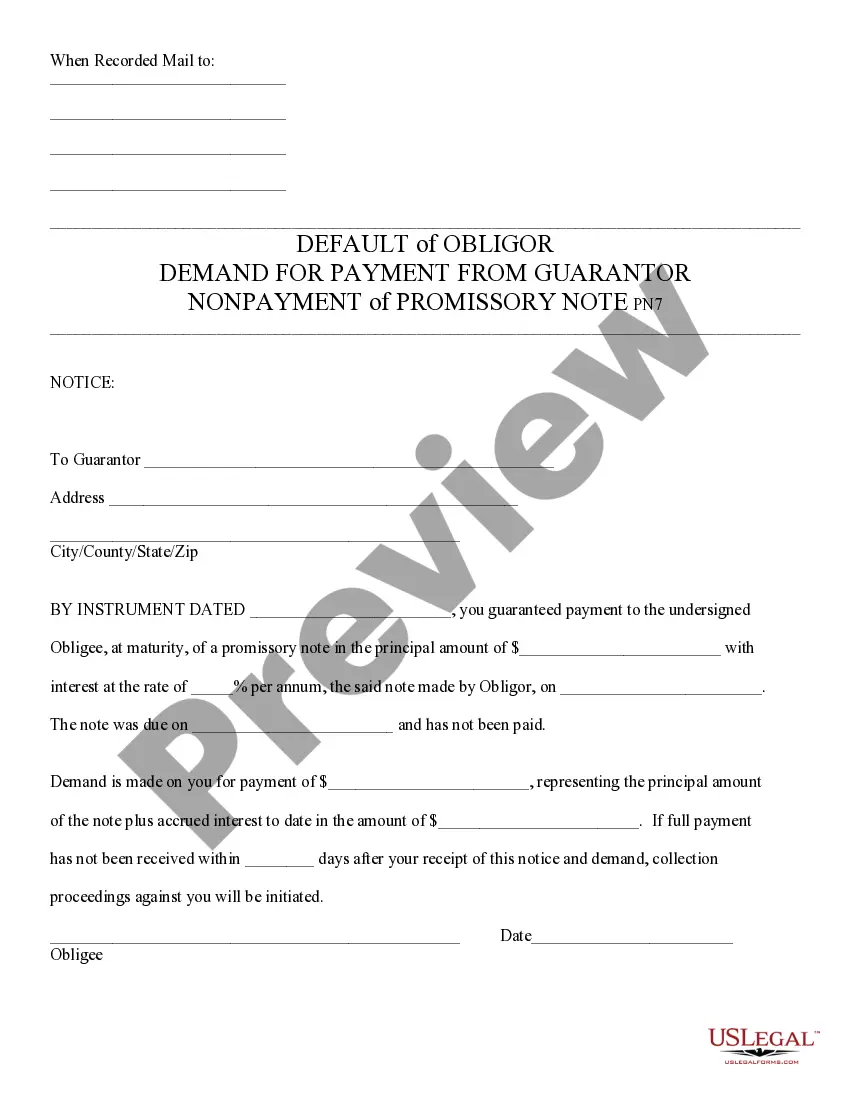

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Default of Promissory Note and Demand for Payment

Description

How to fill out Arizona Default Of Promissory Note And Demand For Payment?

We consistently endeavor to reduce or avert legal repercussions when navigating intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically quite expensive.

However, not all legal issues are equally intricate.

Most can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the Phoenix Arizona Default of Promissory Note and Demand for Payment or any other document swiftly and securely. Simply Log In to your account and click the Get button next to it. If you lose the document, you can always re-download it from the My documents section. The procedure is equally simple if you are new to the site! You can create your account in just a few minutes. Ensure to verify if the Phoenix Arizona Default of Promissory Note and Demand for Payment adheres to the laws and regulations of your state and region. Additionally, it is crucial to review the form’s outline (if available), and if you find any inconsistencies with what you initially sought, look for a different form. Once you’ve confirmed that the Phoenix Arizona Default of Promissory Note and Demand for Payment is appropriate for your situation, you can select the subscription plan and make a payment. After that, you can download the document in any suitable format. For over 24 years, we have aided millions of individuals by providing ready-to-customize and up-to-date legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal templates covering everything from wills and power of attorneys to articles of incorporation and petitions for dissolution.

- Our platform empowers you to handle your own affairs without requiring a lawyer.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, greatly enhancing the search process.

Form popularity

FAQ

Promissory Notes are negotiable instruments issued under the Negotiable Instruments Act and can be of different types, such as with single or joint borrowers, to be paid on demand or on installments, payment to be made in a lump sum, with interest or without interest.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

To enforce a promissory note, the holder must provide notice as is required per the note. If timely payment is not made by the borrower, the note holder can file an action to recover payment.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note may include a default on secured debt as part of the agreement. This means that if the borrower fails to pay under the agreed-upon terms of the promissory note, then the lender can take the secured debt as a form of payment.

Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due. Promissory notes may be used in combination with security agreements.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Introduction Item. NoDescription of suitPeriod of limitation34On a bill of exchange or promissory note payable at a fixed time after sight or after demandThree years35On a bill of exchange or promissory note payable on demand and not accompanied by any writing restraining or postponing the right to sue.Three years5 more rows ?

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.