Puerto Rico Commission List

Description

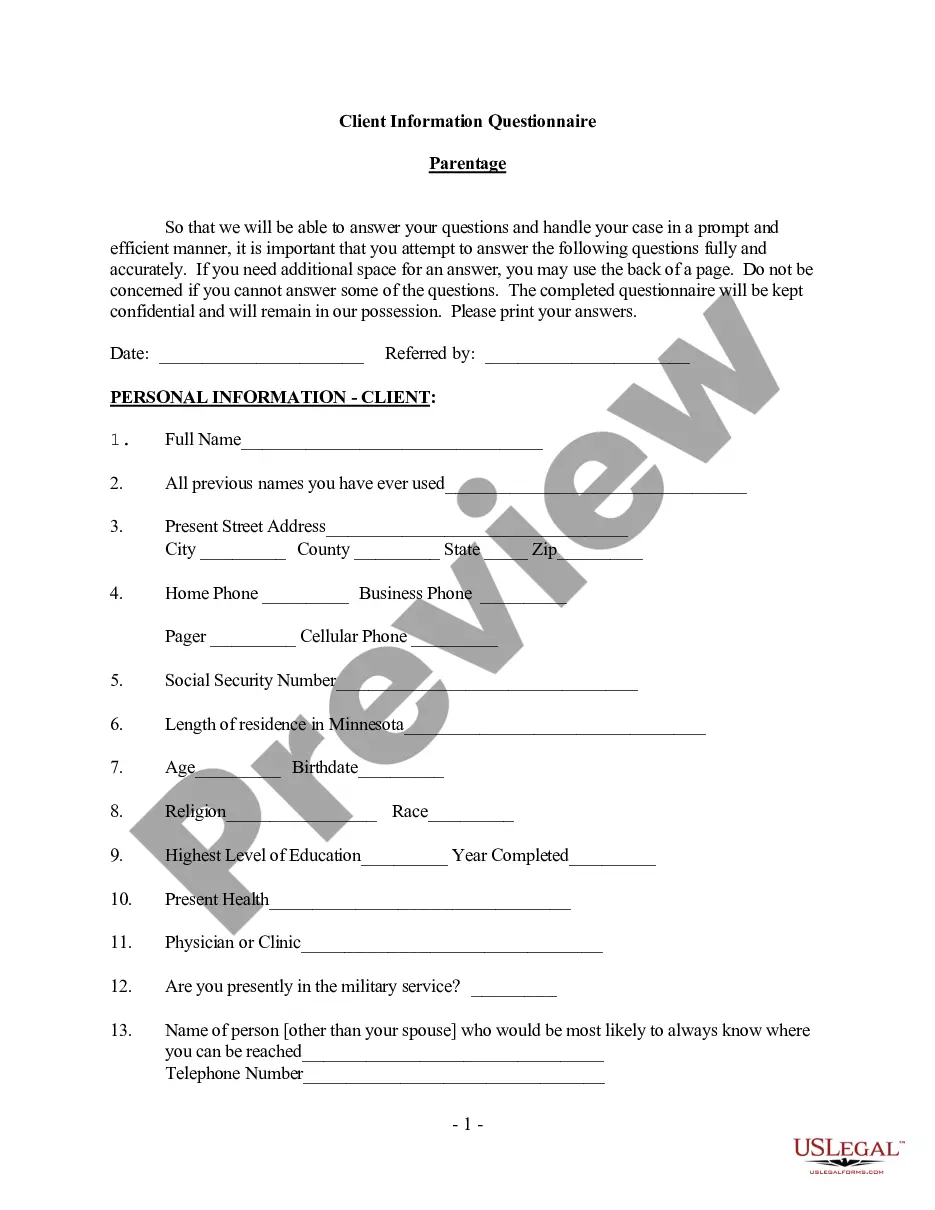

How to fill out Commission List?

Have you found yourself in a situation where you require documentation for either business or particular purposes nearly every day.

There are numerous authentic document templates accessible online, but obtaining trustworthy ones isn't straightforward.

US Legal Forms offers thousands of template options, such as the Puerto Rico Commission List, which comply with federal and state regulations.

When you locate the right form, click on Purchase now.

Select the payment plan you desire, complete the necessary information to create your account, and finalize your order with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can obtain the Puerto Rico Commission List template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct state/region.

- Use the Review option to verify the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

Filling out an address in Puerto Rico follows a specific format that includes the street name, followed by the number, apartment or suite number, city, and postal code. Ensure that you use the correct municipality name and include 'PR' for Puerto Rico as the state abbreviation. For clarity and accuracy, access the Puerto Rico Commission List for more detailed examples and tips to help you.

Registering for sales tax in Puerto Rico requires you to submit a form to the Department of Treasury. You must provide details about your business and the products or services you intend to sell. After approval, you will receive your sales tax registration certificate. The Puerto Rico Commission List offers step-by-step instructions that can aid you in this process.

In Puerto Rico, the sales tax for business-to-business transactions generally mirrors the standard sales tax rate. This means that most sales transactions between businesses will be subject to the same tax rate, which is currently at 11.5%. Knowing these details can help you budget and plan accordingly. Check out the Puerto Rico Commission List for updates and relevant business practices.

To register for Puerto Rico sales tax, you will need to fill out an application with the Puerto Rico Department of Treasury. This includes providing your business information, such as the type and location of your business. Completing the registration correctly ensures you can operate legally in Puerto Rico. For more streamlined registration, consult the Puerto Rico Commission List to find useful tips.

Declaring residency in Puerto Rico involves more than just moving to the island; it requires you to establish a domicile through intent and physical presence. You may need to file tax forms indicating your status and meet specific duration requirements. To make this process easier and stay compliant, explore resources like the Puerto Rico Commission List and the uslegalforms platform.

To establish a sales tax nexus in Puerto Rico, you must have a physical presence or business activities that meet specific criteria. This includes having a location, warehouse, or employees in Puerto Rico. Furthermore, any substantial economic activity related to taxable goods or services may also create nexus. For clarity on your business's situation, refer to the Puerto Rico Commission List for detailed advisories.

The 10 percent withholding tax in Puerto Rico applies to certain payments made to non-residents. This tax is generally withheld on payments such as dividends, interest, and certain services. If you're engaging in business that involves these payments, understanding this tax is essential. For comprehensive guidance, consider checking the Puerto Rico Commission List and related resources.

To obtain a Puerto Rico birth certificate, you must request it through the Puerto Rico Department of Health. Generally, you will need to provide identification and fill out a request form. The Puerto Rico Commission List provides valuable links and information, making it easier for you to navigate this process and secure your birth certificate without hassle.

You can find property records in Puerto Rico through the Property Registry, which maintains detailed information about real estate transactions. Online searches are available, and you can also visit local government offices for more comprehensive records. The Puerto Rico Commission List can guide you to official resources, helping you streamline your property record inquiry process.

To gain residency in Puerto Rico, you need to establish a permanent residence in the territory. This generally involves either relocating and living there for a specified period or applying for residency through investment options available under Puerto Rico's tax incentives. The Puerto Rico Commission List includes resources and tools that can assist you in navigating the residency process, ensuring compliance with local laws.