Wyoming Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures

Description

How to fill out Issuer - Underwriter - Oriented Sample Stored Value Product Agreement And Disclosures?

Discovering the right lawful papers format might be a have a problem. Needless to say, there are a lot of themes available on the net, but how would you obtain the lawful type you need? Utilize the US Legal Forms internet site. The service gives thousands of themes, including the Wyoming Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures, which you can use for company and private demands. All the types are checked out by professionals and meet up with federal and state demands.

If you are already listed, log in to your accounts and click the Acquire key to have the Wyoming Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures. Make use of your accounts to search with the lawful types you have bought earlier. Check out the My Forms tab of your respective accounts and obtain one more copy of the papers you need.

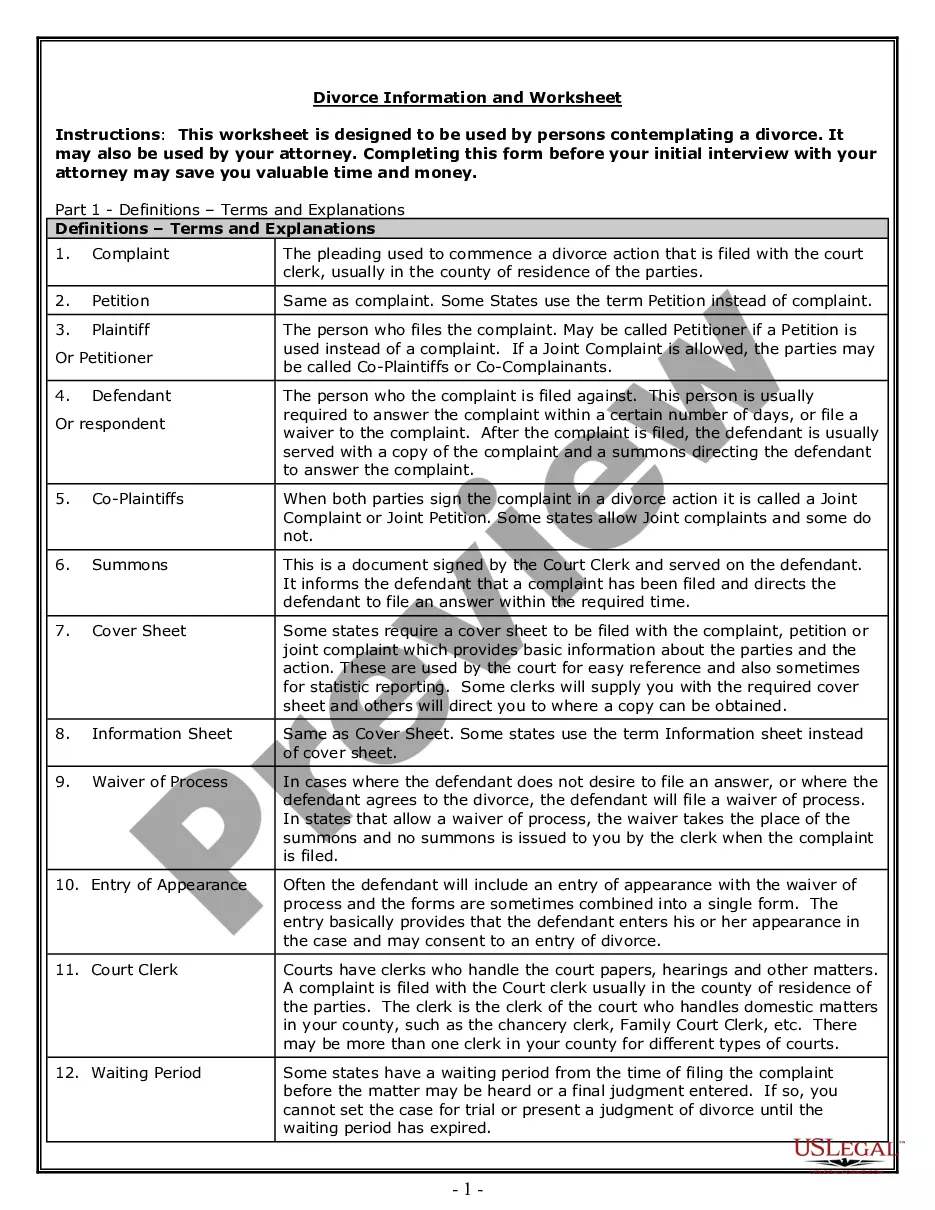

If you are a new customer of US Legal Forms, allow me to share basic guidelines for you to comply with:

- Initial, ensure you have selected the appropriate type for your metropolis/county. It is possible to look through the shape making use of the Preview key and look at the shape outline to make sure this is the best for you.

- When the type fails to meet up with your requirements, take advantage of the Seach industry to find the right type.

- When you are certain that the shape is proper, click the Purchase now key to have the type.

- Choose the rates plan you want and enter the necessary info. Make your accounts and buy an order with your PayPal accounts or Visa or Mastercard.

- Select the document formatting and acquire the lawful papers format to your device.

- Full, change and print and sign the obtained Wyoming Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosures.

US Legal Forms is the biggest local library of lawful types that you can find various papers themes. Utilize the company to acquire expertly-produced documents that comply with status demands.

Form popularity

FAQ

(i) "Adjuster" means any individual who either investigates and negotiates settlements relative to insurance claims or applies the factual circumstances of an insurance claim to the insurance policy provisions, or both, arising under property and casualty insurance contracts.

The disclosure document prepared by a bond issuer that gives detailed financial information about the issuer and the bond offering. Municipal securities issuers must prepare an ?Official Statement? before presenting the primary offering.

An offering statement gives people interested in investing in your co-op the information they need to make an informed decision. Essentially, it outlines the risks involved in purchasing a co-op's securities. An offering statement must include: A description of the co-op's business. How it will use the money it raises.

In investment finance, an offering memorandum is a kind of a detailed business plan that highlights information required by an investor to understand the business. It provides details on the terms of engagement, potential risks associated with the business, and a detailed description of the operations of the business.

An offering memorandum is a legal document that states the objectives, risks, and terms of an investment involved with a private placement. This document includes items such as a company's financial statements, management biographies, a detailed description of the business operations, and more.

Form 1-A is the offering document required to be filed for securities offerings that are qualified under Regulation A and Regulation A+. Issuers should take note of terms, conditions, and requirements of Regulation A, as the exemption is not available to all issuers or for every type of securities transaction.

Section 1-4-101 - Causes of Action That Survive. 1-4-101. Causes of action that survive. In addition to the causes of action which survive at common law, causes of action for mesne profits, injuries to the person, an injury to real or personal estate, or any deceit or fraud also survive.

An insurance adjuster, also known as a claims adjuster, is a person who investigates an insurance claim to determine if the insurer should pay for damage or injuries, and if so, how much they should pay.

Fighting in public; penalties. A person commits a misdemeanor punishable by imprisonment for not more than six (6) months, a fine of not more than seven hundred fifty dollars ($750.00), or both, if, by agreement, he fights with one (1) or more persons in public.