The Maryland Financial Statement is an itemized financial report that is filed with the Maryland State Department of Assessments and Taxation (SEAT). It is a document that details the financial activity of a business or individual in the state of Maryland. The Maryland Financial Statement includes information such as assets, liabilities, income, expenses, and other financial data that must be reported to the state of Maryland. It is used to determine the amount of taxes that an individual or business owes to the state. There are two types of Maryland Financial Statement: the Short Form Financial Statement and the Long Form Financial Statement. The Short Form Financial Statement is used to report an individual's or business's financial data to the state, while the Long Form Financial Statement is used to report more detailed financial information. Both forms of the Maryland Financial Statement are required to be filed with the SEAT annually.

Maryland Financial Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Financial Statement?

How much time and resources do you generally allocate for creating official documents.

There's a more advantageous option for obtaining such forms than recruiting legal professionals or spending hours scouring the internet for an appropriate template. US Legal Forms is the premier online repository that provides expertly crafted and verified state-specific legal paperwork for all purposes, including the Maryland Financial Statement.

Another advantage of our service is that you can reach previously downloaded documents that are securely stored in your profile under the My documents tab. Access them at any time and re-complete your paperwork as often as required.

Conserve time and effort when preparing official documents with US Legal Forms, one of the most reliable online services. Join us today!

- Review the form content to ensure it adheres to your state guidelines. To do this, consult the form description or utilize the Preview option.

- If your legal template fails to fulfill your needs, locate an alternative using the search bar located at the top of the page.

- If you are already a member of our service, Log In and retrieve the Maryland Financial Statement. If not, continue to the subsequent steps.

- Click Buy now after locating the appropriate document. Select the subscription plan that best fits your needs to access the complete offerings of our library.

- Create an account and pay for your subscription. Payments can be made via credit card or PayPal - our service is entirely secure for transactions.

- Download your Maryland Financial Statement to your device and complete it on a printed hard copy or electronically.

Form popularity

FAQ

Rule 9-205.2 - Parenting Coordination (a) Applicability. This Rule applies to the appointment of parenting coordinators by a court and to consent orders approving the employment of parenting coordinators by the parties in actions under this Chapter.

Child Support Guidelines Have Changed Meaning Increased Child Support for Many Parents. The legislature recently changed the Maryland Child Support Guidelines such that beginning July 1, 2022, child support increases for parents whose combined adjusted actual income is more than $19,200/year.

Rule 9-204 - Educational Seminar (a) Applicability. This Rule applies in an action in which child support, custody, or visitation is involved and the court determines to send the parties to an educational seminar designed to minimize disruptive effects of separation and divorce on the lives of children.

Financial information can be found on the company's web page in Investor Relations where Securities and Exchange Commission (SEC) and other company reports are often kept. The SEC has financial filings electronically available beginning in 1993/1994 free on their website. See EDGAR: Company Filings.

Child Care Expenses: Actual child care expenses incurred on behalf of a child due to employment or job search of either parent with amount to be determined by actual experience or the level required to provide quality care from a licensed source.

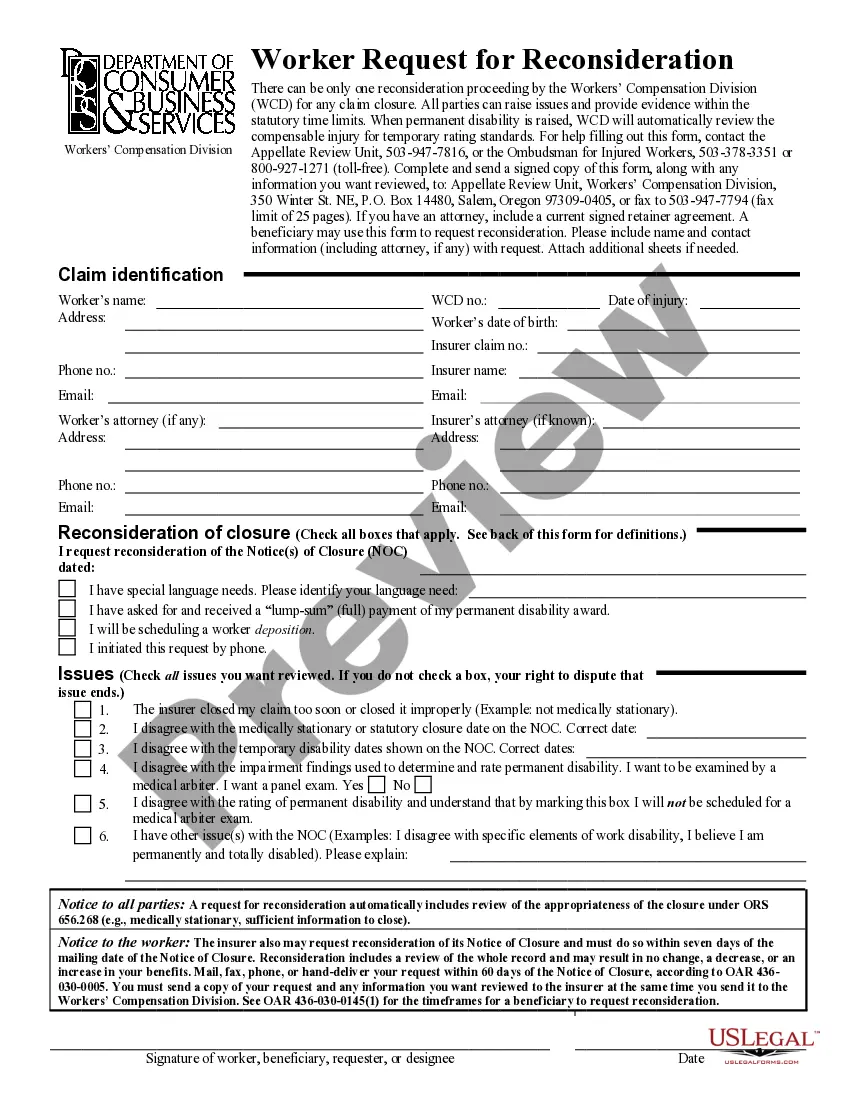

A Maryland Long Form Financial Statement is a key document which the Court relies on when determining child support and alimony and is often used by the court to determine whether a party should be awarded attorney's fees.

Rule 9-202 - Pleading (a)Signing-Telephone Number. A party shall personally sign each pleading filed by that party and, if the party is not represented by an attorney, shall state in the pleading a telephone number at which the party may be reached during ordinary business hours.