This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Mesa Arizona Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Arizona Unsecured Installment Payment Promissory Note For Fixed Rate?

If you have previously employed our service, Log In to your account and download the Mesa Arizona Unsecured Installment Payment Promissory Note for Fixed Rate to your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment schedule.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have constant access to each document you have purchased: you can find it in your profile under the My documents section whenever you need to reuse it. Leverage the US Legal Forms service to quickly find and save any template for your personal or business requirements!

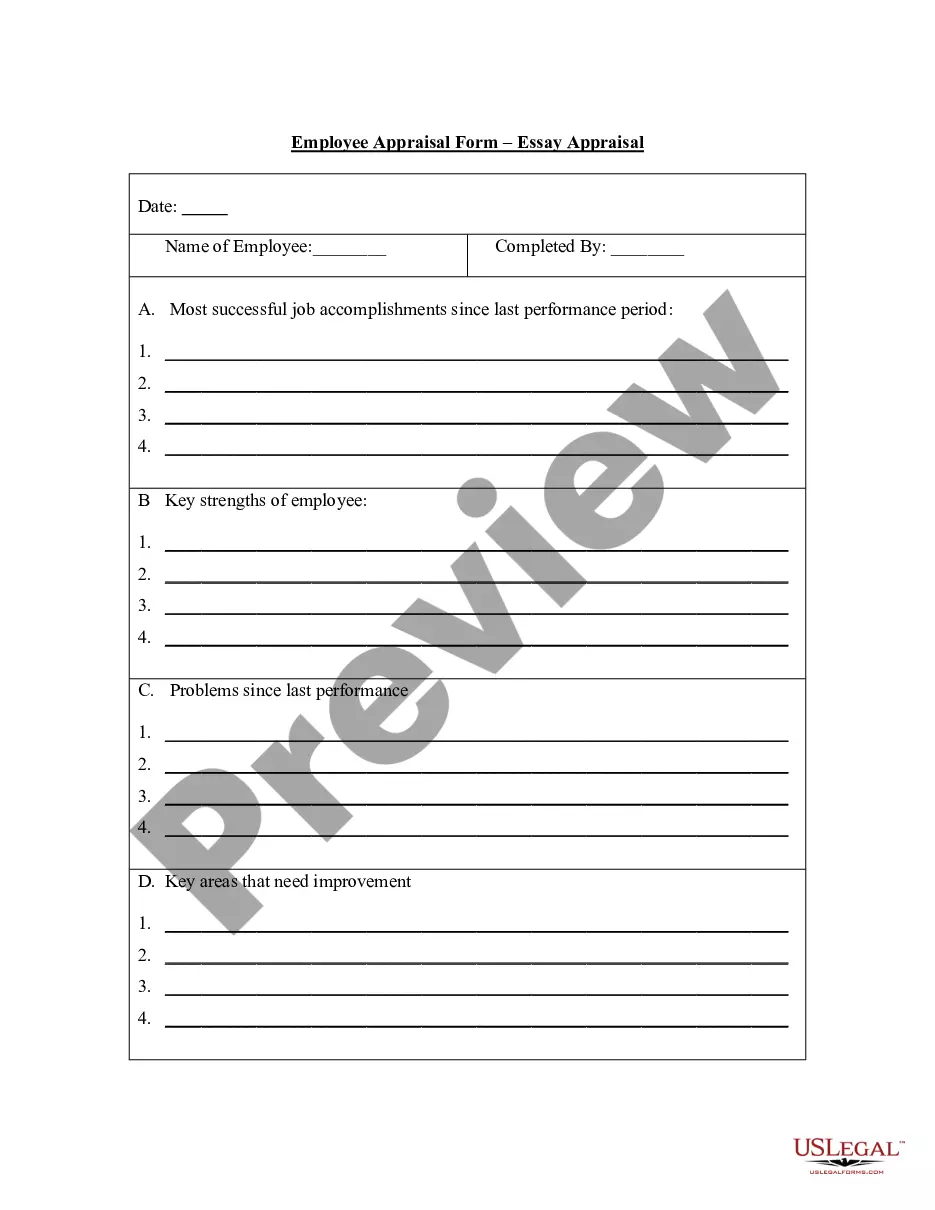

- Confirm you’ve found an appropriate document. Browse through the description and use the Preview feature, if available, to see if it fulfills your needs. If it doesn’t match your requirements, utilize the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Set up an account and process a payment. Input your credit card information or choose the PayPal option to finalize the transaction.

- Receive your Mesa Arizona Unsecured Installment Payment Promissory Note for Fixed Rate. Select the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

If you're signing a promissory note, make sure it includes these details: Date. The promissory note should include the date it was created at the top of the page. Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

How to Write a Promissory Note Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

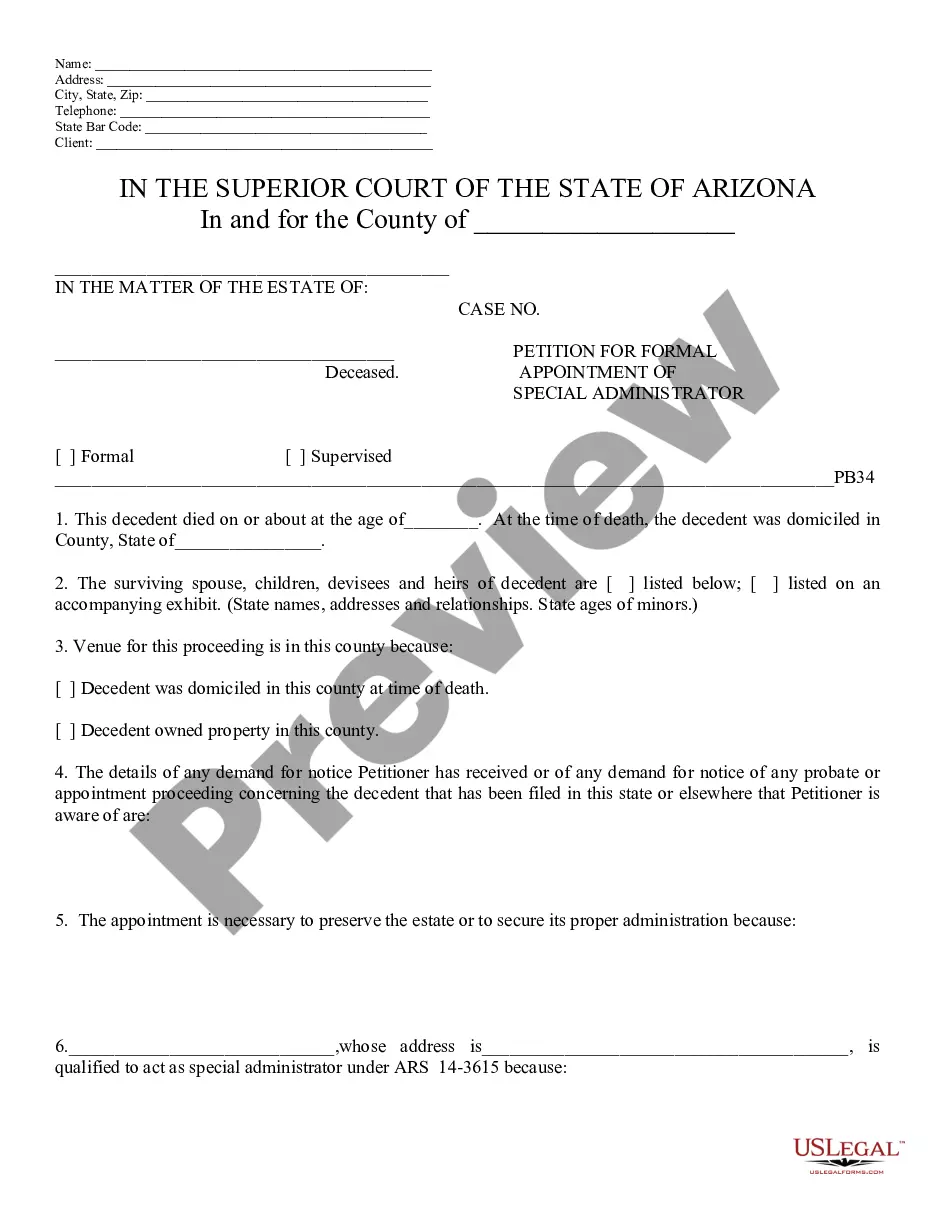

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.