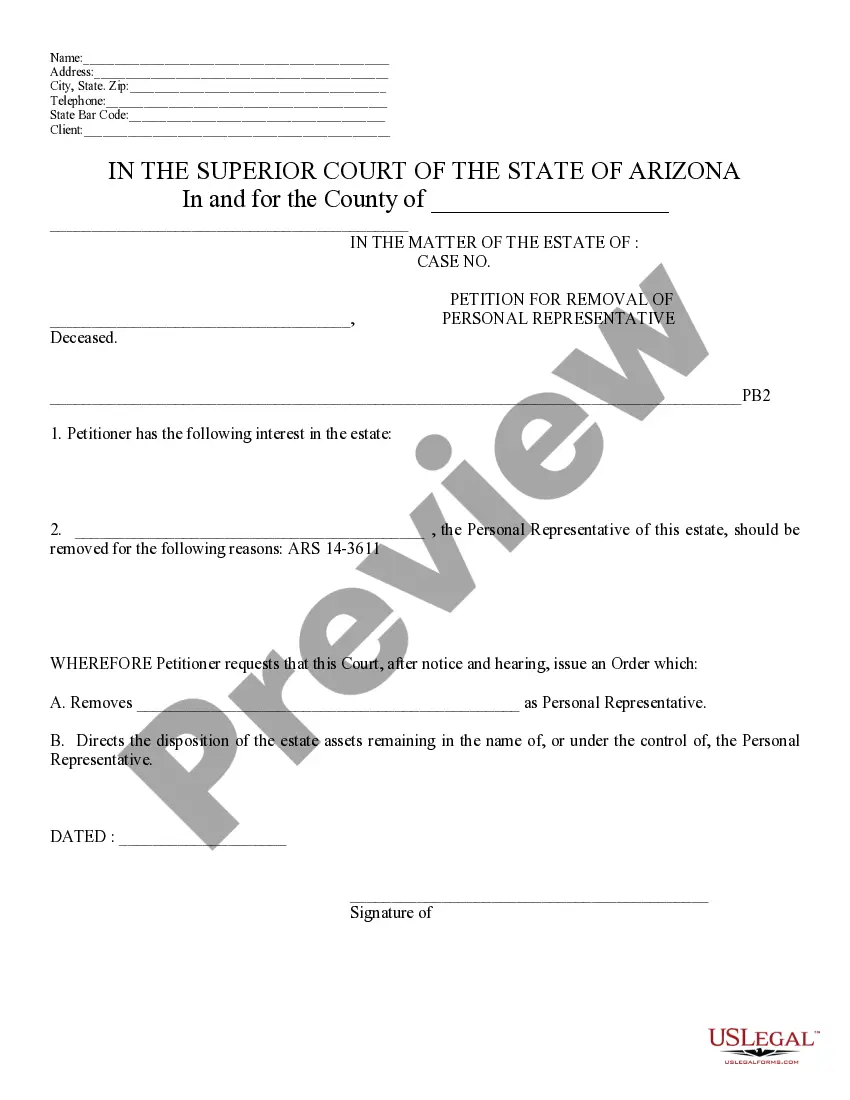

This model form, a Petition for Removal of Personal Representative - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Phoenix Arizona Petition for Removal of Personal Representative

Description

How to fill out Arizona Petition For Removal Of Personal Representative?

Finding approved templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms database.

It’s an online resource comprising over 85,000 legal documents catering to both personal and professional requirements and various real-life situations.

All the files are appropriately sorted by area of application and jurisdiction, so finding the Phoenix Arizona Petition for Removal of Personal Representative is as swift and straightforward as 123.

Maintaining documentation organized and in accordance with legal stipulations is crucial. Take advantage of the US Legal Forms library to consistently have vital document templates for all requirements readily available!

- Examine the Preview mode and form details.

- Ensure you’ve chosen the correct one that fulfills your requirements and fully complies with your local jurisdiction regulations.

- Search for a different template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one.

- Proceed to purchase the document.

Form popularity

FAQ

A person interested in the estate may petition for removal of a personal representative for cause at any time. Once the petition is filed the court will set a time and place for a hearing. Notice shall be given by the petitioner to the personal representative, and to other persons as the court may order.

For instance, if a personal representative (executor) wants to get paid from the estate for the services he/she provides, proper notice and disclosure must be made within 120 days of the appointment. Generally, personal representative (executor) compensation is based on a reasonable $25 to $50 hourly rate standard.

A Personal Representative, or executor, has 365 days in which to administer the estate of the deceased and to distribute their assets to the Beneficiaries. As complex estates can take longer than a year to wind up, this isn't a strict deadline.

In summary, there must be clear and compelling reasons that would impede the effective administration of the estate and the welfare of the beneficiaries. Clear evidence of misconduct must be provided, especially in relation to financial matters, dishonesty, or lack of good faith.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

Once the Grant has been received the personal representative has a duty to collect in the assets of the deceased, pay the liabilities and distribute the estate to the beneficiaries. They have many powers to assist them when dealing with an estate e.g. power to sell property, insure property and invest monies, etc.

You can make an application to remove an Executor either before a Grant of Probate has been issued or after. Generally, if such an application is made after the issue of a Grant of Probate, it would be made to the High Court under Section 50 of the Administration of Justice Act 1985.

There are several statutes of limitations and general time limits regarding wills and probate in Arizona, and each of them depends on the circumstances. Generally speaking, probate needs to be opened within two years of the decedent's death, and objections to the will should be submitted within the same two years.