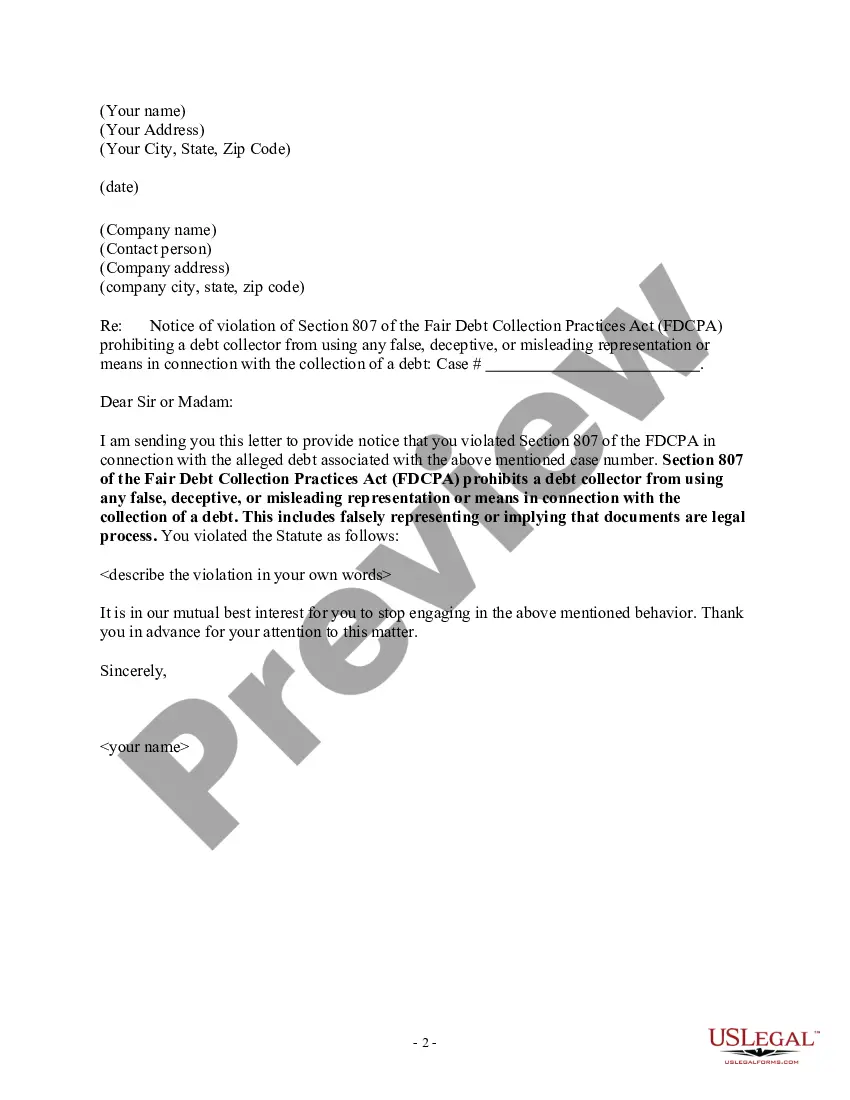

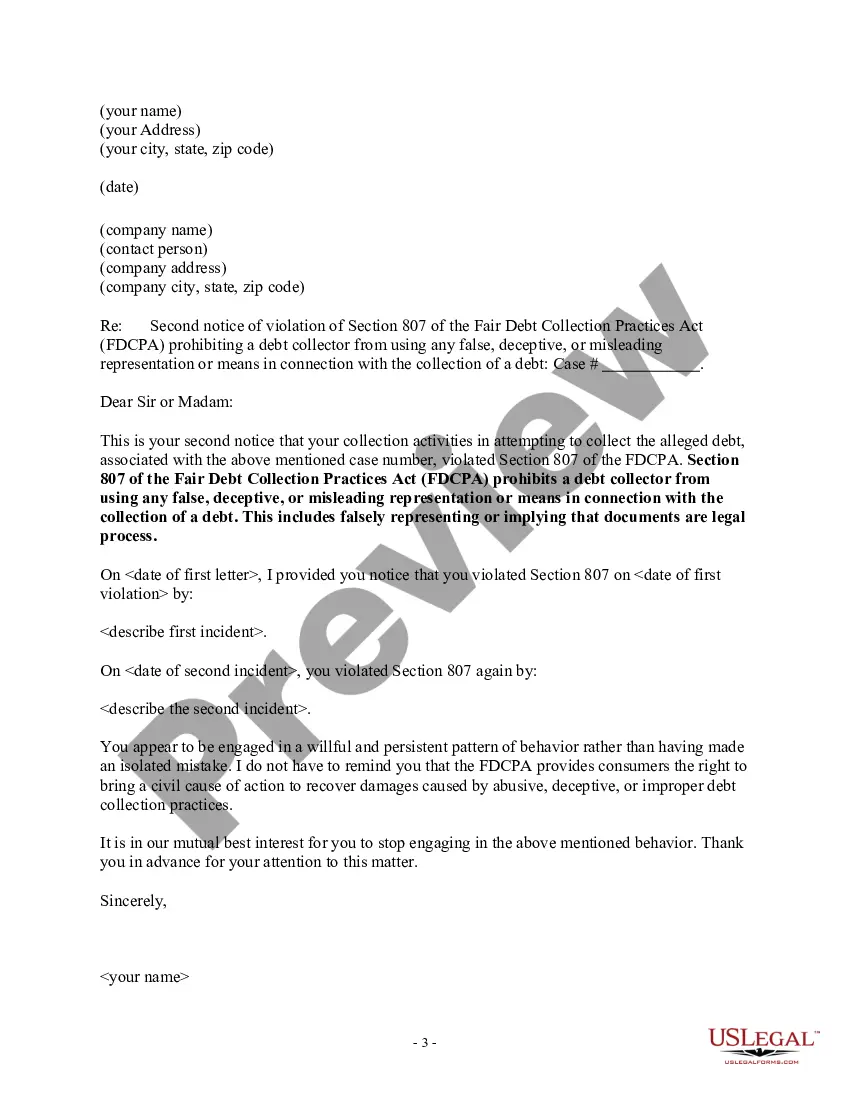

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Wyoming Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

Are you currently in a situation where you require documents for either business or personal activities every single day.

There are numerous legal document templates available online, but finding reliable ones is not straightforward.

US Legal Forms offers a vast collection of template options, including the Wyoming Notice to Debt Collector - Falsely Representing a Document is Legal Process, designed to comply with federal and state regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Select a preferred file format and download your copy. Access all the legal document templates you have acquired in the My documents section. You can obtain an additional copy of the Wyoming Notice to Debt Collector - Falsely Representing a Document is Legal Process whenever needed; just click on the desired form to download or print it. Use US Legal Forms, the most comprehensive collection of legal templates, to save time and avoid errors. The service provides professionally crafted legal document templates suitable for a wide range of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and own an account, simply Log In.

- Then, you can download the Wyoming Notice to Debt Collector - Falsely Representing a Document is Legal Process form.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/county.

- Utilize the Preview button to examine the form.

- Read the description to confirm that you have selected the correct template.

- If the form is not what you are seeking, use the Lookup area to find the form that suits your requirements.

Form popularity

FAQ

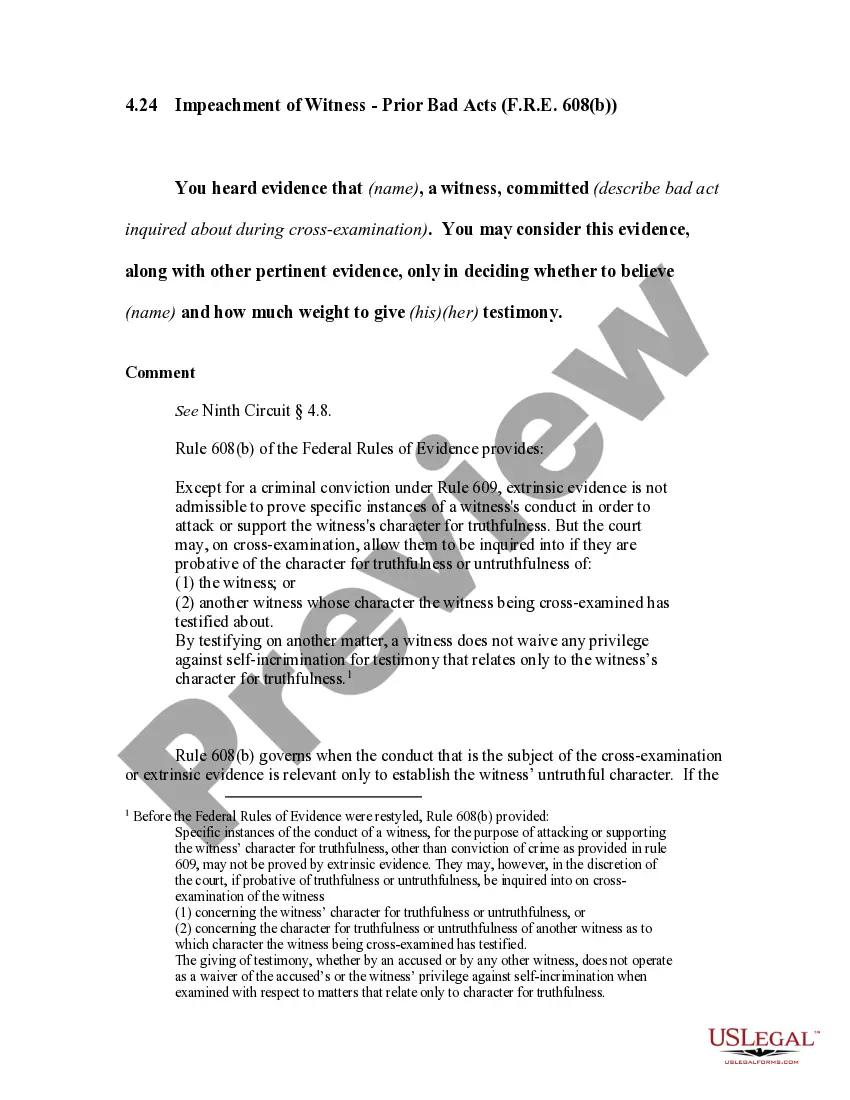

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Debt collectors cannot make false or misleading statements. For example, they cannot lie about the debt they are collecting or the fact that they are trying to collect debt, and they cannot use words or symbols that falsely make their letters to you seem like they're from an attorney, court, or government agency.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

A debt collector's No. 1 goal is to collect their missing funds. They can't curse at you or make empty threats, but they can say other things to try and scare you into paying up. Staying calm, keeping the call short and keeping your comments to a minimum are the best ways to deal with persistent bill collectors.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

Honesty: Debt collectors cannot mislead you about who they are, how much money you owe or the legal repercussions of not paying your debt for instance, by threatening arrest. Challenging the debt: You have a right to dispute the debt.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.