessary forms and guidance for the California Assignment of Deed of Trust by Corporate Mortgage Holder.

Typically, the Assignment of a deed of trust must be signed by the original lender, also known as the mortgage holder. In the case of a California Assignment of Deed of Trust by Corporate Mortgage Holder, an authorized representative from the corporation must also provide their signature. Ensuring that all required signatures are present is vital to uphold the validity of the assignment. You can turn to uslegalforms for guidance on proper signing protocols.

To be valid in California, a trust must have the intent to create one, a clear subject matter, and a designated beneficiary. It also needs a trustee who can manage the trust assets and is competent to fulfill that role. Following these guidelines ensures that the trust is legally recognized. If you are involved in a California Assignment of Deed of Trust by Corporate Mortgage Holder, having a valid trust can streamline the process.

A trust can become invalid in California due to lack of proper execution, absence of a clear intent to create the trust, or if it violates the rules set by state law. Additionally, if the trust fails to comply with formalities such as having a designated trustee or beneficiary, it may be deemed invalid. Understanding these aspects is essential when navigating a California Assignment of Deed of Trust by Corporate Mortgage Holder. Uslegalforms can provide resources to ensure your trust stands strong.

In California, a deed must be in writing, clearly identify the parties involved, and describe the property being conveyed. Additionally, it must include the necessary signatures, usually from the grantor, and should be notarized to ensure its validity. A valid deed is crucial for a legitimate transfer of property ownership. When dealing with a California Assignment of Deed of Trust by Corporate Mortgage Holder, confirming validity ensures a smooth transaction.