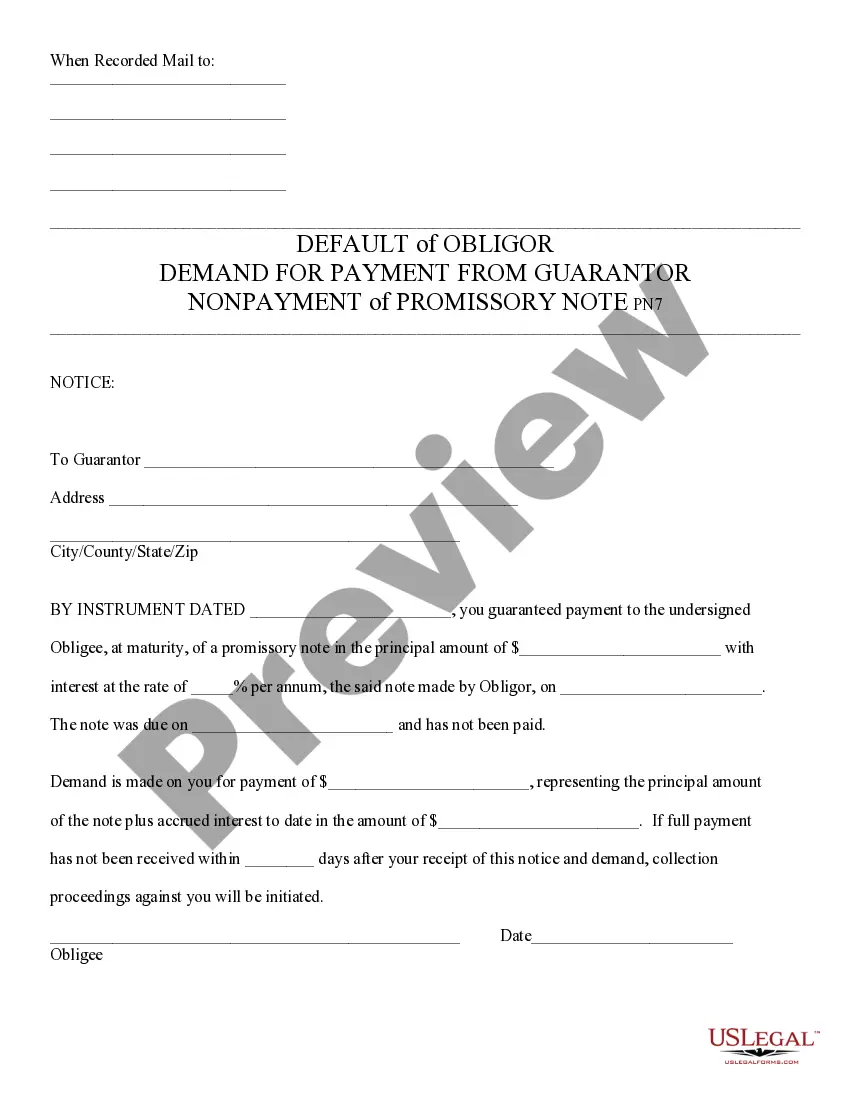

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Scottsdale Arizona Default of Promissory Note and Demand for Payment

Description

How to fill out Arizona Default Of Promissory Note And Demand For Payment?

If you are seeking a pertinent form template, it’s challenging to discover a more user-friendly service than the US Legal Forms website – likely the most extensive repositories on the web.

Here you can access a vast array of document examples for business and personal use categorized by type and state or keywords.

With the efficient search capability, obtaining the latest Scottsdale Arizona Default of Promissory Note and Demand for Payment is as simple as 1-2-3.

Complete the payment process. Use your debit card or PayPal account to finalize the registration procedure.

Acquire the template. Choose the file format and save it to your device.

- Furthermore, the relevancy of each document is verified by a team of skilled attorneys who routinely review the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Scottsdale Arizona Default of Promissory Note and Demand for Payment is to Log In to your profile and click the Download button.

- If you're utilizing US Legal Forms for the first time, simply adhere to the directions below.

- Ensure you have located the form you need. Review its description and use the Preview feature (if accessible) to examine its content. If it does not meet your requirements, utilize the Search box at the top of the screen to find the suitable document.

- Confirm your choice. Select the Buy now button. Then, pick your desired subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

If you default on a promissory note, the lender may initiate a Scottsdale Arizona Default of Promissory Note and Demand for Payment. This means the lender can demand immediate payment of the outstanding balance and any accrued interest. Additionally, failing to repay can lead to legal action, including potential court proceedings to recover the owed amount. It is crucial to address any default promptly to avoid further complications.

The 12-month default rate refers to the percentage of loans that have defaulted within a year. In Scottsdale, Arizona, this statistic helps lenders and borrowers gauge the overall health of loans in the area. A rising default rate might signal economic concerns or issues specific to the lending environment. Awareness of the 12-month default rate is essential, especially when dealing with matters of Scottsdale Arizona Default of Promissory Note and Demand for Payment.

An acceptable default rate is usually considered to be around 1% to 5%, varying by lender and market conditions. However, acceptable levels can differ based on the specific terms and agreements in Scottsdale, Arizona. If the default rate exceeds this range, it can indicate underlying issues with the borrower's ability to repay. Being informed about acceptable default rates can help you manage financial decisions related to your Scottsdale Arizona Default of Promissory Note and Demand for Payment.

A default on a promissory note occurs when the borrower fails to meet the payment terms outlined in the agreement. This can include not making scheduled payments or failing to meet other obligations outlined in the note. In Scottsdale, Arizona, a default can lead to severe financial penalties, including the potential demand for immediate payment or legal action. It's vital to be aware of the implications surrounding a Scottsdale Arizona Default of Promissory Note and Demand for Payment.

The default rate on a promissory note typically varies depending on the terms agreed upon in the contract. In Scottsdale, Arizona, this rate is often set to provide a clear understanding of consequences in case of non-payment. A higher default rate may apply if the borrower neglects their payment responsibilities, which can lead to significant financial repercussions. Understanding these details can help you navigate the Scottsdale Arizona Default of Promissory Note and Demand for Payment effectively.

Yes, a promissory note can indeed be structured as on demand, meaning the lender can request repayment at any time. This type of note is advantageous for lenders who seek quick access to funds. When faced with a Scottsdale Arizona Default of Promissory Note and Demand for Payment, being aware of this type of agreement can help navigate financial recovery more efficiently.

An example of an on-demand promissory note might be a document stating that a borrower will repay a specified amount upon the lender's request. This arrangement allows for flexibility in repayment timing, reflecting the urgent need for payment in many cases. Understanding the nuances of such notes is essential in managing a Scottsdale Arizona Default of Promissory Note and Demand for Payment.

In Arizona, a promissory note does not necessarily need to be notarized to be legally valid. However, having a notarized note may provide additional protection and clarity, especially in disputed situations. This can be particularly beneficial when dealing with a Scottsdale Arizona Default of Promissory Note and Demand for Payment.

Yes, it is possible to default on a promissory note if the borrower fails to meet their repayment obligations. A default can trigger various consequences, including legal actions to recover the owed amount. It is important to understand the implications of a default, especially in the context of Scottsdale Arizona Default of Promissory Note and Demand for Payment.

In Arizona, the statute of limitations for enforcing a promissory note is generally six years. This time frame begins from the date of default or the last payment. Understanding this limitation is critical when dealing with a Scottsdale Arizona Default of Promissory Note and Demand for Payment, as it affects your rights to collect any due amounts.