Wyoming Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

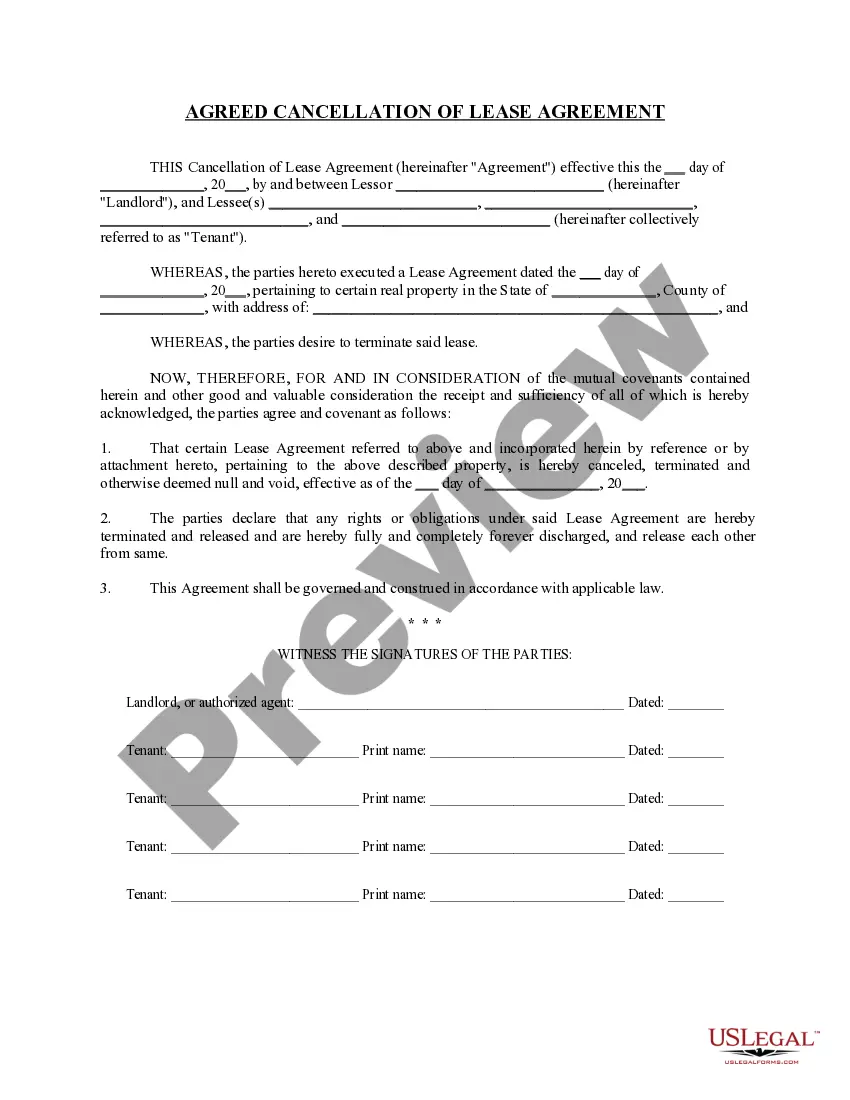

How to fill out Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

It is possible to commit several hours on the Internet trying to find the lawful papers design which fits the federal and state needs you need. US Legal Forms supplies 1000s of lawful kinds that happen to be reviewed by professionals. It is simple to down load or print the Wyoming Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease from your assistance.

If you already possess a US Legal Forms account, you are able to log in and click the Down load button. Next, you are able to complete, change, print, or indication the Wyoming Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease. Every lawful papers design you purchase is your own property for a long time. To acquire yet another duplicate associated with a bought kind, go to the My Forms tab and click the corresponding button.

If you use the US Legal Forms website the first time, keep to the straightforward guidelines under:

- First, make sure that you have selected the right papers design for your area/city of your choosing. Look at the kind outline to make sure you have picked out the correct kind. If readily available, take advantage of the Preview button to check throughout the papers design as well.

- In order to get yet another model of the kind, take advantage of the Search area to obtain the design that meets your requirements and needs.

- Once you have identified the design you would like, just click Get now to proceed.

- Select the rates plan you would like, enter your accreditations, and register for a merchant account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal account to cover the lawful kind.

- Select the structure of the papers and down load it for your device.

- Make modifications for your papers if possible. It is possible to complete, change and indication and print Wyoming Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease.

Down load and print 1000s of papers web templates making use of the US Legal Forms Internet site, which offers the most important selection of lawful kinds. Use skilled and express-distinct web templates to deal with your organization or personal requirements.

Form popularity

FAQ

The royalty rate on State of Wyoming leased minerals is usually 16.66%, and has been since the 1980s. The royalty rate on new private mineral leases in the most productive parts of Campbell, Platte, Johnson, Converse and neighboring counties usually ranges from 17% to 20%.

Oil and gas royalties refer to the payments made to the owner of the mineral rights, which are the rights to extract oil and gas from the land. These royalties are typically a percentage of the revenue generated from the production and sale of the oil and gas extracted from the land.

In such a circumstance, the Payor may elect to file what is known as an Interpleader action to determine the proper owner (or might be encouraged to do so). In an Interpleader, the stakeholder sues the parties who are asserting conflicting claims to the royalties due and deposits the royalties into the court.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

Cost Free Royalty Provision shall refer to a provision in the royalty clause of a lease pursuant to which the lessor does not bear certain post production costs traditionally shared by the lessor, i.e., providing that the lessor's royalty interest shall not bear any charge for the cost of compressing, treating, ...

Landowner's royalty is a type of payment made to the owner of a piece of land for the use of its resources, such as oil, gas, or minerals. This is similar to a royalty payment made to an author or inventor for the use of their intellectual property.