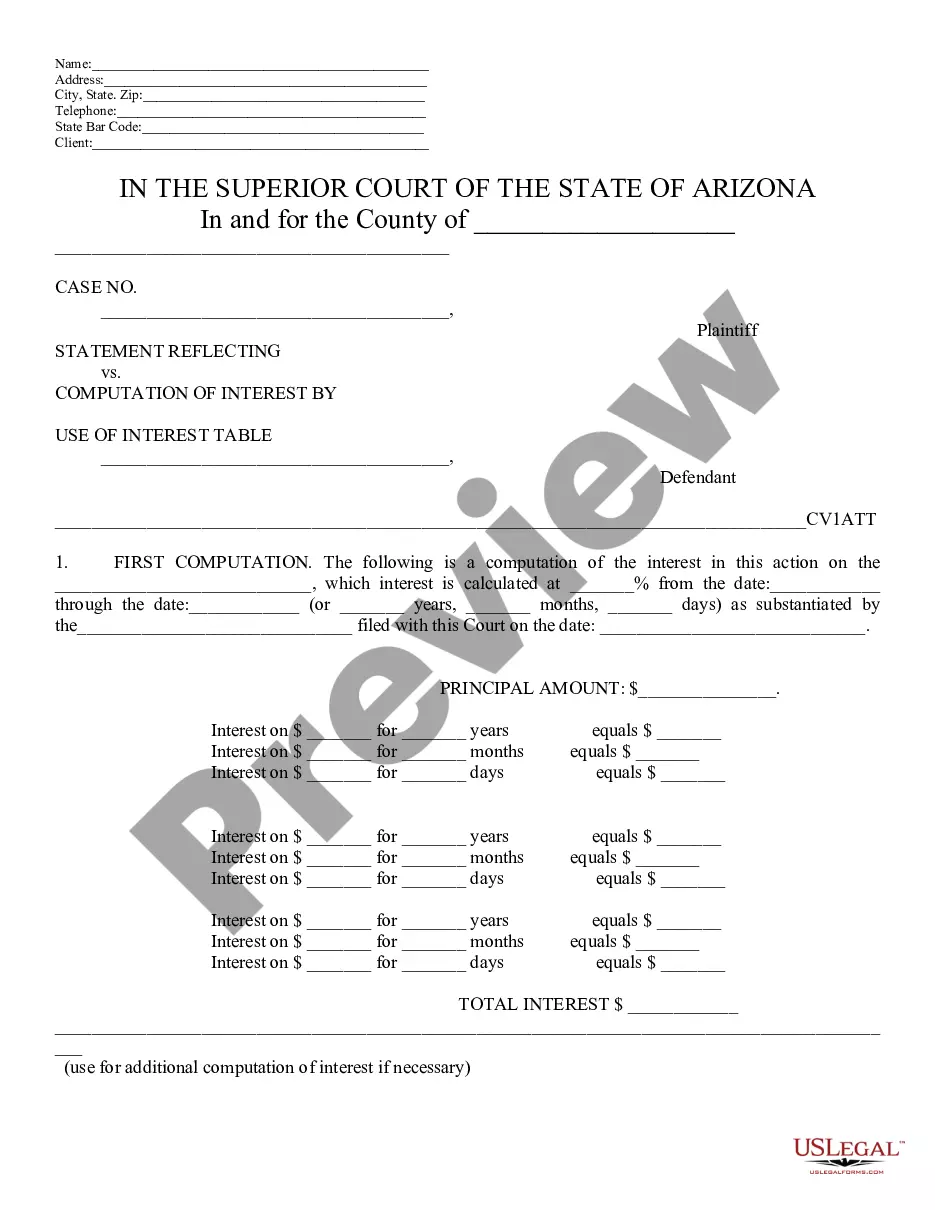

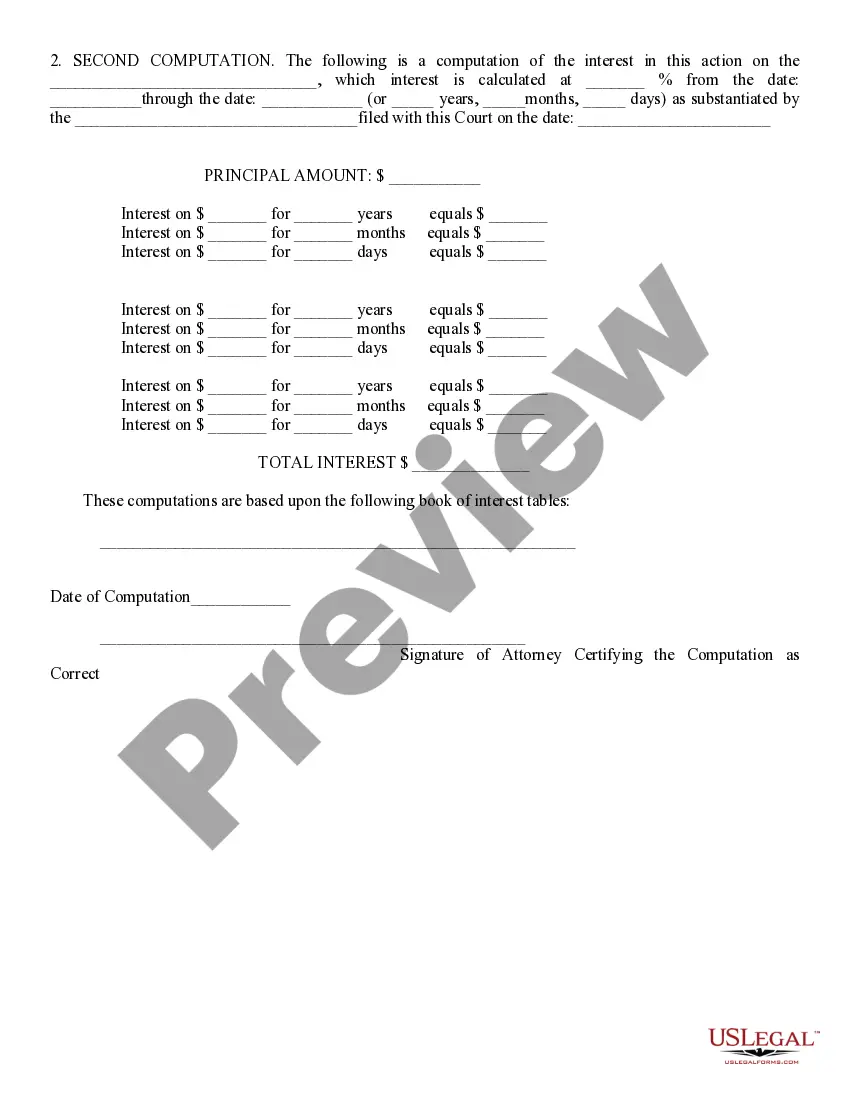

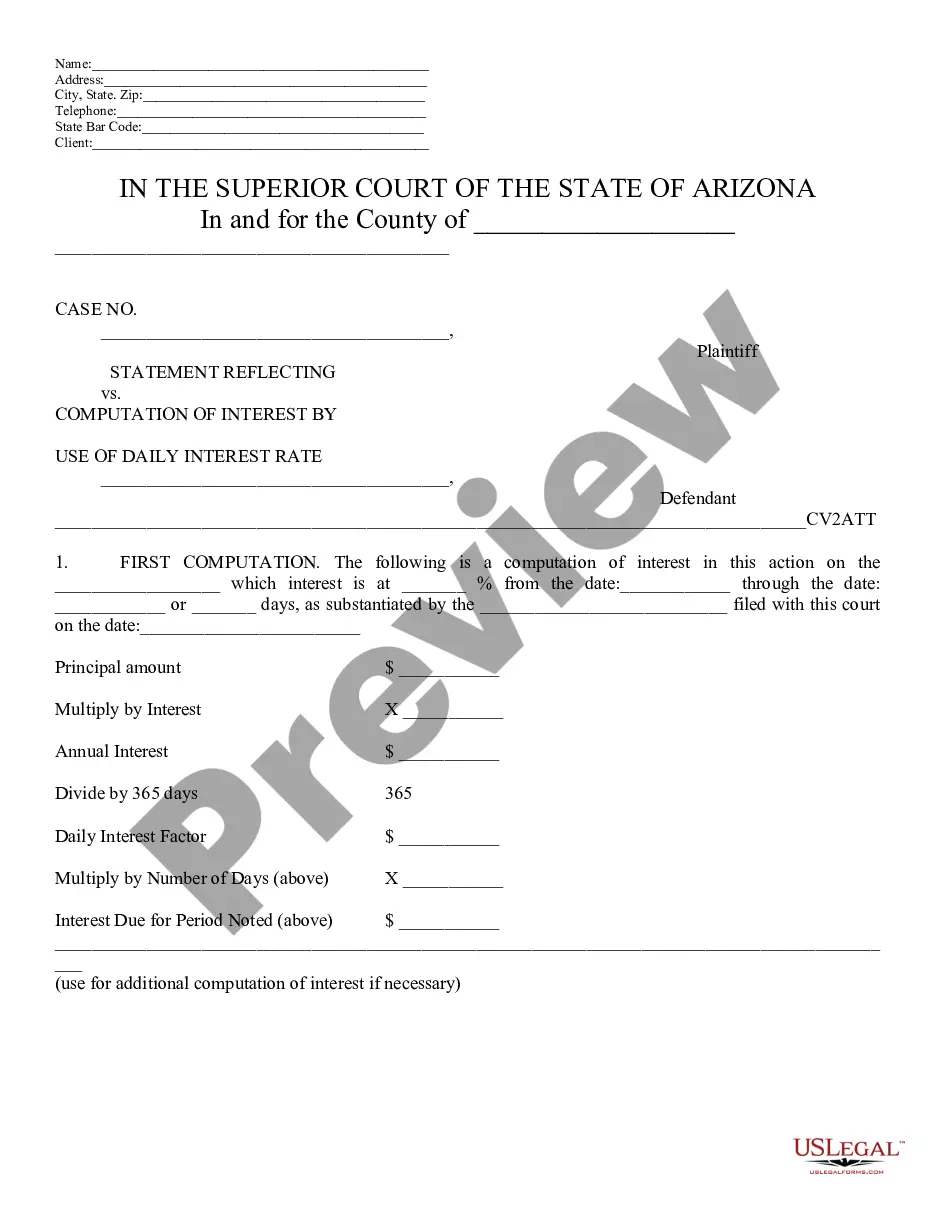

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table

Description

How to fill out Arizona Statement Reflecting Computation Of Interest Using Interest Table?

We consistently seek to minimize or evade legal complications when handling subtle law-related or financial issues. To achieve this, we enroll in legal assistance solutions that are generally quite expensive.

However, not every legal complication is inherently difficult. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform empowers you to take control of your affairs without resorting to legal representation.

We offer access to legal document templates that are not always publicly accessible. Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Be sure to verify if the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table complies with the laws and regulations of your state and locality.

- Utilize US Legal Forms whenever you need to locate and acquire the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table or any other document promptly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

- If you misplace the document, you can always retrieve it again in the My documents section.

- The procedure remains just as straightforward if you are unacquainted with the platform!

Form popularity

FAQ

In Arizona, various types of income are taxable, including wages, pensions, and interest from non-exempt sources. Being aware of the types of income that are liable for tax is essential for proper financial planning. It can prevent surprises at tax time. Using the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can offer guidance on navigating your taxable income.

The property tax rate in Surprise, Arizona, is approximately 0.67% of the assessed value of the property. This rate can vary slightly depending on various factors, including local assessments. Property owners should be aware of these rates for effective budgeting. Utilizing the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can help manage your financial expectations regarding property taxes.

Yes, interest income is generally taxable in Arizona, including interest from savings accounts and investments. However, specific interest types may have different tax implications. It's essential to understand your tax responsibilities. The Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can clarify how much you’ll owe based on your interest earnings.

In Arizona, retirees may find that some forms of income are subject to tax, while others are not. For instance, Social Security benefits are not taxed, but pensions and withdrawals from traditional retirement accounts can be taxable. Retirees should review their income sources carefully. Utilizing the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can assist in managing these taxes.

Surprise, Arizona has a sales tax rate of 8.6%. This rate includes the state sales tax along with the local tax. It's important to factor this into your budget when making purchases in the area. Understanding the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can help you calculate any relevant costs.

The new tax rate in Arizona is determined by various factors, including economic performance and legislative adjustments. Keeping abreast of these rates can optimize your tax strategy. Whether you are an individual or a business, understanding the nuances of the new tax regulations is vital. The Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can guide you in navigating these changes effectively.

Arizona state income tax brackets are structured to reflect income ranges and tax responsibilities. These brackets can affect how much you owe each year. Understanding these categories is essential for effective tax planning. For details on income tax calculations and implications, refer to the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table.

As of 2025, Arizona's sales tax is calculated based on state and local rates combined. This aggregate tax rate affects various purchases, and staying updated ensures precise budgeting. Adjustments may occur based on fiscal policies, so it is wise to check official resources. The Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can provide insight into how these taxes may impact your finances.

Surprise, AZ imposes a rental tax on short-term rentals to support local infrastructure and services. The current rental tax rate is a key consideration for property owners in the area. Understanding how this tax works can help you make informed decisions about renting out property. You can find relevant information using the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table.

In 2025, Arizona will introduce new tax brackets to accommodate shifts in the economy. These brackets will determine how much income is taxed at the state level. As such, keeping track of income levels and corresponding brackets is crucial. The Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table can help clarify how these brackets may affect your financial situation.