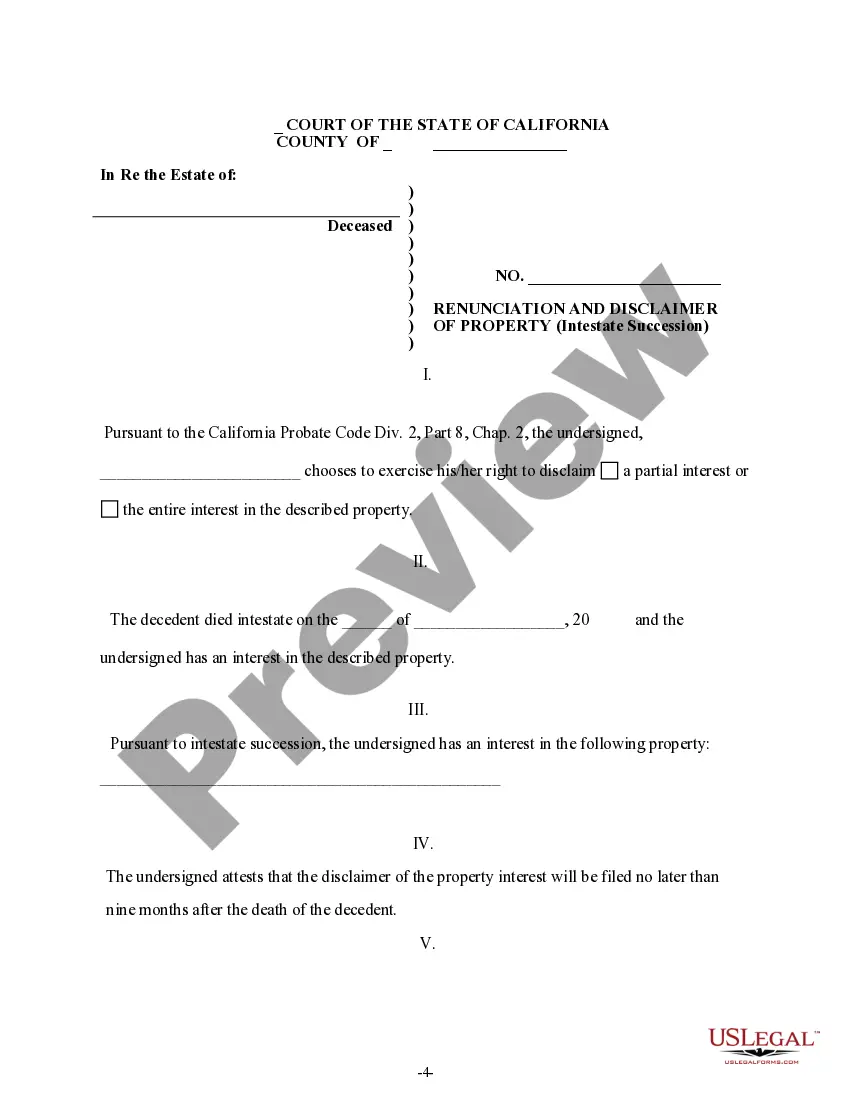

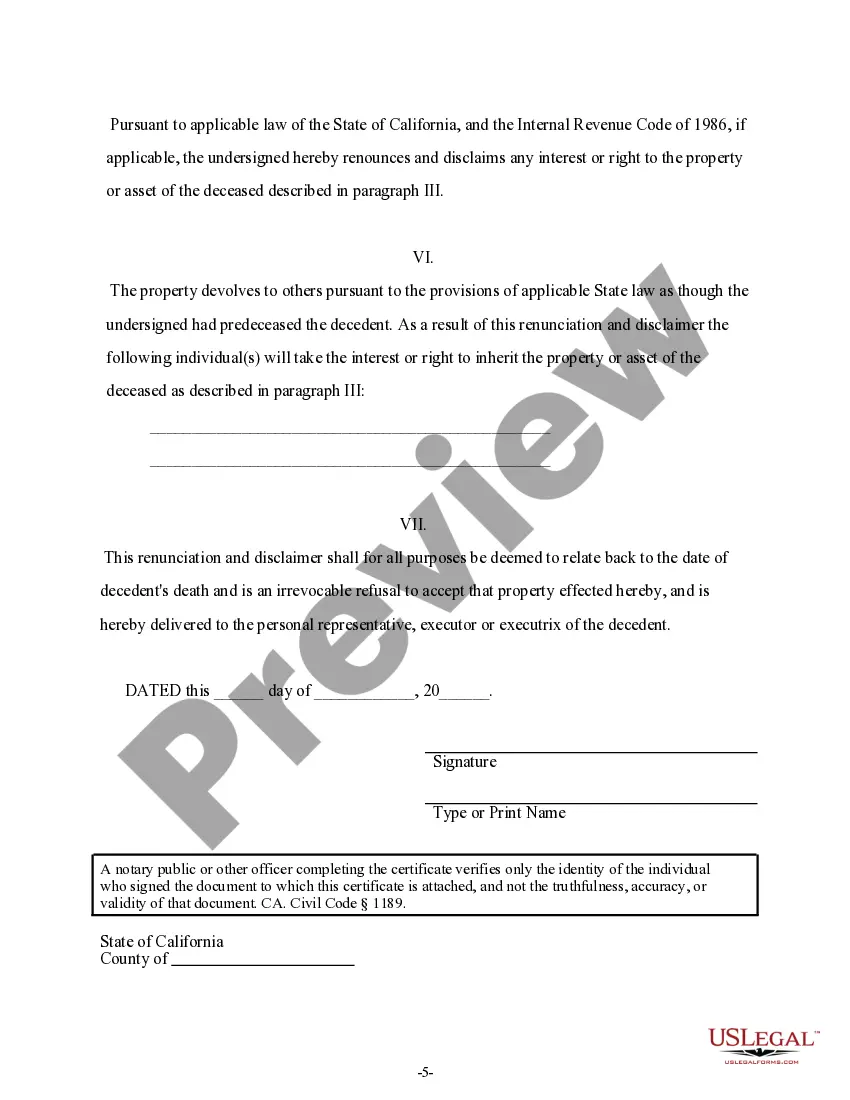

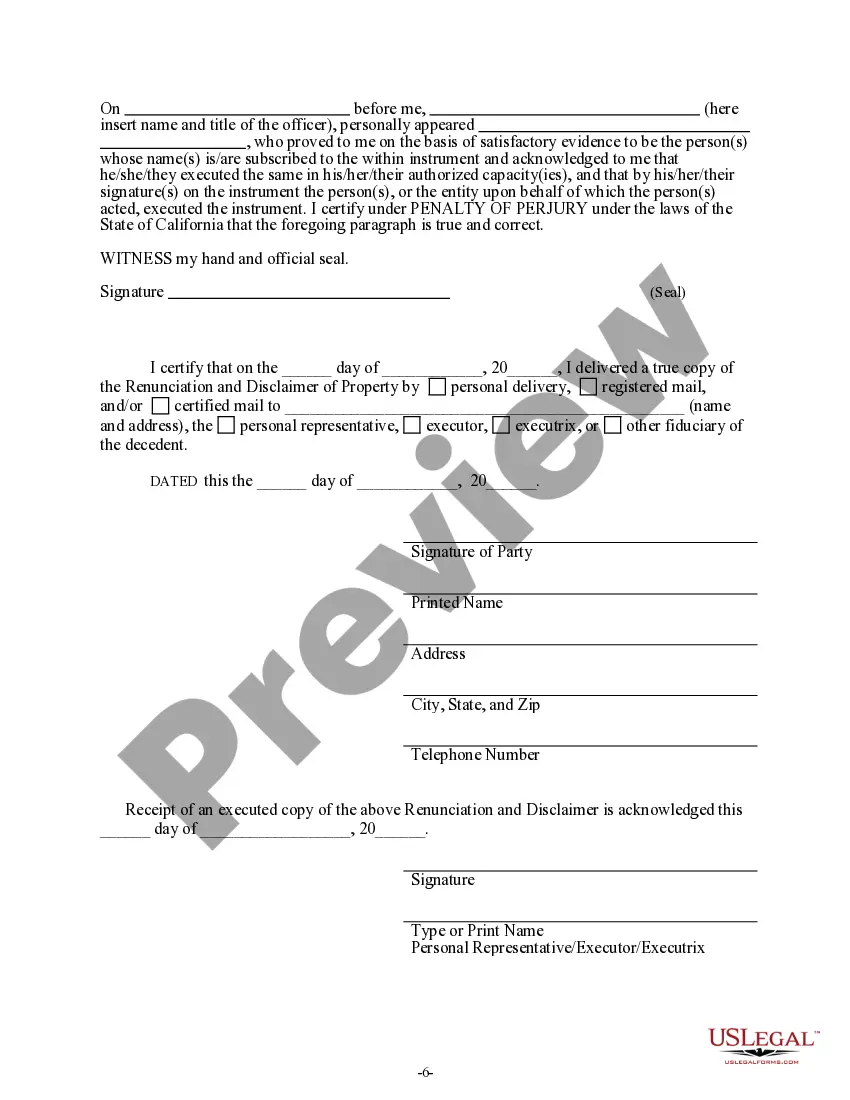

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Escondido California Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

Take advantage of the US Legal Forms and gain immediate access to any document you desire.

Our helpful website with a vast array of document templates allows you to effortlessly locate and acquire almost any document sample you need.

You can export, complete, and validate the Escondido California Renunciation And Disclaimer of Property obtained through Intestate Succession in just a few minutes, rather than spending hours online searching for the correct template.

Utilizing our catalog is a superb method to enhance the security of your document submissions.

If you haven’t created an account yet, follow the instructions below.

Locate the template you require. Ensure that it is the form you are looking for: check its title and description, and use the Preview option if available. Otherwise, utilize the Search field to find the appropriate one.

- Our skilled attorneys routinely review all documents to ensure that the forms are suitable for a specific area and adhere to new laws and regulations.

- How can you obtain the Escondido California Renunciation And Disclaimer of Property acquired via Intestate Succession.

- If you already possess a subscription, simply Log In to your account.

- The Download option will be available for all the samples you view.

- Additionally, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

The rules for disclaiming an inheritance include the necessity for the disclaimer to be in writing, stating the specific property being disclaimed, and ensuring that it is filed within nine months of the decedent's death. The disclaimer should also comply with the Escondido California Renunciation and Disclaimer of Property received by Intestate Succession to be legally effective. Additionally, the disclaimant should not accept any benefits or interests from the property before filing the disclaimer. Consulting with legal resources or services like uslegalforms can simplify this process.

To disclaim an inheritance in California, you must file a written disclaimer with the appropriate court or trustee. This notice should clearly identify the property you wish to decline and reference the Escondido California Renunciation and Disclaimer of Property received by Intestate Succession. Remember, you must do this within a specified timeframe after the inheritance is made known to you. Platforms like uslegalforms can help streamline the process and ensure compliance.

In California, you can inherit up to $11.7 million from your parents without incurring federal estate taxes, as of recent updates. However, it’s important to understand that state tax regulations may vary. Always check the current laws to ensure you fully comprehend the tax obligations related to the Escondido California Renunciation and Disclaimer of Property received by Intestate Succession. Consulting with a tax professional can provide clarity and guidance.

The renunciation of the right of succession is a legal act where a person voluntarily relinquishes their right to inherit property from a deceased relative. This process is outlined in the Escondido California Renunciation and Disclaimer of Property received by Intestate Succession. By renouncing these rights, you may avoid potential tax implications and other liabilities associated with the inherited property. Consider seeking professional assistance to navigate this process effectively.

To write a disclaimer of inheritance sample, start by clearly stating your intent to disclaim the property received through intestate succession. Include your name, the relationship to the deceased, and a description of the inherited property. You must also reference the Escondido California Renunciation and Disclaimer of Property received by Intestate Succession to ensure compliance with state laws. It’s advisable to consult a legal expert or use platforms like uslegalforms to draft an effective disclaimer.

A person who inherits items in an intestate estate is typically referred to as an heir. In Escondido California, these heirs are identified based on the intestate succession laws governing property distribution without a will. This classification is crucial in understanding who has rights to inherit from the estate.

Individuals may choose to disclaim property for various reasons, such as avoiding debts associated with the estate or tax burdens. In Escondido California, the renunciation can provide clarity and ease for heirs. This decision often allows for a more streamlined distribution process while ensuring the rightful heirs receive their due.

When a beneficiary disclaims an inheritance, the property is reallocated to the next eligible heir as per intestate succession laws. In Escondido California, this process is essential for ensuring that the estate is distributed fairly. Thus, beneficiaries can make informed decisions about their inheritances.

Individuals inheriting property through intestate succession in Escondido California receive a share of the deceased's estate as defined by state law. This may include real estate, personal belongings, or financial assets. Understanding this process can help potential heirs know what to expect during inheritance situations.

Disclaimed property refers to assets that an heir chooses not to accept. In Escondido California, this means the individual formally renounces their right to the inheritance, allowing it to pass to the next eligible heir. This process can be beneficial for those looking to avoid tax liabilities or other obligations tied to the property.