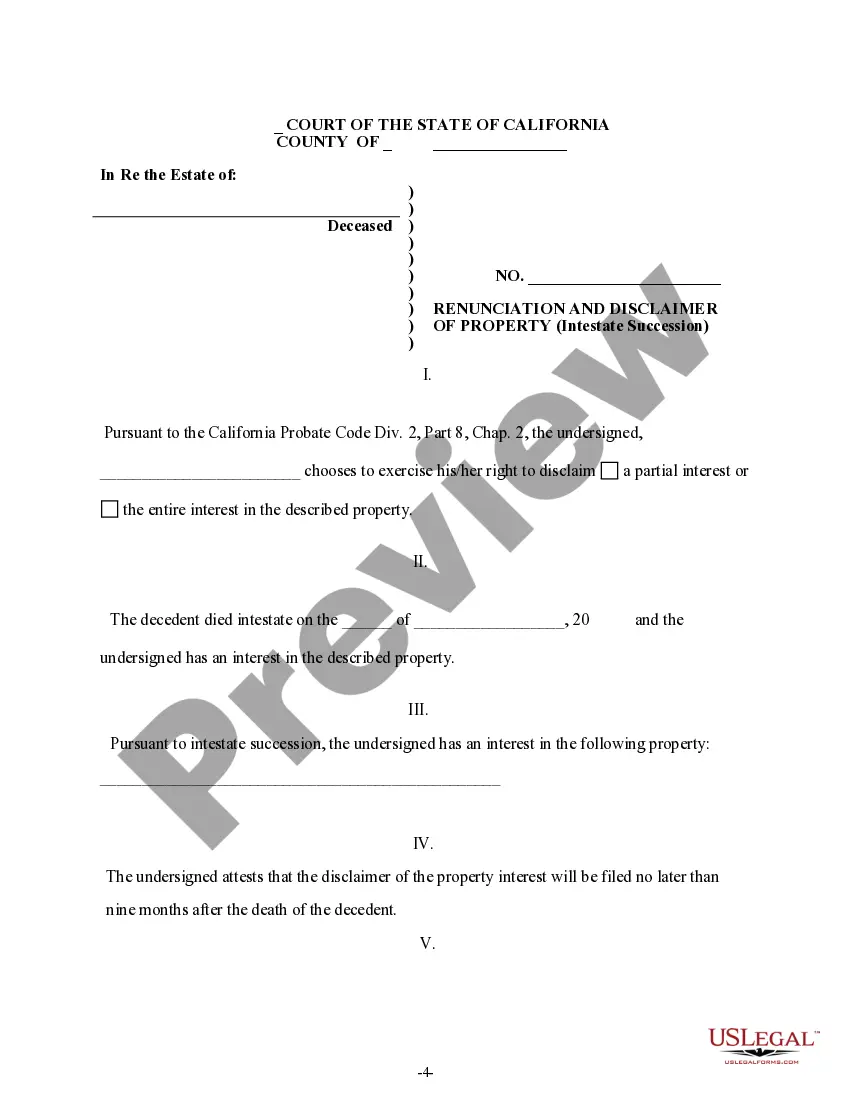

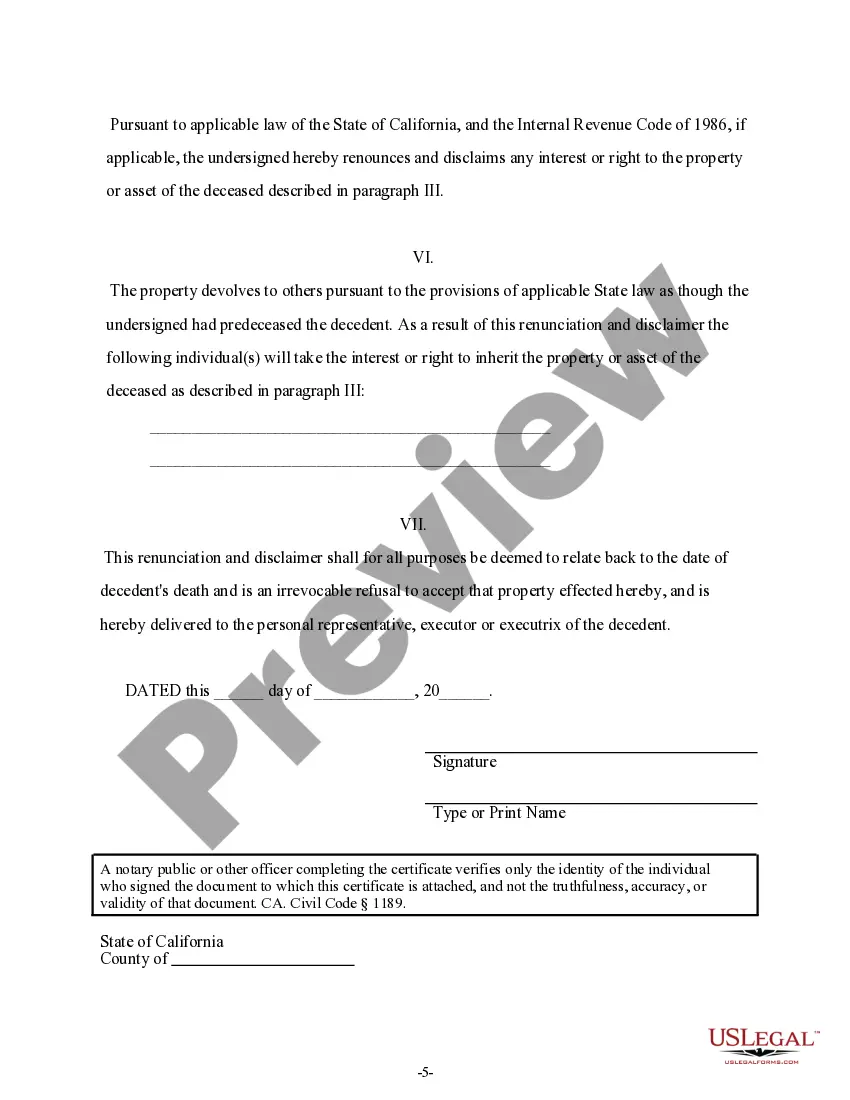

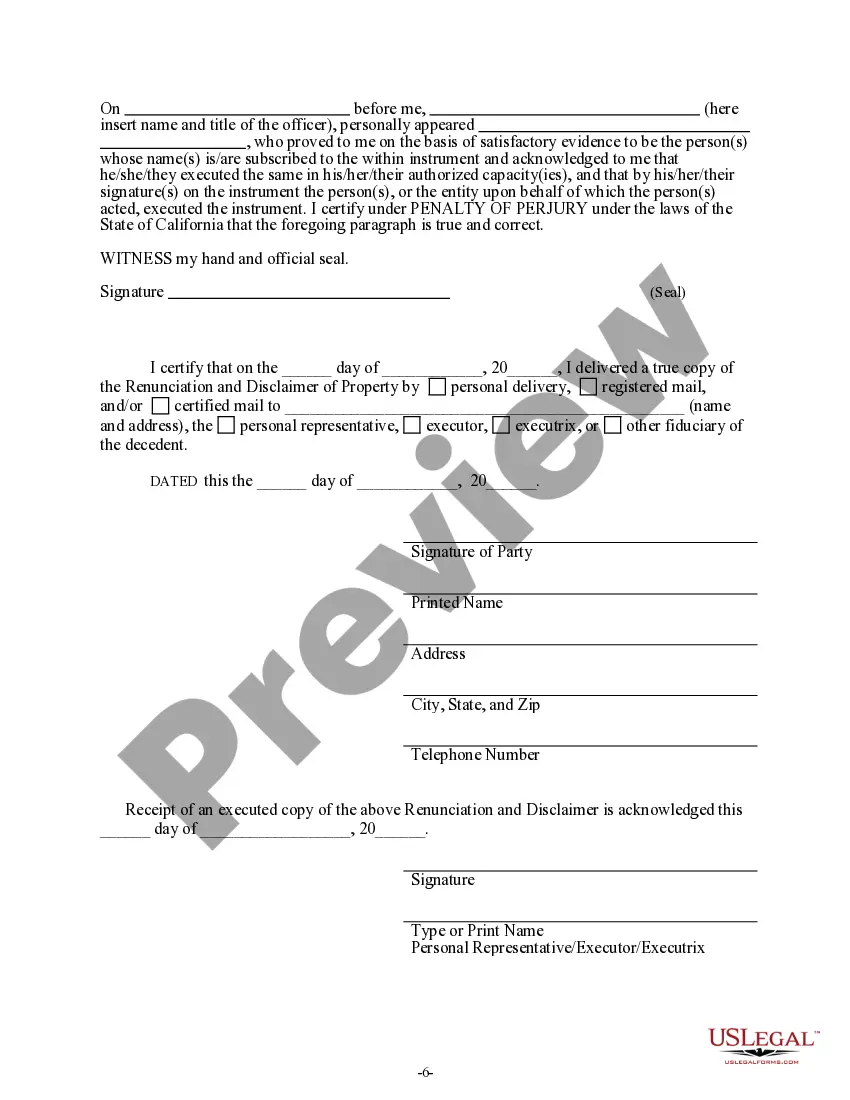

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Costa Mesa California Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

Take advantage of the US Legal Forms and gain immediate access to any document you desire.

Our advantageous platform with a substantial collection of files makes it easy to locate and obtain nearly any document sample you require.

You can export, complete, and validate the Costa Mesa California Renunciation And Disclaimer of Property acquired from Intestate Succession in just a few minutes instead of spending hours online searching for an appropriate template.

Utilizing our directory is an excellent method to enhance the security of your document submission.

If you haven’t created an account yet, follow the steps below.

Locate the document you require. Verify that it is the correct form: check its title and description, and utilize the Preview option if available. Otherwise, use the Search box to find the necessary one.

- Our experienced legal experts routinely review all the files to ensure that the forms are applicable for a specific state and adhere to new laws and regulations.

- How can you obtain the Costa Mesa California Renunciation And Disclaimer of Property gained from Intestate Succession.

- If you have a membership, simply Log In to your account. The Download feature will be activated on all the documents you view.

- Moreover, you can retrieve all previously saved files in the My documents section.

Form popularity

FAQ

In California, intestate succession rules determine how property is distributed when an individual passes away without a will. Generally, the surviving spouse and children have the primary claim to the estate, followed by parents, siblings, and more distant relatives. Familiarizing yourself with the Costa Mesa California Renunciation And Disclaimer of Property received by Intestate Succession can greatly assist in navigating these rules and ensuring rightful beneficiaries receive their inheritance.

When you disclaim an inheritance, the property typically passes to the next beneficiary in line, according to the laws of intestate succession. This means that if you renounce your claim, the property will move to the next eligible heir as defined in California law. Understanding the Costa Mesa California Renunciation And Disclaimer of Property received by Intestate Succession can help clarify the inheritance flow and ensure rightful ownership.

A beneficiary may choose to disclaim property for various reasons, including avoiding debt or tax responsibilities associated with the inheritance. Additionally, some individuals may wish to enable the property to pass directly to someone else they deem more suitable for its ownership. By utilizing the Costa Mesa California Renunciation And Disclaimer of Property received by Intestate Succession, beneficiaries can make informed decisions that align with their financial goals.

Disclaiming inherited property refers to a legal process where a beneficiary formally rejects their right to receive the property. This act can be crucial in situations where accepting the property may create financial burdens or unintended tax implications. Through the process of Costa Mesa California Renunciation And Disclaimer of Property received by Intestate Succession, individuals can ensure that the property is passed on to the next eligible heir without complications.

An inheritance disclaimer is a legal document where you formally refuse an inheritance. For instance, if you inherit a property but do not wish to accept it, you can create a disclaimer that states your intent to renounce that property. In Costa Mesa California Renunciation and Disclaimer of Property received by Intestate Succession, a well-drafted disclaimer ensures that the property is passed on according to state laws, potentially benefiting other heirs.

The intestate succession order in California dictates how assets are distributed when someone dies without a will. Generally, the surviving spouse or registered domestic partner is first in line, followed by children, parents, and siblings, among others. Understanding this hierarchy is essential for beneficiaries involved in the Costa Mesa California Renunciation and Disclaimer of Property received by Intestate Succession process.

To disclaim an inheritance letter, you must submit a written disclaimer to the estate representative, typically within a specified time frame. The disclaimer should clearly state your intention to renounce your rights to the inheritance, highlighting the specific property involved. Utilizing resources like USLegalForms can streamline this process, ensuring you comply with the necessary legal requirements under Costa Mesa California Renunciation and Disclaimer of Property received by Intestate Succession.

An inheritance letter typically details the assets and property you are set to receive following a person’s death. For instance, if you inherit a house or investment accounts, the letter outlines your rights to those assets. In the context of Costa Mesa California Renunciation and Disclaimer of Property received by Intestate Succession, this letter serves as formal communication to express your claim to the inheritance.

The probate code for intestate succession in California is primarily outlined in the California Probate Code Sections 6400-6414. This set of laws dictates how property is distributed when someone dies without a will. Understanding this code is essential for anyone navigating the probate process, especially regarding the Costa Mesa California Renunciation and Disclaimer of Property received by Intestate Succession. This ensures clarity in property rights and responsibilities among potential heirs.

In California, you are generally required to declare any inheritance for tax purposes, particularly when the inheritance is substantial. Even though property received through intestate succession can be disclaimed, any monetary value or asset must be reported on your financial statements or tax returns. If you are unsure about these obligations, consider using the US Legal Forms platform for guidance on the Costa Mesa California Renunciation and Disclaimer of Property received by Intestate Succession.