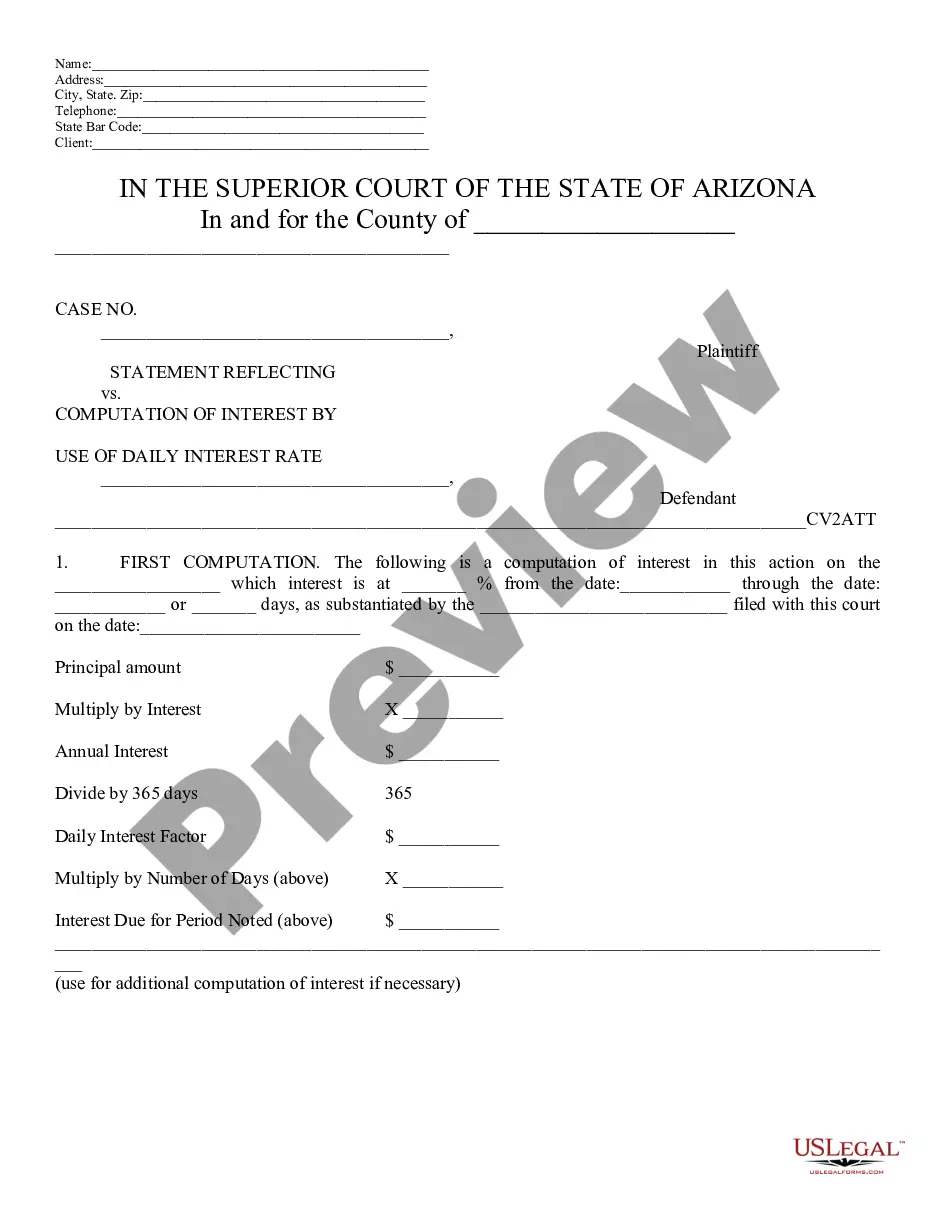

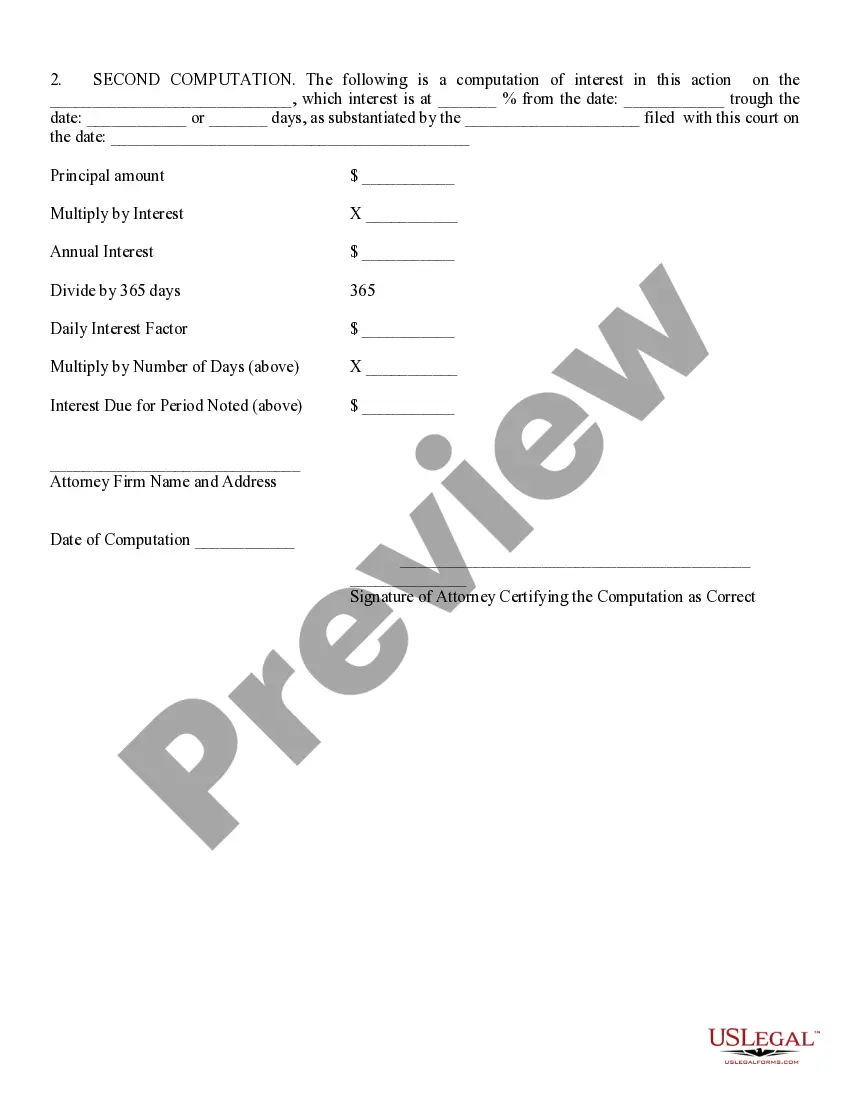

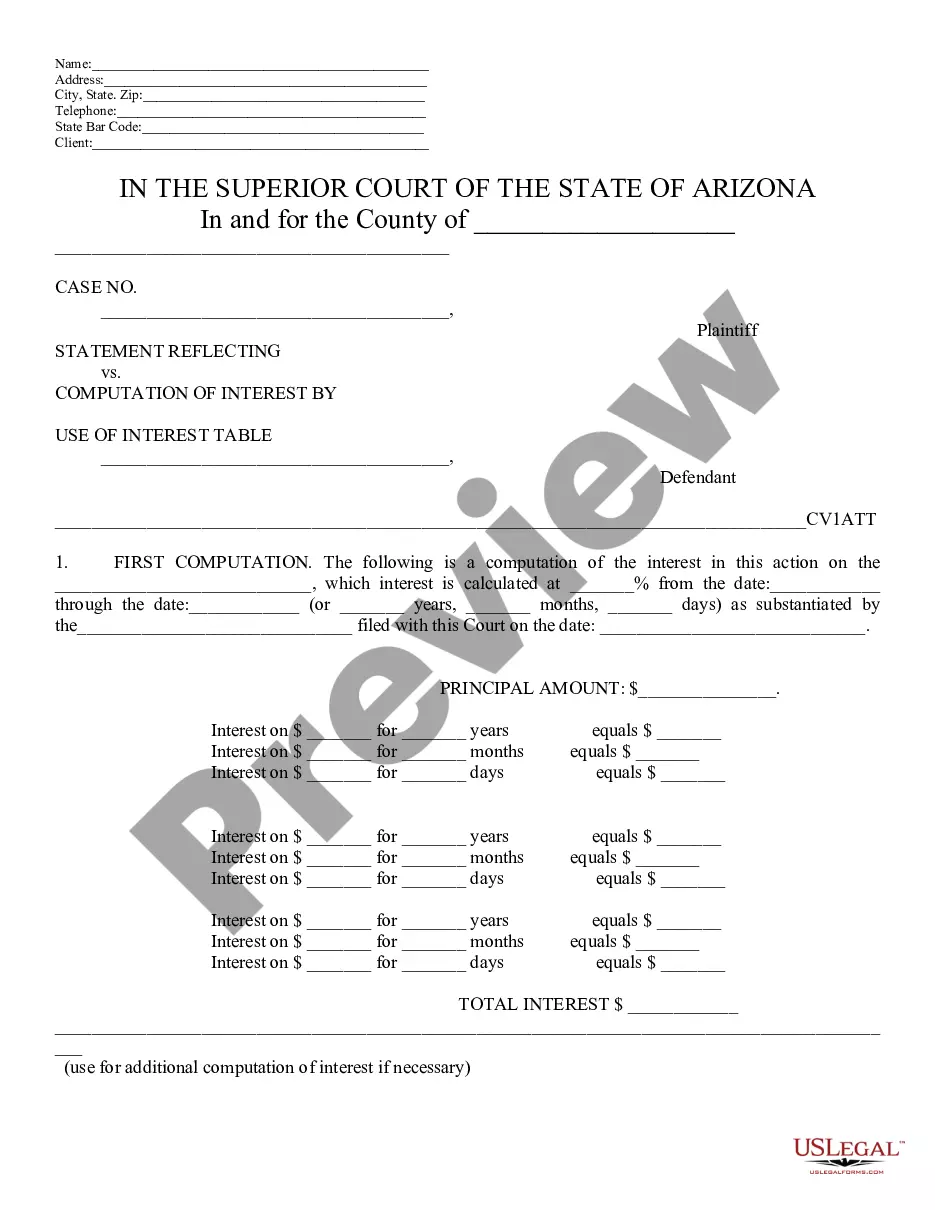

Statement Reflecting Computation of Interest By Daily Interest Rate: This statement reflects the way an attorney arrived at the total amount for damages, attorney's fees,e tc. It displays his/ her mathmatical equation, as well as the exact interest rate he/ she used in their findings. This form is available in both Word and Rich Text formats.

Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate

Description

How to fill out Arizona Statement Reflecting Computation Of Interest By Daily Interest Rate?

Do you require a trustworthy and affordable legal forms provider to acquire the Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate? US Legal Forms is your top selection.

Whether you need a simple contract to establish terms for living with your partner or a collection of documents to progress your divorce through the court, we have you covered. Our platform offers more than 85,000 current legal document templates for personal and business use.

All templates that we provide are not generic and are tailored based on the regulations of individual states and regions.

To download the form, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired form templates at any time from the My documents section.

Now you are ready to create your account. Then select the subscription plan and continue to payment. After the transaction is complete, download the Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate in any accessible file format. You can return to the website whenever necessary and redownload the form at no additional charges.

Finding current legal documents has never been simpler. Try US Legal Forms today, and cease spending your precious time sifting through legal paperwork online indefinitely.

- Are you unfamiliar with our platform? No problem.

- You can set up an account in a few minutes, but before that, ensure to do the following.

- Verify if the Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate complies with the statutes of your state and locality.

- Review the form’s specifics (if available) to ascertain who and what the form is appropriate for.

- Restart your search if the template does not fit your particular situation.

Form popularity

FAQ

Yes, interest income is generally taxable in Arizona and must be reported on your state tax return. This includes interest earned from bank savings accounts, bonds, and other sources. Being aware of this tax requirement is essential, and utilizing a Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can help you accurately track and report your interest income.

The IRS calculates daily interest by taking the annual interest rate and dividing it by the number of days in a year, usually 365. This process helps determine the exact amount of interest accrued on various tax-related matters. Using a Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can simplify this calculation and provide clarity on your financial obligations.

To calculate the daily interest rate from a monthly interest rate, start by dividing the monthly rate by the number of days in the month. Typically, a month is considered to have an average of 30 days. The result will give you the daily interest rate, which is crucial for preparing a Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

To calculate an interest statement, you first need to determine the principal amount and the applicable interest rate. You then multiply the principal by the interest rate and divide by the time period for which the interest is calculated. This approach will give you a comprehensive view, allowing for an accurate Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

The formula for calculating interest per day is fairly straightforward. You take the annual interest rate, convert it into a decimal, and then divide this by 365. This calculation gives you the daily interest amount, which is vital for your Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

In Arizona, charging interest above 10% per annum without a valid agreement is considered illegal usury. This law protects consumers from predatory lending practices. To avoid running afoul of these regulations, always refer to your Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate for accurate calculations.

The legal rate of interest in Arizona follows the statutory rate and applies when no specific interest rate is outlined in a contract. Typically, it is 10% per annum. Using this information will help ensure your Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate aligns with legal expectations.

The statutory rate of interest in Arizona is set at 10% per year unless a different rate is specified in a contract. This rate plays a significant role in financial agreements and should be noted when managing loans or debts. To accurately reflect this in your Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate, it's essential to check your specific agreements.

To calculate the daily interest rate on a credit card, you will first need to find your annual percentage rate (APR). You then divide the APR by 365, the number of days in a year. This formula provides the daily interest rate that will apply to your outstanding balance. Understanding this daily rate is crucial for reviewing your Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

Retirees in Arizona may find that their pensions and withdrawals from retirement accounts are subject to state taxation. It’s advisable to review your Surprise Arizona Statement Reflecting Computation of Interest By Daily Interest Rate for clear insights into how much tax you may owe. However, Social Security benefits remain exempt, providing some relief to retirees. Understanding these tax implications allows retirees to better plan their finances and ensure compliance with state laws.