Article 9 of the Uniform Commercial Code covers most types of security agreements for personal property that are both consensual and commercial. All states have adopted and adapted the entire UCC, with the exception of Louisiana, which only adopted parts of it.

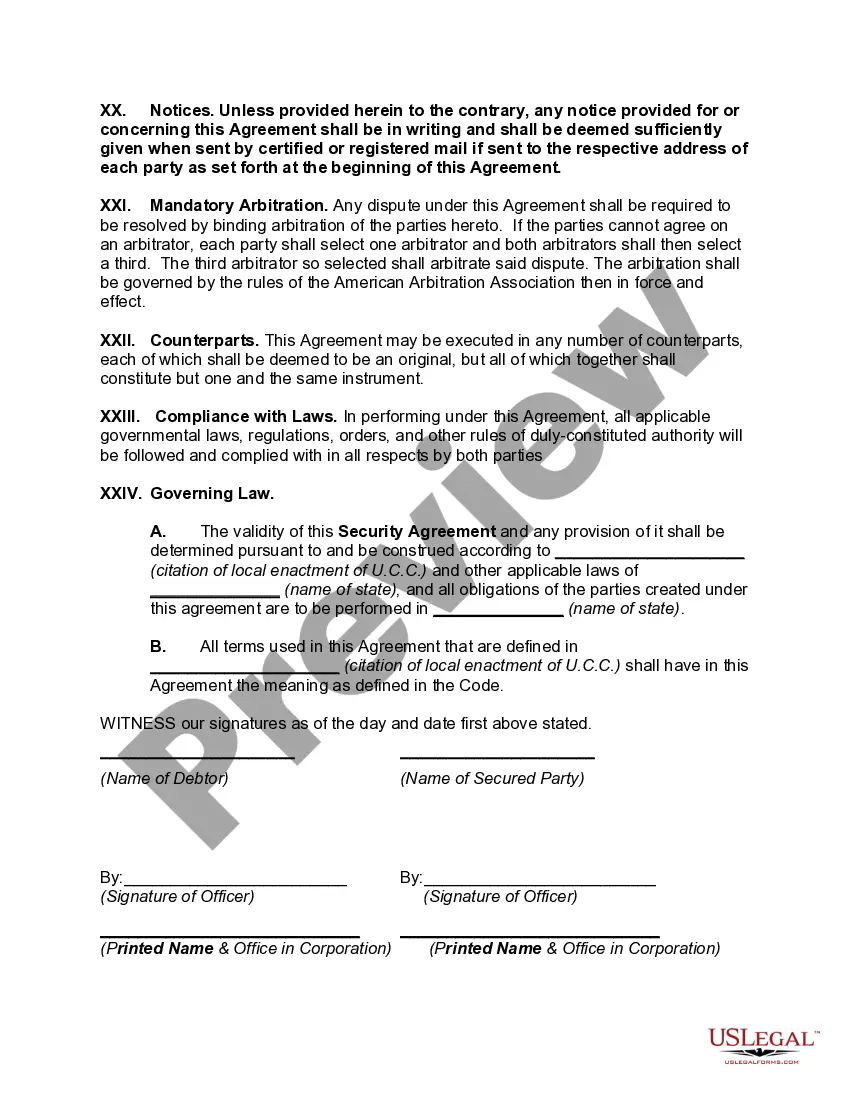

A Security Agreement Covering Inventory, Accounts Receivable and Equipment is a contract between a creditor and a debtor that states the terms and conditions of the security interest that will be taken over the debtor’s assets. The agreement is used to secure the repayment of a loan or other debt. The assets covered by the agreement include Inventory, Accounts Receivable and Equipment. The agreement outlines the obligations of the debtor, including details of the security interest, the timing of the payments, the interest rate, and the consequences in the event of a default. It also specifies the rights of the creditor, such as the ability to take possession of the collateral in the event of non-payment. The types of Security Agreement Covering Inventory, Accounts Receivable and Equipment include a General Security Agreement, an Equipment Security Agreement, and an Accounts Receivable Security Agreement. A General Security Agreement covers all assets owned by the debtor, while an Equipment Security Agreement covers only equipment owned by the debtor. Finally, an Accounts Receivable Security Agreement covers only accounts receivable owned by the debtor.