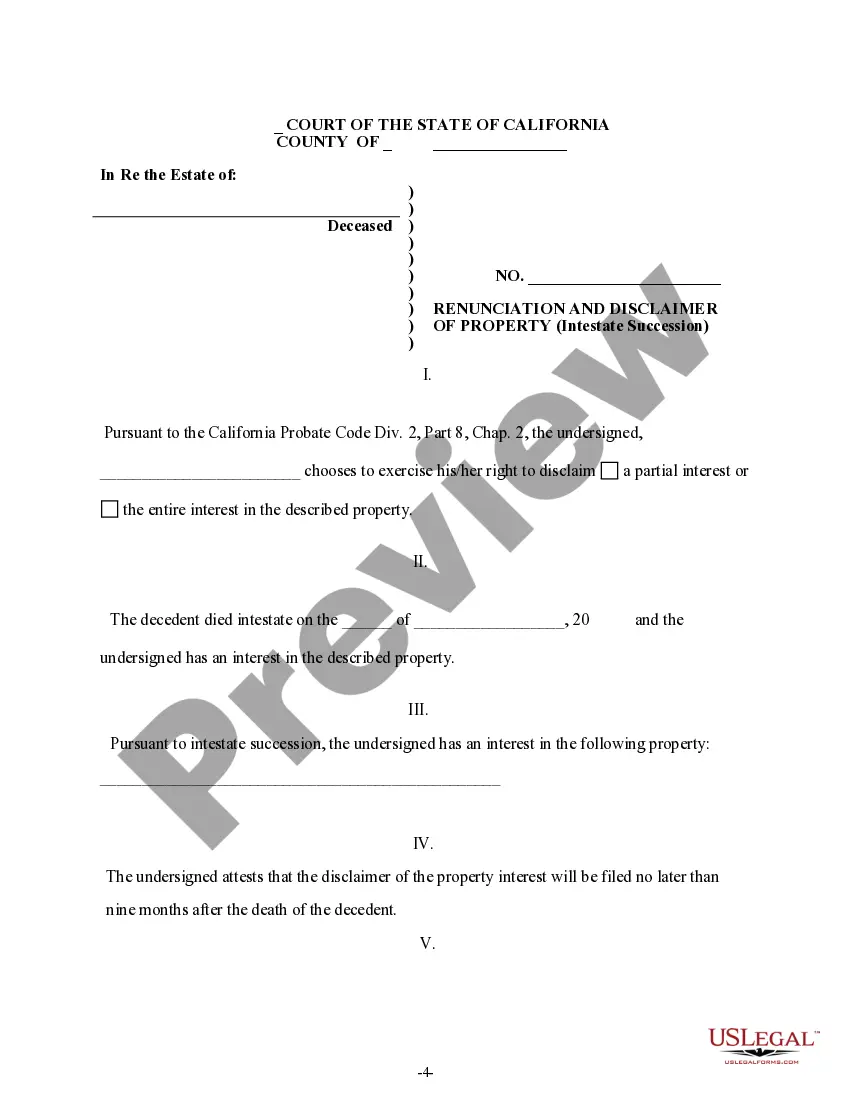

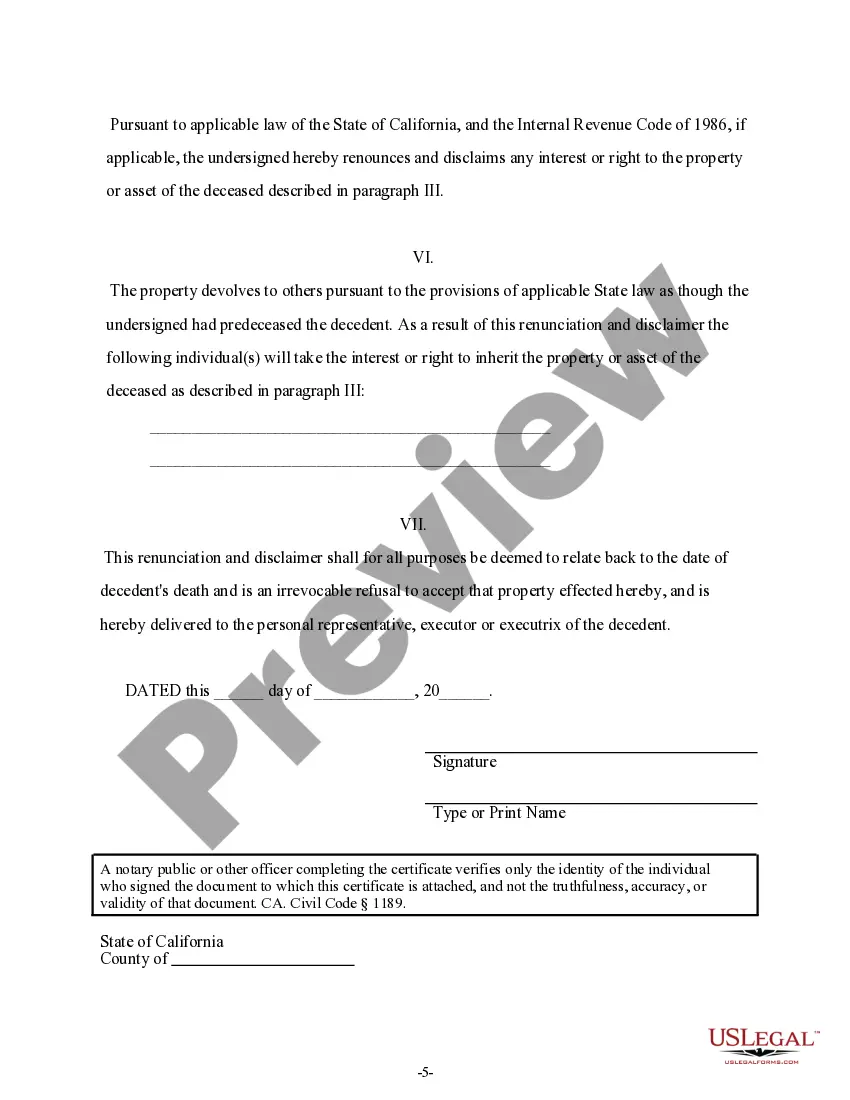

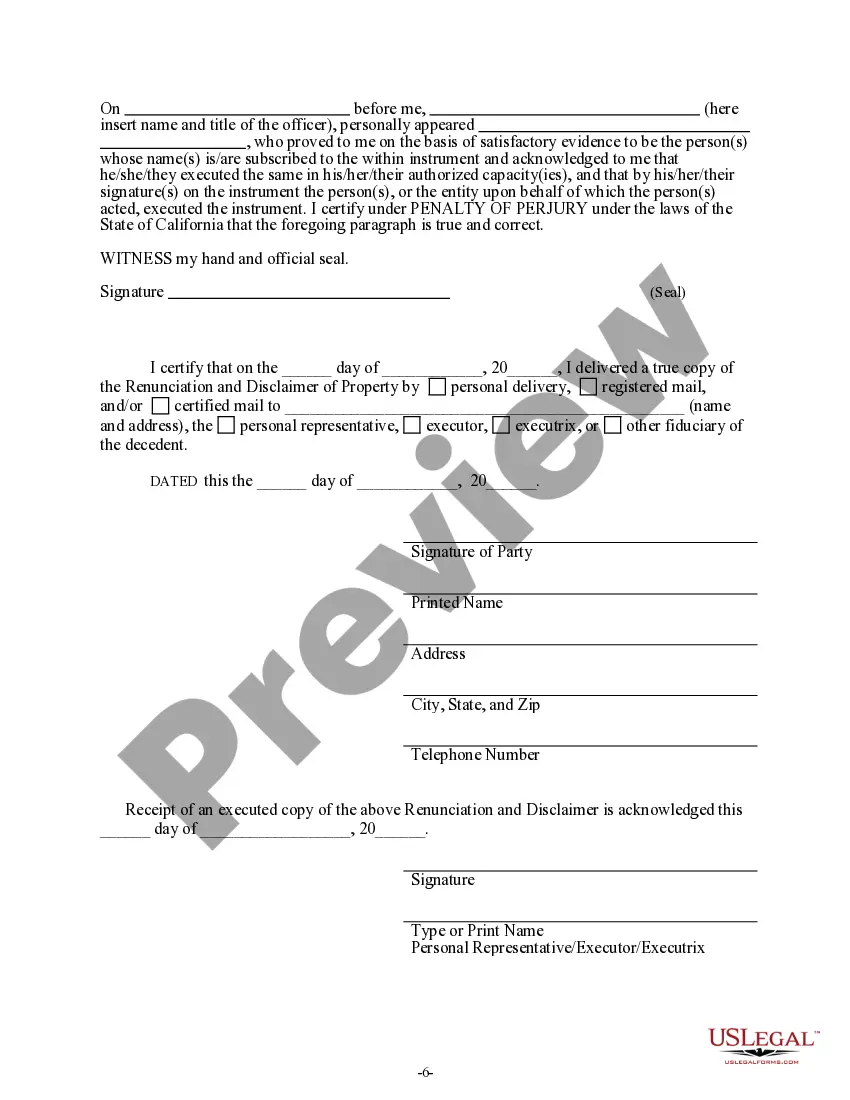

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

Utilize the US Legal Forms and gain immediate access to any template you require.

Our helpful website with a vast collection of documents simplifies finding and obtaining nearly any document sample you need.

You can download, complete, and authorize the Thousand Oaks California Renunciation And Disclaimer of Property obtained through Intestate Succession in just a few minutes rather than spending hours online searching for the right template.

Using our catalog is an excellent method to enhance the security of your document submissions.

If you haven't created an account yet, follow the steps below.

- Our skilled legal experts routinely examine all documents to ensure that the forms are suitable for a specific state and comply with updated laws and regulations.

- How can you access the Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession.

- If you already have a subscription, just sign in to your account.

- The Download option will be visible on all documents you access.

- Furthermore, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

Intestate succession refers to the legal process that occurs when a person dies without a valid will. In such cases, state laws dictate how their assets will be distributed to heirs. Familiarizing yourself with the meaning of intestate succession is vital, especially in the context of Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession, as it impacts inheritance outcomes.

Beneficiaries may choose to disclaim property for several reasons, such as financial burdens, tax implications, or preference for other heirs to inherit. This decision allows for a more streamlined distribution of assets according to the rules of intestate succession. Understanding the Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession can aid beneficiaries in making informed decisions.

Intestate succession statutes in California transfer a variety of assets, including real estate, bank accounts, and personal belongings that were solely owned by the decedent. The distribution typically follows a hierarchy among relatives, ensuring that more immediate family members receive priority. Engaging with topics like Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession can clarify specific circumstances related to asset transfers.

Individuals who inherit property through intestate succession receive assets as dictated by California law, which determines distribution based on familial relationships. This statutory method aims to honor the decedent's intent by distributing property to next of kin. Understanding this process is crucial for heirs navigating the complexities of Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession.

To properly disclaim an inheritance in California, begin by creating a written disclaimer that includes pertinent information about the estate and your decision. This written disclaimer must be submitted to the appropriate court or executor without delay. Familiarize yourself with the laws governing the Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession, as failure to adhere to the guidelines may result in unwanted inheritance.

When writing a disclaimer, it is essential to include your name, the decedent's name, and a clear statement of the intent to disclaim the inheritance. The document should also specify the property or assets you are renouncing. Using resources from uslegalforms can help ensure that your disclaimer follows California laws correctly, particularly those relating to Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession.

In California, there is no state inheritance tax, allowing you to inherit property without incurring taxes at the state level. However, federal estate tax exemptions apply, which allow an individual to inherit a certain amount without facing federal taxation. It's beneficial to consult a tax professional to understand the implications when dealing with the Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession.

In California, an heir typically has up to 40 days from the date of the decedent's passing to claim their inheritance. However, the rules can vary, and it is prudent to consult local laws or seek guidance regarding the Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession. Take the time to understand your rights during this critical period.

Disclaiming an inheritance in California involves drafting a formal disclaimer that expresses your intent not to accept the inheritance. This document must be filed with the relevant court or the estate executor within a designated timeframe. Please ensure you understand local laws, particularly those surrounding Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession, to navigate this process successfully.

To disclaim inheritance in California, an heir must follow specific legal rules. It is essential to submit a written disclaimer to the appropriate court or executor within nine months of the decedent's passing. This process shapes how the property you do not wish to inherit is passed on according to Thousand Oaks California Renunciation And Disclaimer of Property received by Intestate Succession.