Wyoming Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

How to fill out Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

If you want to complete, down load, or print out authorized document layouts, use US Legal Forms, the greatest selection of authorized forms, which can be found on the web. Take advantage of the site`s basic and handy look for to discover the documents you will need. A variety of layouts for enterprise and person reasons are categorized by categories and claims, or keywords. Use US Legal Forms to discover the Wyoming Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit in a few mouse clicks.

In case you are currently a US Legal Forms client, log in to the bank account and click on the Down load button to find the Wyoming Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit. Also you can access forms you earlier acquired inside the My Forms tab of the bank account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape to the correct town/land.

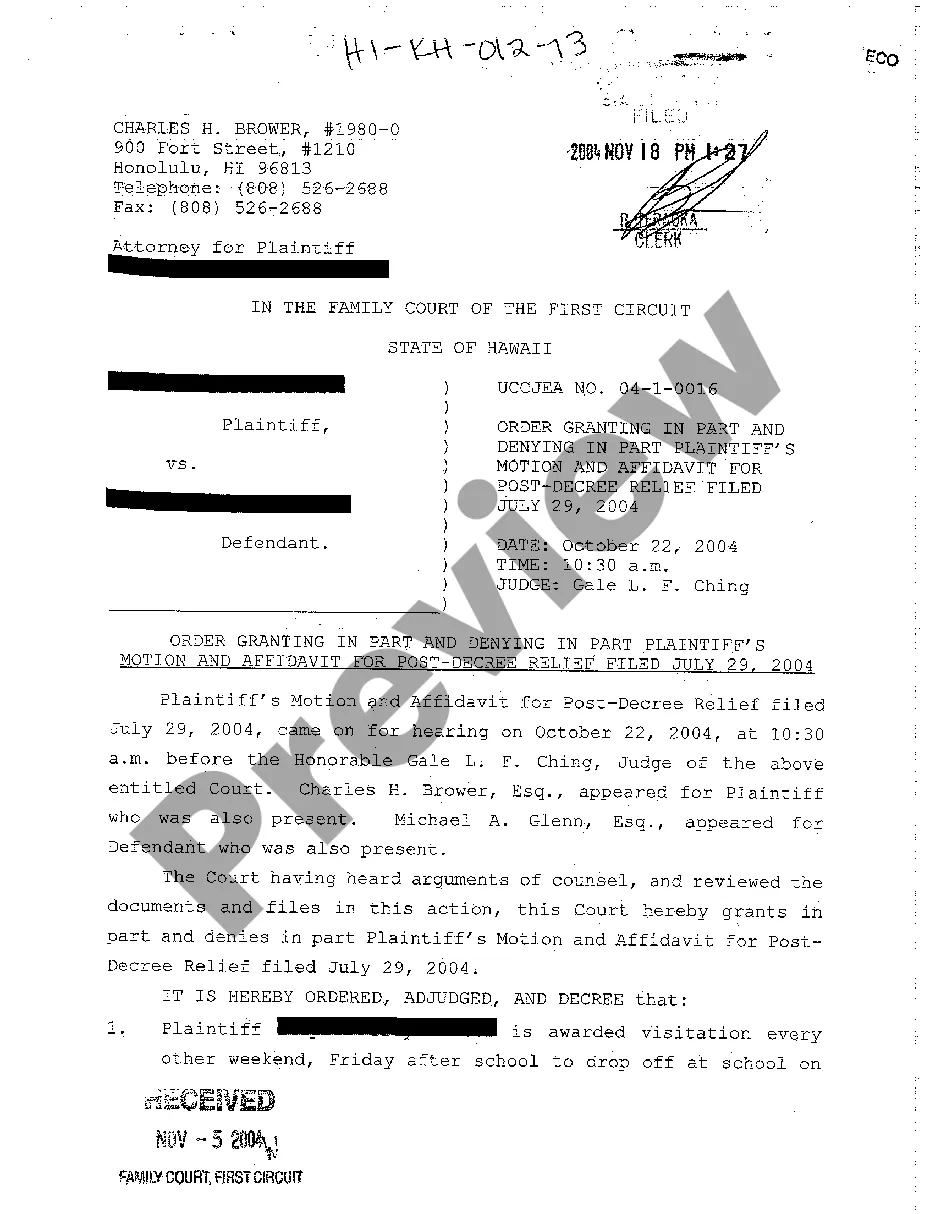

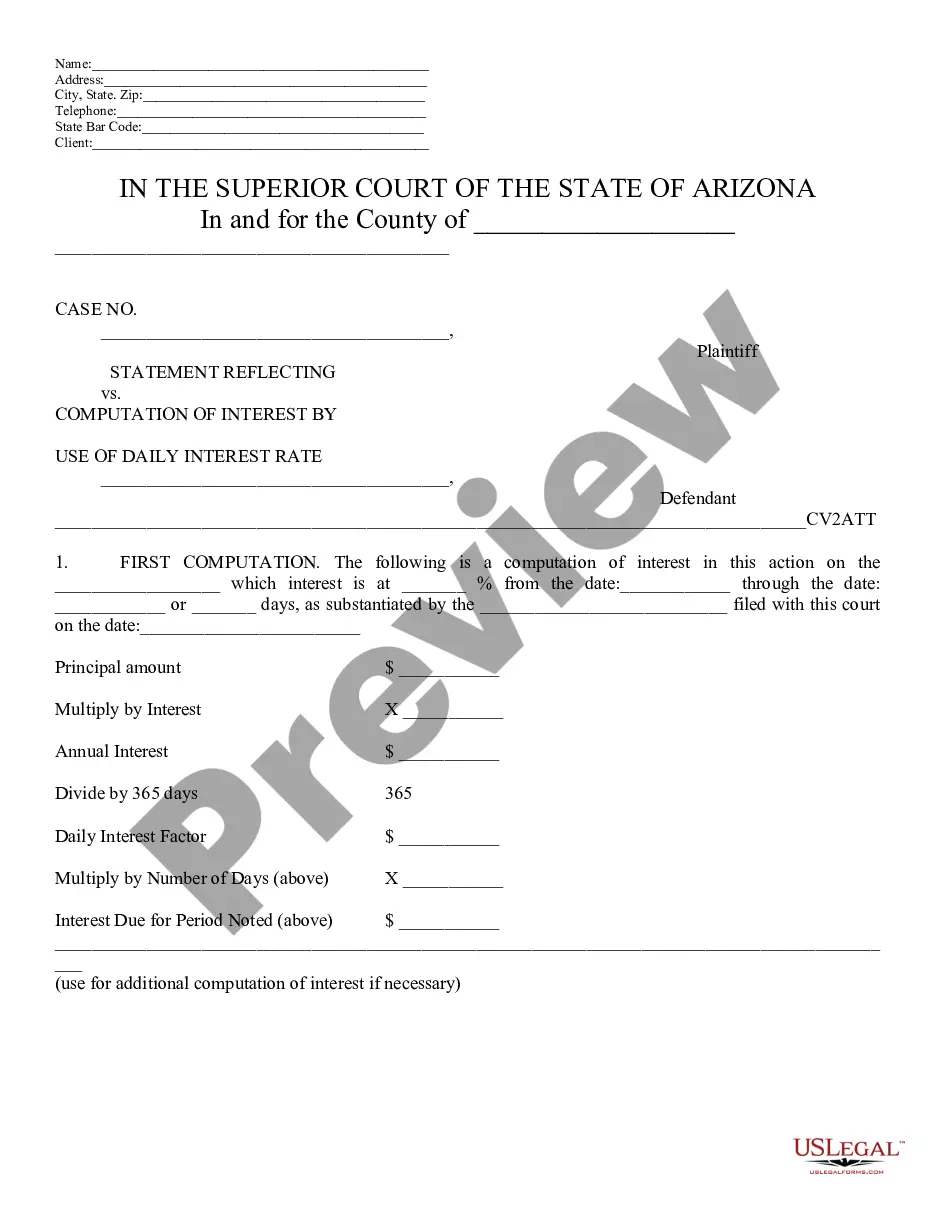

- Step 2. Make use of the Review option to examine the form`s content. Do not forget about to read the description.

- Step 3. In case you are not happy using the develop, utilize the Look for discipline near the top of the display to discover other variations in the authorized develop web template.

- Step 4. Upon having discovered the shape you will need, select the Purchase now button. Opt for the costs plan you like and add your references to sign up for the bank account.

- Step 5. Approach the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Pick the format in the authorized develop and down load it on the system.

- Step 7. Comprehensive, revise and print out or signal the Wyoming Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit.

Each authorized document web template you purchase is yours forever. You may have acces to every develop you acquired inside your acccount. Go through the My Forms segment and choose a develop to print out or down load yet again.

Remain competitive and down load, and print out the Wyoming Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit with US Legal Forms. There are many skilled and express-distinct forms you may use for your personal enterprise or person demands.

Form popularity

FAQ

If you already have par value and you want to raise or lower it, things are a bit more complicated. Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

Wyoming laws on close corps allow small corporations to forego many traditional corporate formalities, while still enjoying the benefits. A departure from regular business corporations, Close Corporations do not require a board of directors, this means ongoing operations generate less paperwork.

A stock split is when a company divides and increases the number of shares available to buy and sell on an exchange. A stock split lowers its stock price but doesn't weaken its value to current shareholders. It increases the number of shares and might entice would-be buyers to make a purchase.

Reverse stock splits do not impact a corporation's value, although they usually are a result of its stock having shed substantial value. The negative connotation associated with such an act is often self-defeating as the stock is subject to renewed selling pressure.

A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed. However, it often leads to a drop in the stock's market price as investors see it as a sign of financial weakness.

This would affect only the number of shares and par value per share of the company. When there is a 2-for-1 stock split, that means that 1 share would increase to 2 shares after this stock split. The total amount of the stocks would be still the same, thus, par value per share would be affected.

Will the reverse stock split change the par value of the share? Yes, the par value of each share will be increased proportionally to the exchange ratio, i.e. it will be multiplied by 20.