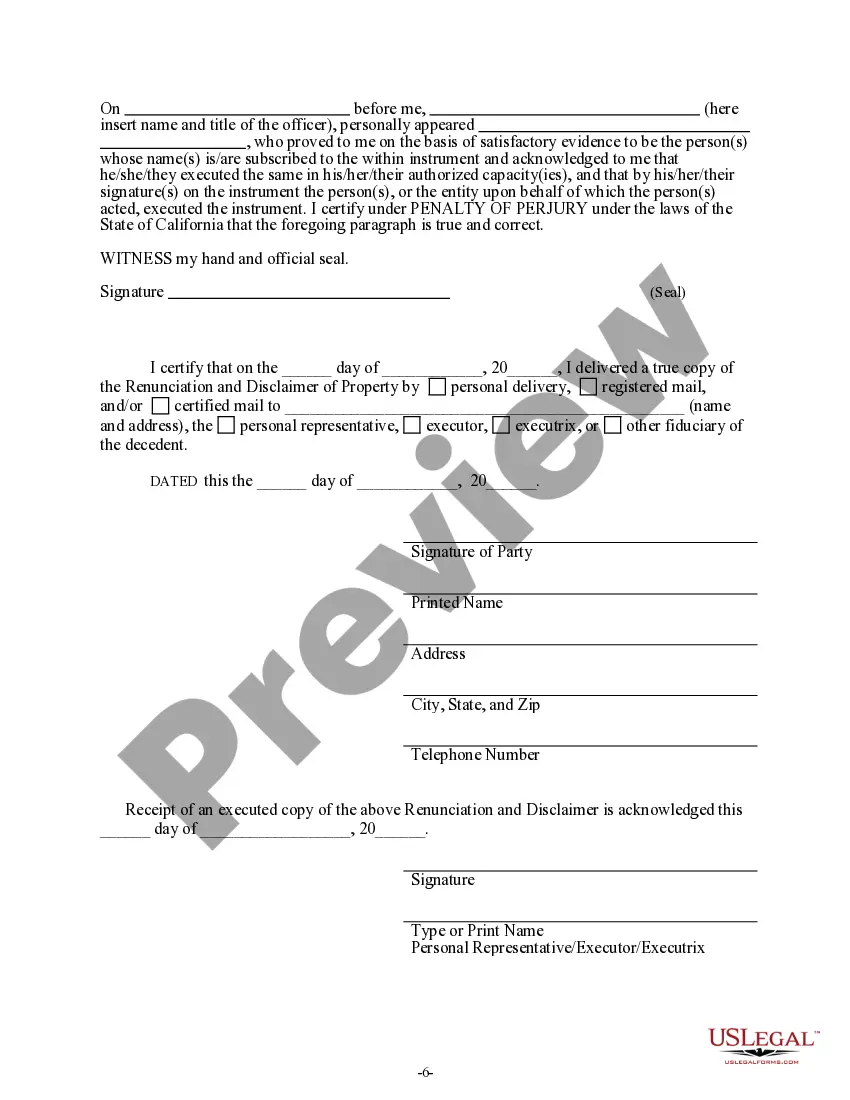

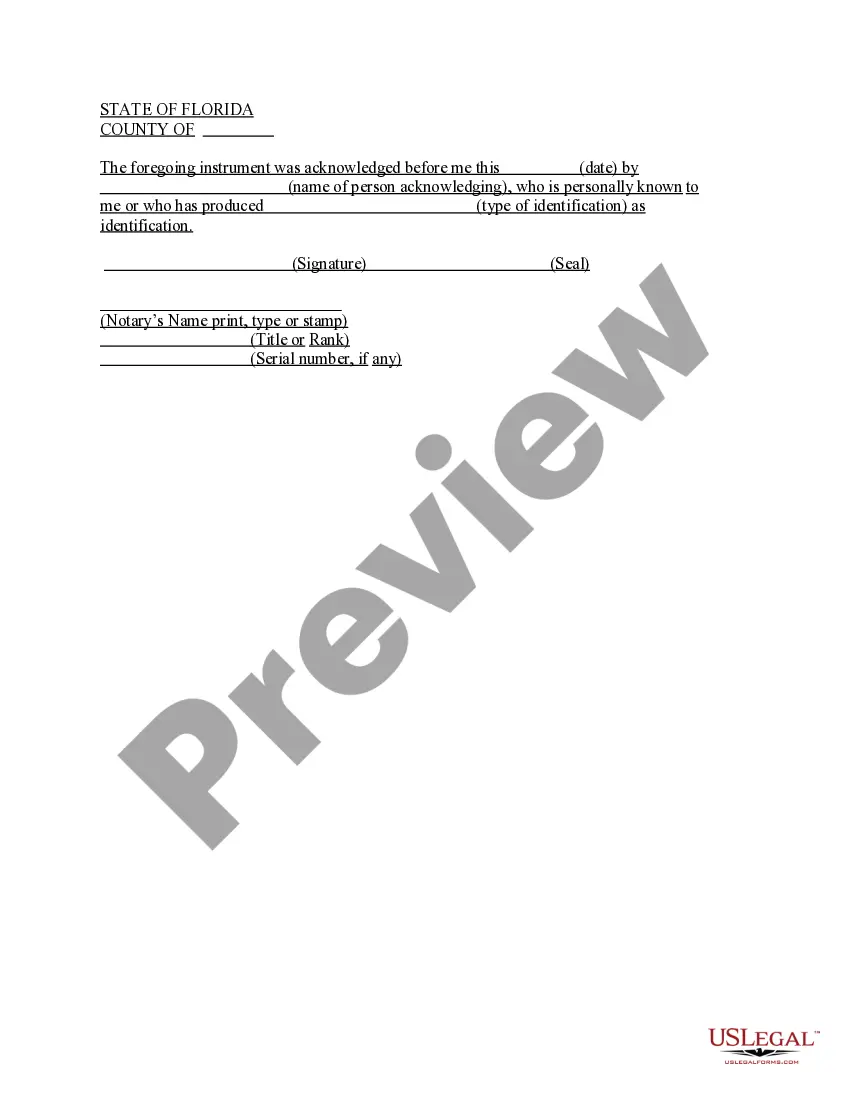

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you are in search of an appropriate form template, it’s challenging to discover a superior platform than the US Legal Forms website – one of the largest repositories on the web.

With this repository, you can access thousands of templates for organizational and individual needs by categories and regions, or keywords.

Utilizing our sophisticated search function, locating the latest Santa Clarita California Renunciation And Disclaimer of Property generated by Intestate Succession is as simple as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Select the format and download it to your device.

- Additionally, the significance of each document is verified by a team of expert lawyers who routinely examine the templates on our site and amend them according to the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Santa Clarita California Renunciation And Disclaimer of Property generated by Intestate Succession is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have selected the form you require. Review its description and use the Preview option to examine its contents. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the appropriate document.

- Validate your selection. Click the Buy now button. After that, choose your desired pricing plan and provide details to create an account.

Form popularity

FAQ

In California, the intestate succession order starts with the decedent's spouse and children. If there are no direct descendants, parents, siblings, and then more distant relatives may inherit the property. Familiarity with the Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession is crucial, as it can help clarify your position in the inheritance line if you choose to disclaim your rights.

If you refuse your inheritance, it typically passes to the next eligible heir according to California's intestate succession laws. This means that your decision to decline the property can alter the beneficiaries' distribution. Engaging in the Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession can ensure your intentions are documented, helping those you may designate as heirs.

Filing probate in California without a will involves several steps, including filing a petition with the probate court to appoint an administrator for the estate. The court will follow California's intestate succession laws to distribute the property accordingly. Understanding the workings of Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession can offer clarity when confronting this process and addressing any potential disclaimers.

To disclaim an inheritance in California, you must file a written disclaimer with the probate court. This document should outline your intention to refuse the property and should be completed within nine months of the inheritance. Leveraging resources like US Legal Forms can help you draft the necessary documentation related to Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession, making the process smoother.

In California, you can inherit an unlimited amount from your parents without incurring inheritance taxes, as the state does not impose these taxes. However, federal estate taxes may apply if the estate exceeds certain thresholds. It's essential to understand that property transfers might influence how you claim your share through Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession, especially if you wish to disclaim your portion.

To transfer property after a parent’s death without a will in California, consider using the Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession. This allows heirs to disclaim their interests in the property, facilitating an easier transfer to eligible beneficiaries. Generally, the estate will be distributed according to state intestacy laws. Consulting a legal expert can help streamline this process effectively.

Probate is not always mandatory in California. It mainly depends on the size of the estate and how the assets are structured. For instance, in cases where the Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession is applicable, probate may be avoided altogether. However, for larger estates or those with complicated assets, going through probate may be necessary. It's important to assess individual situations with a legal professional.

If no probate is filed in California, the estate may remain unsettled, and assets can be frozen or remain unclaimed. This situation complicates the transfer of property, making it difficult for heirs to access their inheritance, particularly in cases involving the Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession. Delaying or avoiding probate can create significant legal challenges and may lead to disputes among heirs. To prevent such issues, seeking legal guidance is highly recommended.

The probate code for intestate succession in California is outlined in the California Probate Code Sections 6400 to 6414. This section details how property is distributed when someone dies without a will. It is essential to understand this code, as it plays a crucial role in the Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession. Knowing the laws will help heirs navigate the estate settlement process more effectively.

In California, if a person dies without a will, the probate must typically be filed within 30 days of the person's death. However, it is advisable to file as soon as possible to avoid complications, especially in cases involving the Santa Clarita California Renunciation And Disclaimer of Property received by Intestate Succession. Delaying the filing could lead to missed opportunities for heirs. Consider seeking assistance from a probate attorney for guidance during this process.