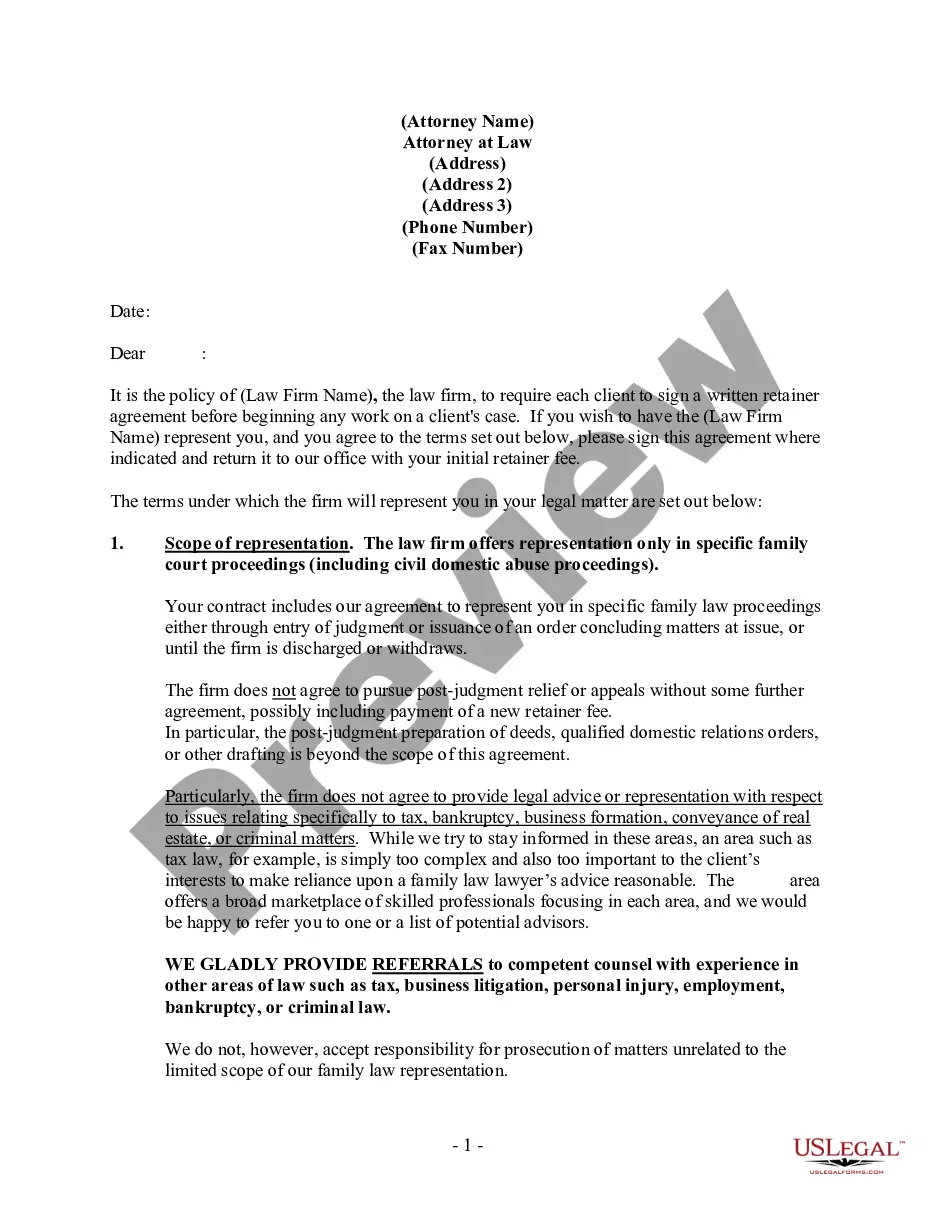

Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees

Description

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Obtain any variant from 85,000 lawful documents such as Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees online with US Legal Forms. Each template is composed and revised by state-licensed legal experts.

If you already possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to access it.

Should you not have subscribed yet, adhere to the guidelines below: Check the state-specific criteria for the Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees you wish to utilize. Review the description and preview the template. When you’re assured the sample meets your needs, simply click Buy Now. Choose a subscription plan that suits your budget. Establish a personal account. Make a payment in one of two convenient methods: by card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the document to the My documents tab. After your reusable template is downloaded, print it out or save it to your device.

- With US Legal Forms, you’ll consistently have immediate access to the appropriate downloadable template.

- The platform provides access to documents and categorizes them to facilitate your search.

- Utilize US Legal Forms to obtain your Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees swiftly and effortlessly.

Form popularity

FAQ

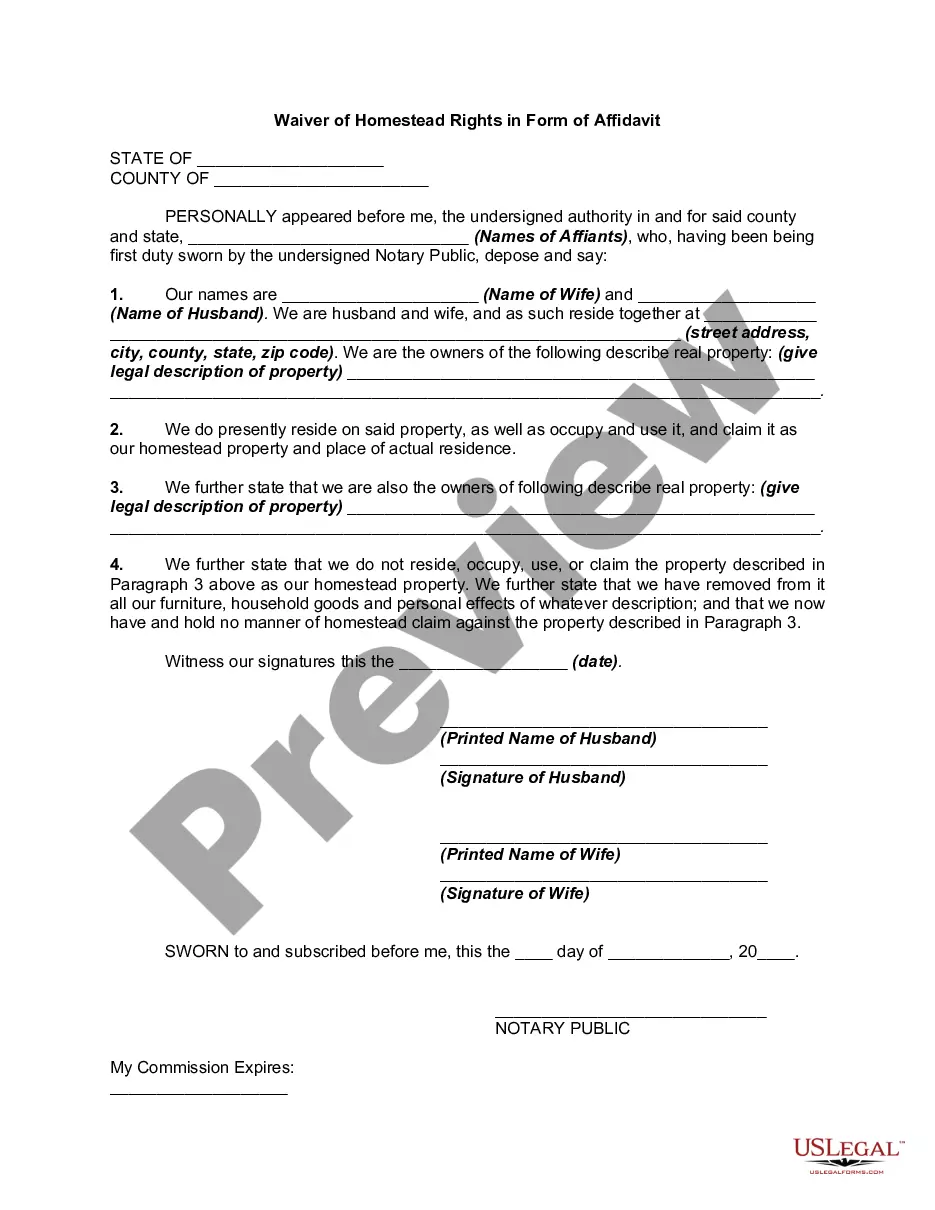

Minnesota statute allows homeowners to claim up to $390,000 in property value, or $975,000 if agricultural, as a "homestead." State law limits this exemption to 160 acres, which in practice may apply to farms, but has removed what was once a half-acre limit on property within city limits.

The homestead market value exclusion provides a tax reduction to all homesteads valued below $413,800 by shifting a portion of the tax burden that would otherwise fall on the homestead to other types of property.

(US) a house and adjoining land designated by the owner as his fixed residence and exempt under the homestead laws from seizure and forced sale for debts. Collins Dictionary of Law © W.J. Stewart, 2006. HOMESTEAD. The place of the house or home place.

Minnesota statute allows homeowners to claim up to $390,000 in property value, or $975,000 if agricultural, as a "homestead." State law limits this exemption to 160 acres, which in practice may apply to farms, but has removed what was once a half-acre limit on property within city limits.

The first $500,000 in taxable market value of a homesteaded property has a rate of 1.00% and the remainder has a rate of 1.25%. I'll point out again that homesteads valued at more than $414,000 do not get any value excluded. Non-homesteaded residential property has a rate of 1.25%.

To qualify for a homestead, you must meet the following criteria: You must be an owner of the property; you must occupy the property as your primary residence; and. you must be a Minnesota resident.

As nouns the difference between waiver and exemption is that waiver is the act of waiving, or not insisting on, some right, claim, or privilege while exemption is an act of exempting.

To qualify for a homestead, you must meet the following criteria: You must be an owner of the property; you must occupy the property as your primary residence; and. you must be a Minnesota resident.

What is a Waiver Of Exemption. A waiver of exemption was a provision in a consumer credit contract or loan agreement which allowed creditors to seize, or threaten the seizure, of specific personal possessions or property.Lenders could enact this clause, even if state law held the property exempt from seizure.