Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust

Description

How to fill out Arizona Assignment Of Beneficiary Interest In Deed Of Trust?

We consistently seek to diminish or avert legal complications when managing intricate legal or financial matters.

To achieve this, we enroll in legal services that are often quite expensive.

Nevertheless, not every legal problem is similarly intricate; most can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it.

- Our repository empowers you to manage your own affairs without resorting to a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, significantly easing the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust or any other form conveniently and securely.

Form popularity

FAQ

When you add someone to a deed in Arizona, it can trigger property tax reassessment and potential gift tax implications. Generally, the value of the property transferred to the new person may be subject to taxation. The Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust allows you to consider these factors carefully, ensuring you make informed decisions. Consulting with a tax professional can further clarify any concerns related to taxes.

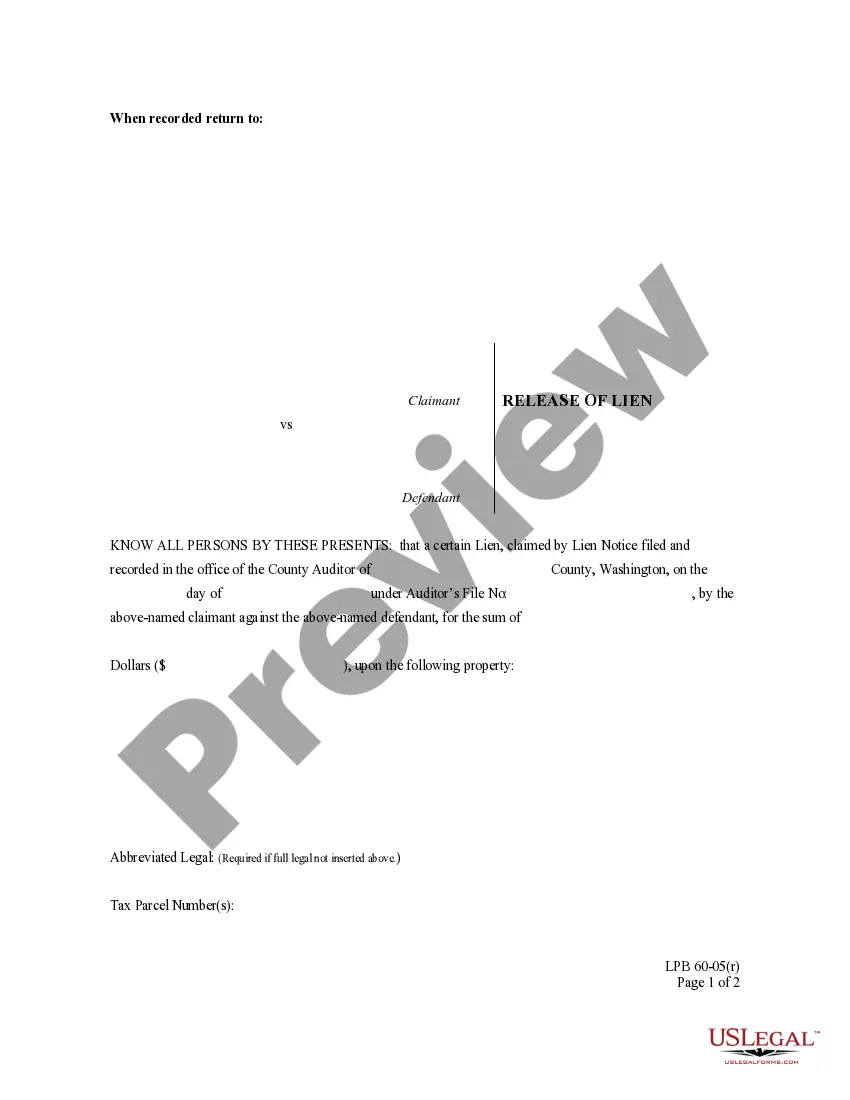

You file a beneficiary deed in the county recorder's office where the property is located in Arizona. It is crucial to ensure the deed is recorded to make it legally effective. The Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust process often includes guidance on proper filing procedures, ensuring compliance with local regulations. By filing your deed correctly, you secure your interests and protect your beneficiary’s rights.

Yes, a beneficiary deed can override the provisions of a will in Arizona. If you have transferred your property through a beneficiary deed, that property will pass to the designated beneficiary, regardless of what your will states. This ensures that your chosen individual receives the property without complications. Utilizing the Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust helps clarify your intent and simplifies the transfer process.

A beneficiary deed in Arizona allows property owners to designate a beneficiary who will automatically inherit the property upon the owner's death. This means that the property can pass directly to the beneficiary without going through probate. The Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust simplifies this process, providing clear legal pathways for ownership transfer. By using such a deed, you can ensure that your wishes are fulfilled efficiently and smoothly.

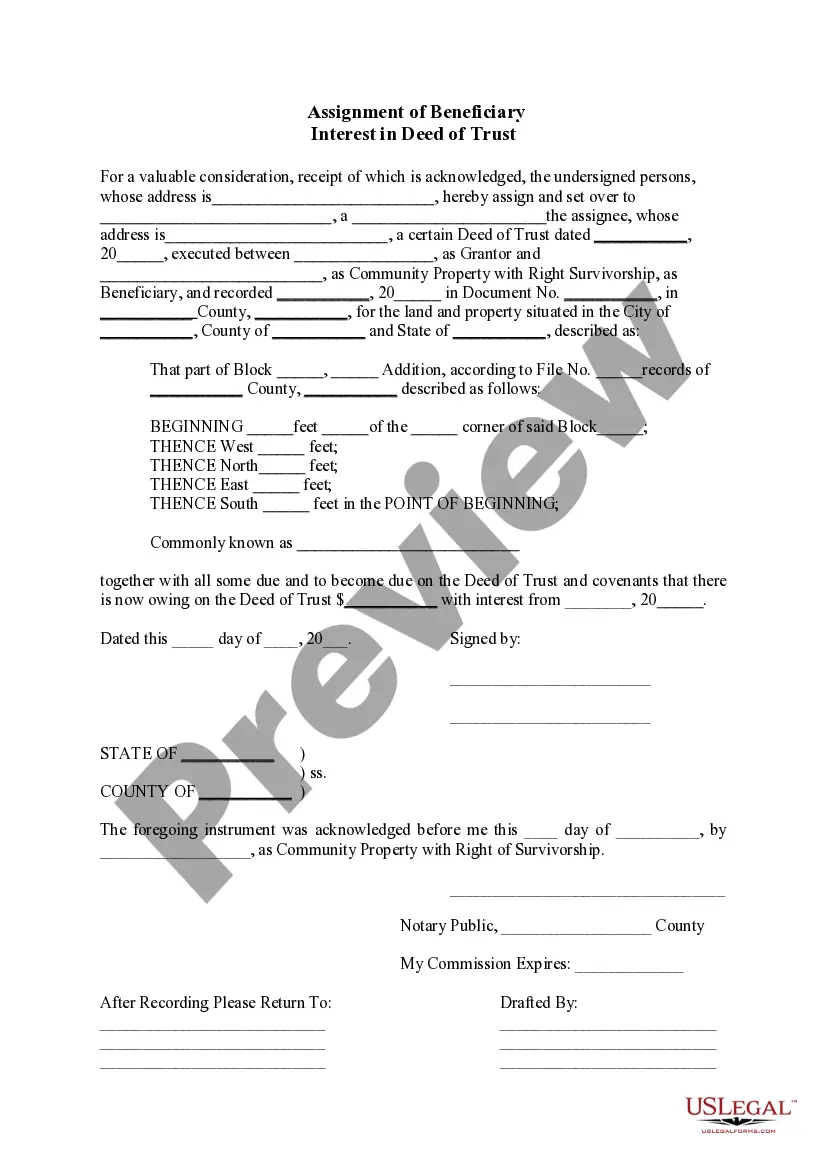

To transfer property to a trust in Arizona, you should prepare a deed that conveys the property from your name into the name of the trust. This deed must include language that clearly identifies both the property and the trust. Following the execution of the deed, it must be recorded with the county recorder's office for it to be effective. Using a resource like USLegalForms can help you navigate the Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust and ensure the transfer is done correctly.

To file a beneficiary deed in Arizona, you must first complete a valid beneficiary deed document. Once you have executed and notarized the deed, you need to submit it to the county recorder's office in the county where the property is located. Filing the document officially records your Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust, which makes your intentions clear and protects the rights of the beneficiary upon your passing. Be sure to confirm any filing fees and specific requirements with your local office beforehand.

Yes, a beneficiary deed in Arizona must be notarized to be legally valid. Notarization serves to verify the identity of the signer and ensure that the deed was executed willingly. This is a crucial step in the process of establishing the Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust because a properly notarized deed can help avoid future disputes about ownership and obligations. Always ensure that you have a notary present when signing the document to comply with state regulations.

To create a beneficiary deed in Arizona, you need to draft a document that clearly names the property, the current owner, and the beneficiary who will receive the property upon the owner's death. This deed must comply with state laws and include a legal description of the property. Utilizing resources such as USLegalForms can streamline this process, ensuring that your Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust meets all legal requirements. After drafting, you must sign the deed in front of a notary public and record it with your county assessor's office.

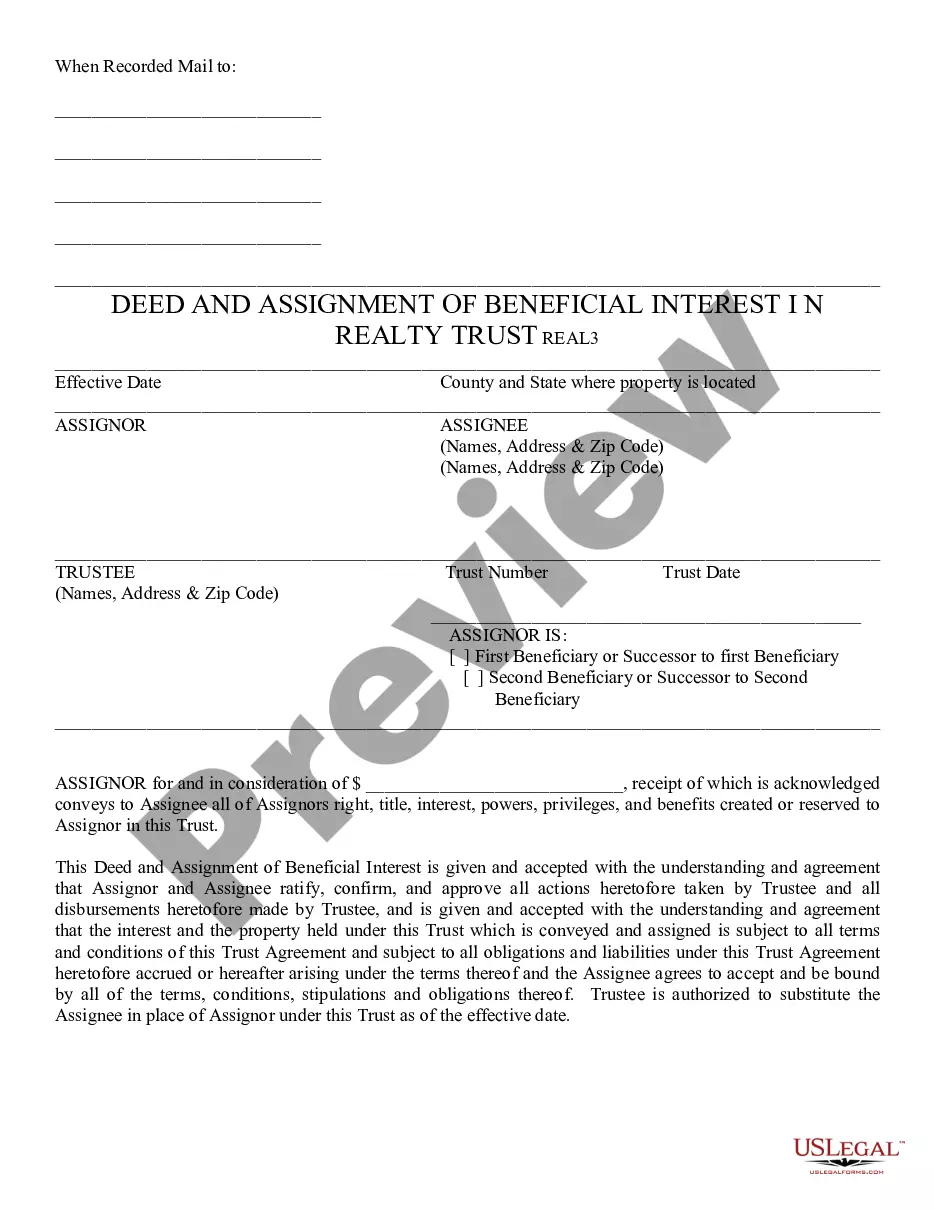

The assignment of deed of trust in Arizona refers to the transfer of the beneficial interest in a deed of trust to another party. This can occur when a lender sells the mortgage, or when the original borrower wishes to transfer their interest to a family member or another individual. The Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust allows the new beneficiary to enforce the terms of the trust. This process ensures that the new beneficiary has the right to receive payments and take action in case of a default.

Yes, a beneficiary deed in Arizona is designed to avoid probate, making the transfer of property easier for your beneficiaries upon your death. By executing this deed, property ownership automatically passes to the nominated beneficiaries, providing them with immediate rights without the need for court intervention. This streamlined process highlights the practicality of the Glendale Arizona Assignment of Beneficiary Interest In Deed of Trust. Consulting resources like US Legal Forms can help you navigate the creation of a beneficiary deed to ensure it is legally sound.