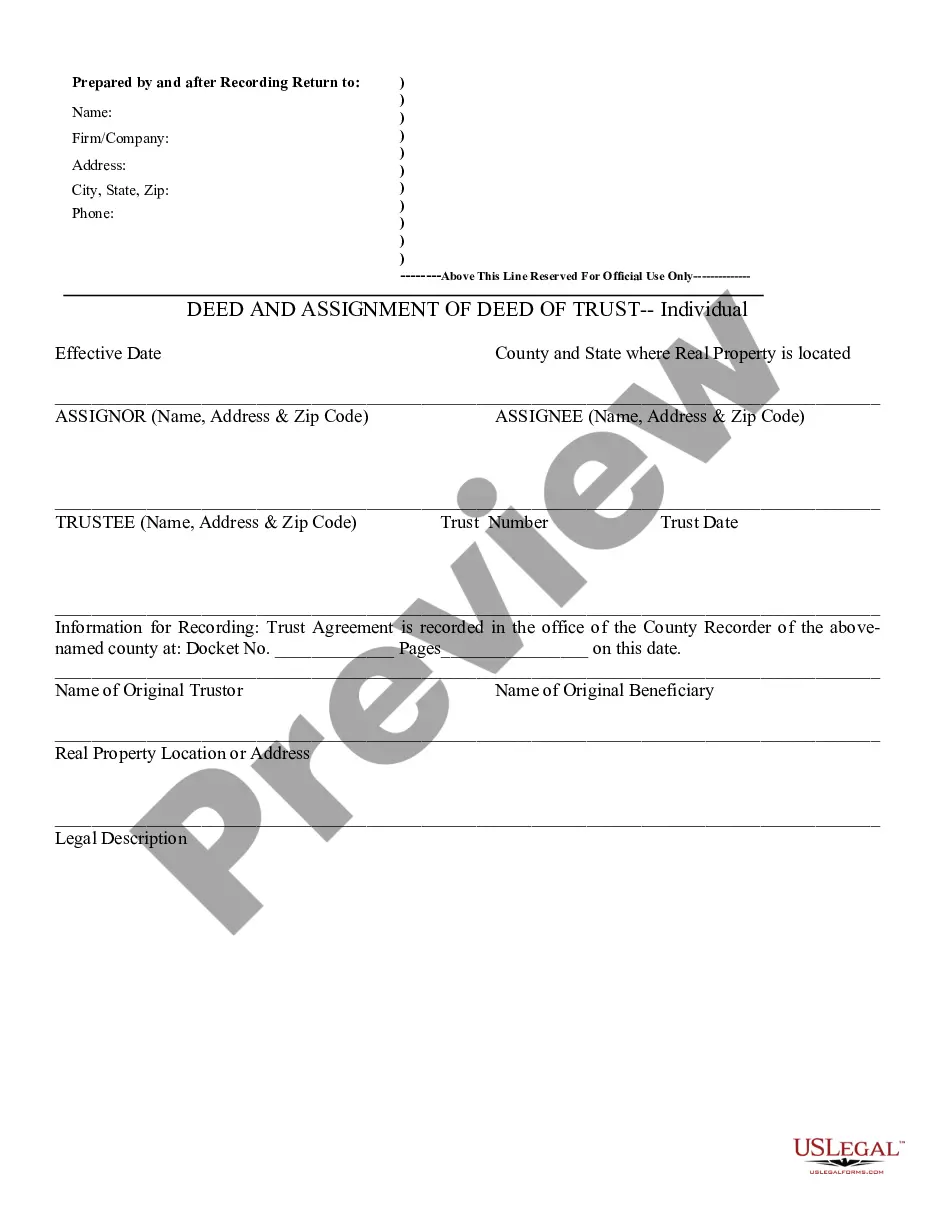

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed & Assignment of Beneficial Interest in Realty Trust, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

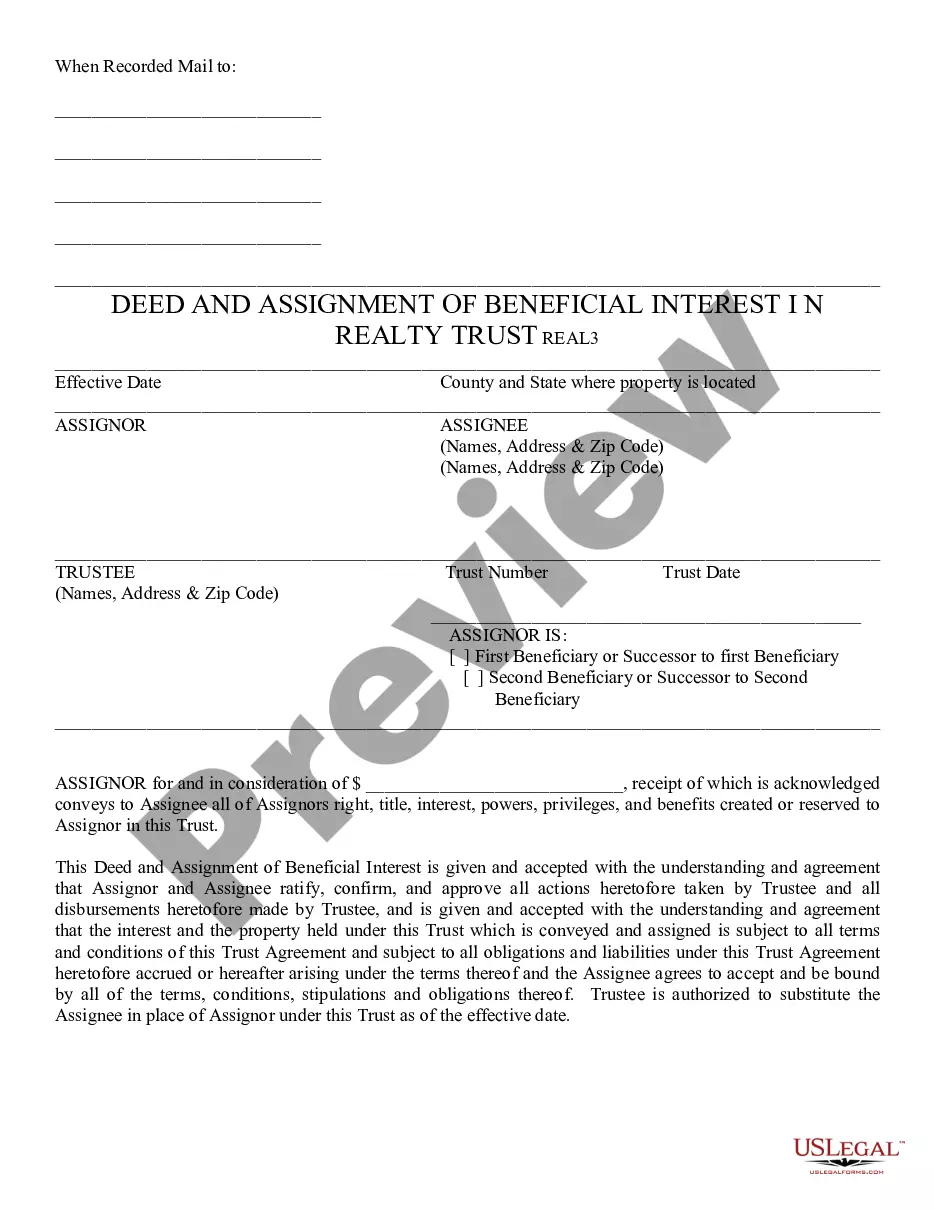

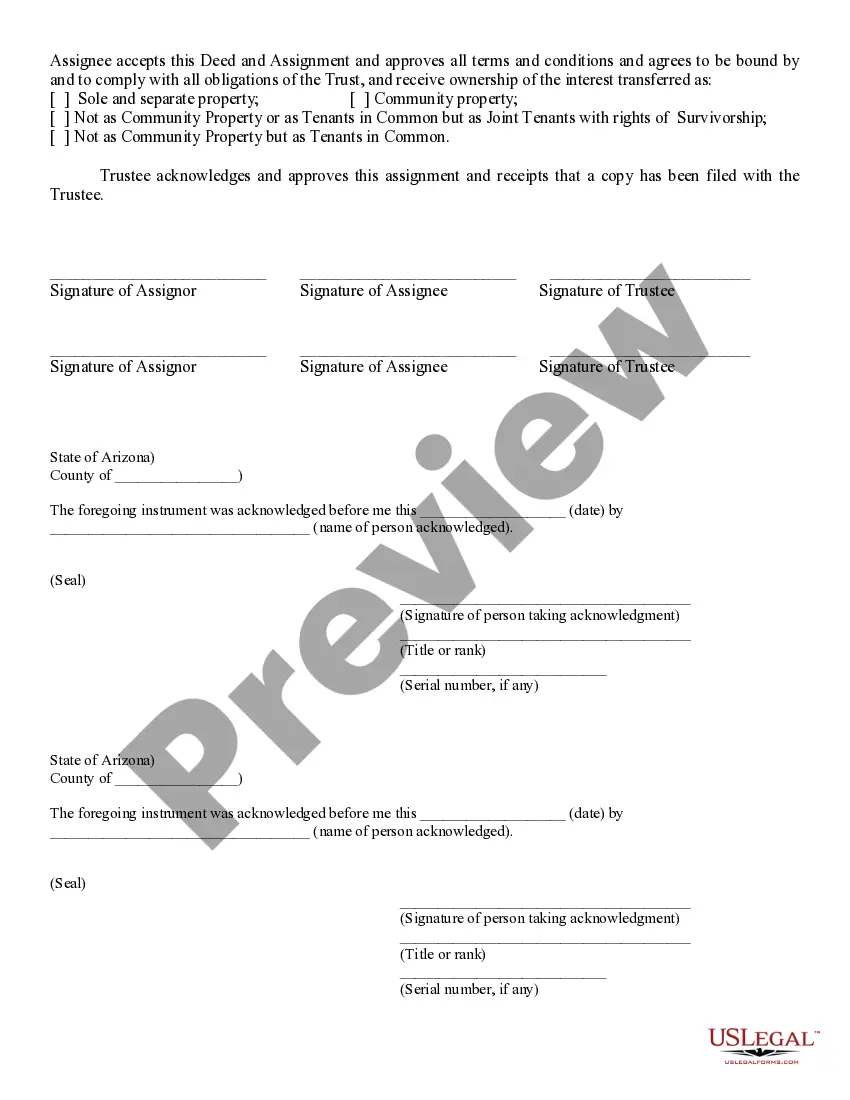

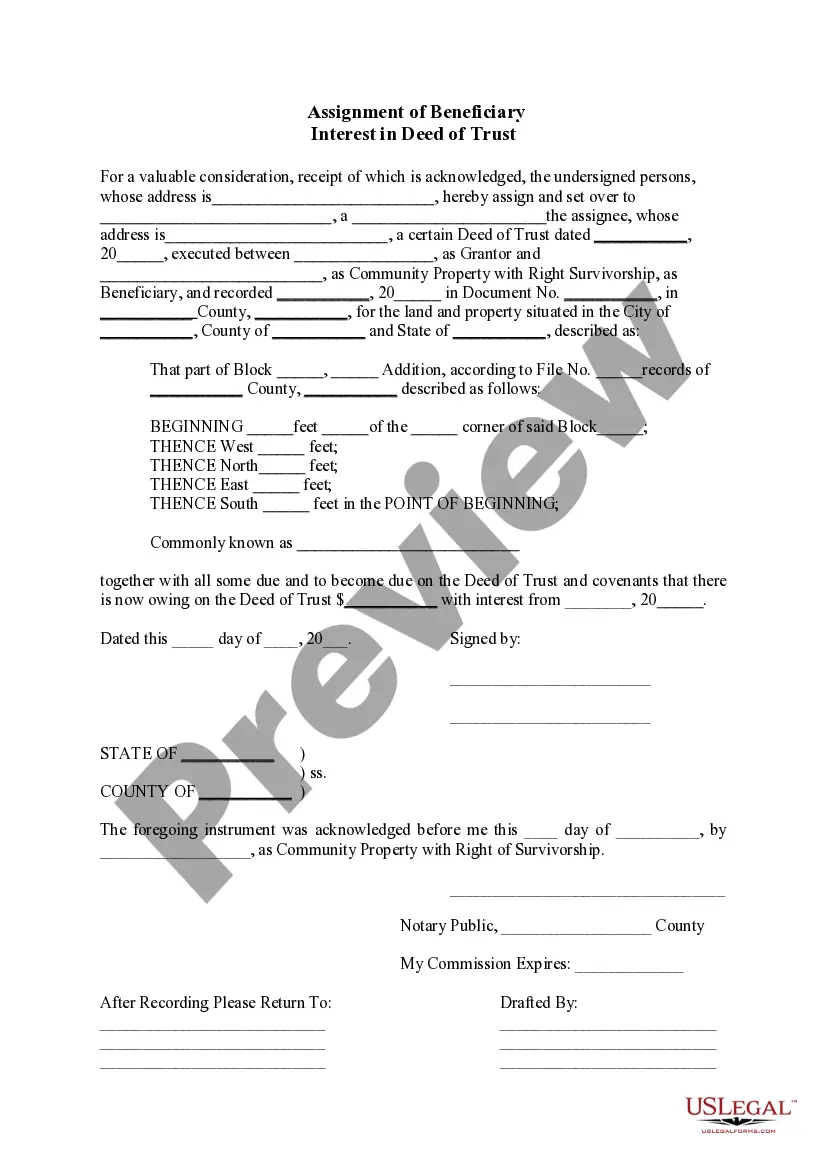

Phoenix Arizona Deed and Assignment of Beneficial Interest in Realty Trust

Description

How to fill out Arizona Deed And Assignment Of Beneficial Interest In Realty Trust?

If you are looking for an authentic form, it’s incredibly challenging to locate a more suitable site than the US Legal Forms platform – likely the most comprehensive online repositories.

Here you can discover numerous form examples for business and personal use sorted by categories and locations, or keywords.

With the enhanced search function, locating the latest Phoenix Arizona Deed and Assignment of Beneficial Interest in Realty Trust is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to conclude the sign-up process.

Acquire the template. Choose the file format and download it to your computer.

- Moreover, the pertinence of each document is confirmed by a group of expert lawyers who routinely review the templates on our site and refresh them according to the most recent state and county regulations.

- If you are already aware of our platform and possess a registered account, all you need to obtain the Phoenix Arizona Deed and Assignment of Beneficial Interest in Realty Trust is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure that you have accessed the sample you need. Review its description and make use of the Preview feature (if applicable) to examine its content. If it does not satisfy your needs, utilize the Search bar at the top of the screen to find the required document.

- Confirm your choice. Click the Buy now button. Subsequently, select your desired subscription plan and enter details to register for an account.

Form popularity

FAQ

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

In Maricopa County, Arizona, you can do this at either the main office in Phoenix, at 111 S. Third Avenue, or in Mesa at 222 E. Javelina Avenue. The recorder will need your original deed or a legible copy with original signatures.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

Real Estate ? Real estate which is to be transferred into a trust must be conveyed in an Arizona Deed. The document must be signed by all parties in front of a Notary Public and filed with the County Recorder's Office.

Arizona allows individuals to transfer property to a beneficiary through what is known as a beneficiary deed. A beneficiary deed is sometimes referred to as a ?transfer on death deed,? or TOD deed. It is a legal document that grants a residential property to a designated beneficiary upon the death of an individual.

? Beneficiary deeds are filed in the Maricopa County Recorder's Office.

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage. Grandchildren and great-grandchildren.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.