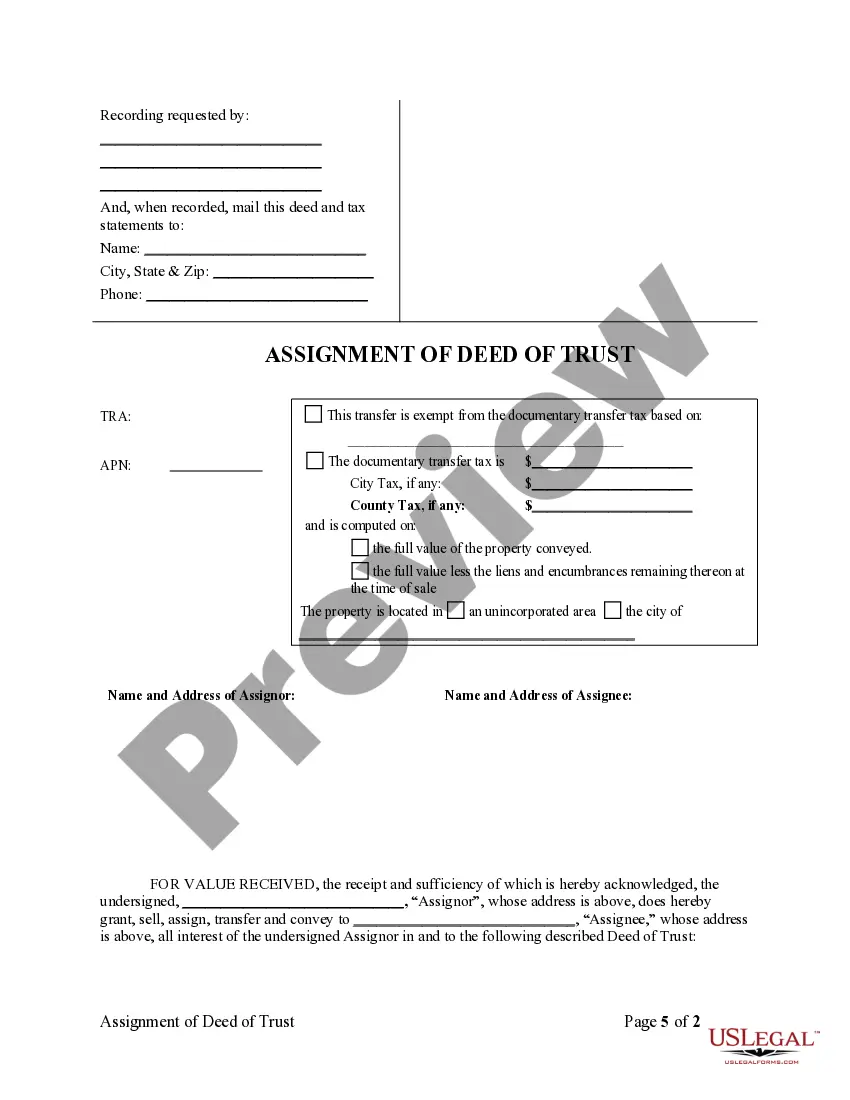

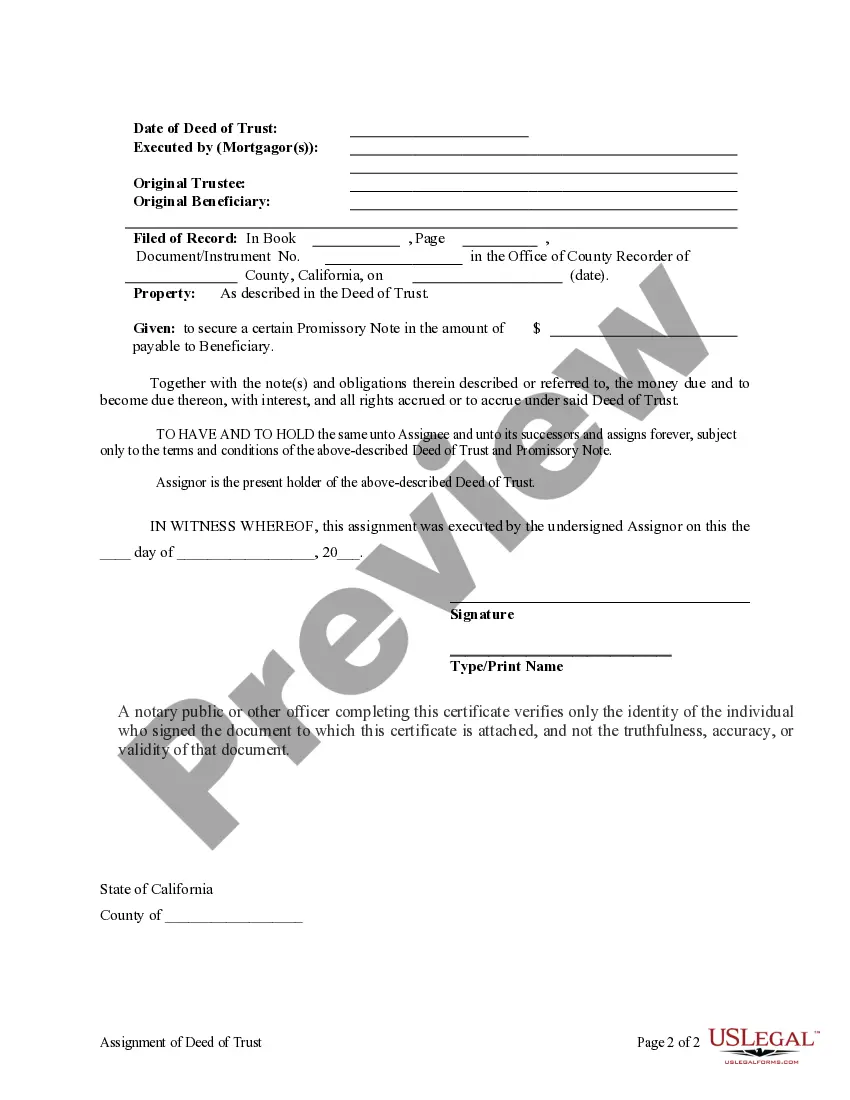

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder

Description

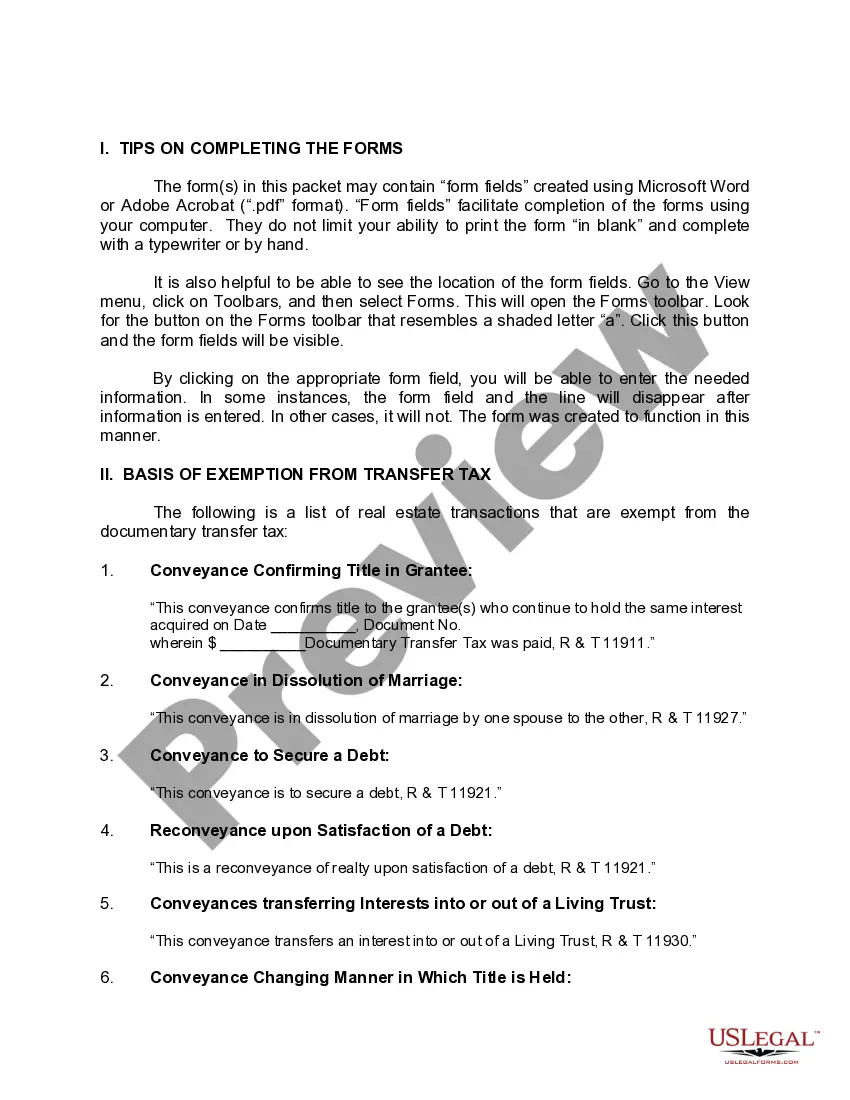

How to fill out California Assignment Of Deed Of Trust By Individual Mortgage Holder?

Are you in search of a reliable and affordable supplier of legal forms to purchase the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to outline guidelines for living together with your partner or a bundle of forms to facilitate your separation or divorce through the legal system, we have you covered. Our website offers over 85,000 current legal document templates for personal and commercial use. All the templates we provide are not generic and are tailored to meet the needs of specific states and counties.

To obtain the form, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please keep in mind that you can access your previously purchased document templates at any time in the My documents section.

Are you unfamiliar with our website? No need to worry. You can easily create an account, but before doing so, ensure you follow these steps.

Now, you can proceed to set up your account. Then select the subscription plan and move forward to payment. Once the payment is successfully processed, download the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder in any provided file format. You can revisit the website at any time and download the form again at no extra cost.

Obtaining current legal forms has never been simpler. Give US Legal Forms a try today, and forget about spending countless hours searching for legal documents online.

- Confirm that the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder complies with the regulations of your state and locality.

- Review the details of the form (if available) to understand its applicability and purpose.

- Restart the search if the template is not appropriate for your legal needs.

Form popularity

FAQ

In California, a deed of trust functions as a security instrument where the borrower conveys property to a trustee, who holds it for the benefit of the lender. This arrangement protects the lender's investment while offering the borrower a path to homeownership. During the repayment period, the borrower retains possession of the property, but should they default, the trustee can initiate foreclosure. Understanding how the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder operates can enhance your property ownership experience.

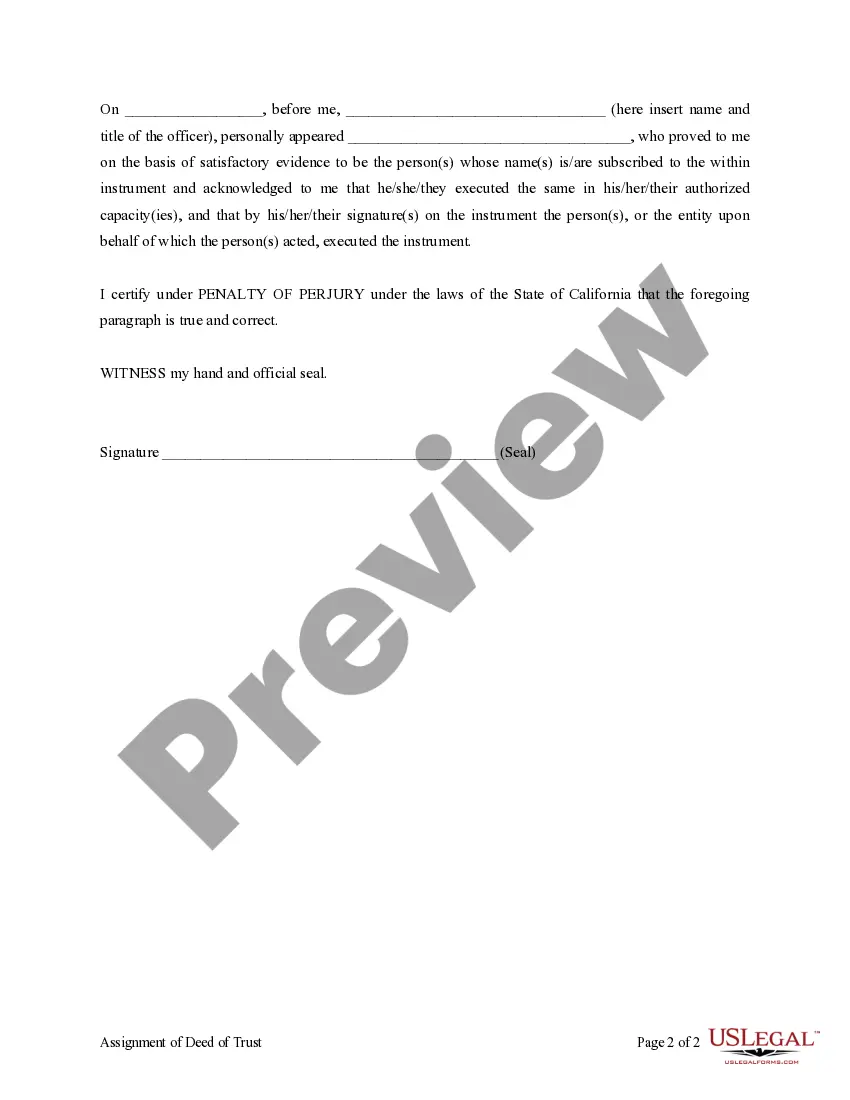

A deed of trust may be deemed invalid in California if it fails to meet specific legal requirements such as proper execution, lack of consideration, or if it lacks required witnesses. Additionally, if the agreement is not recorded correctly, it may not provide the legal protection intended. To avoid these pitfalls, utilizing resources like UsLegalForms can guide you in creating a valid Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder. Ensuring all elements are present will help safeguard your interests.

Transferring a deed to a trust in California involves drafting a new deed that names the trust as the grantee. This deed should be signed and notarized, then recorded at the county recorder's office. It is vital to ensure that all forms are correctly filed to protect the interests of the trust beneficiaries. For streamlined assistance, explore the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder service offered by US Legal Forms.

Transferring property into a trust in California may have several tax implications, including potential reassessment of property taxes. Generally, if the transfer meets specific guidelines, it may avoid reassessment. However, consulting with a tax professional is advisable to understand your unique situation. The Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder can be facilitated using US Legal Forms, ensuring you stay informed on tax matters.

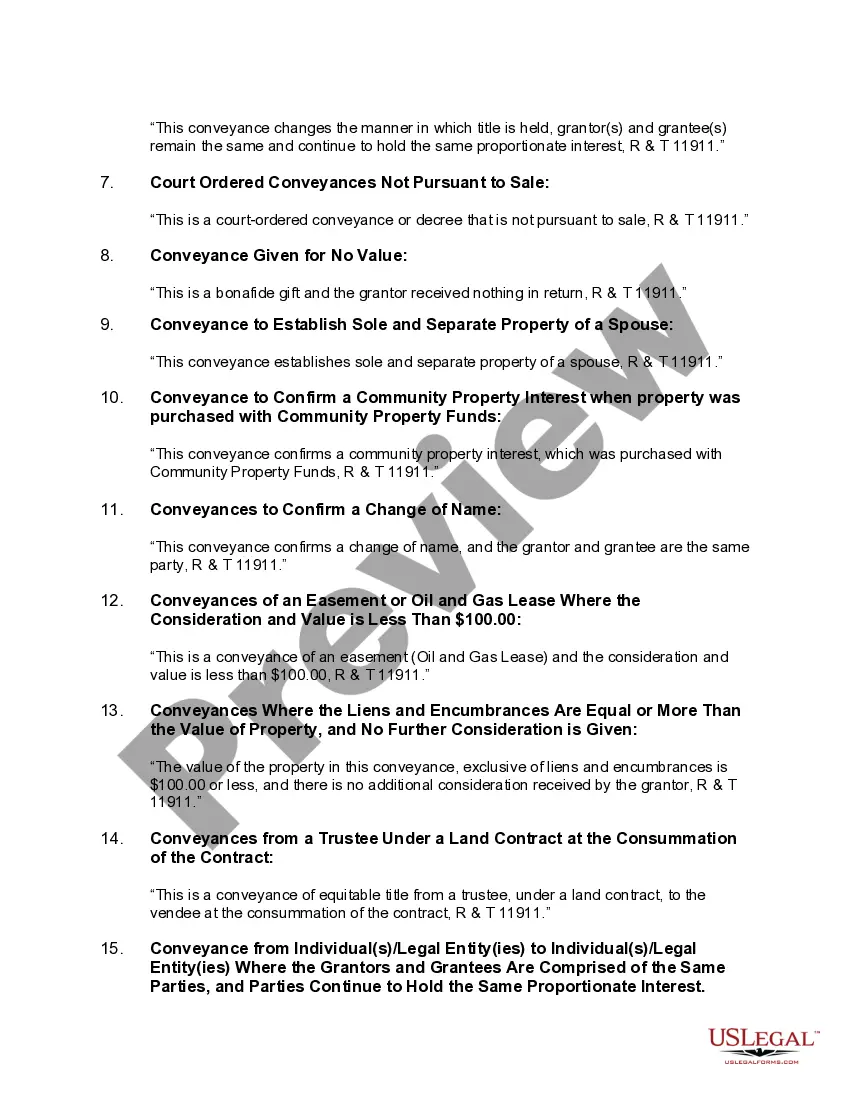

A deed of assignment typically refers to the transfer of one party’s rights or interests in a property to another. In contrast, a deed of transfer is the legal document used to formally change ownership of a property. Understanding their distinct functions is crucial, especially in transactions involving the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder. For clear guidance, consult with resources from US Legal Forms.

Transferring property from a trust to an individual in California requires specific steps. You will need to execute a deed, often a grant deed or quitclaim deed, to transfer ownership. Additionally, it is essential to update the county records to reflect this change. For assistance, consider the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder through US Legal Forms to ensure you meet all legal requirements.

The biggest mistake parents often make when setting up a trust fund is failing to communicate their intentions to their heirs. Not discussing the purpose of the trust can lead to confusion and conflict later on. Another mistake is neglecting to review and update the trust as circumstances change. Addressing these issues early can lead to a smoother execution of the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder.

Some disadvantages of putting your house in a trust in California include potential costs associated with setting up and maintaining the trust, and the possibility of losing certain tax benefits. Additionally, if not properly structured, the trust might become subject to creditors' claims. Understanding these limitations is essential for anyone considering the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder.

To put your house in a trust in California, first establish a trust by drafting a trust document with the help of a legal professional. Next, execute a new deed that transfers the property from your name into the trust's name. Recording this new deed with your county establishes the trust's ownership. Utilizing resources like US Legal Forms can simplify this process as you handle the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder.

In California, a trustee can sell trust property to himself, but this transaction must be conducted with utmost transparency and fairness. The sale should be in the best interest of the beneficiaries and ideally requires their consent. If you are navigating such situations, resources from US Legal Forms can be beneficial in ensuring compliance with the law regarding the Oxnard California Assignment of Deed of Trust by Individual Mortgage Holder.